false

0000731653

0000731653

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

OR 15(d)

of The Securities Exchange

Act of 1934

Date of Report (Date

of earliest event reported): May 9, 2024

UNITED BANCORP, INC.

(Exact name of registrant

as specified in its charter)

| Ohio |

0-16540 |

34-1405357 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 201 South 4th Street, Martins Ferry, Ohio |

43935-0010 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone

number, including area code: (740) 633-0445

(Former name or former

address, if changed since last report.)

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, Par Value $1.00 |

|

UBCP |

|

NASDAQ Capital Market |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. | Results of Operations and Financial Condition. |

On May 9, 2024, United Bancorp, Inc. issued a

press release announcing its results of operations and financial condition for and as of the three month period ended March 31, 2024,

unaudited. The press release is furnished as Exhibit No. 99.

| Item 9.01. | Financial Statements and Exhibits. |

(d)

Exhibits

The following exhibits are furnished herewith:

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: May 9, 2024 |

UNITED BANCORP, INC. |

| |

|

|

| |

/s/ Randall M. Greenwood |

| |

Randall M. Greenwood |

| |

Senior Vice President and |

| |

Chief Financial Officer |

Exhibit 99.1

PRESS

RELEASE

United Bancorp, Inc. 201 South 4th at Hickory Street, Martins

Ferry, OH 43935

| Contacts: |

Scott A. Everson |

Randall M. Greenwood |

| |

President and CEO |

Senior Vice President, CFO

and Treasurer |

| |

(740) 633-0445, ext. 6154 |

(740) 633-0445, ext.

6181 |

| |

ceo@unitedbancorp.com |

cfo@unitedbancorp.com |

| FOR IMMEDIATE RELEASE: |

11:00 a.m. |

May 9, 2024 |

United Bancorp, Inc. Reports

2024 First Quarter Earnings Performance

MARTINS FERRY, OHIO ¨¨¨

United Bancorp, Inc. (NASDAQ: UBCP) reported diluted earnings per share of $0.35 and net income of $1,993,000 for the three months ended

March 31, 2024. This compares to diluted earnings per share of $0.33 and net income of $1,888,000 reported in the first quarter of the

previous year.

Randall M. Greenwood, Senior Vice President, CFO

and Treasurer remarked, “We are pleased to report on the earnings performance of United Bancorp, Inc. (UBCP) for the first quarter

ended March 31, 2024. For the quarter, our Company achieved solid net income and diluted earnings per share results of $1,993,000 and

$0.35, which were respective increases of $105,000, or 5.6%, and $0.02, or 6.1%, over the results achieved during the first quarter of

last year. As we started the current year, the interest rate forecast by most economists and the financial markets indicated that we could

expect seven rate cuts this year, which, overall, was projected to be favorable for our industry. As we progressed through and ended the

first quarter, it became apparent that interest rates will be higher for longer, with potentially only two rate cuts this year--- now

forecast to occur much later in the year than originally anticipated. This higher for longer posturing of the Federal Open Market Committee

of the Federal Reserve (FOMC) is creating different challenges for our industry and putting pressure on the net interest margins and bottom-line

performances of most financial institutions. Our Company is not immune from these same challenges and, even though our performance improved

in the first quarter of 2024 over the previous year, we are currently feeling this aforementioned pressure. Regardless of this challenge,

we are very happy with the present performance of our Company. In addition, we continue to focus on growing and leveraging our foundation,

which should be of benefit and lead to higher performance in future periods.”

Greenwood continued, “At March 31,

2024 and as previously mentioned, United Bancorp, Inc. (UBCP) did achieve a higher level of bottom-line earnings on a year-over-year

basis. But, like most other financial institutions in the current “higher for longer” interest rate environment in which

we are operating, our Company did also experience a decline in the level of net interest income that it achieved. Even though our

total interest income realized on a year-over-year basis was higher by $1.4 million, or 17.2%, our total interest expense increased

by $1.7 million, or 96.4%, during the same time period. Accordingly, the level of net interest income that we achieved declined by

($308,000), or (4.8%), to a level of $6.1 million. In addition, UBCP’s net interest margin declined by twenty-nine basis

points (-29 bps) over the previous year, to a level of 3.46%, as of the most recently ended quarter.” Greenwood further

explained, “Even though our Company’s total assets declined from last year by $13.5 million, or 1.6%, to a level of

$834.0 million due to a runoff in retail deposit funding and cash balances, we were able to generate a higher level of total

interest income due to our loans outstanding continuing to reprice in a higher interest rate environment along with our gross loans

increasing $16.6 million, or 3.6%, to a level of $480.3 million as of this year’s quarter-end. In addition, our investment

securities balances increased by $17.8 million, or 7.5%, year-over-year to a level of $255.8 million. But, as mentioned, this

increase in total interest income was more than offset by the increase in total interest expense experienced by UBCP. Our

Company’s total interest expense increased even though total deposits decreased by $27.6 million year-over-year. The increase

in our Company’s total interest expense can be attributed to both the change in the mix of our retail depository funding from

lower cost demand and savings balances to higher cost term funding, along with having a previously disclosed $75.0 million Federal

Home Loan Bank (FHLB) Advance--- which we originated in mid-March of 2023--- for the entirety of this year’s first quarter.

Relating to the change in the mix of our retail funding, lower cost demand and savings balances decreased by (-$66.8) million, or

12.6%, while higher cost time balances increased by $39.2 million or 31.6%. Of importance, our Company does not have any brokered

deposits and total uninsured deposits as of March 31, 2024 totaled 18.2%, which is very low compared to industry

standards.”

Greenwood further stated, “Even with a compressing

net interest margin and declining net interest income, United Bancorp, Inc. (UBCP) was able to achieve a higher level of earnings year-over-year

as of March 31, 2024 due to a few strategies that started to gain traction in or were successfully implemented and carried out during

the first quarter. As we have previously mentioned, our Company started Unified Mortgage in the fourth quarter of last year, a mortgage

products and services division with a more dedicated focus on mortgage production for our Company. We are starting to see some positive

results as a result of this effort, with a net realized gain on the sale of loans of $77,000 during the quarter. We firmly believe that

the revenue production from this enhanced new focus on mortgage production will continue to increase in future quarters as we further

scale it out. In addition, we executed on a securities portfolio rebalancing initiative early in the first quarter of the current year

by selling a portion of our lower-yielding investment securities and reinvesting those balances into higher yielding investment securities,

which improved our Company’s overall portfolio yield and better positioned our portfolio for the projected downward change in rates.

Specifically, we sold $25.0 million in municipal and agency securities and reinvested a like amount in new municipal security offerings

that yielded an additional 1.23% on a taxable equivalent basis. Although this strategy did lead to a loss on sale of ($194,000)…

which negatively impacted our Company’s noninterest income during the most recently ended quarter… it did add to our interest

income stream and has a break-even of approximately eight months. Most importantly, this securities portfolio rebalance strategy will

be accretive to our bottom-line earnings in the current year. In addition, if interest rates do drop as anticipated, it will give our

Company valuable call protection in a falling rate environment.” Greenwood continued, “Relating to the noninterest expense

of UBCP, even though our Company has taken on some additional expenses relating to our revenue enhancement and growth initiatives such

as our recently implemented Unified Mortgage focus and the announcement of our new Wheeling Banking Center (which is soon to begin construction),

our Company was able to successfully apply and be approved for an Employee Retention Credit (ERC) in the first quarter. This tax credit

helped offset the expenses associated with these new initiatives along with other expenses--- including the one-time expenses attributed

to our securities portfolio rebalancing strategy and benefits payouts recognized during the first quarter--- and led to the year-over-year

reduction in UBCP’s noninterest expense of ($600,000). In the quarter-ended March 31, 2024, the net result of the realization of

these aforementioned nonrecurring expense items and the tax credit led to an increase in our Company’s net income of approximately

$271,000 and diluted earnings per share of $0.05.”

In addition, Greenwood mentioned, “Even

with our Company’s higher investment securities balances as of March 31, 2024 and the increase in market rates over the course of

the first quarter of this year, our Company’s accumulated other comprehensive loss, net of taxes (AOCI) remained relatively stable

at $7.8 million, an increase of $77,000 year-over-year. With this year-over-year stability in AOCI and an increase in our retained earnings,

our shareholders equity improved to a level of $63.2 million, an increase of $4.2 million, or 7.1%, and our book value improved to $10.62,

an increase of $0.56, or 5.6%. Overall, our Company continues to be considered well-capitalized from a regulatory perspective with equity

to assets of 7.6%, which is up from 7.0% from the same period last year. With the overall quality of our investment portfolio, our well

capitalized position, our solid liquidity position and our low level of uninsured deposits, we firmly believe that any issues which could

potentially create a risk to our capital and capital position are very minimal.”

Lastly, Greenwood stated, “Even with the

continued heightened inflation levels and related increases in interest rates that may be impacting some of our borrowers with higher

operating costs and rate resets to higher interest rate levels on their loans, we have successfully maintained credit-related strength

and stability within our loan portfolio. As of March 31, 2024, our Company’s total nonaccrual loans and loans past due 30 plus days

were $1.43 million, or 0.30% of gross loans, which is up from last year by $901,000. Also, as of the most recently ended quarter, United

Bancorp, Inc.’s (UBCP) nonperforming assets to total assets was a very respectable 0.51%, a seven-basis point increase over the

previous year. Further highlighting the overall strength of our loan portfolio, our Company had net loans charged off of (-$28,000), which

is (-0.01%) of average loans. With the enhanced loan credit reserve build-up under CECL over the course of the past year and our Company’s

stable and solid credit quality metrics, we did not have a provision for credit losses in the most recently ended quarter, which matched

last year.” Greenwood concluded, “We are very happy that we were able to forgo, once again, a credit provision in the current

year due to our Company’s overall solid credit quality, while maintaining a total allowance for credit losses to total loans of

0.81% and having a total allowance for credit losses to nonperforming loans of 438%. Overall, we firmly believe that we are presently

well reserved with very strong coverage.”

Scott A. Everson, President and CEO stated, “United

Bancorp, Inc. (UBCP), like most banking organizations, is currently feeling the pressure of operating in an environment wherein monetary

policy has driven interest rates higher for a longer duration than many of us anticipated--- which is creating different challenges for

us and all banks. But, overall, we are very happy with the solid financial performance that our Company achieved during the first quarter

of 2024. As previously mentioned, both our net income and diluted earnings per share are higher than the levels that we produced in the

first quarter of the previous year. But, as you might expect in this higher-for-longer interest rate environment in which we are presently

operating, our Company did experience a decline in the level of net interest income that it realized and compression of its net interest

margin in the most recently ended quarter for the first time in quite a while. Even though UBCP experienced year-over-year, double-digit

percentage growth in the level of total interest income that it generated this past quarter, our Company experienced a greater increase

in the total interest expense that it incurred, which caused the aforementioned decline in our net interest income. Fortunately for our

Company, taking the $75.0 million advance from the Federal Home Loan Bank (FHLB) toward the end of the first quarter of last year (at

terms which are now considered very competitive) has helped us to somewhat mitigate this decline in our net interest income by affording

us the ability to be more selective in the pricing of our offering rates on our interest-bearing depository products. Although the interest

levels that we are paying on our depository products have increased in the current environment in which we are operating, this wholesale

funding from the FHLB has helped us to somewhat control our interest expense levels while maintaining very adequate liquidity levels.

With a present net interest margin of 3.46% as of March 31, 2024, we believe that this performance metric compares favorably to that of

our peer group and industry at present.”

Everson continued, “With the current pressure

on our net interest margin and net interest income, United Bancorp, Inc. (UBCP) is focused on controlling its net noninterest margin.

Regarding the noninterest income-side of the noninterest margin, some fee generating services and lines of business continue to be under

attack by both regulatory and political authorities, which has ultimately put pressure on the level of noninterest income that our Company

is able to realize. Accordingly (and, instead of dwelling on this negative reality), UBCP is looking to find new alternatives to generating

additional levels of both noninterest income and other sources of revenue. One of these new alternatives is our focus on enhancing our

mortgage origination function with the development of Unified Mortgage, which is beginning to help our Company generate higher levels

of fee income with the heightened production and sale of secondary market mortgage products, along with the enhancement of our interest

income levels through the origination of higher levels of portfolio-type mortgage products. Another alternative is our stronger commitment

to developing our Treasury Management function, which offers fee-based services to our commercial customers in the areas of cash management

and payments that produces noninterest income… in addition to helping to control interest expense by generating a higher level

of low or no-cost depository balances for our Company. Lastly, another alternative to enhancing the overall performance of UBCP (and,

one that should strongly contribute to our Company attaining its goal growing its total assets to a level of $1.0 billion or greater)

is the development of our newest banking center, which is soon to be constructed in the highly favorable market of Wheeling, West Virginia.

Our Company already has many solid customer relationships in this coveted marketplace and we firmly believe that by finally having a “brick-and-mortar”

location therein, we will be able to more fully leverage these already existing relationships, while having the opportunity to build many

new relationships within this prime market.” Everson further stated, “Obviously, these new alternatives that can lead to additional

noninterest income and revenue enhancement opportunities for UBCP do have a cost, which will lead to additional expense or overhead for

our Company. But, sometimes you have to take one-step back in order to take several-steps forward and that is what we firmly believe that

we are doing by undertaking these new initiatives. With the revenue challenges that both we and the players within our industry are currently

facing, we firmly believe now is the time for our Company to focus on enhancing and expanding existing lines of business and growing new

lines of business… thus, achieving the organic growth that will lead to the continued and future relevance of UBCP.”

Everson further mentioned, “Our primary

focus is protecting the investment of our shareholders in our Company and rewarding them in a balanced fashion by growing their value

and paying an attractive cash dividend. In these areas, our shareholders have been nicely rewarded. In the first quarter of this year,

we, once again paid both our regular cash dividend, which increased by $0.0025 to a level of $0.1725, and a special cash dividend of $0.15…

for a total payout of $0.3225 for the quarter. This is a 3.2% increase over the total cash dividend paid in the first quarter of the previous

year and produces a near-industry leading total dividend yield of 5.81%. This total dividend yield is based on our first quarter cash

dividend on a forward basis, plus the special dividend (which combined total $0.84) and our quarter-end fair market value of $14.47. On

a year-over-year basis as of March 31, 2024, the fair market value of our Company’s stock remained relatively stable in comparison

to the prior year and our Company’s market price to book value was 136%, which compares favorably to current industry standards.”

Everson concluded, “Considering that we

continue to operate in a challenging economic and concerning industry-related environment, we are very pleased with our current performance

and future prospects. Even with the present threats with which our overall industry is exposed, we are very optimistic about the future

growth and earnings potential for United Bancorp, Inc. (UBCP). We firmly believe that with the challenges that our industry has experienced

over the course of the past few years, our Company has evolved into a more fundamentally sound organization with a focus on evolving and

growing in order to achieve greater efficiencies and scales and generate higher levels of revenue--- while prudently managing expenses

and controlling overall costs. We have and continue to invest in areas that will lead to our continued and future relevancy within our

industry. Although such initiatives can stress the short-term performance of our Company, we firmly believe that the will help us fulfil

our intermediate and longer-term goals and produce above industry earnings and overall performance. As previously mentioned, we still

have a vision of growing UBCP to an asset threshold of $1.0 billion or greater in the near term in a prudent and profitable fashion. We

are truly excited about our Company’s direction and the potential that it brings. With a keen focus on continual process improvement,

product development and delivery, we firmly believe the future for our Company is very bright.”

As of March 31, 2024, United Bancorp, Inc.

has total assets of $834.0 million and total shareholders’ equity of $63.2 million. Through its single bank charter, Unified

Bank, the Company currently has eighteen banking centers that serve the Ohio Counties of Athens, Belmont, Carroll, Fairfield, Harrison,

Jefferson and Tuscarawas and Marshall County in West Virginia. United Bancorp, Inc. trades on the NASDAQ Capital Market tier of the NASDAQ

Stock Market under the symbol UBCP, Cusip #909911109.

Certain statements contained herein are not based

on historical facts and are "forward-looking statements" within the meaning of Section 21A of the Securities Exchange Act of

1934. Forward-looking statements, which are based on various assumptions (some of which are beyond the Company's control), may be identified

by reference to a future period or periods, or by the use of forward-looking terminology, such as "may," "will," "believe,"

"expect," "estimate," "anticipate," "continue," or similar terms or variations on those terms,

or the negative of these terms. Actual results could differ materially from those set forth in forward-looking statements, due to a variety

of factors, including, but not limited to, those related to the economic environment, particularly in the market areas in which the company

operates, competitive products and pricing, fiscal and monetary policies of the U.S. Government, changes in government regulations affecting

financial institutions, including regulatory fees and capital requirements, changes in prevailing interest rates, acquisitions and the

integration of acquired businesses, credit risk management, asset/liability management, changes in the financial and securities markets,

including changes with respect to the market value of our financial assets, and the availability of and costs associated with sources

of liquidity. The Company undertakes no obligation to update or carry forward-looking statements, whether as a result of new information,

future events or otherwise.

| United Bancorp, Inc. |

| "UBCP" |

| |

| |

At or for the Quarter Ended | | |

| | |

| |

| |

March 31, | | |

March 31, | | |

% | | |

$ | |

| | |

2024 | | |

2023 | | |

Change | | |

Change | |

| Earnings | |

| | |

| | |

| | |

| |

| Interest income on loans | |

$ | 6,623,848 | | |

$ | 5,628,758 | | |

| 17.68 | % | |

$ | 995,090 | |

| Loan fees | |

| 138,329 | | |

| 180,047 | | |

| -23.17 | % | |

$ | (41,718 | ) |

| Interest income on securities | |

| 2,858,644 | | |

| 2,399,296 | | |

| 19.15 | % | |

$ | 459,348 | |

| Total interest income | |

| 9,620,821 | | |

| 8,208,101 | | |

| 17.21 | % | |

$ | 1,412,720 | |

| Total interest expense | |

| 3,505,995 | | |

| 1,785,130 | | |

| 96.40 | % | |

$ | 1,720,865 | |

| Net interest income | |

| 6,114,826 | | |

| 6,422,971 | | |

| -4.80 | % | |

$ | (308,145 | ) |

| Provision for credit losses | |

| - | | |

| - | | |

| #DIV/0! | | |

$ | - | |

| Net interest income after provision for credit losses | |

| 6,114,826 | | |

| 6,422,971 | | |

| -4.80 | % | |

$ | (308,145 | ) |

| Service charge on deposit account | |

| 702,754 | | |

| 720,837 | | |

| -2.51 | % | |

$ | (18,083 | ) |

| Net realized gains on sale of loans | |

| 77,523 | | |

| - | | |

| #DIV/0! | | |

$ | 77,523 | |

| Net realized loss on sale of available-for-sale securities | |

| (194,202 | ) | |

| - | | |

| #DIV/0! | | |

$ | (194,202 | ) |

| Other noninterest income | |

| 280,249 | | |

| 294,714 | | |

| -4.91 | % | |

$ | (14,465 | ) |

| Total noninterest income | |

| 866,324 | | |

| 1,015,551 | | |

| -14.69 | % | |

$ | (149,227 | ) |

| Total noninterest expense | |

| 4,837,904 | | |

| 5,437,617 | | |

| -11.03 | % | |

$ | (599,713 | ) |

| Income tax expense | |

| 150,335 | | |

| 113,294 | | |

| 32.69 | % | |

$ | 37,041 | |

| Net income | |

$ | 1,992,911 | | |

$ | 1,887,611 | | |

| 5.58 | % | |

$ | 105,300 | |

| Key performance data | |

| | | |

| | | |

| | | |

| | |

| Earnings per common share - Basic | |

$ | 0.35 | | |

$ | 0.33 | | |

| 6.06 | % | |

$ | 0.020 | |

| Earnings per common share - Diluted | |

| 0.35 | | |

| 0.33 | | |

| 6.06 | % | |

$ | 0.020 | |

| Cash dividends paid | |

| 0.3225 | | |

| 0.3125 | | |

| 3.20 | % | |

$ | 0.01000 | |

| Stock data | |

| | | |

| | | |

| | | |

| | |

| Dividend payout ratio (without special dividend) | |

| 49.29 | % | |

| 49.24 | % | |

| 0.04 | % | |

| | |

| Price earnings ratio | |

| 10.34 | | x |

| 10.98 | | x |

| -5.91 | % | |

| | |

| Market price to book value | |

| 136 | % | |

| 144 | % | |

| -5.47 | % | |

| | |

| Annualized yield based on quarter end close (without special dividend) | |

| 4.77 | % | |

| 4.48 | % | |

| 6.47 | % | |

| | |

| Market value - last close (end of period) | |

| 14.47 | | |

| 14.50 | | |

| -0.21 | % | |

| | |

| Book value (end of period) | |

| 10.62 | | |

| 10.06 | | |

| 5.57 | % | |

| | |

| Tangible book value (end of period) | |

| 10.46 | | |

| 9.88 | | |

| 5.87 | % | |

| | |

| Shares Outstanding | |

| | | |

| | | |

| | | |

| | |

| Average - Basic | |

| 5,499,877 | | |

| 5,485,129 | | |

| -------- | | |

| | |

| Average - Diluted | |

| 5,499,877 | | |

| 5,485,129 | | |

| -------- | | |

| | |

| Common stock, shares issued | |

| 6,188,141 | | |

| 6,043,851 | | |

| -------- | | |

| | |

| Shares held as treasury stock | |

| 234,363 | | |

| 179,363 | | |

| -------- | | |

| | |

| Return on average assets (ROA) | |

| 0.97 | % | |

| 1.03 | % | |

| -0.07 | % | |

| | |

| Return on average equity (ROE) | |

| 12.59 | % | |

| 12.58 | % | |

| 0.00 | % | |

| | |

| At quarter end | |

| | | |

| | | |

| | | |

| | |

| Total assets | |

$ | 834,026,953 | | |

$ | 847,493,300 | | |

| -1.59 | % | |

$ | (13,466,347 | ) |

| Total assets (average) | |

| 822,468,000 | | |

| 774,822,000 | | |

| 6.15 | % | |

$ | 47,646,000 | |

| Cash and due from Federal Reserve Bank | |

| 46,876,621 | | |

| 100,588,646 | | |

| -53.40 | % | |

$ | (53,712,025 | ) |

| Average cash and due from Federal Reserve Bank | |

| 46,891,000 | | |

| 40,619,000 | | |

| 15.44 | % | |

$ | 6,272,000 | |

| Securities and other restricted stock | |

| 255,786,120 | | |

| 238,015,596 | | |

| 7.47 | % | |

$ | 17,770,524 | |

| Average securities and other restricted stock | |

| 246,854,000 | | |

| 235,247,000 | | |

| 4.93 | % | |

$ | 11,607,000 | |

| Other real estate and repossessions (OREO) | |

| 3,377,414 | | |

| 3,518,718 | | |

| -4.02 | % | |

$ | (141,304 | ) |

| Gross loans | |

| 480,306,405 | | |

| 463,688,134 | | |

| 3.58 | % | |

$ | 16,618,271 | |

| Allowance for credit losses | |

| (3,870,309 | ) | |

| (4,452,462 | ) | |

| -13.07 | % | |

$ | 582,153 | |

| Net loans | |

| 476,436,096 | | |

| 459,235,672 | | |

| 3.75 | % | |

$ | 17,200,424 | |

| Average loans | |

| 478,843,000 | | |

| 458,977,000 | | |

| 4.33 | % | |

$ | 19,866,000 | |

| Net loans recovered (charged-off) | |

| (28,418 | ) | |

| 4,330 | | |

| -756.30 | % | |

$ | (32,748 | ) |

| Net overdrafts (charged-off ) | |

| (19,458 | ) | |

| (23,363 | ) | |

| -16.71 | % | |

$ | 3,905 | |

| Total net (charge offs ) | |

| (47,876 | ) | |

| (19,033 | ) | |

| 151.54 | % | |

$ | (28,843 | ) |

| Nonaccrual loans | |

| 477,474 | | |

| 235,275 | | |

| 102.94 | % | |

$ | 242,199 | |

| Loans past due 30+ days (excludes non accrual loans) | |

| 953,580 | | |

| 293,326 | | |

| 225.09 | % | |

$ | 660,254 | |

| Total Deposits | |

| | | |

| | | |

| | | |

| | |

| Noninterest bearing demand | |

| 135,994,882 | | |

| 147,485,194 | | |

| -7.79 | % | |

$ | (11,490,312 | ) |

| Interest bearing demand | |

| 197,611,658 | | |

| 238,221,642 | | |

| -17.05 | % | |

$ | (40,609,984 | ) |

| Savings | |

| 128,810,010 | | |

| 143,544,118 | | |

| -10.26 | % | |

$ | (14,734,108 | ) |

| Time < $250,000 | |

| 125,550,068 | | |

| 105,526,900 | | |

| 18.97 | % | |

$ | 20,023,168 | |

| Time > $250,000 | |

| 37,783,568 | | |

| 18,586,762 | | |

| 103.28 | % | |

$ | 19,196,806 | |

| Total Deposits | |

| 625,750,186 | | |

| 653,364,616 | | |

| -4.23 | % | |

$ | (27,614,430 | ) |

| Average total deposits | |

| 620,439,000 | | |

| 647,478,000 | | |

| -4.18 | % | |

$ | (27,039,000 | ) |

| Advances from the Federal Home Loan Bank | |

| 75,000,000 | | |

| 75,000,000 | | |

| N/A | | |

$ | - | |

| Overnight advances | |

| - | | |

| - | | |

| N/A | | |

$ | - | |

| Term advances | |

| 75,000,000 | | |

| 75,000,000 | | |

| N/A | | |

$ | - | |

| Repurchase Agreements | |

| 37,804,711 | | |

| 23,741,060 | | |

| 59.24 | % | |

$ | 14,063,651 | |

| Shareholders' equity | |

| 63,206,181 | | |

| 59,005,777 | | |

| 7.12 | % | |

$ | 4,200,404 | |

| Common Stock, Additional Paid in Capital | |

| 32,186,863 | | |

| 31,216,095 | | |

| 3.11 | % | |

$ | 970,768 | |

| Retained Earnings | |

| 44,072,619 | | |

| 39,895,287 | | |

| 10.47 | % | |

$ | 4,177,332 | |

| Shares held by Deferred Plan and Treasury Stock | |

| (5,246,415 | ) | |

| (4,375,967 | ) | |

| 19.89 | % | |

$ | (870,448 | ) |

| Accumulated other comprehensive loss, net of taxes | |

| (7,806,886 | ) | |

| (7,729,638 | ) | |

| 1.00 | % | |

$ | (77,248 | ) |

| Goodwill and intangible assets (impact on Shareholders' equity | |

| (905,793 | ) | |

| (1,054,793 | ) | |

| -14.13 | % | |

$ | 149,000 | |

| Tangible shareholders' equity | |

| 62,300,388 | | |

| 57,950,984 | | |

| 7.51 | % | |

$ | 4,349,404 | |

| Shareholders' equity (average) | |

| 63,325,000 | | |

| 63,343,000 | | |

| -0.03 | % | |

$ | (18,000 | ) |

| Key performance ratios | |

| | | |

| | | |

| | | |

| | |

| Net interest margin (Federal tax equivalent) | |

| 3.46 | % | |

| 3.75 | % | |

| -0.29 | % | |

| | |

| Interest expense to average assets | |

| 1.71 | % | |

| 0.92 | % | |

| 0.78 | % | |

| | |

| Total allowance for credit losses | |

| | | |

| | | |

| | | |

| | |

| to nonperforming loans | |

| 437.78 | % | |

| 1892.45 | % | |

| -1454.67 | % | |

| | |

| Total allowance for credit losses | |

| | | |

| | | |

| | | |

| | |

| to total loans | |

| 0.81 | % | |

| 0.96 | % | |

| -0.15 | % | |

| | |

| Total past due and nonaccrual loans to gross loans | |

| 0.30 | % | |

| 0.11 | % | |

| 0.19 | % | |

| | |

| Nonperforming assets to total assets | |

| 0.51 | % | |

| 0.44 | % | |

| 0.07 | % | |

| | |

| Net charge-offs to average loans | |

| -0.04 | % | |

| -0.02 | % | |

| 0.02 | % | |

| | |

| Equity to assets at period end | |

| 7.58 | % | |

| 6.96 | % | |

| 0.62 | % | |

| | |

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

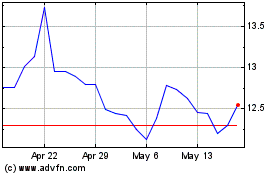

United Bancorp (NASDAQ:UBCP)

Historical Stock Chart

From May 2024 to Jun 2024

United Bancorp (NASDAQ:UBCP)

Historical Stock Chart

From Jun 2023 to Jun 2024