By Chris Matthews, MarketWatch , Andrea Riquier

Fed grew more worried about economy at September meeting,

minutes show

U.S. stocks rose Wednesday, as China and the U.S. attempted to

ease simmering tensions, a day before high-level trade talks are

scheduled to commence.

Investors were also parsing minutes from the most recent Federal

Reserve meeting as expectations for further rate cuts have risen in

recent weeks.

How are benchmarks performing?

The Dow Jones Industrial Average rose 204 points, or 0.8%, at

26,366. The S&P 500 index gained 29 points to reach 2,921, up

about 1%, while the Nasdaq added 87 points, or 1.1%, to 7,910.

What's driving the stock market?

Equity markets were boosted by reports that infused some

optimism about the possibility of at least a partial U.S.-China

trade deal.

A report from Bloomberg News

(https://www.bloomberg.com/news/articles/2019-10-09/china-open-to-partial-u-s-trade-deal-despite-tech-blacklist)

indicated that China was open to a limited tariff resolution with

the U.S., while another from the Financial Times

(https://www.ft.com/content/a24f6948-ea77-11e9-85f4-d00e5018f061)

(paywall) indicated that China has offered to increase by 50%

purchases of agricultural products from U.S. farmers to $50

billion.

The reports come after the U.S. State Department on Tuesday

announced visa restrictions

(http://www.marketwatch.com/story/us-restricts-visas-for-chinese-officials-involved-in-xinjiang-abuses-2019-10-08)on

Chinese government and Communist Party officials who are believed

to be involved in abuse of Uighurs and other Muslim minority groups

(http://www.marketwatch.com/story/socially-responsible-investors-may-have-unwittingly-backed-police-state-surveillance-in-china-2019-05-30)

in Xinjiang, China. That announcement came after the U.S.

blacklisted some 28 entities for the same alleged violations,

prompting Beijing to reportedly consider rolling out its own visa

restrictions on U.S. nationals, according to Reuters

(https://uk.reuters.com/article/us-usa-trade-china-visas/china-plans-to-restrict-visas-for-u-s-visitors-with-anti-china-links-idUKKBN1WO0L7).

Import duties on $250 billion worth of Chinese goods are set to

be raised to a rate of 30% from 25% on Oct. 15.

Wednesday's bounce comes from a hope that "this time is

different" for the trade talks, said Kim Forrest, founder and chief

investment officer at Bokeh Capital Management.

Talks have been "contentious," Forrest said, "but both sides

absolutely know something needs to be done." Semiconductor stocks,

and ETFs that track them, like the iShares PHLX fund(SOXX) and the

ProShares Ultra Semiconductors fund(USD) were up sharply Wednesday,

she pointed out, on investor optimism not just about a trade truce,

but also better conditions for businesses.

Concerns about international trade issues have been weighing on

the market, and drove stocks lower on Tuesday even after Federal

Reserve Chairman Jerome Powell said the central bank believes the

current economic expansion can be sustained, and that the Fed

intends to expand its balance sheet

(http://www.marketwatch.com/story/powell-says-economic-expansion-can-last-but-there-are-risks-2019-10-08)by

purchasing short-term U.S. government debt in exchange for bank

reserves, in an attempt to quell recent stress in the market for

overnight bank-to-bank lending.

Minutes from the rate-setting Federal Open Market Committee's

Sept. 17-18 meeting, released Wednesday,

(http://www.marketwatch.com/story/fed-had-grown-more-worried-about-economy-at-september-meeting-minutes-show-2019-10-09)

showed that Fed officials have become somewhat more concerned about

the state of the U.S. economy, with several Fed officials arguing

that the chances of a U.S. recession ""had increased notably in

recent months."

The meeting notes showed the central bank is split over the

proper trajectory of monetary policy, with several members

believing that the Fed should not have cut rates in September,

while others have argued for an even more aggressive stance.

Following a series of disappointing manufacturing and service

sector survey data on the U.S. economy last week, market

expectations for a third-consecutive rate cut at the upcoming Oct.

30-31 meeting has risen to 80.7% from 60.7% a month ago, according

to CME group data

(https://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html).

In U.S. economic data, the number of job openings nationwide

fell in August

(http://www.marketwatch.com/story/us-job-openings-fall-in-august-to-a-1-12--year-low-as-hiring-and-the-economy-slow-2019-10-09)for

the third month in a row and hit a one-and-a-half-year low,

coinciding with a decline in hiring that's taken place against the

backdrop of a slowing U.S. economy.

Read: Fed grew more worried about economy at September meeting,

minutes show

(http://www.marketwatch.com/story/fed-had-grown-more-worried-about-economy-at-september-meeting-minutes-show-2019-10-09)

See also: Fed's Powell says planned bond buying isn't emergency

stimulus; investors are skeptical

(http://www.marketwatch.com/story/feds-powell-says-planned-bond-buying-isnt-emergency-stimulus-investors-are-skeptical-2019-10-09)

Stocks to watch

Dow component Johnson & Johnson(JNJ) shares fell 2.3%

Wednesday after a Philadelphia jury ordered the company

(http://www.marketwatch.com/articles/jjs-johnson-stock-8-billion-punitive-damages-51570629876)

to pay $8 billion in damages to a man who said its Risperdal drug

caused enlarged breast tissue.

Apple Inc. (AAPL) has been accused of aiding Hong Kong

protesters

(http://www.marketwatch.com/story/apple-accused-of-unwise-and-reckless-decision-on-tracking-app-by-chinas-peoples-daily-2019-10-09)via

an app that allegedly enables tracking of local law enforcement --

representing the latest company ensnared in political tensions

between the semiautonomous territory and China.

Fitbit Inc. shares (FIT) jumped after the maker of wearables

said it's diversifying its supply chain out of China

(http://www.marketwatch.com/story/fitbit-shares-jump-4-premarket-after-company-unveils-plans-to-move-supply-chain-out-of-china-to-avoid-tariffs-2019-10-09)to

avoid U.S.-imposed tariffs.

American Airlines (AAL) said it expects Boeing Co.'s 737 MAX

will remain out of service until January

(http://www.marketwatch.com/story/american-airlines-pushes-737-max-return-to-january-2019-10-09),

the latest example of how the grounded plane continues to create

additional costs and logistical burdens for carriers and

passengers.

How are other markets trading?

The yield on the 10-year U.S. Treasury note rose to 1.579% from

1.532% late Tuesday.

(http://www.marketwatch.com/story/gold-edges-higher-ahead-of-trade-talks-2019-10-09)Gold

futures ended higher on Wednesday

(http://www.marketwatch.com/story/gold-edges-higher-ahead-of-trade-talks-2019-10-09)

to post their first gain in four sessions, as traders kept an eye

on U.S.-China tariff negotiations, developments around Brexit and

economic data. Gold for December delivery was up $8.90, or 0.6%, to

$1,512.80 an ounce, after settling at $1,503.90 an ounce on

Tuesday.

Oil futures traded lower Wednesday

(http://www.marketwatch.com/story/oil-prices-climb-though-us-crude-supplies-rise-a-4th-week-but-product-stocks-decline-2019-10-09)

after the U.S. government reported a fourth straight rise in crude

supplies.West Texas Intermediate crude for November delivery was

down 13 cents to $52.49 a barrel on the New York Mercantile

Exchange.

In Asia overnight Wednesday, trade was mixed, with Hong Kong's

Hang Seng Index fell 0.8% to 25,682.81, the China CSI 300 rose 0.1%

to reach 3,843.24, and Japan's Nikkei 225 fell 0.2%. The Stoxx

Europe 600 closed 0.4% higher.

(http://www.marketwatch.com/story/european-stocks-drift-lower-on-china-worries-and-lse-stumbles-2019-10-08)--

Mark Decambre contributed to this report

(END) Dow Jones Newswires

October 09, 2019 14:49 ET (18:49 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

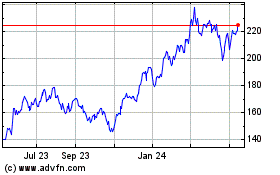

iShares Semiconductor ETF (NASDAQ:SOXX)

Historical Stock Chart

From Mar 2024 to Apr 2024

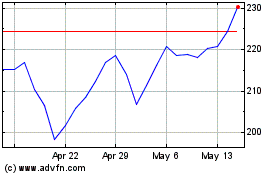

iShares Semiconductor ETF (NASDAQ:SOXX)

Historical Stock Chart

From Apr 2023 to Apr 2024