MarketAxess Holdings Inc. (Nasdaq: MKTX), the operator of a leading

electronic trading platform for fixed-income securities, and the

provider of market data and post-trade services for the global

fixed-income markets, today announced results for the quarter ended

June 30, 2020.

“Record corporate bond new issuance and elevated

credit spread volatility led to record corporate bond market

volumes in the second quarter,” said Rick McVey, Chairman and CEO

of MarketAxess. “Institutional investors and dealers both leaned

into our Open Trading marketplace to meet their trading and

liquidity needs, driving record estimated market share for both

high-grade and high-yield bonds on the system. Estimated

transaction cost savings delivered back to our clients reached an

all-time high, with client savings exceeding company revenue for

the second quarter in a row. We are encouraged by the breadth

of volume and market share gains across all credit products and

geographic regions, leading to robust revenue and earnings

growth. Accelerating market share gains, record active

clients, and growing product diversification all position the

company well for future growth.”

Second Quarter

Results

Total revenues for the second quarter of 2020

increased 47% to $184.8 million, compared to $125.5 million for the

second quarter of 2019. Operating income was $104.1 million,

compared to $60.9 million for the second quarter of 2019, an

increase of 71%. Operating margin was 56.4%, compared to 48.5% for

the second quarter of 2019. Net income totaled $83.9 million,

or $2.20 per share on a diluted basis, compared to $48.1 million,

or $1.27 per share, for the second quarter of 2019.

Commission revenue for the second quarter of

2020 increased 51% to $172.1 million, compared to $114.1 million

for the second quarter of 2019. Variable transaction fees increased

61% to $146.0 million for the second quarter of 2020, compared to

variable transaction fees of $90.8 million for the second quarter

of 2019. U.S. high-grade trading volume as a percentage of FINRA’s

high-grade TRACE trading volume increased to an estimated 21.5% for

the second quarter of 2020, compared to an estimated 18.7% for the

second quarter of 2019. Variable transaction fees in the second

quarter of 2020 includes approximately $3.2 million of U.S.

Treasuries trading commissions related to the November 2019

acquisition of LiquidityEdge LLC, now operating as MarketAxess

Rates.

All other revenue, which consists of information

services, post-trade services and other revenue, increased 12% to

$12.7 million, compared to $11.4 million for the second quarter of

2019. The increase in all other revenue was principally due

to higher information services revenue of $1.3 million.

Total expenses for the second quarter of 2020

increased 25% to $80.7 million, compared to $64.6 million for the

second quarter of 2019. The increase in total expenses was largely

due to higher employee compensation and benefit costs, mainly due

to an increase in headcount, of $9.0 million, clearing costs,

mainly due to record Open Trading activity and U.S. Treasury

matched-principal trading, of $3.1 million, technology and

communications costs of $2.1 million and depreciation and

amortization of $2.0 million. MarketAxess Rates expenses, including

amortization of acquired intangibles expense, totaled $3.8 million

during the second quarter of 2020.

The effective tax rate for the second quarter of

2020 was 19.7%, compared to 23.5% for the second quarter of 2019.

The income tax provision for the second quarter of 2020 and 2019

reflected $5.7 million and $0.4 million, respectively, of excess

tax benefits related to share-based compensation awards.

Employee headcount was 561 as of June 30, 2020

compared to 527 as of December 31, 2019 and 480 as of June 30,

2019. The increase in headcount was due to the continued investment

in the Company’s growth initiatives, including geographic

expansion, trading automation, new trading protocols and the

transition to self-clearing.

Dividend

The Company’s board of directors declared a cash

dividend of $0.60 per share of common stock outstanding, to be paid

on August 19, 2020 to stockholders of record as of the close of

business on August 5, 2020.

Share

Repurchases

A total of 13,064 shares were repurchased in the

second quarter of 2020 at a cost of $5.9 million.

Balance Sheet

Data

As of June 30, 2020, total assets were $1.0

billion and included $535.5 million in cash, cash equivalents and

investments. Total stockholders’ equity as of June 30, 2020

was $853.5 million.

Non-GAAP Financial Measures and

Other Items

To supplement the Company’s unaudited financial

statements presented in accordance with generally accepted

accounting principles (“GAAP”), the Company uses certain non-GAAP

measures of financial performance, including earnings before

interest, taxes, depreciation and amortization (“EBITDA”) and free

cash flow. The Company believes that these non-GAAP financial

measures, when taken into consideration with the corresponding GAAP

financial measures, are important in understanding the Company's

operating results. See the attached schedule for a

reconciliation of GAAP net income to EBITDA and GAAP cash flow from

operating activities to free cash flow.

Webcast and Conference Call

Information

Rick McVey, Chairman and Chief Executive

Officer, Chris Concannon, President and Chief Operating

Officer and Tony DeLise, Chief Financial Officer, will host a

conference call to discuss the Company’s financial results and

outlook on Wednesday, July 22, 2020 at 10:00 a.m.

EDT. To access the conference call, please dial 855-425-4206 (U.S.)

or 484-756-4249 (international). The Company will also host a live

audio Webcast of the conference call on the Investor Relations

section of the Company's website at

http://investor.marketaxess.com. A replay of the call will be made

available by dialing 855-859-2056 (U.S.) or 404-537-3406

(international) and using the conference ID: 8916147 for one week

after the announcement. The Webcast will also be archived on

http://investor.marketaxess.com for 90 days following the

announcement.

About MarketAxess

MarketAxess operates a leading, institutional

electronic trading platform delivering expanded liquidity

opportunities, improved execution quality and significant cost

savings across global fixed-income markets. A global network of

over 1,700 firms, including the world’s leading asset managers and

institutional broker-dealers, leverages MarketAxess’ patented

trading technology to efficiently trade bonds. MarketAxess’

award-winning Open Trading™ marketplace is regarded as the

preferred all-to-all trading solution in the global credit markets,

creating a unique liquidity pool for a broad range of credit market

participants. Drawing on its deep data and analytical resources,

MarketAxess provides automated trading solutions, market data

products and a range of pre- and post-trade services.

MarketAxess is headquartered in New York and has

offices in London, Amsterdam, Boston, Chicago, Los Angeles, Miami,

San Francisco, São Paulo, Hong Kong and Singapore. For more

information, please visit www.marketaxess.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release may contain forward-looking

statements, including statements about the outlook and prospects

for Company and industry growth, as well as statements about the

Company’s future financial and operating performance. These

and other statements that relate to future results and events are

based on MarketAxess’ current expectations. The Company’s

actual results in future periods may differ materially from those

currently expected or desired because of a number of risks and

uncertainties, including: risks relating to the COVID-19 pandemic,

including the possible effects of the economic conditions worldwide

resulting from the COVID-19 pandemic; global economic, political

and market factors; the volatility of financial services markets

generally; the level of trading volume transacted on the

MarketAxess platform; the absolute level and direction of interest

rates and the corresponding volatility in the corporate

fixed-income market; the level and intensity of competition in the

fixed-income electronic trading industry and the pricing pressures

that may result; the variability of our growth rate; the rapidly

evolving nature of the electronic financial services industry; our

ability to introduce new fee plans and our clients’ response; our

exposure to risks resulting from non-performance by counterparties

to transactions executed between our clients in which we act as an

intermediary in matched principal trades; our dependence on our

broker-dealer clients; the loss of any of our significant

institutional investor clients; our ability to develop new products

and offerings and the market’s acceptance of those products; the

effect of rapid market or technological changes on us and the users

of our technology; our ability to successfully maintain the

integrity of our trading platform and our response to system

failures, capacity constraints and business interruptions; our

vulnerability to cyber security risks; our ability to protect our

intellectual property rights or technology and defend against

intellectual property infringement or other claims; our ability to

enter into strategic alliances and to acquire other businesses and

successfully integrate them with our business; our ability to

comply with new and existing laws, rules and regulations both

domestically and internationally; our ability to maintain effective

compliance and risk management methods; the strain of growth

initiatives on management and other resources; our future capital

needs and our ability to obtain capital when needed; limitations on

our operating flexibility contained in our credit agreement; and

other factors. The Company undertakes no obligation to update

any forward-looking statements, whether as a result of new

information, future events or otherwise. More information

about these and other factors affecting MarketAxess’ business and

prospects is contained in MarketAxess’ periodic filings with the

Securities and Exchange Commission and can be accessed at

www.marketaxess.com.

|

Media and Investor Relations Contacts: |

|

David Cresci MarketAxess Holdings

Inc.+1-212-813-6027 |

William McBrideRF|Binder+1-917-239-6726 |

|

|

|

|

Kyle WhiteMarketAxess Holdings Inc.+1-212-813-6355 |

|

|

|

|

|

|

|

MarketAxess Holdings Inc.Consolidated Statements of

Operations |

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

| |

(In thousands, except per share data) |

| |

(unaudited) |

| |

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

|

Commissions |

$ |

172,092 |

|

|

$ |

114,124 |

|

|

$ |

328,046 |

|

|

$ |

226,884 |

|

|

Information services |

|

8,427 |

|

|

|

7,156 |

|

|

|

17,069 |

|

|

|

14,522 |

|

|

Post-trade services |

|

4,054 |

|

|

|

3,956 |

|

|

|

8,207 |

|

|

|

8,056 |

|

|

Other |

|

222 |

|

|

|

254 |

|

|

|

451 |

|

|

|

519 |

|

|

Total revenues |

|

184,795 |

|

|

|

125,490 |

|

|

|

353,773 |

|

|

|

249,981 |

|

| |

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

Employee compensation and benefits |

|

41,636 |

|

|

|

32,623 |

|

|

|

82,830 |

|

|

|

65,281 |

|

|

Depreciation and amortization |

|

8,305 |

|

|

|

6,345 |

|

|

|

16,372 |

|

|

|

12,427 |

|

|

Technology and communications |

|

8,592 |

|

|

|

6,474 |

|

|

|

16,753 |

|

|

|

12,256 |

|

|

Professional and consulting fees |

|

8,065 |

|

|

|

6,296 |

|

|

|

13,740 |

|

|

|

12,127 |

|

|

Occupancy |

|

3,286 |

|

|

|

2,798 |

|

|

|

6,760 |

|

|

|

5,747 |

|

|

Marketing and advertising |

|

1,810 |

|

|

|

3,667 |

|

|

|

4,485 |

|

|

|

5,966 |

|

|

Clearing costs |

|

5,713 |

|

|

|

2,610 |

|

|

|

11,223 |

|

|

|

5,187 |

|

|

General and administrative |

|

3,253 |

|

|

|

3,800 |

|

|

|

6,386 |

|

|

|

6,924 |

|

|

Total expenses |

|

80,660 |

|

|

|

64,613 |

|

|

|

158,549 |

|

|

|

125,915 |

|

|

Operating income |

|

104,135 |

|

|

|

60,877 |

|

|

|

195,224 |

|

|

|

124,066 |

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

Investment income |

|

714 |

|

|

|

2,096 |

|

|

|

1,983 |

|

|

|

4,085 |

|

|

Other, net |

|

(446 |

) |

|

|

(64 |

) |

|

|

(1,102 |

) |

|

|

(22 |

) |

|

Total other income |

|

268 |

|

|

|

2,032 |

|

|

|

881 |

|

|

|

4,063 |

|

|

Income before income taxes |

|

104,403 |

|

|

|

62,909 |

|

|

|

196,105 |

|

|

|

128,129 |

|

|

Provision for income taxes |

|

20,549 |

|

|

|

14,804 |

|

|

|

37,435 |

|

|

|

27,502 |

|

|

Net income |

$ |

83,854 |

|

|

$ |

48,105 |

|

|

$ |

158,670 |

|

|

$ |

100,627 |

|

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Per Share Data: |

|

|

|

|

|

|

|

|

Net income per common share |

|

|

|

|

|

|

|

|

Basic |

$ |

2.25 |

|

|

$ |

1.30 |

|

|

$ |

4.25 |

|

|

$ |

2.72 |

|

|

Diluted |

$ |

2.20 |

|

|

$ |

1.27 |

|

|

$ |

4.16 |

|

|

$ |

2.66 |

|

| |

|

|

|

|

|

|

|

|

Cash dividends declared per common share |

$ |

0.60 |

|

|

$ |

0.51 |

|

|

$ |

1.20 |

|

|

$ |

1.02 |

|

| |

|

|

|

|

|

|

|

|

Weighted-average common shares: |

|

|

|

|

|

|

|

|

Basic |

|

37,340 |

|

|

|

37,049 |

|

|

|

37,322 |

|

|

|

37,046 |

|

|

Diluted |

|

38,153 |

|

|

|

37,910 |

|

|

|

38,115 |

|

|

|

37,871 |

|

| |

|

|

|

|

|

|

|

|

|

|

MarketAxess Holdings Inc.Commission Revenue

Details |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

| |

|

|

|

|

|

|

|

| |

Total Commissions Revenue |

| |

(In thousands) |

| |

(unaudited) |

| |

|

|

|

|

|

|

|

|

Variable transaction Fees |

|

|

|

|

|

|

|

|

U.S. high-grade |

$ |

75,208 |

|

$ |

42,914 |

|

$ |

133,178 |

|

$ |

85,415 |

|

Other credit 1 |

|

66,977 |

|

|

47,233 |

|

|

132,587 |

|

|

93,267 |

|

Total credit |

|

142,185 |

|

|

90,147 |

|

|

265,765 |

|

|

178,682 |

|

Rates 2 |

|

3,846 |

|

|

615 |

|

|

9,432 |

|

|

1,172 |

|

Total variable transaction fees |

|

146,031 |

|

|

90,762 |

|

|

275,197 |

|

|

179,854 |

|

|

|

|

|

|

|

|

|

|

Distribution Fees |

|

|

|

|

|

|

|

|

U.S. high-grade |

|

19,635 |

|

|

17,483 |

|

|

39,609 |

|

|

35,461 |

|

Other credit1 |

|

6,329 |

|

|

5,774 |

|

|

12,987 |

|

|

11,332 |

|

Total credit |

|

25,964 |

|

|

23,257 |

|

|

52,596 |

|

|

46,793 |

|

Rates2 |

|

97 |

|

|

105 |

|

|

253 |

|

|

237 |

|

Total distribution fees |

|

26,061 |

|

|

23,362 |

|

|

52,849 |

|

|

47,030 |

|

Total commissions |

$ |

172,092 |

|

$ |

114,124 |

|

$ |

328,046 |

|

$ |

226,884 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Average Variable Transaction Fee Per Million |

| |

(unaudited) |

| |

|

|

|

|

|

|

|

|

U.S. high-grade - fixed-rate |

$ |

186.67 |

|

$ |

168.05 |

|

$ |

185.04 |

|

$ |

163.15 |

|

U.S. high-grade - floating-rate |

|

55.06 |

|

|

65.22 |

|

|

51.38 |

|

|

70.65 |

|

Total U.S. high-grade |

|

181.41 |

|

|

161.72 |

|

|

178.86 |

|

|

157.37 |

|

Other credit 1 |

|

204.66 |

|

|

190.07 |

|

|

201.80 |

|

|

193.10 |

|

Total credit |

|

191.66 |

|

|

175.43 |

|

|

189.62 |

|

|

174.19 |

|

|

|

|

|

|

|

|

|

|

Rates2 |

|

4.02 |

|

|

46.69 |

|

|

3.93 |

|

|

42.69 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

1 Other credit includes high-yield, emerging markets, Eurobonds and

municipal bonds. |

|

2 Rates includes U.S. Government bonds, agencies and other

government bonds. |

| |

|

|

|

|

|

|

|

| |

| MarketAxess

Holdings Inc.Consolidated Condensed Balance Sheet

Data |

| |

|

|

|

| |

As of |

| |

June 30, 2020 |

|

December 31, 2019 |

| |

|

| |

(In

thousands) |

| |

(unaudited) |

| |

|

|

|

|

Assets |

|

|

|

|

Cash and cash equivalents |

$ |

404,148 |

|

|

$ |

270,124 |

|

|

Investments, at fair value |

|

131,372 |

|

|

|

230,477 |

|

|

Accounts receivable, net |

|

99,222 |

|

|

|

62,017 |

|

|

Goodwill |

|

147,394 |

|

|

|

146,861 |

|

|

Intangible assets, net of accumulated amortization |

|

59,552 |

|

|

|

60,986 |

|

|

Furniture, equipment, leasehold improvements and capitalized

software, net |

|

78,461 |

|

|

|

71,795 |

|

|

Operating lease right-of-use assets |

|

77,933 |

|

|

|

81,399 |

|

|

Prepaid expenses and other assets |

|

41,102 |

|

|

|

30,770 |

|

|

Deferred tax assets, net |

|

33 |

|

|

|

501 |

|

|

Total assets |

$ |

1,039,217 |

|

|

$ |

954,930 |

|

| |

|

|

|

|

Liabilities and stockholders' equity |

|

|

|

|

Liabilities |

|

|

|

|

Accrued employee compensation |

$ |

39,434 |

|

|

$ |

47,365 |

|

|

Income and other tax liabilities |

|

24,906 |

|

|

|

16,690 |

|

|

Deferred revenue |

|

4,068 |

|

|

|

3,499 |

|

|

Accounts payable, accrued expenses and other liabilities |

|

22,624 |

|

|

|

19,294 |

|

|

Operating lease liabilities |

|

94,701 |

|

|

|

97,991 |

|

|

Total liabilities |

|

185,733 |

|

|

|

184,839 |

|

|

|

|

|

|

|

Stockholders' equity |

|

|

|

|

Common stock |

|

122 |

|

|

|

122 |

|

|

Additional paid-in capital |

|

327,970 |

|

|

|

342,541 |

|

|

Treasury stock |

|

(164,676 |

) |

|

|

(153,388 |

) |

|

Retained earnings |

|

704,219 |

|

|

|

591,086 |

|

|

Accumulated other comprehensive loss |

|

(14,151 |

) |

|

|

(10,270 |

) |

|

Total stockholders' equity |

|

853,484 |

|

|

|

770,091 |

|

|

Total liabilities and stockholders' equity |

$ |

1,039,217 |

|

|

$ |

954,930 |

|

| |

|

|

|

|

|

|

MarketAxess Holdings Inc.Reconciliation of Non-GAAP

Financial Measures |

| |

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

June 30, |

|

June 30, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

| |

|

|

|

|

|

|

|

| |

Earnings Before Interest, Taxes, Depreciation and

Amortization |

| |

(In thousands) |

| |

(unaudited) |

|

Net income |

$ |

83,854 |

|

|

$ |

48,105 |

|

|

$ |

158,670 |

|

|

$ |

100,627 |

|

|

Add back: |

|

|

|

|

|

|

|

|

Interest expense |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Provision for income taxes |

|

20,549 |

|

|

|

14,804 |

|

|

|

37,435 |

|

|

|

27,502 |

|

|

Depreciation and amortization |

|

8,305 |

|

|

|

6,345 |

|

|

|

16,372 |

|

|

|

12,427 |

|

|

Earnings before interest, taxes, depreciation and

amortization |

$ |

112,708 |

|

|

$ |

69,254 |

|

|

$ |

212,477 |

|

|

$ |

140,556 |

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow |

|

|

(In thousands) |

|

|

(unaudited) |

|

Cash flows from operating activities |

$ |

104,853 |

|

|

$ |

69,733 |

|

|

$ |

225,222 |

|

|

$ |

109,102 |

|

|

Exclude: Net change in trading investments |

|

(6,880 |

) |

|

|

(2,839 |

) |

|

|

(63,274 |

) |

|

|

(8,854 |

) |

|

Less: Purchases of furniture, equipment and leasehold

improvements |

|

(4,973 |

) |

|

|

(5,465 |

) |

|

|

(9,264 |

) |

|

|

(6,114 |

) |

|

Less: Capitalization of software development costs |

|

(6,225 |

) |

|

|

(4,126 |

) |

|

|

(13,003 |

) |

|

|

(7,310 |

) |

|

Free cash flow |

$ |

86,775 |

|

|

$ |

57,303 |

|

|

$ |

139,681 |

|

|

$ |

86,824 |

|

| |

|

|

|

|

|

|

|

|

|

|

MarketAxess Holdings Inc.Volume Statistics* |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

Three Months EndedJune 30, |

|

Six MonthsEnded June 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| |

|

|

|

|

|

|

|

| |

Total Trading Volume |

| |

(In millions) |

| |

(unaudited) |

| |

|

|

|

|

|

|

|

|

U.S. high-grade - fixed-rate |

$ |

398,006 |

|

$ |

249,025 |

|

$ |

710,194 |

|

$ |

508,858 |

|

U.S. high-grade - floating-rate |

16,574 |

|

16,335 |

|

34,380 |

|

33,912 |

|

Total U.S. high-grade |

414,580 |

|

265,360 |

|

744,574 |

|

542,770 |

|

Other credit |

327,266 |

|

248,503 |

|

657,019 |

|

482,994 |

|

Total credit |

741,846 |

|

513,863 |

|

1,401,593 |

|

1,025,764 |

|

|

|

|

|

|

|

|

|

|

Rates |

955,594 |

|

13,174 |

|

2,400,472 |

|

27,450 |

| |

|

|

|

|

|

|

|

| |

Average Daily Volume |

| |

(In millions) |

| |

(unaudited) |

|

U.S. high-grade |

$ |

6,581 |

|

$ |

4,212 |

|

$ |

5,957 |

|

$ |

4,377 |

|

Other credit |

5,234 |

|

3,979 |

|

5,256 |

|

3,895 |

|

Total credit |

11,815 |

|

8,191 |

|

11,213 |

|

8,272 |

|

|

|

|

|

|

|

|

|

|

Rates |

15,169 |

|

209 |

|

19,204 |

|

221 |

| |

|

|

|

|

|

|

|

|

Number of U.S. Trading Days 1 |

63 |

|

63 |

|

125 |

|

124 |

|

Number of U.K. Trading Days 2 |

61 |

|

61 |

|

125 |

|

124 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 The number of U.S. trading days is based on the SIFMA holiday

recommendation calendar. |

|

2 The number of U.K. trading days is based on the U.K. Bank holiday

schedule. |

|

|

|

|

|

|

|

|

|

|

*Consistent with FINRA TRACE reporting standards, both sides of

trades are included in the Company's reported volumes when the

Company executes trades on a matched principal basis between two

counterparties. Consistent with industry standards, U.S. Government

Bond trades are single-counted. |

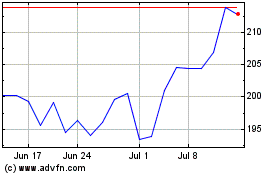

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

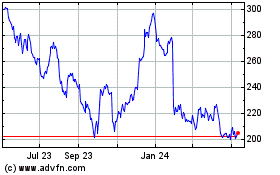

MarketAxess (NASDAQ:MKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024