CPI Card Group Inc. Announces Closing of Private Offering of $310 Million of Senior Secured Notes & Entry into $50 Million AB...

March 15 2021 - 4:15PM

Business Wire

CPI Card Group Inc. (OTCQX: PMTS; TSX: PMTS) (“CPI” or the

“Company”) today announced the closing of the previously announced

private offering by its wholly-owned subsidiary, CPI CG Inc. (the

“issuer”), of $310 million aggregate principal amount of its 8.625%

senior secured notes due 2026 (the “notes”) and related

guarantees.

The issuer used the net proceeds from the offering, together

with $22.8 million cash on hand and $15 million of initial

borrowings under a $50 million secured asset based revolving credit

facility that it entered into concurrently with the issuance of the

notes (the “ABL revolver”), to repay in full and terminate its

existing credit facilities and to pay related fees and

expenses.

The notes are general senior secured obligations of the issuer

and guaranteed by the Company and certain of its current and future

wholly-owned domestic subsidiaries (other than the issuer) that

guarantee the ABL revolver, and are secured by substantially all of

the assets of the issuer and the guarantors, subject to customary

exceptions.

The notes and related guarantees were offered only to persons

reasonably believed to be qualified institutional buyers in

accordance with Rule 144A under the Securities Act of 1933, as

amended (the “Securities Act”), or outside the United States to

certain non-U.S. persons in compliance with Regulation S under the

Securities Act. The issuance and sale of the notes and related

guarantees have not been, and will not be, registered under the

Securities Act or the securities laws of any state or other

jurisdiction, and the notes and related guarantees may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements of the

Securities Act and other applicable securities laws.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the notes and related guarantees.

Offers of the notes and related guarantees were made only by means

of a private offering memorandum, and are not being made to any

person in any jurisdiction in which such offer, sale or

solicitation is unlawful.

About CPI Card Group Inc.

CPI Card Group® is a payment technology company and leading

provider of credit, debit and prepaid solutions delivered

physically, digitally and on-demand. CPI helps our customers foster

connections and build their brands through innovative and reliable

solutions, including financial payment cards, personalization, and

Software-as-a-Service (SaaS) instant issuance. CPI has more than 20

years of experience in the payments market and is a trusted partner

to financial institutions and payments services providers. Serving

customers from locations throughout the United States, CPI has a

large network of high security facilities, each of which is

registered as PCI compliant by one or more of the payment brands:

Visa, Mastercard®, American Express® and Discover®.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210315005708/en/

CPI Card Group Inc. Investor

Relations: (877) 369-9016

InvestorRelations@cpicardgroup.com CPI

Card Group Inc. Media Relations:

Media@cpicardgroup.com

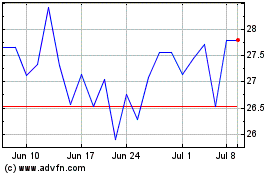

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Mar 2024 to Apr 2024

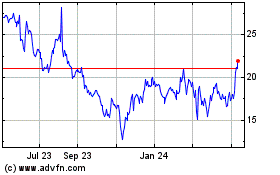

CPI Card (NASDAQ:PMTS)

Historical Stock Chart

From Apr 2023 to Apr 2024