Current Report Filing (8-k)

June 17 2020 - 6:56AM

Edgar (US Regulatory)

0000868857

false

0000868857

2020-06-15

2020-06-16

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): June 17, 2020 (June 16, 2020)

AECOM

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

0-52423

|

|

61-1088522

|

|

(State or Other Jurisdiction

|

|

(Commission

|

|

(I.R.S. Employer

|

|

of Incorporation)

|

|

File Number)

|

|

Identification No.)

|

1999 Avenue of the Stars, Suite 2600

Los Angeles, California 90067

(Address of Principal Executive Offices,

including Zip Code)

Registrant’s telephone number, including

area code (213) 593-8000

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

ACM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On June 16, 2020, the Compensation and Organization Committee

of the Board of Directors of AECOM (the “Compensation Committee”) approved the AECOM Senior Leadership Severance Plan

(the “Severance Plan”). Each named executive officer (other than Michael S. Burke, who previously announced his plans to retire as Chief Executive

Officer) currently employed by AECOM (the “Company”) will be an eligible employee under the Severance Plan.

The Severance Plan provides that, upon the termination of employment

of an eligible employee by the Company other than for “cause” or due to death or disability (other than a termination

in connection with a change in control of the Company), in addition to the payment of accrued obligations, the eligible employee

will receive the following compensation and benefits: (i) a lump sum payment equal to one (1) times the eligible employee’s

base salary (except with respect to W. Troy Rudd, whose multiple is two (2) times base salary, pursuant to his letter agreement

with the Company setting forth the terms of his employment and compensation while serving as Chief Executive Officer of the Company

(the “Rudd Letter Agreement”)); (ii) a prorated target bonus for the fiscal year in which the termination occurred

based on the number of days of service in the fiscal year; (iii) additional service vesting credit for purposes of outstanding

equity awards based on the eligible employee’s years of service with the Company (12 months of credit for five to ten years

of service and 24 months of credit for more than ten years of service); and (iv) a lump sum payment in respect of the monthly employer

portion of healthcare premiums multiplied by 12 (except with respect to Mr. Rudd, whose premiums are multiplied by 24 pursuant

to the Rudd Letter Agreement). The receipt of the foregoing severance payments and benefits will be subject to the eligible employee’s

execution of a separation and release agreement that contains customary restrictive covenants, including obligations with respect

to confidentiality and restrictions on soliciting the Company’s employees and customers.

Item 8.01. Other Events.

On June 17, 2020, the Company issued a press release announcing

that it has commenced a cash tender offer (the “Offer”) for up to $639 million in aggregate principal amount of its

outstanding 5.875% Senior Notes due 2024 and 5.125% Senior Notes due 2027 (collectively, the “Notes”). A copy of the

press release is attached hereto as Exhibit 99.1 and is incorporated into this Item 8.01 by reference.

The Company is making the Offer at par to satisfy obligations

under the indentures governing the Notes relating to the use of certain cash proceeds from the Company’s previously announced

disposition of its Management Services business, which was completed on January 31, 2020.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

AECOM

|

|

|

|

|

Dated: June 17, 2020

|

By:

|

/s/ David Y. Gan

|

|

|

|

David Y. Gan

|

|

|

|

Executive Vice President, Chief Legal Officer

|

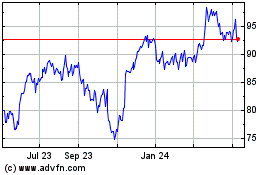

AECOM (NYSE:ACM)

Historical Stock Chart

From Aug 2024 to Sep 2024

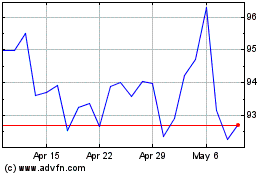

AECOM (NYSE:ACM)

Historical Stock Chart

From Sep 2023 to Sep 2024