UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934

For the month of February, 2023

Commission File Number: 001-36671

ATENTO S.A.

(Translation of Registrant’s name into English)

1, rue Hildegard Von Bingen, 1282, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(1) only permits the

submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [ X ]

Note: Regulation S-T Rule 101(b)(7) only permits the

submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must

furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the

registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the

registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or

other Commission filing on EDGAR.

Atento S.A. (NYSE: ATTO, “Atento”) entered into financing

arrangements on February 15, 2023 with a group of certain existing investors in Atento to provide additional financing to Atento. The

investors have agreed to provide Atento with a new debt financing commitment that will address the company’s near-term liabilities

and provide the company with additional financial flexibility. The total capital raised is approximately $40 million.

The primary terms of the debt financing are:

·

Atento Luxco 1, S.A. will issue senior secured notes due 2025. Interest on the new notes will be

10% per annum payable in cash and 10% per annum payable in additional new notes. Interest will be payable every three months.

·

The new senior secured notes due 2025 will be guaranteed by selected receivables of certain subsidiaries.

·

In addition, Atento will issue 7,920,000 warrants to subscribe for shares at an exercise price that

is the trading price of the shares on the day prior to issuance of the warrants.

·

Atento Luxco 1, SA will use reasonable endeavors to explore an exchange of existing senior secured

notes due 2026 held by the investors with an equal principal amount of priority secured notes due 2026 to the extent permitted under the

terms of the existing debt documents and subject to other conditions.

·

The proceeds will be used by Atento and its subsidiaries to make certain payments under financing

agreements as well as to finance transaction costs.

Subject to the fulfillment of customary conditions

precedent, including certain third-party consents, this latest transaction is expected to provide Atento with additional operating liquidity

and financial flexibility in the coming months, while Atento continues to advance the transformation of its operational core and to further

strengthen its financial position in the medium term.

Atento intends to pay coupon payment obligations

under its senior secured notes due 2026 and all associated hedge payments upon completion of the new financing.

Atento intends to disclose further details of the transaction, including

copies of the relevant agreements, in the coming days.

On February 15, 2023, Atento issued a press release about the new

debt financing, which is attached as exhibit 99.1.

Forward-Looking Statements

This report contains forward-looking statements. Forward-looking

statements can be identified by the use of words such as “may,” “should,” “expects,” “plans,”

“anticipates,” “believes,” “estimates,” “predicts,” “intends,” “continue”

or similar terminology. In particular, these forward-looking statements include those about completion of the additional financing, Atento’s

liquidity and financial position, and Atento’s transformation plan. These statements reflect only Atento’s current expectations

and are not guarantees of future outcomes, performance or results. These statements are subject to risks and uncertainties that could

cause actual results to differ materially from those contained in the forward-looking statements. Risks and uncertainties include, but

are not limited to, obtaining required consents from third-parties and satisfying other conditions precedent for the additional financing

that might be outside Atento’s control; actions by Atento’s lenders and other financing sources; Atento’s future cash

requirements; competition in Atento’s highly competitive industries; increases in the cost of voice and data services or significant

interruptions in these services; Atento’s ability to keep pace with its clients’ needs for rapid technological change and

systems availability; the continued deployment and adoption of emerging technologies; the loss, financial difficulties or bankruptcy

of any key clients; the effects of global economic trends on the businesses of Atento’s clients; the non-exclusive nature of Atento’s

client contracts and the absence of revenue commitments; security and privacy breaches of the systems Atento uses to protect personal

data; the cost of pending and future litigation; the cost of defending Atento against intellectual property infringement claims; extensive

regulation affecting many of Atento’s businesses; Atento’s ability to protect its proprietary information or technology;

service interruptions to Atento’s data and operation centers; Atento’s ability to retain key personnel and attract a sufficient

number of qualified employees; increases in labor costs and turnover rates; the political, economic and other conditions in the countries

where Atento operates; changes in foreign exchange rates; Atento’s ability to complete future acquisitions and integrate or achieve

the objectives of its recent and future acquisitions; future impairments of our substantial goodwill, intangible assets, or other long-lived

assets; and Atento’s ability to recover consumer receivables on behalf of its clients. Atento is also subject to other risk factors

described in documents filed by the company with the United States Securities and Exchange Commission. These forward-looking statements

speak only as of the date on which the statements were made. Atento undertakes no obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events or otherwise.

The securities being issued in connection with the transactions

described herein have not and will not been registered under the U.S. Securities Act of 1933 and may not be offered or sold in the United

States absent registration or an applicable exemption from the registration requirements. This press release is not an offer of any securities

for sale or solicitation of an offer to buy any securities.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

ATENTO S.A.

(Registrant)

Date: February 15, 2023

By: /s/ Dimitrius Oliveira

Name: Dimitrius Oliveira

Title: Chief Executive Officer

EXHIBITS

Exhibit 99.1

Press Release – “Atento Announces That It Has Successfully Raised New Financing from Existing Investors” dated February 15, 2023

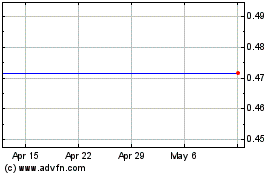

Atento (NYSE:ATTO)

Historical Stock Chart

From May 2024 to Jun 2024

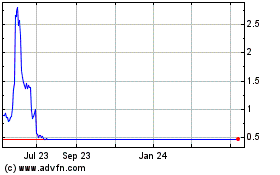

Atento (NYSE:ATTO)

Historical Stock Chart

From Jun 2023 to Jun 2024