ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying prospectus are part of a “shelf” registration statement on Form F-3 (File No. 333-238162) utilizing

a shelf registration process relating to the securities described in this prospectus supplement that was initially filed with

the Securities and Exchange Commission, or the SEC, on May 11, 2020, and that was declared effective by the SEC on May 15, 2020.

Other than ADSs being sold pursuant to this offering, we have sold an aggregate of 6,993,069 ADSs, including ADSs issuable upon

the exercise of pre-funded warrants, at a total of approximately $8.30 million, under that shelf registration statement. This

document comprises two parts. The first part is this prospectus supplement, which describes the specific terms of this offering

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference

herein. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering.

Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is

a conflict between the information contained in this prospectus supplement and the accompanying prospectus, you should rely on

the information in this supplement.

This prospectus supplement

and the accompanying prospectus relate to the offering of our ADSs. Before buying any of the ADSs offered hereby, we urge you to

read carefully this prospectus supplement and the accompanying prospectus, together with the information incorporated herein by

reference as described below under the heading “Incorporation by Reference.” This prospectus supplement contains information

about the ADSs offered hereby and may add to, update or change information in the accompanying prospectus.

In this prospectus

supplement, as permitted by law, we “incorporate by reference” information from other documents that we file with the

SEC. This means that we can disclose important information to you by referring to those documents. The information incorporated

by reference is considered to be a part of this prospectus supplement and the accompanying prospectus, and should be read with

the same care. When we make future filings with the SEC to update the information contained in documents that have been incorporated

by reference, the information included or incorporated by reference in this prospectus supplement is considered to be automatically

updated and superseded. If the description of the offering varies between this prospectus supplement and the accompanying prospectus,

you should rely on the information contained in this prospectus supplement. However, if any statement in this prospectus supplement

or the accompanying prospectus is inconsistent with a statement in another document having a later date (including a document incorporated

by reference in the accompanying prospectus), the statement in the document having the later date modifies or supersedes the earlier

statement.

Neither we nor the

underwriter have authorized anyone to provide you with information different from that contained in this prospectus supplement,

the accompanying prospectus or any free writing prospectus we have authorized for use in connection with this offering. We and

the underwriter take no responsibility for, and can provide no assurance as to the reliability of, any other information that others

may give you. The information contained in, or incorporated by reference into, this prospectus supplement, the accompanying prospectus,

and any free writing prospectus we have authorized for use in connection with this offering is accurate only as of the date of

each such document. Our business, financial condition, results of operations and prospects may have changed since those dates.

You should read this prospectus supplement, the accompanying prospectus, the documents incorporated by reference in this prospectus

supplement, the accompanying prospectus and any free writing prospectus that we have authorized for use in connection with this

offering in their entirety before making an investment decision. You should also read and consider the information in the documents

to which we have referred you in the sections of the accompanying prospectus entitled “Where You Can Find More Information”

and “Incorporation of Certain Documents by Reference.” These documents contain important information that you should

consider when making your investment decision.

We are not making offers

to sell or solicitations to buy our ADSs in any jurisdiction in which an offer or solicitation is not authorized or in which the

person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to make an offer or solicitation.

You should assume that the information in this prospectus supplement and the accompanying prospectus is accurate only as of the

date on the front of the respective document and that any information that we have incorporated by reference is accurate only as

of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement or the

accompanying prospectus or the time of any sale of a security.

Throughout this prospectus,

unless otherwise designated, the terms “we”, “us”, “our”, “Medigus”, “the

Company” and “our Company” refer to Medigus Ltd. and its consolidated subsidiaries. References to “ordinary

shares”, “ADSs”, and “share capital” refer to the ordinary shares, ADSs and share capital, respectively,

of Medigus.

This prospectus supplement

and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but

reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the

actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated herein

by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below under the

section entitled “Where You Can Find More Information.”

Market data and certain

industry data and forecasts used throughout this prospectus supplement were obtained from sources we believe to be reliable, including

market research databases, publicly available information, reports of governmental agencies and industry publications and surveys.

We have relied on certain data from third-party sources, including internal surveys, industry forecasts and market research, which

we believe to be reliable based on our management’s knowledge of the industry. Forecasts are particularly likely to be inaccurate,

especially over long periods of time. In addition, we do not necessarily know what assumptions regarding general economic growth

were used in preparing the third-party forecasts we cite. Statements as to our market position are based on the most currently

available data. While we are not aware of any misstatements regarding the industry data presented in this prospectus, our estimates

involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading

“Risk Factors” in this prospectus. Our financial statements are prepared and presented in accordance with International

Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our historical results

do not necessarily indicate our expected results for any future periods.

Certain figures included

in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be

an arithmetic aggregation of the figures that precede them.

Unless derived from

our financial statements or otherwise noted, the terms “shekels,” “Israeli shekels” and “NIS”

refer to New Israeli Shekels, the lawful currency of the State of Israel, and the terms “dollar,” “U.S. dollar,”

“US$,” “USD” or “$” refer to U.S. dollars, the lawful currency of the United States.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights

selected information about us, this offering and information contained in greater detail elsewhere in this prospectus supplement,

the accompanying prospectus, and in the documents incorporated by reference. This summary is not complete and does not contain

all of the information that you should consider before investing in our securities. You should carefully read and consider this

entire prospectus supplement, the accompanying prospectus and the documents, including financial statements and related notes,

and information incorporated by reference into this prospectus supplement, including the financial statements and “Risk

Factors” starting on pages S-8 of this prospectus supplement, before making an investment decision. If you invest in our

securities, you are assuming a high degree of risk.

Business Overview

The activities carried out by us, and our subsidiaries are focused

on medical-related devices and products and on internet and other online-related technologies. Our medical-related activities include

miniaturized imaging equipment through Scoutcam Inc. (formerly known as Intellisense Solutions Inc.), or Scoutcam, our 46.03% held

subsidiary, innovative surgical devices with direct visualization capabilities for the treatment of Gastroesophageal Reflux Disease,

or GERD, by the Company using Medigus Ultrasonic Surgical Endostapler, or MUSE, and biological gels to protect patients against

biological threats and prevent intrusion of allergens and viruses through the upper airways and eye cavities through our stake

and licensing arrangement with Polyrizon Ltd., or Polyrizon. Our internet-related activities include ad-tech operations through

our stake in Gix Internet Ltd., f/k/a Algomizer Ltd., or Gix, and its subsidiary, Linkury Ltd., or Linkury. Eventer Technologies

Ltd., or Eventer, an online event management and ticketing platform and Smart Repair Pro Inc. and Purex Corp, e-Commerce companies

which operate online stores for the sale of various consumer products on the Amazon online marketplace, utilizing the fulfillment

by Amazon, or FBA model, and Charging Robotics Ltd., or Charging Robotics, our recently incorporated wholly owned subsidiary, which

will focus on our electric vehicle and wireless charging activities.

The diversification

of our core activity and our entry into the internet and online-related operations are in accordance with a change to our business

model, which we initiated in 2019. Following an analysis of our previous efforts to commercialize the MUSETM system

and the ScoutCamTM portfolio, we decided to broaden our activities to include operations in fields with a shorter go-to-market

pathway and increased growth potential. In accordance with this strategy, we abandoned the efforts to commercialize the MUSETM

system, transferred the ScoutCamTM activity to our Israel subsidiary, ScoutCam Ltd., and consummated a securities exchange

agreement relating to ScoutCam Ltd. Since implementing these steps, we have pursued investments that have granted us substantial

and controlling interests in other ventures, which we believe will provide a greater return to our shareholders.

Medical Activity Overview

ScoutCam – Miniaturized Imaging Equipment

We previously engaged

in the development, production and marketing of innovative miniaturized imaging equipment known as the micro ScoutCam™ portfolio

for use in medical procedures as well as various industrial applications, through ScoutCam Ltd. ScoutCam Ltd. was incorporated

as part of a reorganization of the Company intended to distinguish the Company’s micro ScoutCam™ portfolio from the

other operations of the Company and to enable the Company to form a separate business unit with dedicated resources, focused on

the promotion of our miniaturized imaging technology. After we completed the transfer of all of the Company’s assets and

intellectual property related to the Company’s miniature video cameras business into ScoutCam Ltd., we consummated a securities

exchange agreement with ScoutCam (formerly known as Intellisense Solutions Inc.), under which we received 60% of the issued and

outstanding stock of ScoutCam in consideration for 100% of our holdings in ScoutCam Ltd. Following the aforementioned transactions,

Intellisense Solutions Inc. changed its name to ScoutCam Inc. Since the securities exchange agreement, the commercialization efforts

relating to the ScoutCam™ portfolio are carried out exclusively by ScoutCam. Commercially, ScoutCam has received purchase

orders for its products from a Fortune 500 company in the healthcare sector and has been added to the Approved Supplier List of

a leading healthcare company. ScoutCam is examining and pursuing additional applications for the micro ScoutCam™ portfolio

outside of the medical device industry, including, among others, the defense, aerospace, automotive, and industrial non-destructing-testing

industries, and plans to further expand the activity in these non-medical spaces.

Since the reorganization

and spinoff of the ScoutCam activity, ScoutCam has made headway in its field both in the form of achieving commercial milestones

and raising additional capital to fund its operations.

On March 3, 2020, ScoutCam

consummated a securities purchase agreement with certain investors in connection with the sale and issuance of $948,400 worth of

units, or the Units. Each Unit consisted of (i) two shares of ScoutCam’s common stock, par value $0.001 per share, or the

ScoutCam Common Stock; and (ii) (a) one warrant to purchase one share of ScoutCam Common Stock with an exercise price of $0.595,

or the A Warrant, and (b) two warrants to purchase one share of ScoutCam Common Stock each with an exercise price of $0.893, or

the B Warrant, at a purchase price of $0.968 per Unit. In connection with the agreement, ScoutCam issued 1,959,504 shares of ScoutCam

Common Stock, 979,754 A Warrants, and 1,959,504 B Warrants to purchase shares of ScoutCam Common Stock. In addition, on May 19,

2020, we announced that ScoutCam entered into and consummated a securities purchase agreement with M. Arkin (1999) Ltd. in connection

with an investment of $2,000,000. Since September 14, 2020, ScoutCam’s common stock is quoted on the OTCQB Venture Market.

On June 23, 2020, we

entered into and consummated a side letter agreement with ScoutCam, whereby the parties agreed to convert, at a conversion price

of $0.484 per share, an outstanding line of credit previously extended by us to ScoutCam, which as of the date thereof was $381,136,

into (i) 787,471 shares of ScoutCam Common Stock, (ii) warrants to purchase 393,736 shares of ScoutCam Common Stock with an exercise

price of $0.595 with a term of twelve months from the date of issuance, and (iii) warrants to purchase 787,471 shares of ScoutCam

Common Stock with an exercise price of $0.893 with a term of eighteen months from the date of issuance.

Our MUSE™ System

In addition, we have

been engaged in the development, production and marketing of innovative surgical devices with direct visualization capabilities

for the treatment of GERD, a common ailment, which is predominantly treated by medical therapy (e.g. proton pump inhibitors) or

in chronic cases, conventional open or laparoscopic surgery. Our U.S. Food and Drug Administration, or FDA, cleared and CE-marked

endosurgical system, known as the Medigus Ultrasonic Surgical Endostapler, or MUSE™ (Medigus Ultrasonic Surgical Endostapler)

system, enables minimally-invasive and incisionless procedures for the treatment of GERD by reconstruction of the esophageal valve

via the mouth and esophagus, eliminating the need for surgery in eligible patients. We believe that this procedure offers a safe,

effective and economical alternative to the current modes of GERD treatment for certain GERD patients, and has the ability to provide

results that are equivalent to those of standard surgical procedures while reducing pain and trauma, minimizing hospital stays,

and delivering economic value to hospitals and payors.

Prevalence of GERD

GERD is a worldwide

disorder, with evidence suggesting an increase in GERD disease prevalence since 1995. Treatment of GERD involves a stepwise approach.

The goals are to control symptoms, to heal esophagitis and to prevent recurrent esophagitis. The most common operation for GERD

is called a surgical fundoplication, a procedure that prevents reflux by wrapping or attaching the upper part of the stomach around

the lower esophagus and securing it with sutures. Due to the presence of the wrap or attachment, increasing pressure in the stomach

compresses the portion of the esophagus, which is wrapped or attached by the stomach, and prevents acidic gastric content from

flowing up into the esophagus. Today, the operation is usually performed laparoscopically: instead of a single large incision into

the chest or abdomen, four or five smaller incisions are made in the abdomen, and the operator uses a number of specially designed

tools to operate under video control.

Our product, the MUSE™

system for transoral fundoplication is a single use innovative device for the treatment of GERD. The MUSE™ technology is

based on our proprietary platform technology, experience and know-how. Transoral means that the procedure is performed through

the mouth, rather than through incisions in the abdomen. The MUSE™ system is used to perform a procedure as an alternative

to a surgical fundoplication. The MUSE™ system offers an endoscopic, incisionless alternative to surgery. A single surgeon

or gastroenterologist can perform the MUSE™ procedure in a transoral way, unlike in a laparoscopic fundoplication, which

requires incisions.

The clearance by the

FDA, or ‘Indications for Use,’ of the MUSE™ system is “for endoscopic placement of surgical staples in

the soft tissue of the esophagus and stomach in order to create anterior partial fundoplication for treatment of symptomatic chronic

Gastro-Esophageal Reflux Disease in patients who require and respond to pharmacological therapy”. As such, the FDA clearance

covers the use by an operator of the MUSE™ endostapler as described in the above paragraph. In addition, in the pivotal study

presented to the FDA to gain clearance, only patients who were currently taking GERD medications (i.e. pharmacological therapy)

were allowed in the study. In addition, all patients had to have a significant decrease in their symptoms when they were taking

medication compared to when they were off the medication. The FDA clearance indicated that the MUSE™ system is intended for

patients who require and respond to pharmacological therapy. The MUSE™ system indication does not restrict its use with respect

to GERD severity from a regulatory point of view. However, clinicians typically only consider interventional treatment options

for moderate to severe GERD. Therefore, it is reasonable to expect the MUSE™ system would be primarily used to treat moderate

and severe GERD in practice. The system has received 510(k) marketing clearance from the FDA in the United States, as well as a

CE mark in Europe.

On

June 3, 2019, we entered into a Licensing and Sale Agreement with Shanghai Golden Grand-Medical Instruments Ltd. (Golden Grand)

for the know-how licensing and sale of goods relating to the MUSE™ system in China, Hong Kong, Taiwan and Macao. Under the

agreement, we committed to providing a license, training services and goods to Golden Grand in consideration for $3,000,000 to

be paid to us in four milestone-based installments. To date, some of these milestones have been achieved and the Company has received

$1,800,000. The final milestones will be completed, and the final installment paid upon completion of a MUSE™ assembly line

in China. Due to COVID-19, the implementation of certain actions required to be achieved under the milestones has been delayed,

specifically due to travel restrictions. In recent months, efforts have been renewed to achieve the next milestones.

Polyrizon – Protective Biological

Gels

Polyrizon is a private

company engaged in developing biological gels designed to protect patients against biological threats and reduce the intrusion

of allergens and viruses through the upper airways and eye cavities.

In July 2020, we entered

into an ordinary share purchase agreement with Polyrizon, pursuant to which we purchased 19.9% of Polyrizon’s issued and

outstanding capital stock on a fully diluted basis for aggregate gross proceeds of $10,000. We also agreed to loan Polyrizon $94,000.

The loan does not bear any interest and is repayable only upon a deemed liquidation event, as defined in that share purchase agreement.

In addition, we have an option, or the Option, to invest an additional amount of up to $1,000,000 in consideration for shares of

Polyrizon such that following the additional investment, we will own 51% of Polyrizon’s capital stock on a fully diluted

basis, excluding outstanding deferred shares, as defined in the share purchase agreement. The Option is exercisable until the earlier

of (i) April 23, 2023, or (ii) the consummation by Polyrizon of equity financing of at least $500,000 based on a pre-money valuation

of at least $10,000,000.

In addition, we entered

into an exclusive reseller agreement with Polyrizon. As part of the reseller agreement, we received an exclusive global license

to promote, market, and resell the Polyrizon products, focusing on a unique Biogel to protect from the COVID-19 virus. The term

of the license is for four years, commencing upon receipt of sufficient FDA approvals for the lawful marketing and sale of the

products globally. We also have the right to purchase the Polyrizon products on a cost-plus 15% basis for the purpose of reselling

the products worldwide. In consideration of the license, Polyrizon will be entitled to receive annual royalty payments equal to

10% of our annualized operating profit arising from selling the products. To date, Poyrizon’s products have not received

the requisite FDA approvals, and therefore manufacturing and commercialization efforts have not yet commenced.

On November 9, 2020,

we entered into a term sheet, with Polyrizon and Mr. Raul Srugo for an additional investment of up to a total of $250,000 in Polyrizon.

Following an investment of $100,000, we will hold approximately 33% of Polyrizon shares on a fully diluted basis, subject to adjustments

upon the consummation of a deferred closing. According to the term sheet, we, and other shareholders, also have the option to invest

an additional aggregate amount of up to $50,000 for a period of 60 days after the initial closing. The initial closing of this

transaction is expected to occur in the upcoming weeks.

Internet Activity Overview

Gix – Ad-Tech and Online Advertising

We currently own a

minority stake in Gix and its subsidiary, Linkury. Linkury operates in the field of software development, marketing, and distribution

to internet users. Gix recently announced its intention to focus its efforts on Linkury, which is the primary source of Gix’s

revenues and operations, with a goal of expanding its product portfolio in the field of technological solutions for advertising

and media. In the coming year, Linkury plans to launch new products in the sector of advertising technologies and mobile. Furthermore,

Gix continues its efforts to seek opportunities for engaging in acquisitions of companies with significant revenues and commercial

potential. Gix operates through two major arms: Gix Apps, which is distributed free of charge (as browser add-ons and desktop apps)

to end-users and drives revenues from the placement of advertisements, and Gix Content, a solution platform for publishers, personalized

content ads and banners per users’ preferences, based on Gix’s proprietary technologies.

Our stake in Gix was acquired pursuant to a securities purchase

agreement dated June 19, 2019, or the Agreement. Pursuant to the Agreement, we are entitled, for a period of three years following

the closing of the investment, to convert any and all of our Linkury shares into Gix shares with a 20% discount over the average

share price of Gix on the Tel Aviv Stock Exchange Ltd., or TASE within the 60 trading days preceding the conversion. On October

14, 2020, we notified Gix of our election to convert the 793,448 ordinary shares of Linkury that we currently own into Gix’s

ordinary shares in accordance with the Agreement. As a result of the conversion, we will be entitled to receive additional 9,858,698

ordinary shares of Gix, which, together with our current holdings, will constitute approximately 33% of Gix’s issued and

outstanding share capital following the conversion. In addition, pursuant to the Agreement, we are entitled to an issuance of additional

ordinary shares of Gix and an adjustment to our outstanding warrant to purchase Gix ordinary shares, in the event that Gix issues

shares at a price per share lower than the price paid by us under the Agreement. On November 10, 2020, Gix announced an offering

of its ordinary shares at a price per share of NIS 1.33, resulting in our entitlement to receive an additional 4,598,243 ordinary

shares. As a result of the aforementioned conversion and adjustment we will hold approximately 40.26% of Gix outstanding share

capital on a fully diluted basis. Pursuant to the provisions of the Companies Law, the issuance of shares representing 25% or more

of the voting rights in a public company is subject to prior shareholder approval. We have requested that Gix convene a shareholder

meeting as soon as practicably possible in order to obtain the requisite approval and affect the conversion. The shareholder meeting

of Gix has not yet been called.

Eventer – Online Event Management

Eventer is a technology

company engaged in the development of unique tools for automatic creation, management, promotion, and billing of events and ticketing

sales. Eventer seeks to tap the growing demand for enterprise and private online communication over the last year. As such, Eventer’s

systems offer and enable advanced, user-friendly solutions for online events such as online concerts, enterprise events and online

conferences, in addition to management and ticket sales for events carried out in offline venues. In addition, Eventer’s

platform provides individuals with the ability to create and sell tickets to custom small-scale private or public events. Eventer’s

revenues are derived from commissions from sales of tickets for online and offline events planned and managed through its platform.

On October 14, 2020,

we signed a share purchase agreement and a revolving loan agreement with Eventer. The Eventer transaction closed on October 26,

2020. Pursuant to the share purchase agreement, we invested $750,000 and were issued an aggregate of 325,270 ordinary shares of

Eventer, representing 50.01% of Eventer’s issued and outstanding share capital on a fully diluted basis. The share purchase

agreement provides that we will invest an additional $250,000 in a second tranche, subject to Eventer achieving certain post-closing

EBITDA based milestones during the fiscal years 2020 through 2023, or the Milestones. In the event that Eventer partially achieves

the Milestones, the $250,000 investment will be reduced in proportion to the Milestones that were achieved.

In addition, we entered

into a revolving loan agreement with Eventer, or the Loan Agreement, under which we committed to lending up to $1,250,000 to Eventer

through advances of funds upon Eventer’s request and subject to our approval. We extended an initial advance of $250,000

upon closing the Loan Agreement, or the Initial Advance. Advances extended under the Loan Agreement may be repaid and borrowed

in part or in full from time to time. The Initial Advance will be repaid in twenty-four equal monthly installments, commencing

on the first anniversary of the Loan Agreement. Other advances extended under the Loan Agreement will be repaid immediately following,

and in no event later than thirty days following the completion of the project or purpose for which they were made. Outstanding

principal balances on the advances will bear interest at a rate equal to the higher of (i) 4% per year, or (ii) the interest rate

determined by the Israeli Income Tax Ordinance [New Version] 5721-1961 and the rules and regulation promulgated thereunder. Interest

payments will be made on a monthly basis.

On October 14, 2020,

we entered into a share exchange agreement with Eventer’s shareholders, or the Exchange Agreement, pursuant to which, during

the period commencing on the second anniversary of the Exchange Agreement and ending fifty-four (54) months following the date

of the Exchange Agreement, Eventer’s shareholders may elect to exchange all of their Eventer shares for ordinary shares of

our company. The number of ordinary shares of the Company to which Eventer’s shareholders would be entitled pursuant to an

exchange will be calculated by dividing the fair market value of each Eventer’s ordinary share, as mutually determined by

our company and the shareholders, by the average closing price of an ordinary share of our company on the principal market on which

its ordinary shares or ADSs are traded during the sixty days prior to the exchange date rounded down to the nearest whole number.

Our board of directors may defer exchange’s implementation in the event it determines in good faith that doing so would be

materially detrimental to the Company and its shareholders. In addition, the exchange may not be effected for so long as $600,000

or greater remains outstanding under the Loan Agreement, or if an event of default under the Loan Agreement has occurred.

On February 23, 2021, Eventer announced that it entered the virtual

conference market by signing an exclusive licensing agreement to adopt Screenz Cross Media Ltd.’s, or Screenz, technology

for virtual conferences. As part of the license agreement, Screenz will provide and adapt its technology to Eventer to host and

broadcast virtual conferences, including an interactive player with capabilities of broadcasting, recording and interactive layers

on video. In consideration for granting the license to use the technology for virtual conferences and developing the necessary

adaptions, Eventer shall pay Screenz a total sum of $1,500,000. In the first five months Eventer shall pay Screenz a monthly sum

of $40,000, with such period being considered a grace period for Eventer’s planning and establishment of the operation. Following

the grace period, Eventer shall pay Screenz the remaining sum of $1,300,000 in three equal payments. The adaptation of the Screenz

technology is expected to be completed in the second half of 2021. Screenz shall be entitled to 8% of the revenue received from

any use of the product.

Smart Repair Pro, Inc. and Purex Corp

– Investment and Secondary

Smart Repair Pro, Inc., or Pro, and Purex, Corp., or Purex,

are both California corporations in the e-Commerce field, which operate online stores for the sale of various consumer products

on the Amazon online marketplace, utilizing the FBA model. Pro and Purex utilize artificial intelligence and machine learning technologies

to analyze sales data and patterns on the Amazon marketplace in order to identify existing stores, niches and products that have

the potential for development and growth as well as maximize sales of its existing proprietary products. Pro and Purex together

manage two online stores through which three distinct product brands are marketed and sold to consumers in the United States. Pro

and Purex’s strategy is to achieve organic growth and profitability by expanding to new geographies, increasing sales of

its existing products through marketing and advertising efforts, development of new products and brands, supply chain optimization

and inventory management. Pro has completed processes with Amazon, which will allow for it to open its stores for sale to consumers

in the United Kingdom, German, France, Spain, Italy and Australia.

On October 8, 2020,

we entered into a common stock purchase agreement with Pro, Purex, and their respective stockholders, or the Purex Purchase Agreement.

Pursuant to the Purex Purchase Agreement, we agreed to acquire 50.01% of each of Pro and Purex issued and outstanding share capital

on a fully diluted basis, was acquired through a combination of cash investments in the companies and acquisition of additional

shares from the current shareholders of the two companies in consideration for our restricted ADSs and a cash component. We agreed

to invest an aggregate amount of $1,250,000 in Pro and Purex, pay $150,000 in cash consideration to the current stockholders,

and issue $500,000 worth of restricted ADSs to the current stockholders of such companies, with the value of restricted ADSs to

be subject to downward adjustment based on the 2020 results of the two companies. In addition, the companies’ current shareholders

are entitled to additional milestone issuances of up to an aggregate $750,000 in restricted ADSs subject to the achievement by

Pro and Purex of certain milestones throughout 2021. The transactions contemplated in the definitive agreements closed on January

4, 2021.

Subsequently according

to the terms of the Purex Purchase Agreement, we entered into a loan and pledge agreement, effective January 5, 2021 with our majority

owned subsidiaries Pro and Purex. Pursuant to this loan and pledge agreement, we extended a $250,000 loan, with an annual interest

of 4%, to be repaid on the second anniversary of the effective date.

Other Activities

Matomy Media Group Ltd.

We hold

approximately 24.92% of the outstanding share capital of Matomy Media Group Ltd.’s, or Matomy, a public company listed

on the TASE.

On September 29, 2020,

Matomy announced that it has entered into a memorandum of understanding, or the Automax MOU, with Global Automax Ltd., or Automax,

an Israeli private company that imports various leading car brands to Israel and Automax’s shareholders. The Automax MOU

provides for a proposed merger in which the shareholders of Automax would exchange 100% of their shares in Automax for shares of

Matomy, or the Proposed Merger. Under the Automax MOU, Automax and Matomy have agreed on an exclusivity period of 60 days. Save

for the exclusivity period, the Automax MOU is non-binding.

On November 9, 2020,

Matomy signed a binding agreement for the Proposed Merger. Matomy expects that, upon completion of the Proposed Merger, Automax

shareholders would hold approximately 53% of the outstanding share capital of Matomy and potentially up to a maximum of 73%, due

to additional share issuances which are subject to achievement of certain revenue and profit milestones by Matomy, or if the value

of the Matomy’s shares reach specific values after the Proposed Merger. There can be no guarantee that the Proposed Merger

will be completed.

On October 20, 2020,

Matomy held an extraordinary general meeting of shareholders and approved the cancellation of the admission of Matomy’s ordinary

shares for trading on the High Growth Segment of the London Stock Exchange.

Recent Developments

Underwritten Public Offerings

On May 22, 2020, we closed an underwritten public offering of

(i) 575,001 ADSs at a public offering price of $1.50 per ADS, and (ii) 2,758,333 pre-funded warrants to purchase one ADS at a public

offering price of $1.499 per ADS. The gross proceeds from this offering were approximately $5,000,000 before deducting underwriting

discounts, commissions and other offering expenses. The pre-funded warrants, which were exercisable at any time after the date

of issuance upon payment of the exercise price of $0.001 per ADS, have been exercised in full.

On December 3, 2020

we closed an underwritten public offering of 7,098,491 ADSs at a public offering price of $1.83 per ADS. On December 16, 2020,

the underwriter exercised, in full, their option to purchase an additional 1,064,774 ADSs at a price of $1.83 per ADS. Total gross

proceeds to the Company from the offering, including the funds received from the prior closing and exercise of this option, were

approximately $14.9 million, before deducting underwriting discounts, commissions and other offering expenses payable by the Company.

On January 13, 2021, we closed an underwritten public offering

of 3,659,735 ADSs at a public offering price of $2.30 per ADS. On January 19, 2021, the underwriter exercised in full their option

to purchase an additional 548,960 ADSs at a price of $2.30 per ADS. Total gross proceeds to the Company from the offering, including

the funds received from the prior closing and exercise of this option, were approximately $9.6 million, before deducting underwriting

discounts, commissions and other offering expenses payable by the Company.

GERD Patent Infringement Litigation

On July 13, 2020, our

subsidiary, GERD IP, Inc., or GERD IP, a Delaware corporation, filed a complaint in the United States District Court for the District

of Delaware, or the Court, alleging infringement of two of its proprietary patents issued by the United States Patent and Trademark

Office by EndoGastric Solutions, Inc. or the Defendant. On August 27, 2020, GERD IP filed an amended complaint and on September

9, 2020 the Defendant filed an answer. Pursuant to the Court’s November 6, 2020 scheduling order, on November 9, 2020, and

on November 12, 2020, GERD IP and Defendant, respectively, provided their initial disclosures. In addition, with the consent of

the parties, the case was referred to a mediation process scheduled for April 8, 2021.

Delisting from the Tel Aviv Stock Exchange

Ltd.

On October 22, 2020,

our board of directors resolved to take steps to voluntarily delist our ordinary shares from trading on the TASE. We delisted our

ordinary shares from TASE in order to be subject to one set of listing regulations instead of two, to allow greater flexibility

to execute our business and financing strategy and to reduce administrative costs, in order to maximize shareholder value in the

medium and long term.

Following the delisting

in Israel, our ADSs continue to trade on the Nasdaq Stock Market. Holders of our ordinary shares were urged to convert their shares

into ADSs through their banks and brokers. Every twenty (20) ordinary shares are convertible into one (1) ADS.

Under applicable Israeli law, including Section 35BB of the

Israeli Securities Law, the delisting of our ordinary shares from trading on the TASE took place three months after the date of

our announcement. The last trading day of our ordinary shares on the TASE was January 21, 2021, and on January 25, 2021, our ordinary

shares were delisted from the TASE. Following the delisting, the Company continues to file public reports and make public disclosures

in accordance with the rules and regulations of the SEC and Nasdaq.

Medigus New Joint Venture

On February 19, 2021,

we entered into the Joint Venture Agreement, or Joint Venture Agreement, with Amir Zaid and Weijian Zhou and our wholly-owned subsidiary

Charging Robotics, pursuant to which have entered into a new joint venture agreement for the purpose of developing and commercializing

three modular electric vehicle (EV) micro mobility vehicles for urban individual use and “last mile” cargo delivery.

Pursuant to the terms of the Joint Venture Agreement, we will own initially 19.99% of the

issued and outstanding share capital of the joint venture and upon the consummation of an investment in a milestone financing

of $1,350,000 in the aggregate, we will be entitled to own 50.01% of the issued and outstanding share capital of the joint venture.

We will initially invest $250,000 upon the closing of the Joint Venture Agreement. An additional $400,000

will be invested based on predefined milestones which include the finalization of a design model within two months following the

initial financing and formation of new entity, finalization of the development of an operational model of the “PORTO”

modular delivery vehicle, within six months, and the execution of two material commercial agreements or long form engagements,

for pilot projects, with at least two global shipping companies for product evaluation and purchase within eight months following

the initial financing.

ScoutCam’s Projects with the Israeli

Air Force

On December 14, 2020,

ScoutCam embarked on three different development projects in cooperation with the

Israeli Air Force. ScoutCam is developing products that leverage its high resilient micro-cameras (as recently demonstrated by

NASA’s Robotic Refueling Mission 3) and its unique wired and wireless transmission capabilities to improve maintenance as

well as flight safety of both helicopters and unmanned aerial vehicles, or UAV, in the service of the Israeli Air Force. These

products, once tried and approved for use by the Israeli Air Force, may lead to these products being sold to other air forces around

the world as well as to helicopter and UAV manufacturers globally.

Collaboration Agreement and Patent and

Intellectual Property Assignment Agreement

On January 7, 2021, the Company entered an agreement to purchase

a provisional patent filed with the United States Patent and Trademark Office and know-how relating to wireless vehicle battery

charging technology in consideration for $75,000. Furthermore, the Company entered a collaboration agreement with the seller, whereby

the Company committed to invest $150,000 in a newly incorporated wholly owned subsidiary of the Company, Charging Robotics, which

was incorporated on February 1, 2021, which will focus on our new electric vehicle and wireless charging activities. Pursuant to

the collaboration agreement, seller is entitled to a monthly consultant fee as well as options to purchase 15% of Charging Robotics’

fully diluted share capital as of its incorporation date based on a valuation of $1,000,000.

Appointment of New Chief Financial Officer

On November 27, 2020,

the Company announced Ms. Tatiana Yosef resignation from her position as the Company’s Chief Financial Officer. On November

30, 2020, the board of directors of the Company appointed Mr. Oz Adler to replace Ms. Tatiana Yosef and to serve as the Company’s

Chief Financial Officer commencing on January 15, 2021. Mr. Adler’s employment with the Company commenced on December 1,

2020.

Pro Loan and Pledge Agreement

On February 2, 2021,

we entered into a loan and pledge agreement, effective February 2, 2021, and amended on February 5, 2021, or the Pro Loan and Pledge

Agreement, with our majority owned subsidiary Pro and its other stockholder, to finance Pro’s additional purchases of three

new brands on the Amazon online marketplace. Pursuant to the Pro Loan and Pledge Agreement, we extended a $3.76 million loan, with

an annual interest of 4%, to be repaid on the fifth anniversary of the effective date. In order to secure the repayment of the

loan and interest amounts, Pro pledged a first priority interest in Pro’s share capital, its interests in its online stores

and a floating charge of Pro cash and cash equivalents.

Elimination of Par Value

On February 12, 2021,

following the approval of an extraordinary general meeting of our shareholders held on February 12, 2021, the Company amended its

articles of association to eliminate the par value of its ordinary shares, such that the authorized share capital of the Company

following the amendment consists of 1,000,000,000 ordinary shares of no par value.

Corporate Information

We were incorporated in the State of Israel on December 9, 1999,

as a private company pursuant to the Israeli Companies Ordinance (New Version), 1983. In February 2006, we completed our initial

public offering in Israel, and until January 25, 2021, our ordinary shares were traded on TASE, under the symbol “MDGS”.

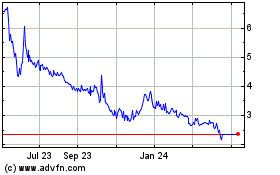

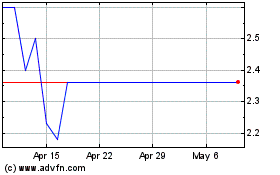

In May 2015, we listed the ADSs on Nasdaq, and since August 2015 the ADSs have been traded on Nasdaq under the symbol “MDGS”.

Our Series C Warrants have been trading on Nasdaq under the symbol “MDGSW” since July 2018. Each Series C Warrant is

exercisable into one ADS for an exercise price of $3.50 and will expire in July 2023. Each ADS represents 20 ordinary shares.

We are a public limited

liability company and operate under the provisions of Israel’s Companies Law, 5759-1999, as amended, or the Companies Law.

Our registered office and principal place of business are located at Omer Industrial Park, No. 7A, P.O. Box 3030, Omer 8496500,

Israel and our telephone number in Israel is +972-73-370-4691. Our website address is www.medigus.com. The information contained

on our website or available through our website is not incorporated by reference into and should not be considered a part of this

prospectus. Our registered agent in the United States is Puglisi & Associates. The address of Puglisi & Associates is 850

Library Avenue, Suite 204, Newark, DE, 19711, USA.

THE OFFERING

|

ADSs offered by us

|

|

ADSs representing ordinary shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Public offering price

|

|

$ per ADS

|

|

|

|

|

|

Ordinary shares to be outstanding after this offering

|

|

ordinary shares.

|

|

|

|

|

|

The ADSs

|

|

Each ADS represents 20 ordinary shares.

The ADSs will be evidenced by American Depositary Receipts, or ADRs, executed and delivered by The Bank of New York Mellon, as

Depositary.

The Depositary, as depositary, will be

the holder of the ordinary shares underlying your ADSs and you will have rights as provided in the Deposit Agreement, among us,

The Bank of New York Mellon, as Depositary, and all owners and holders from time to time of ADSs issued thereunder, or the Deposit

Agreement, a form of which has been filed as Exhibit 1 to the Registration Statement on Form F-6 filed by The Bank of New York

Mellon with the SEC on May 7, 2015.

Subject to compliance with the relevant

requirements set out in the prospectus, you may turn in your ADSs to the Depositary in exchange for ordinary shares underlying

your ADSs.

The Depositary will charge you fees for

such exchanges pursuant to the Deposit Agreement.

You should carefully read the “Description

of American Depositary Shares” section of the accompanying prospectus and the Deposit Agreement to better understand the

terms of the ADSs.

|

|

|

|

|

|

Over-allotment option

|

|

We have granted the underwriter an option, exercisable until 45

days following the date of this prospectus (but not to close after March 31, 2021, unless we have filed our Annual Report on Form

20-F by that day), to acquire purchase up to additional ADSs solely to cover over-allotments,

if any.

|

|

|

|

|

|

Use of proceeds

|

|

We estimate the net proceeds from this offering will be approximately

$ million (approximately $ million if the underwriter exercises its over-allotment

option in full), after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We currently

intend to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds”

on page S-22 of this prospectus supplement.

|

|

|

|

|

|

Risk factors

|

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement, on page 4 of the accompanying prospectus and in our Annual Report on Form 20-F filed with the SEC, on April 21, 2020, for a discussion of certain factors you should consider before investing in our securities.

|

|

|

|

|

|

Listings

|

|

The ADSs are traded on Nasdaq under

the symbol “MDGS”.

|

|

|

|

|

|

Depositary

|

|

The Bank of New York Mellon

|

Unless otherwise indicated, the number of ordinary shares outstanding

prior to and after this offering is based on 400,616,638 ordinary shares issued and outstanding as of February 24, 2021,

and excludes:

|

|

●

|

6,963,630 ordinary shares issuable upon the exercise of outstanding options at a weighted average exercise price of NIS 0.68 per share or $0.21 per share (based on the exchange rate reported by the Bank of Israel on such date), equivalent to 348,182 ADSs at a weighted average exercise price of $4.26 per ADS; and

|

|

|

●

|

85,988,240 ordinary shares issuable upon the exercise of warrants to purchase up to an aggregate of 4,299,412 ADSs at a weighted average exercise price of $5.26 per ADS.

|

Unless otherwise indicated,

all information in this prospectus supplement assumes no exercise of the outstanding options or warrants described above, and assumes

no exercise of the underwriter’s over-allotment option.

RISK FACTORS

An investment in

our securities involves significant risks. Before making an investment in our securities, you should carefully read all of the

information contained in this prospectus supplement, the accompanying prospectus and in the documents incorporated by reference

herein, including the risk factors contained in our Annual Report on Form 20-F for the year ended December 31, 2019 filed with

the SEC on April 21, 2020. For a discussion of risk factors that you should carefully consider before deciding to purchase any

of our securities, please review the additional risk factors disclosed below and the information under the heading “Risk

Factors” in the accompanying prospectus. In addition, please read “About this Prospectus Supplement” and “Cautionary

Note Regarding Forward-Looking Statements” in this prospectus supplement, where we describe additional uncertainties associated

with our business and the forward-looking statements included or incorporated by reference in this prospectus supplement and the

accompanying prospectus. The risks and uncertainties described below are not the only risks facing us. Please note that additional

risks not currently known to us or that we currently deem immaterial also may adversely affect our business, results of operations,

financial condition and prospects. Our business, financial condition, results of operations and prospects could be materially and

adversely affected by these risks, and you may lose all or part of your original investment.

Risks Related to Our Business and the

Business of our Subsidiaries

We made material changes to our business

strategy during 2019 and 2020, which we continued to implement in 2021. We cannot guarantee that any of these changes will result

in any value to our shareholders.

Since 2019, we have

materially changed our business model, adjusted our exclusive focus on the medical device industry to include other industries,

abandoned our strategy to commercialize the MUSE™ system, transferred our ScoutCam™ activity

into our subsidiary, ScoutCam Ltd., and consummated a securities exchange agreement in relation to ScoutCam Ltd. As a result of

these changes, we have acquired substantial stakes in a number of ventures, including but not limited to online business activities

such as ad-tech and online event management. We cannot guarantee that these strategic decisions will derive the anticipated value

to our shareholders, or any value at all and us.

We have had a history of losses and our ability to grow

sales and achieve profitability are unpredictable.

We have incurred losses

since our incorporation. As of June 30, 2020, we had an accumulated deficit of $79.2 million and incurred total comprehensive losses

of approximately $14.2 million, $6.6 million and $3.6 million in the years ended December 31, 2019 and 2018 and the six months

ended June 30, 2020, respectively. Our ability to reach profitability depends on many factors, which include:

|

|

●

|

successfully implementing our business strategy;

|

|

|

●

|

increasing revenues; and

|

There can be no assurance

that we will be able to successfully implement our business plan, meet our challenges and become profitable in the future.

Changes in laws and regulations related

to the Internet or changes in the Internet infrastructure itself may diminish the demand for our products and services and could

harm our business.

The future success

of the online businesses of our subsidiaries depends upon the continued use of the internet as a primary medium for commerce, communication,

and business applications. Federal, state, or foreign government bodies or agencies have in the past adopted, and may in the future

adopt, laws or regulations affecting the use of the Internet as a commercial medium. The adoption of any laws or regulations that

could reduce the growth, popularity, or use of the Internet, including laws or practices limiting Internet neutrality, could decrease

the demand for, or the usage of, services provided by Eventer and Gix increase the cost of doing business and harm our results

of operations. Changes in these laws or regulations could require our subsidiaries and us to modify our offerings, or certain aspects

of them, in order to comply with these changes. In addition, government agencies or private organizations have imposed and may

impose additional taxes, fees, or other charges for accessing the Internet or commerce conducted via the Internet. These laws or

charges could limit the growth of Internet-related commerce or communications generally, or result in reductions in the demand

for Internet-based products such as those of our subsidiaries. In addition, the use of the Internet as a business tool could be

harmed due to delays in the development or adoption of new standards and protocols to handle increased demands of Internet activity,

security, reliability, cost, ease-of-use, accessibility, and quality of service. Further, the applicability and demand for services

and products offered by our subsidiaries and us depend on the quality of our users’ access to the Internet. Certain features

of our offerings, and specifically those of Eventer, may require significant bandwidth and fidelity to work effectively. Internet

access is frequently provided by companies that have significant market power that could take actions that degrade, disrupt, or

increase the cost of access to our services, which would negatively impact our results. The Internet’s performance and its acceptance

as a business and commerce tool have been harmed by “viruses,” “worms” and similar malicious programs,

and the Internet has experienced a variety of outages and other delays as a result of damage to portions of its infrastructure.

If the Internet’s use is adversely affected by these issues, demand for the services provided by our subsidiaries and us

could decline.

The global outbreak

of COVID-19 (coronavirus) may negatively impact the global economy in a significant manner for an extended period of time, and

also adversely affect our operating results in a material manner.

The COVID-19 pandemic,

including the efforts to combat it, has had and may continue to have a widespread effect on our business. In response to the pandemic,

public health authorities and local and national governments have implemented measures that have and may continue to impact our

business, including voluntary or mandatory quarantines, restrictions on travel and orders to limit the activities of non-essential

workforce personnel. As of the date of this registration statement, the COVID-19 (coronavirus) pandemic had made a significant

impact on global economic activity, with governments around the world, including Israel, having closed office spaces, public transportation

and schools, and restricting travel. These closures and restrictions, if continued for a sustained period, could trigger a global

recession that could negatively impact our business in a material manner. We are actively monitoring the pandemic and we are taking

any necessary measures to respond to the situation in cooperation with the various stakeholders.

In light of the evolving

nature of the pandemic and the uncertainty it has produced around the world, we do not believe it is possible to predict with precision

the pandemic’s cumulative and ultimate impact on our future business operations, liquidity, financial condition and results

of operations. For example, travel restrictions have adversely affected our ability to timely achieve certain milestones included

in our Golden Grand Agreement and has delayed the recognition revenues deriving therefrom. These travel restrictions have also

impacted our sales and marketing efforts and those of our subsidiaries.

The extent of the impact

of the pandemic on our business and financial results will depend largely on future developments, including the duration of the

spread of the outbreak and any future “waves” of the outbreak, globally and specifically within Israel and the United

States. In addition, the extent of the impact on capital and financial markets, foreign currencies exchange and governmental or

regulatory orders that impact our business are highly uncertain and cannot be predicted. If economic conditions generally or in

the industries in which we operate specifically, worsen from present levels, our results of operations could be adversely affected

and our financial condition will depend on future developments that are highly uncertain and cannot be predicted, including new

government actions or restrictions, new information that may emerge concerning the severity, longevity and impact of the COVID-19

pandemic on economic activity.

Additionally, concerns

over the economic impact of the pandemic have caused extreme volatility in financial markets, which has adversely impacted and

may continue to adversely impact our share price and our ability to access capital markets. To the extent the pandemic or any worsening

of the global business and economic environment as a result adversely affects our business and financial results, it may also have

the effect of heightening many of the other risks described in this “Risk Factors” section and the risk factors in

our Annual Report on Form 20-F for the year ended December 31, 2019.

Unfavorable conditions in the industry

of our subsidiaries and the global economy in general could limit their ability to grow their business and negatively affect their

operations results.

The results of operations

of our subsidiaries may vary based on the impact of changes in the industry or the global economy on their customers or the subsidiaries.

Our subsidiaries’ businesses revenue growth and potential profitability and our subsidiaries depend on the demand for our

services and products, including the demand online and offline events and advertising. Current or future economic uncertainties

or downturns could adversely affect our business and results of operations. Negative conditions in the global economy or individual

markets, including changes in gross domestic product growth, financial and credit market fluctuations, political turmoil, natural

catastrophes, warfare and terrorist attacks in Israel, the United States or elsewhere, could cause a decrease in business investments,

leisure related spending, event organization and organization spend on marketing and advertising which could negatively affect

our business.

Pro, Purex, Gix and Eventer each

rely on key employees and highly skilled personnel, and, if they are unable to attract, retain or motivate qualified personnel,

they may not be able to operate its business effectively.

The success of Gix

and Eventer depends largely on the continued employment of their senior management and key personnel who can effectively operate

its business and its ability to attract and retain skilled employees. Competition for highly skilled management, technical, research

and development, and other employees is intense, and Gix and Eventer may not be able to attract or retain highly qualified personnel

in the future. If any of the key employees of Gix and Eventer leave or are terminated, and such companies fail to manage a transition

to new personnel effectively, or if they fail to attract and retain qualified and experienced professionals on acceptable terms,

the business, financial condition and results of operations of Gix and Eventer could be adversely affected.

We, and our subsidiaries, are subject

to stringent and changing laws, regulations, standards, and contractual obligations related to privacy, data protection, and data

security. The actual or perceived failure to comply with such obligations could harm our business.

Our subsidiaries and

we receive, collect, store, process, transfer, and use personal information and other data relating to users of our products, our

employees and contractors, and other persons. We have legal and contractual obligations regarding the protection of confidentiality

and appropriate use of certain data, including personal information. We are subject to numerous federal, state, local, and international

laws, directives, and regulations regarding privacy, data protection, and data security and the collection, storing, sharing, use,

processing, transfer, disclosure, and protection of personal information and other data, the scope of which are changing, subject

to differing interpretations, and may be inconsistent among jurisdictions or conflict with other legal and regulatory requirements.

We are also subject to certain contractual obligations to third parties related to privacy, data protection and data security.

We strive to comply with our applicable policies and applicable laws, regulations, contractual obligations, and other legal obligations

relating to privacy, data protection, and data security to the extent possible. However, the regulatory framework for privacy,

data protection and data security worldwide is, and is likely to remain for the foreseeable future, uncertain and complex, and

it is possible that these or other actual or alleged obligations may be interpreted and applied in a manner that we do not anticipate

or that is inconsistent from one jurisdiction to another and may conflict with other legal obligations or our practices. Further,

any significant change to applicable laws, regulations or industry practices regarding the collection, use, retention, security

or disclosure of data, or their interpretation, or any changes regarding the manner in which the consent of users or other data

subjects for the collection, use, retention or disclosure of such data must be obtained, could increase our costs and require us

to modify our services and features, possibly in a material manner, which we may be unable to complete, and may limit our ability

to store and process user data or develop new services and features.

If our subsidiaries

or we were found in violation of any applicable laws or regulations relating to privacy, data protection, or security, our business

may be materially and adversely affected and we would likely have to change our business practices and potentially the services

and features available through our platform. In addition, these laws and regulations could impose significant costs on us and could

constrain our ability to use and process data in manners that may be commercially desirable. In addition, if a breach of data security

were to occur or to be alleged to have occurred, if any violation of laws and regulations relating to privacy, data protection

or data security were to be alleged, or if we had any actual or alleged defect in our safeguards or practices relating to privacy,

data protection, or data security, our solutions may be perceived as less desirable, and our business, prospects, financial condition,

and results of operations could be materially and adversely affected.

We also expect that

there will continue to be new laws, regulations, and industry standards concerning privacy, data protection, and information security

proposed and enacted in various jurisdictions. For example, the data protection landscape in the European Union (“EU”)

is currently evolving, resulting in possible significant operational costs for internal compliance and risks to our business. The

EU adopted the General Data Protection Regulation or GDPR, which became effective in May 2018, and contains numerous requirements

and changes from previously existing EU laws, including more robust obligations on data processors and heavier documentation requirements

for data protection compliance programs by companies. Among other requirements, the GDPR regulates the transfer of personal data

subject to the GDPR to third countries that have not been found to provide adequate protection to such personal data, including

the United States. Failure to comply with the GDPR could result in penalties for noncompliance (including possible fines of up

to the greater of €20 million and 4% of our global annual turnover for the preceding financial year for the most serious

violations, as well as the right to compensation for financial or non-financial damages claimed by individuals under

Article 82 of the GDPR).

In addition to the

GDPR, the European Commission has another draft regulation in the approval process that focuses on a person’s right to conduct

a private life. The proposed legislation, known as the Regulation of Privacy and Electronic Communications, or ePrivacy Regulation,

would replace the current ePrivacy Directive. Originally planned to be adopted and implemented at the same time as the GDPR, the

ePrivacy Regulation is still being negotiated.

Additionally, in June

2018, California passed the California Consumer Privacy Act, or CCPA, which provides new data privacy rights for California consumers

and new operational requirements for covered companies. Specifically, the CCPA provides that covered companies must provide new

disclosures to California consumers and afford such consumers new data privacy rights that include the right to request a copy

from a covered company of the personal information collected about them, the right to request deletion of such personal information,

and the right to request to opt-out of certain sales of such personal information. The CCPA became operative on January 1,

2020. The California Attorney General can enforce the CCPA, including seeking an injunction and civil penalties for violations.

The CCPA also provides a private right of action for certain data breaches expected to increase data breach litigation. The CCPA

may require us to modify our data practices and policies and to incur substantial costs and expenses in order to comply. A new

privacy law, the California Privacy Rights Act, or CPRA, was recently certified by the California Secretary of State to appear

on the ballot for the November 3, 2020 election. If this initiative is approved by California voters, the CPRA would significantly

modify the CCPA, potentially resulting in further uncertainty and requiring us to incur additional costs and expenses in an effort

to comply. More generally, some observers have noted the CCPA could mark the beginning of a trend toward more stringent privacy

legislation in the United States, which could increase our potential liability and adversely affect our business. Further, in March

2017, the United Kingdom (“U.K.”) formally notified the European Council of its intention to leave the EU pursuant

to Article 50 of the Treaty on European Union (“Brexit”). The U.K. ceased to be an EU Member State on January 31,

2020, but enacted a Data Protection Act substantially implementing the GDPR, effective in May 2018, which was further amended to

align more substantially with the GDPR following Brexit. It is unclear how U.K. data protection laws or regulations will develop

in the medium to longer-term and how data transfers to and from the U.K. will be regulated. Some countries also are considering

or have enacted legislation requiring local storage and processing of data that could increase the cost and complexity of delivering

our services.

In addition, failure

to comply with the Israeli Privacy Protection Law 5741-1981, and its regulations as well as the guidelines of the Israeli Privacy

Protection Authority, may expose us to administrative fines, civil claims (including class actions), and in certain cases, criminal

liability. Current pending legislation may result in a change in the current enforcement measures and sanctions.

Any failure or perceived

failure by our subsidiaries or by us to comply with our posted privacy policies, our privacy-related obligations to users or other

third parties, or any other legal obligations or regulatory requirements relating to privacy, data protection, or data security

may result in governmental investigations or enforcement actions, litigation, claims, or public statements against us by consumer

advocacy groups or others and could result in significant liability, cause our users to lose trust in us, and otherwise materially

and adversely affect our reputation and business. Furthermore, the costs of compliance with, and other burdens imposed by, the

laws, regulations, other obligations, and policies that are applicable to the businesses of our users may limit the adoption and

use of, and reduce the overall demand for, our platform. Additionally, if third parties we work with violate applicable laws, regulations,

or contractual obligations, such violations may put our users’ data at risk, could result in governmental investigations

or enforcement actions, fines, litigation, claims, or public statements against us by consumer advocacy groups or others and could

result in significant liability, cause our users to lose trust in us, and otherwise materially and adversely affect our reputation

and business. Further, public scrutiny of, or complaints about, technology companies or their data handling or data protection

practices, even if unrelated to our business, industry, or operations, may lead to increased scrutiny of technology companies,

including us, and may cause government agencies to enact additional regulatory requirements, or to modify their enforcement or

investigation activities, which may increase our costs and risks.

We have signed the Joint Venture

Agreement to commercialize three modular EV micro mobility vehicles but we have not yet dedicated significant time or resources

to this joint venture and, to date, it is not a material part of our business.

On February 19, 2021,

we entered into the Joint Venture Agreement, with Amir Zaid and Weijian Zhou and our wholly-owned subsidiary Charging Robotics,

pursuant to which we will enter into a new joint venture agreement for the purpose of developing and commercializing three modular

electric vehicle (EV) micro mobility vehicles for urban individual use and “last mile” cargo delivery. We shall invest

$250,000 upon the closing of the Joint Venture Agreement and may invest future sums based on the meeting of milestones.

As of the date hereof,

we have not yet dedicated significant time or resources to the joint venture, and we do not consider the joint venture a material

part of our business. There is no guarantee that the joint venture will meet the milestones necessary for us to commit additional

funds to the project, nor is there a guarantee that, even if such milestones are met, that we will be able to commercialize any

EV or micro mobility vehicles that are profitable, if at all.

Risks Related to Our Subsidiaries, Pro

and Purex, Business

Our e-commerce operations are reliant

on the Amazon marketplace and fulfillment by Amazon and changes to the marketplace, Amazon services and their terms of use may

harm Pro and Purex business.

Pro and Purex products

are sold predominantly on the Amazon marketplace, with the fulfillment aspect of the operations carried out entirely by Amazon

utilizing the fulfilled by Amazon, or FBA, model. In order to continue to utilize the Amazon Marketplace and FBA, Pro and Purex

must comply with the applicable policies and terms of use relating to these services. Such policies and terms of use may be altered

or amended at Amazon’s sole discretion, including changes regarding the cost of securing these services, and changes that

increase the burden of compliance and requirements, may cause Pro and Purex to alter their business model in order to comply, cause

us to incur additional costs, and the results of Pro and Purex business can be negatively impacted. Non-compliance with applicable

terms of use and policies can result in the removal of one or more products from the market place and suspension of fulfillment

services which would have an adverse effect on Pro and Purex results of operations. Although Pro and Purex exert efforts in order

to ensure ongoing compliance and no notices of non-compliance have been received to date, we cannot assure that events of this

kind will occur in the future.

Certain aspects of Pro and Purex

business is reliant on foreign manufacturing and international sales which expose us to risks that could impeded plans of expansion

and growth.

The manufacturers

or the products sold on Pro and Purex online stores are located in China. As such, Pro and Purex business is

affected by inter-country trade agreements and tariffs. Based on recent U.S. administrative policy there are, and may be additional,

changes to existing trade agreements, greater restrictions on free trade and significant increases in tariffs on goods imported

into the United States, particularly those manufactured in China, Mexico and Canada. Future actions of the U.S. administration

and that of foreign governments, including China, with respect to tariffs or international trade agreements and policies remains

currently unclear. The escalation of a trade war, tariffs, retaliatory tariffs or other trade restrictions on products and materials

imported by Pro and Purex from China may impede their supply chain and ability to provide products which could adversely affect

their business, financial condition, operating results and cash flows.

Potential growth of Pro and Purex

is based on international expansion, making us susceptible to risks associated with international sales and operations.

Pro and Purex currently

sell products exclusively in the U.S. and they intend to expand their operations to reach new markets and localities. For example,

Pro has completed the requisite processes in order to offer its products through the Amazon marketplace to the United Kingdom,

major European countries and Australia. Conducting international operations subjects us to certain risks which include localization

of solutions and products and adapting them to local practices and regulatory requirements, exchange rate fluctuations and unexpected

changes in tax, trade laws, tariffs, governmental controls and other trade restriction. To the extent that Pro and Purex do not

succeed in expanding their operations internationally and managing the associated legal and operational risks, their results of

operations may be adversely affected.

Pro and Purex operating results are

subject to seasonal fluctuations.

The