An event of default has occurred with respect to $79.25 million

aggregate principal amount of three series of senior notes of

Anthracite Capital, Inc. (NYSE:AHR) (the "Company" or "Anthracite")

as the Company did not cure within 30 days its previously announced

default on interest payments due October 30, 2009 (approximately

$1.6 million). Under the indentures governing these senior notes,

the failure to make an interest payment within a 30-day cure period

after it is due constitutes an event of default. The senior notes

the Company defaulted on are its outstanding $13.75 million

aggregate principal amount of 7.22% senior notes due 2016, $28

million aggregate principal amount of 7.772%-to-floating rate

senior notes due 2017 and $37.5 million aggregate principal amount

of 8.1275%-to-floating rate senior notes due 2017.

While the events of default are continuing, the trustee or the

holders of at least 25% in aggregate principal amount of any of the

three series of the outstanding senior notes may, by a written

notice to the Company, declare the principal amount of such series

of senior notes to be immediately due and payable. As of the time

of this release, the Company has not received any written notice of

acceleration of the senior notes.

The events of default have triggered cross-default provisions in

the Company’s secured bank facilities and its credit facility with

BlackRock Holdco 2, Inc. and, if any debt were accelerated, would

trigger a cross-acceleration provision in the Company’s convertible

notes indenture. If acceleration were to occur, the Company would

not have sufficient liquid assets available to repay such

indebtedness and, unless the Company were able to obtain additional

capital resources or waivers, the Company would be unable to

continue to fund its operations or continue its business.

One of the Company's secured bank lenders, Deutsche Bank, whose

loans to the Company were made under a repurchase agreement, has

informally indicated to the Company that it intends to exercise its

remedy of taking the collateral under the repurchase agreement.

Under the repurchase agreement, Deutsche Bank must give the Company

at least five business days' written notice before it may exercise

this remedy. As of the time of this release, the Company has not

received any such written notice from Deutsche Bank. Approximately

$58 million principal amount of indebtedness remains outstanding

under the Company’s repurchase facility with Deutsche Bank.

The Company is discussing the events of default and situation

with certain of its creditors, but there can be no assurance that

such discussions will result in the continuing operations of the

Company.

Currently, the cash flows from substantially all of the

Company’s assets are being diverted to a cash management account

for the benefit of the Company’s secured bank lenders due to the

continuation of the Company’s default on amortization payments

required under such secured bank facilities.

Management’s assessment of the Company’s liabilities and the

current market value of the Company’s assets suggests that, in the

event of a reorganization or liquidation of the Company in the near

term, shareholders would not receive any value and the value

received by the Company’s unsecured creditors would be minimal.

Forward-Looking Statements

This release, and other statements that Anthracite may make, may

contain forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, with respect to

Anthracite's future financial or business performance, strategies

or expectations. Forward-looking statements are typically

identified by words or phrases such as "trend," "potential,"

"opportunity," "pipeline," "believe," "comfortable," "expect,"

"anticipate," "current," "intention," "estimate," "position,"

"assume," "outlook," "continue," "remain," "maintain," "sustain,"

"seek," "achieve," and similar expressions, or future or

conditional verbs such as "will," "would," "should," "could," "may"

or similar expressions.

Anthracite cautions that forward-looking statements are subject

to numerous assumptions, risks and uncertainties, which change over

time. Forward-looking statements speak only as of the date they are

made, and Anthracite assumes no duty to and does not undertake to

update forward-looking statements. Actual results could differ

materially from those anticipated in forward-looking statements and

future results could differ materially from historical

performance.

In addition to factors previously disclosed in Anthracite's SEC

reports and those identified elsewhere in this release, the

following factors, among others, could cause actual results to

differ materially from forward-looking statements or historical

performance: (1) as a result of its liquidity position, current

commercial real estate market conditions and the uncertainty

relating to its ability to meet covenants in restructured

agreements, substantial doubt about the Company's ability to

continue as a going concern; (2)the Company's ability to meet its

liquidity requirements to continue to fund its operations,

including its ability to renew its existing secured credit

facilities or obtain additional sources of financing, to meet

amortization payments under the facilities and to service debt

(including interest payment obligations not paid when originally

due); (3) the Company's ability to obtain amendments and waivers in

the event that a secured bank lender terminates a facility before

the maturity date or events of default occur under the Company's

debt obligations due to a covenant breach or otherwise; (4) the

Company's ability to maintain listing on the NYSE; (5) the

introduction, withdrawal, success and timing of business

initiatives and strategies; (6) changes in political, economic or

industry conditions, the interest rate environment, financial and

capital markets or otherwise, which could result in changes in the

value of the Company's assets and liabilities, including net

realized and unrealized gains or losses, and could adversely affect

the Company's operating results; (7) the relative and absolute

investment performance and operations of BlackRock Financial

Management, Inc. (the ''Manager''), the Company's Manager; (8) the

impact of increased competition; (9) the impact of future

acquisitions or divestitures; (10) the unfavorable resolution of

legal proceedings; (11) the impact of legislative and regulatory

actions and reforms and regulatory, supervisory or enforcement

actions of government agencies relating to the Company or the

Manager; (12) terrorist activities and international hostilities,

which may adversely affect the general economy, domestic and global

financial and capital markets, specific industries, and the

Company; (13) the ability of the Manager to attract and retain

highly talented professionals; (14) fluctuations in foreign

currency exchange rates; and (15) the impact of changes to tax

legislation and, generally, the tax position of the Company.

Anthracite's Annual Report on Form 10-K for the year ended

December 31, 2008 and Anthracite's subsequent filings with the SEC,

including its Quarterly Report on Form 10-Q/A for the quarter ended

June 30, 2009, which are accessible on the SEC's website at

www.sec.gov, identify additional factors that can affect

forward-looking statements.

To learn more about Anthracite, visit our website at

www.anthracitecapital.com. The information contained on the

Company's website is not a part of this release.

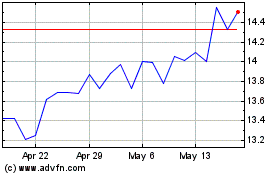

American Healthcare REIT (NYSE:AHR)

Historical Stock Chart

From Apr 2024 to May 2024

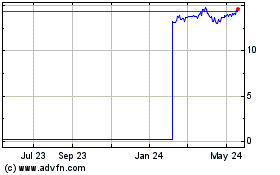

American Healthcare REIT (NYSE:AHR)

Historical Stock Chart

From May 2023 to May 2024