CBL Properties Completes Sale of The Forum at Grandview in Madison, MS for $31.75 Million

July 16 2019 - 2:30PM

Business Wire

CBL Properties (NYSE:CBL) today announced that it had closed on

the sale of The Forum at Grandview, a 216,000-square-foot shopping

center located in Madison, MS. The center was sold to Hendon

Properties for $31.75 million, all cash. Proceeds from the sale

were used to reduce outstanding balances on the Company’s line of

credit.

“The sale of The Forum at Grandview is an excellent example of

our continued access to attractively priced capital,” said Stephen

Lebovitz, CEO of CBL Properties. “Proceeds from this disposition

will supplement our significant free cash flow, providing liquidity

to fund our redevelopment opportunities and debt reduction.”

The Forum at Grandview is anchored by Best Buy, Dick’s Sporting

Goods, HomeGoods, Michaels, HomeGoods, Stein Mart, Petco and ULTA.

The center was originally developed in 2010 in a 75/25 joint

venture with Mattiace Development. CBL received 100% of the

proceeds from the sale.

About CBL Properties

Headquartered in Chattanooga, TN, CBL Properties owns and

manages a national portfolio of market-dominant properties located

in dynamic and growing communities. CBL’s portfolio is comprised of

111 properties totaling 69.7 million square feet across 26 states,

including 69 high‑quality enclosed, outlet and open-air retail

centers and 11 properties managed for third parties. CBL

continuously strengthens its company and portfolio through active

management, aggressive leasing and profitable reinvestment in its

properties. For more information, visit cblproperties.com.

Information included herein contains "forward-looking

statements" within the meaning of the federal securities laws. Such

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not even be anticipated. Future events and actual events, financial

and otherwise, may differ materially from the events and results

discussed in the forward-looking statements. The reader is directed

to the Company’s various filings with the Securities and Exchange

Commission, including without limitation the Company’s Annual

Report on Form 10-K and the "Management’s Discussion and Analysis

of Financial Condition and Results of Operations" included therein,

for a discussion of such risks and uncertainties.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190716005912/en/

Investor Contact: Katie Reinsmidt, EVP & Chief Investment

Officer, 423.490.8301, Katie.Reinsmidt@cblproperties.com Media

Contact: Stacey Keating, Director of Public Relations &

Corporate Communications, 423.490.8361,

Stacey.Keating@cblproperties.com

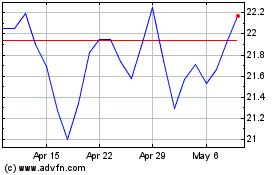

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Mar 2024 to Apr 2024

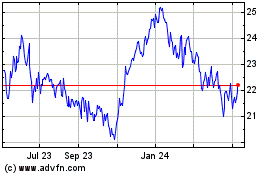

CBL and Associates Prope... (NYSE:CBL)

Historical Stock Chart

From Apr 2023 to Apr 2024