Filed

Pursuant to General Instruction II.L of Form F-10

File

No. 333-254709

No

securities regulatory authority has expressed an opinion about these securities and it is an offence to claim otherwise.

This

prospectus supplement (the “Prospectus Supplement”), together with the accompanying short form base shelf prospectus dated

March 25, 2021 to which it relates, as amended or supplemented (the “ Prospectus”), and each document incorporated or deemed

to be incorporated by reference into this Prospectus Supplement and into the Prospectus constitutes a public offering of these securities

only in those jurisdictions where they may be lawfully offered for sale and therein only by persons permitted to sell such securities.

See “Plan of Distribution”.

Information

has been incorporated by reference in this Prospectus Supplement from documents filed with securities commissions or similar authorities

in Canada and the United States. Copies of the documents incorporated herein by reference may be obtained on request without

charge from the Corporate Secretary of Engine Gaming and Media, Inc., 77 King Street West, Suite 3000, Toronto, Ontario M5K 1G8, or by

telephone at (212) 931-1200, and are also available electronically at www.sedar.com and www.sec.gov.

Prospectus

Supplement to the Short Form Base Shelf Prospectus Dated March 25, 2021

ENGINE

GAMING AND MEDIA, INC.

(to be renamed “GameSquare Inc.”)

US$1.25

Up

to US$9,000,000

Up

to 7,200,000 Subscription Receipts

each representing the right to receive one Common Share

Engine

Gaming and Media, Inc. (“Engine Gaming” or the “Company”) is hereby qualifying for distribution (the “Offering”)

up to 7,200,000 subscription receipts (“Subscription Receipts”) of the Company at a price of US$1.25 per Subscription Receipt

(the “Offering Price”), each of which will entitle the holder thereof to automatically receive, upon the closing of the Transaction

(as defined herein), without any further action on the part of the holder thereof and without payment of additional consideration, one

common share (“Common Share”) of the Company post-Consolidation (as defined herein). If the Over-Allotment Option (as defined

herein) is exercised in full, an aggregate of an additional 1,080,000 Subscription Receipts will be offered by the Company. There

is no minimum amount of funds that must be raised under the Offering. The Company could complete this Offering after raising only a small

portion of the offering amount set out above. See “Details of the Offering” and “Plan of Distribution”. The

Company is also hereby qualifying for distribution the Common Shares issuable on exchange of the Subscription Receipts. The Subscription

Receipts are being offered to the public in each of the provinces of Canada, other than Québec, and in the United States pursuant

to the MJDS (as defined herein).

The

gross proceeds from the sale of the Subscription Receipts (the “Escrowed Funds”) will, from the Offering Closing Date (as

defined herein) until the Transaction Closing Date (as defined herein), be held in escrow by Computershare Trust Company of Canada, as

escrow agent (the “Escrow Agent”), pending closing of the Transaction or termination of the Arrangement Agreement (as defined

herein).

The

Subscription Receipts are being issued pursuant to an agency agreement (the “Agency Agreement”) entered into between the

Company and Roth Canada, Inc. (the “Agent”).

On

December 7, 2022, the Company entered into an arrangement agreement (the “Arrangement Agreement”) with GameSquare

Esports Inc. (“GameSquare”) to acquire all of the issued and outstanding securities of GameSquare by way of an all-share

transaction pursuant to a plan of arrangement under the Business Corporations Act (Ontario) (the “Transaction”).

See “Recent Developments”.

| Price:

US$1.25 per Subscription Receipt |

| | |

Price to the Public | | |

Agent’s Fee(1)(2) | | |

Net Proceeds to the Company(3) | |

| Per Subscription Receipt | |

US$ | 1.25 | | |

US$ | 0.0875 | | |

US$ | 1.1625 | |

| Total(4) | |

US$ | 9,000,000 | | |

US$ | 630,000 | | |

US$ | 8,370,000 | |

(1) Pursuant

to the Agency Agreement, the Company has agreed to pay to the Agent an aggregate cash commission (the “Agent’s Fee”)

equal to 7.0% of the gross proceeds from the sale of Subscription Receipts (including any gross proceeds raised on exercise of the Over-Allotment

Option (as defined herein)), provided that the Agent’s’ Fee shall not be paid in respect of gross proceeds from the sale

of Subscription Receipts to purchasers on a “president’s list” (the “President’s List”).The Agent’s

Fee is payable as to 50% on the Offering Closing Date and 50% upon release of the Escrowed Funds. In the event the Escrowed Funds are

refunded to purchasers, the fee payable to the Agent (as defined herein) will consist solely of the amount payable on the Offering Closing

Date.

(2) The

Agent will also be paid a corporate finance fee of US$125,000 on the Offering Closing Date.

(3) Before

deducting the estimated expenses of the Offering of approximately US$300,000 and excluding any interest that may be earned on the Escrowed

Funds. The expenses of the Offering, the corporate finance fee and the Agent’s Fee will be paid from the general funds of the Company.

(4) The

Company has granted to the Agent an option (the “Over-Allotment Option”), exercisable at any time until the earlier

of (i) 30 days following the Offering Closing Date, and (ii) the Termination Date (as defined herein), to purchase up to an additional

15% of the Subscription Receipts at the Offering Price. If the Over-Allotment Option is exercised in full, the total price to the public,

the Agent’s Fee and the net proceeds to the Company, before expenses and interest on the Escrowed Funds, will be US$10,350,000,

US$724,500 (of which 50% is payable upon release of the Escrowed Funds) and US$9,625,500, respectively. See “Plan of Distribution”.

The grant of the Over-Allotment Option, the distribution of the Subscription Receipts that may be issued on the exercise of the Over-Allotment

Option, and the issuance of Common Shares on exchange of such Subscription Receipts are also qualified under this Prospectus Supplement.

A purchaser who acquires securities forming part of the Agent’s over allocation position acquires those securities under the Prospectus,

regardless of whether the Agent’s over-allocation position is ultimately filled through the exercise of the Over- Allotment Option

or secondary market purchases.

The

following table sets out the maximum number of securities under options issuable to the Agent in connection with the Offering assuming

the exercise of the Over-Allotment Option in full:

| Agent’s

Position |

|

Maximum

Number of Securities Available |

|

Exercise

Period |

|

Exercise

Price |

| Over-Allotment

Option |

|

1,080,000

Subscription Receipts |

|

On

or before the 30th day following the Closing Date |

|

US$1.25

per Subscription Receipt |

Immediately

before the completion of the Transaction, the Company intends to consolidate its Common Shares on the basis of one (1) new Common Share

for approximately every three (3) pre-consolidation Common Shares or such other ratio as is necessary to satisfy the minimum bid price

requirement of the Nasdaq Capital Market (the “Consolidation”), and the Subscription Receipts shall be consolidated on

the same ratio as the Consolidation prior to exchange into Common Shares. The issued and outstanding Common Shares are listed

on the TSX Venture Exchange (the “TSXV”) and the NASDAQ Capital Market (the “NASDAQ”) under the symbol “GAME”.

On March 30, 2023, the closing prices of the Common Shares on such exchanges were $1.79 and US$1.41, respectively. There is currently

no market through which the Subscription Receipts may be sold and purchasers may not be able to resell Subscription Receipts purchased

under this Prospectus Supplement. This may affect the pricing of the Subscription Receipts in the secondary market, the transparency

and availability of trading prices, the liquidity of the Subscription Receipts and the extent of issuer regulation. See “Risk Factors”.

The Company has applied to the TSXV to list, and notified NASDAQ of, the Common Shares issuable upon exchange of the Subscription

Receipts offered by this Prospectus Supplement. Listing will be subject to the Company fulfilling all the listing requirements of the

TSXV and NASDAQ.

It

is currently anticipated that the closing date of the Offering (the “Offering Closing Date”) will be on or about April 5,

2023, or such later date as the Company and the Agent may agree but in any event not later than April 21, 2023. Each Subscription Receipt

will be automatically exchanged for one post-Consolidation Common Share, without any further action required on the part of the holder

of the Subscription Receipt and without payment of additional consideration, at 5:00 p.m. (Toronto time) on the closing date of the Transaction

(the “Transaction Closing Date”), which is expected to occur on or about April 10, 2023, provided that this date occurs

on or prior to April 30, 2023 (the “Outside Date”). See “Details of the Offering”.

If

the Transaction fails to close on or prior to 5:00 p.m. (Toronto time) on the Outside Date or if the Arrangement Agreement is terminated

or the Company advises the Agent and the Escrow Agent or announces to the public that it does not intend to proceed with the Transaction

(such date being the “Termination Date”), the Escrow Agent and the Company will return to each holder of Subscription Receipts,

commencing on the third business day following the Outside Date or Termination Date, as the case may be, an amount equal to (i) the aggregate

issue price of such holder’s Subscription Receipts plus (ii) an amount equal to such holder’s share of the interest earned

on the Escrowed Funds, net of any applicable withholding taxes. See “Details of the Offering”.

Engine

Gaming currently expects that the Offering Closing Date will occur prior to the Transaction Closing Date. However, if all of the conditions

to the closing of the Transaction are satisfied or waived on or prior to the Offering Closing Date, the Company will deliver Common Shares

on the Offering Closing Date instead of Subscription Receipts. This Prospectus Supplement also qualifies any such distribution of Common

Shares. See “Details of the Offering” and “Use of Proceeds”.

Provided

that the Transaction Closing Date occurs on or prior to the Outside Date and the Escrow Release Notice (as defined herein) is provided

to the Escrow Agent on or prior to 5:00 p.m. (Toronto time) on the Outside Date, the Escrowed Funds (together with the interest earned

thereon) will be released by the Escrow Agent to the Company. See “Details of the Offering”.

The

Agent is conditionally offering the Subscription Receipts on a best efforts basis, subject to prior sale, if, as and when issued by the

Company and accepted by the Agent in accordance with the terms and conditions contained in the Agency Agreement, and subject to the approval

of certain legal matters relating to Canadian law on behalf of the Company by Fogler, Rubinoff LLP and on behalf of the Agent by Norton

Rose Fulbright Canada LLP and certain legal matters relating to United States law on behalf of the Company by Dorsey & Whitney LLP

and on behalf of the Agent by Norton Rose Fulbright US LLP.

Subscriptions

will be received subject to rejection or allotment in whole or in part and the Agent reserves the right to close the subscription books

at any time without notice. It is anticipated that the Subscription Receipts will be delivered under the book-based system through CDS

Clearing and Depository Services Inc. (“CDS”) or its nominee and deposited in electronic form, or will otherwise be delivered

registered as directed by the Agent, on the Closing Date. Except in limited circumstances, a purchaser of Subscription Receipts will

receive only a customer confirmation from the registered dealer from or through which the Subscription Receipts are purchased and who

is a CDS participant. CDS will record the CDS participants who hold Subscription Receipts on behalf of owners who have purchased Subscription

Receipts in accordance with the book-based system. No definitive certificates will be issued unless specifically requested or required.

Subject

to applicable laws, the Agent may, in connection with the Offering, over-allot the offering of the Subscription Receipts The Agent proposes

to offer the Subscription Receipts initially at the Offering Price. After the Agent has made reasonable efforts to sell the Subscription

Receipts at the Offering Price, the Agent may offer the Subscription Receipts at a price lower than the Offering Price specified in this

Prospectus Supplement in order to sell any of the Subscription Receipts remaining unsold. Any such reduction will not affect the proceeds

received by the Company. See “Plan of Distribution”.

Investing

in the Subscription Receipts involves certain risks. See “Risk Factors” in the accompanying Prospectus and in this Prospectus

Supplement.

The

Company is permitted, under the multi-jurisdictional disclosure system adopted by the securities regulatory authorities in the United

States and Canada (the “MJDS”), to prepare this prospectus supplement and the accompanying prospectus in accordance with

Canadian disclosure requirements, which are different from United States disclosure requirements. The Company prepares its annual financial

statements, certain of which are incorporated by reference herein, in United States dollars and in accordance with International Financial

Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (the “IASB”), and its

interim financial statements, certain of which are incorporated by reference herein, in United States dollars and in accordance with

IFRS as issued by the IASB as applicable to interim financial reporting, and they therefore may not be comparable to financial statements

of United States companies.

The

enforcement by investors of civil liabilities under United States federal securities laws may be affected adversely by the fact that

the Company is incorporated under the laws of British Columbia, a province of Canada, some of the officers and directors are not residents

of the United States, and that all or a substantial portion of the Company’s assets are located outside of the United States. See

“Enforceability of Certain Civil Liabilities”.

Mr.

Louis Schwartz, Mr. Michael Munoz, Mr. Tom Rogers, Mr. Stuart Porter, Mr. Rudolph Cline-Thomas and Mr. Gregory Raifman, each a director

or officer of the Company, reside outside of Canada. Each of Mr. Louis Schwartz, Mr. Michael Munoz, Mr. Tom Rogers, Mr. Stuart Porter,

Mr. Rudolph Cline-Thomas and Mr. Gregory Raifman have appointed Fogler, Rubinoff LLP, 77 King Street West, Suite 3000, Toronto, Ontario,

M9A 1Y1 as agent for service of process in Canada. Purchasers are advised that it may not be possible for investors to enforce judgments

obtained in Canada against any person that resides outside of Canada, even if the party has appointed an agent for service of process.

NEITHER

THE SEC NOR ANY STATE OR CANADIAN SECURITIES COMMISSION OR REGULATOR HAS APPROVED OR DISAPPROVED THE SUBSCRIPTION RECEIPTS OR THE COMMON

SHARES ISSUABLE ON EXCHANGE OF THE SUBSCRIPTION RECEIPTS, NOR PASSED UPON THE ADEQUACY OR ACCURACY OF THE PROSPECTUS OR THIS PROSPECTUS

SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Prospective

investors should be aware that the acquisition of the Subscription Receipts described herein or Common Shares issuable on exchange of

the Subscription Receipts may have tax consequences both in the United States and in Canada. Such consequences for investors who are

resident in, or citizens of, the United States may not be described fully in this Prospectus Supplement or the Prospectus. Prospective

investors should read the tax discussion in this Prospectus Supplement and consult their own tax advisors with respect to their particular

circumstances. See “Certain Canadian Federal Income Tax Considerations” and “Certain United States Federal Income Tax

Considerations”.

The

Company’s head office is located at 33 Whitehall Street, 8th Floor, New York, NY 10004. The Company’s registered office is

located at 77 King Street West, Suite 3000, PO Box 95, Toronto, Ontario M5K 1G8.

TABLE

OF CONTENTS

Important

Notice About Information in this

Prospectus Supplement and the Accompanying Prospectus

This

document is in two parts. The first part is this Prospectus Supplement, which describes the specific terms of the securities the Company

is offering and also adds to and updates certain information contained in the Prospectus and the documents incorporated by reference

therein. The second part, the Prospectus, gives more general information, some of which may not apply to the Subscription Receipts offered

hereunder.

Prospective

investors should rely only on the information contained in or incorporated or deemed to be incorporated by reference into this Prospectus

Supplement and the Prospectus. The Company has not authorized any other person to provide prospective investors with additional or different

information. If anyone provides prospective investors with different or inconsistent information, prospective investors should not rely

on it. The Company is offering to sell, and seeking offers to buy, these securities only in jurisdictions where offers and sales are

permitted. Prospective investors should assume that the information appearing in this Prospectus Supplement and the Prospectus, as well

as information the Company has previously filed with, or furnished to, the SEC and with the securities regulatory authority in each of

the provinces of Canada (other than Québec) that is incorporated herein and in the Prospectus by reference, is accurate as of

their respective dates only. The Company’s business, financial condition, results of operations and prospects may have changed

since those dates.

In

this Prospectus Supplement, unless otherwise specified or the context otherwise requires, all dollar amounts are expressed in United

States dollars. References to “dollars”, “$”, US dollars” or “US$” are to lawful currency of

the United States, and references to “CDN dollars” or “CDN$” are to lawful currency of Canada.

Unless

otherwise indicated, all financial information included and incorporated by reference in this Prospectus Supplement and the Prospectus

is determined using IFRS.

Forward-Looking

Information

This

Prospectus Supplement and the Prospectus and the documents incorporated by reference therein include “forward-looking statements”

and “forward-looking information” within the meaning of securities laws (collectively, “forward-looking statements”),

including the “safe harbour” provisions of the Securities Act (Ontario), the United States Private Securities Litigation

Reform Act of 1995, Section 21E of the United States Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and Section 27A of the United States Securities Act of 1933, as amended. All forward-looking statements are based on the Company’s

current beliefs as well as assumptions made by and information currently available to the Company and relate to, among other things,

anticipated financial performance, business prospects, strategies, regulatory developments, new services, market forces, commitments

and technological developments. Forward-looking statements may be identified by the use of words like “believes”, “intends”,

“expects”, “may”, “will”, “should”, or “anticipates”, or the negative equivalents

of those words or comparable terminology, and by discussions of strategies that involve risks and uncertainties.

Forward-looking

statements include, but are not limited to, statements relating to: the business, opportunities and future activities of, and developments

related to, the Company after the date of this Prospectus Supplement or the Prospectus, as applicable; expectations of the use by the

Company of the net proceeds raised from the Offering, including as to achieving the related business objectives described herein; expectations

of the timing and completion of the Offering; exercise of the Over-Allotment Option; expectations of the timing and completion of the

Transaction; future outlook, future events, trends and future growth potential and performance of the Company; expectations regarding

the ability to raise capital; the economy generally; anticipated and unanticipated costs; expectations regarding the Company’s

revenue, expenses and operations; anticipated cash and financing needs of the Company; future growth plans of the Company including the

entry into adjacent markets; the ability to attract new customers and develop and maintain existing customers; the ability to attract

and retain personnel; and, the competitive position of the Company and its expectations regarding competition.

Forward-looking

statements are necessarily based upon a number of factors and assumptions that, if untrue, could cause actual results, performance or

achievements to be materially different from future results, performance or achievements expressed or implied by such statements. Forward-looking

statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently

subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company’s actual financial

results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors

or assumptions used to develop forward-looking statements include, without limitation, general expectations with respect to the development

of the Company’s products and services; general economic conditions; anticipated costs and the Company’s ability to fund

its operations; the Company’s ability to obtain financing as and when required and on reasonable terms; the risks and uncertainties

described under “Risk Factors” will not materialize; that the Company will continue to conduct its operations in a manner

consistent with past operations; availability of financing and/or cash flow to fund current and future plans and expenditures; the impact

of increasing competition; the general continuance of current industry conditions; the ability of the Company to obtain qualified staff,

equipment and/or services in a timely and cost efficient manner; and currency, exchange and/or interest rates.

Forward-looking

statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Although we have attempted to identify important factors that could cause actual actions, events or results to differ materially from

those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated,

estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future

events could differ materially from those anticipated in such statements.

The

factors identified above are not intended to represent a complete list of the factors that could affect the Company. The risks and uncertainties

of the Company’s business, including those discussed and incorporated by reference in the Prospectus and the Annual Information

Form (as defined herein) and as described under “Risk Factors” herein could cause the Company’s actual results and

experience to differ materially from the anticipated results or other expectations expressed. The material assumptions in making these

forward-looking statements are disclosed in the MD&A (as defined herein and as may be modified or superseded by documents incorporated

or deemed to be incorporated by reference herein and in the Prospectus). In addition, the Company bases forward-looking statements on

assumptions about future events, which may not prove to be accurate. In light of these risks, uncertainties and assumptions, prospective

investors should not place undue reliance on forward-looking statements and should be aware that events described in the forward-looking

statements set out in this Prospectus Supplement and the documents incorporated by reference in this Prospectus Supplement and the Prospectus

may not occur.

The

Company cannot assure prospective investors that its future results, levels of activity and achievements will occur as the Company expects,

and neither the Company nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements.

Except as required by law, the Company has no obligation to update or revise any forward-looking statement, whether as a result of new

information, future events or otherwise.

Exchange

Rates

The

following table sets forth, for each of the periods indicated, the high, low and average exchange rates, and the exchange rate at the

end of the period, for the conversion of one (1) United States dollar into the equivalent Canadian dollar, based on the indicative exchange

rate as reported by the Bank of Canada.

| | |

Year Ended December 31, | | |

12 Months-Ended August 31, | |

| | |

2022 | | |

2021 | | |

2022 | | |

2021 | |

| High for the period | |

| 1.3856 | | |

| 1.2942 | | |

| 1.3138 | | |

| 1.3966 | |

| Low for the period | |

| 1.2451 | | |

| 1.2040 | | |

| 1.2329 | | |

| 1.2040 | |

| End of period | |

| 1.3544 | | |

| 1.2678 | | |

| 1.3111 | | |

| 1.2617 | |

| Average for the period(1) | |

| 1.3011 | | |

| 1.2535 | | |

| 1.2720 | | |

| 1.2688 | |

(1) Average

represents the average of the rates on the last day of each month during the period.

On

March 30, 2023, the exchange rate for United States dollars expressed in terms of the Canadian dollar, as reported by the Bank of Canada,

was US$1.00 = CDN$1.3533

Where

to Find More Information

The

Company has filed with the SEC a registration statement on Form F-10, as amended (File No. 333-254709) (the “Registration Statement”)

relating to the Subscription Receipts. This Prospectus Supplement and the Prospectus, which constitute a part of the Registration Statement,

do not contain all of the information contained in the Registration Statement, certain items of which are contained in the exhibits to

the Registration Statement as permitted by the rules and regulations of the SEC. Statements included or incorporated by reference in

this Prospectus Supplement and in the Prospectus about the contents of any contract, agreement or other documents referred to are not

necessarily complete, and in each instance, prospective investors should refer to the exhibits for a complete description of the matter

involved. Each such statement is qualified in its entirety by such reference.

The

Company files annual and quarterly financial information, material change reports, business acquisition reports and other material with

the securities commissions or similar regulatory authority in each of the provinces of Canada (other than Québec) and the Company

files with, or furnishes to, the SEC such information. Under the MJDS, documents and other information that the Company files with the

SEC may be prepared in accordance with the disclosure requirements of Canada, which are different from those of the United States. Prospective

investors may read and download any public document that the Company has filed with the securities commissions or similar authorities

in each of the provinces of Canada (other than Québec) on the System for Electronic Document Analysis and Retrieval (“SEDAR”)

at www.sedar.com. Prospective investors may read and copy any document the Company has filed with, or furnished to, the SEC on

the SEC’s Electronic Data Gathering and Retrieval (“EDGAR”) system at www.sec.gov.

Documents

Incorporated by Reference

This

Prospectus Supplement is deemed, as of the date hereof, to be incorporated by reference into the Prospectus only for the purposes of

the Subscription Receipts, the Over-Allotment Option and the Common Shares issuable on exchange of Subscription Receipts offered hereby.

Other documents are also incorporated or deemed to be incorporated by reference into the Prospectus and reference should be made to the

Prospectus for full details.

The

following documents of the Company, which are filed by the Company with the various securities commissions or similar authorities in

each of the provinces of Canada (other than Québec), are specifically incorporated by reference into and form an integral part

of this Prospectus Supplement and the Prospectus:

| |

(a) |

the

audited consolidated financial statements of the Company for the years ended August 31, 2022 and 2021, together with the notes thereto

and auditor’s reports thereon, and management’s discussion and analysis of financial condition and results of operations

as at and for the year ended August 31, 2022 (the “MD&A”); |

| |

|

|

| |

(b) |

annual

information form for the year ended August 31, 2022 dated November 29, 2022 (the “Annual Information Form”); |

| |

|

|

| |

(c) |

the

information circular of the Company dated January 23, 2023 relating to the annual and special meeting of shareholders held on March

8, 2023, excluding the fairness opinion of Haywood Securities Inc. dated December 6, 2022 (the “Circular”); |

| |

|

|

| |

(d) |

the

unaudited interim consolidated financial statements as at and for the three months ended November 30, 2022, and related notes thereto,

and management’s discussion and analysis of financial condition and results of operations as at and for the three month period

ended November 30, 2022; |

| |

|

|

| |

(e) |

the

material change report dated December 8, 2022 relating to Engine Gaming’s pending acquisition of GameSquare (the “MCR”);

and |

| |

|

|

| |

(f) |

the

template version of the term sheet dated March 29, 2023 and the revised term sheet dated March 30, 2023, both in connection with

the Offering (the “Marketing Materials”). |

Any

documents of the type referred to above or otherwise required by National Instrument 44-101 – Short Form Prospectus Distributions

to be incorporated by reference into a short form prospectus which are filed by the Company after the date hereof and prior to the

termination of the Offering shall be deemed to be incorporated by reference into this Prospectus Supplement and the Prospectus for the

purposes of this Offering. These documents are available through the internet on SEDAR, which can be accessed at www.sedar.com.

In addition, any similar documents filed by the Company with the SEC after the date of this Prospectus Supplement, shall be deemed to

be incorporated by reference into this Prospectus Supplement and the Registration Statement of which the Prospectus Supplement forms

a part, if and to the extent expressly provided in such reports. The Company’s reports filed with, or furnished to, the SEC are

available on EDGAR, which can be accessed at www.sec.gov.

Any

statement contained in the Prospectus, this Prospectus Supplement or in a document incorporated or deemed to be incorporated by reference

in the Prospectus or this Prospectus Supplement for the purposes of the Offering shall be deemed to be modified or superseded, for the

purposes of the Prospectus and this Prospectus Supplement, to the extent that a statement contained herein or in any other subsequently

filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. The modifying

or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth

in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for

any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material

fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in

light of the circumstances in which it was made. Any statement so modified or superseded shall not constitute a part of the Prospectus

or this Prospectus Supplement, except as so modified or superseded.

marketing

materials

Any

“template version” of “marketing materials” (each as defined in National Instrument 41-101 – General

Prospectus Requirements) filed with the securities commission or similar authority in each of the provinces of Canada (other than

Québec) in connection with this offering after the date of this Prospectus Supplement and before the termination of the distribution

of the Subscription Receipts under this Prospectus Supplement (including any amendments to, or an amended version of, the Marketing Materials)

is deemed to be incorporated by reference into this Prospectus Supplement. The Marketing Materials do not form part of this Prospectus

Supplement to the extent that the contents of the Marketing Materials have been modified or superseded by a statement contained in this

Prospectus Supplement. The Marketing Materials are available under the Company’s profile on SEDAR at www.sedar.com.

CORPORATE

STRUCTURE

Name,

Address and Incorporation

The

Company was incorporated as “Stratton Capital Corp.” under the Business Corporations Act (Ontario) pursuant to articles

of incorporation on April 8, 2011. On October 19, 2016, the Company filed Articles of Amendment changing its name from “Stratton

Capital Corp.” to “Millennial Esports Corp.”

On

June 7, 2019, the Company filed Articles of Amendment to effect a consolidation of the Common Shares on the basis of one post-consolidation

Common Share for every fifteen pre-consolidation Common Shares. On October 17, 2019, the Company filed Articles of Amendment to (i) change

its name from “Millennial Esports Corp.” to “Torque Esports Corp.”, and (ii) to effect a consolidation of the

Common Shares on the basis of one post-consolidation Common Share for every five pre-consolidation Common Shares.

On

August 13, 2020, the Company filed Articles of Amendment to (i) change its name from “Torque Esports Corp.” to “Engine

Gaming and Media, Inc.”, and (ii) to effect a consolidation of the Common Shares on the basis of one post-consolidation Common

Share for every fifteen pre-consolidation Common Shares.

On

December 18, 2020, the Company filed a Continuance Application with the British Columbia Registrar of Companies to continue into British

Columbia under the Business Corporations Act (British Columbia).

On

October 19, 2021, the Company changed its name from “Engine Media Holdings, Inc.” to “Engine Gaming and Media, Inc.”

The

head office of the Company is located at 2110 Powers Ferry Road SE, Suite 450, Atlanta, GA 30339 and the registered office of the Company

is located at 77 King Street West, Suite 3000, PO Box 95, Toronto, Ontario M5K 1G8.

Intercorporate

Relationships and Material Subsidiaries

The

following is a summary of the inter-corporate relationships between the Company and its material subsidiaries, which together comprise

the consolidated Company as at the date hereof:

Recent

Developments

GameSquare

Transaction

On

December 8, 2022, Engine Gaming announced that it had entered into the Arrangement Agreement with GameSquare, pursuant to which, and

subject to the terms and conditions of the Arrangement Agreement, GameSquare and Engine will combine their businesses via an all share

deal whereby Engine Gaming will acquire all of the issued and outstanding shares of GameSquare in exchange for shares of Engine Gaming

in accordance with a plan of arrangement of GameSquare under the Business Corporations Act (Ontario) (the “Arrangement”).

Pursuant to the terms of the Arrangement Agreement, Engine Gaming will acquire each outstanding GameSquare share in exchange for 0.08262

of a Common Share (subject to adjustment for the Consolidation) (the “Exchange Ratio”). Each outstanding option of GameSquare

will be exchanged for an Engine Gaming option entitling the holder to a number of Engine Gaming common shares, as adjusted on the basis

of the Exchange Ratio, and be subject to exercise thereof in accordance with the terms of the options, including payment of the exercise

price, which will also be adjusted based upon the Exchange Ratio. All other material terms of the options will remain the same. Each

outstanding restricted share unit of GameSquare will be exchanged for an Engine Gaming restricted share unit entitling the holder to

a number of Engine Gaming common shares, as adjusted on the basis of the Exchange Ratio. All other material terms of the restricted share

units will remain the same. Each outstanding warrant of GameSquare will be adjusted pursuant to its governing contractual instrument

to entitle the holder to receive, upon due exercise, Engine Gaming common shares, adjusted on the basis of the Exchange Ratio.

On

March 8, 2023, the shareholders of Engine Gaming voted to approve the Transaction and separately the shareholders of GameSquare approved

the Arrangement with Engine Gaming at their respective meetings of shareholders. On March 13, 2023, GameSquare received the final approval

from the Ontario Superior Court of Justice (Commercial List) to complete the Arrangement.

Immediately

prior to the completion of the Transaction, the board of directors intends to change the name of the Company to “GameSquare Inc.”

and to effect the Consolidation.

GameSquare

is a vertically integrated, international digital media and entertainment company enabling global brands to connect and interact with

gaming and esports fans. GameSquare owns a portfolio of companies including Code Red Esports Ltd., an esports talent agency serving the

UK, GCN, a digital media company focusing on the gaming and esports audience based in Los Angeles, USA., NextGen Tech, LLC (dba as Complexity

Gaming), a leading esports organization operating in the United States, Swingman LLC (dba ZONED), a gaming and lifestyle marketing agency

based in Los Angeles, USA, Fourth Frame Studios, a multidisciplinary creative production studio, and Mission Supply, a merchandise and

consumer products business.

Arrangement

Agreement

Representations

and Warranties

The

Arrangement Agreement includes customary representations and warranties for transactions of this nature made by GameSquare and Engine

Gaming.

Covenants

The

parties to the Arrangement Agreement have made customary covenants relating to certain events occurring between the signing of the Arrangement

Agreement and the Transaction Closing Date, and the conduct of the business of GameSquare and Engine Gaming in the ordinary course of

business except for the transactions contemplated or required by the Arrangement Agreement or as otherwise mutually agreed.

Indemnities

The

Arrangement Agreement also contains customary indemnities by the parties thereto. These indemnities cover, among others, losses relating

to or arising from breaches of the representations and warranties, or of the covenants and agreements, contained in the Arrangement Agreement.

Closing

Conditions

The

closing of the Transaction is subject to the mutual condition that no injunction or other order issued by a governmental authority prohibit

or otherwise make illegal the consummation of the Transaction.

The

closing of the Transaction is further subject to additional, customary closing conditions including, among others, that the parties shall

have complied in all material respects with all covenants and agreements in the Arrangement Agreement and that the representations and

warranties of the parties shall be true and correct in all material respects.

Termination

of the Arrangement Agreement

The

Arrangement Agreement may be terminated at any time prior to the Transaction Closing Date: (i) by the mutual written consent of the parties;

(ii) by either party, if the closing of the Transaction has not occurred on or before the Outside Date, unless otherwise agreed by the

parties; (iii) by Engine Gaming, if GameSquare fails to comply with any of its covenants or breaches its representations and warranties

and such failure to comply or breach is not cured by the Outside Date and results in a failure to satisfy the conditions to closing;

or (iv) by GameSquare, if Engine Gaming fails to comply with any of its covenants or breaches its representations and warranties and

such failure to comply or breach is not cured by the Outside Date and results in a failure to satisfy the conditions to closing.

More

information regarding the Transaction is set out in the MCR and the Circular, each of which is incorporated herein by reference, and

subsequent press releases related to the Transaction. A copy of the Arrangement Agreement is available under the Company’s SEDAR

and EDGAR profiles.

Consolidated

Capitalization

There

has been no material change in the Company’s share and debt capital on a consolidated basis since November 30, 2022, the date of

the Company’s most recently completed financial period, except as disclosed under the heading “Prior Sales” in this

Prospectus Supplement. Immediately before the completion of the Transaction, the Company intends to implement the Consolidation.

The

following table sets forth (i) the consolidated capitalization of the Company as at November 30, 2022; and (ii) the pro forma consolidated

capitalization of the Company after giving effect to the Transaction and the Offering (without giving effect to the exercise of the Over-Allotment

Option). This table should be read in conjunction with the Company’s consolidated financial statements for the period ended November

30, 2022 and the notes thereto.

Notes:

(1) Proforma

adjustment to account for common shares issued by Engine under a shares for debt arrangement. Total of 200,000 common shares issued to

settle convertible debt at its maturity date of February 28, 2023. The principal and accrued interest settled at maturity amounted to

$250,000 and $55,137, respectively.

(2) Proforma

adjustment to record the book value of GameSquare equity from its September 30, 2022 balance sheet. The number of GameSquare common shares

outstanding on September 30, 2022 of 307,541,466 (included assumed conversion of 150,000 PVS to 15,000,000 common shares), was adjusted

using the exchange ratio from the Arrangement Agreement of 0.08262 Engine common share for every 1 GameSquare common share, for a total

of 25,409,076 Common Shares.

(3) Proforma

adustment of $(1.8) million to estimate the total costs incurred by Engine in connection with the merger with GameSquare. These costs

are reflected as a pre-closing adustment to Engine to arrive at the Engine closing balance sheet prior to recording of fair value adjustments

from the purchase price allocation of Engine.

Proforma

adjustment to record the purchase price allocation of Engine. See below for further breakdown of the PPA. The common shares and fully

vested warrants, options and RSUs were valued using the offering price of $1.25 per common share.

(1) Proforma

adjustment of $(1.6) million to estimate the total costs incurred by GameSquare in connection with the Transaction with Engine.

(2) Proforma

adjustment to record the estimated results of the Offering. For purposes of the proforma, it was assumed none of the Over-Allotment Option

of 15% was utilized, and total gross proceeds from the Offering were $9 million. At Offering Price of $1.25 per Common Share, a total

of 7,200,000 Common Shares are issued. The gross proceeds of $9 million were offset by an estimated $736,159 in offering costs.

(3) Proforma

adjustment to account for the 1 for 3 Consolidation. The total number of Common Shares of Engine after considering the impact of the

proforma adjustments was 49,780,817 or 16,593,606 after applying the 1 for 3 Consolidation.

USE

OF PROCEEDS

The

maximum net proceeds to be received by the Company from the Offering, after deducting the Agent’s Fee and expenses of the Offering

in the estimated amount of $300,000 (including the corporate finance fee), will be (i) $8,070,000 if the Over-Allotment Option is not

exercised, and (ii) $9,325,500, if the Over-Allotment Option is exercised in full.

The

funds being raised in the Offering are being used to fund the ongoing expansion of the Company’s operations, including the funding

of pending development initiatives. In addition, the funds will be used to fund the Company’s operating deficits until it can achieve

positive cash flows from its operating activities.

In

the event that the Over-Allotment Option is exercised by the Agent, the Company intends to use the additional funds for general corporate

and working capital purposes.

Although

the Company intends to use the proceeds from the Offering as described above, the actual allocation of the net proceeds may vary depending

on future developments, at the discretion of the Company’s board of directors and management. Unallocated funds from the Offering

will be added to the working capital of the Company, and will be expended at the discretion of management. The Company had negative cash

flow from its most recently completed interim period for which financial statements have been included in this Prospectus Supplement.

To the extent that the Company has negative cash flow from operating activities in future periods, the Company may need to use a portion

of available funds to fund such negative cash flow. See “Risk Factors – Negative Operating Cash Flow” below and in

the accompanying Base Prospectus.

PRIOR

SALES

In

the 12 months prior to the date of this Prospectus, the Company has issued the following securities:

| Types of Security | |

Date of Issue | |

Number of Securities/ Principal Amount | | |

Issue

Price | | |

Expiry Date |

| RSUs(1) | |

May 26, 2022 | |

| 966,691 | | |

| N/A | | |

N/A |

| Common Shares(2) | |

July 4, 2022 | |

| 57,029 | | |

$ | 11.69 | | |

N/A |

| RSUs(3) | |

July 15, 2022 | |

| 11,719 | | |

| N/A | | |

N/A |

| RSUs(4) | |

August 10, 2022 | |

| 7,346 | | |

| N/A | | |

N/A |

| Common Shares(5) | |

August 31, 2022 | |

| 87,963 | | |

$ | 0.75 | | |

N/A |

| Common Shares(6) | |

November 8, 2022 | |

| 108,269 | | |

$ | 0.69 | | |

N/A |

| Common Shares(7) | |

November 25, 2022 | |

| 10,164 | | |

$ | 0.63 | | |

N/A |

| Common Shares(8) | |

November 30, 2022 | |

| 114,057 | | |

$ | 11.69 | | |

N/A |

| Common Shares(9) | |

March 22, 2023 | |

| 200,000 | | |

$ | 1.525 | | |

N/A |

| Common Shares(10) | |

March 22, 2023 | |

| 100,000 | | |

| N/A | | |

N/A |

Notes:

(1) On

May 26, 2022, the Company granted 966,691 RSUs to employees and members of the board of directors pursuant to the Company’s incentive

plan. The fair value of the RSUs will be recognized as share-based compensation expense over the vesting period, which is approximately

one to three years.

(2) On

July 4, 2022 the Company issued a total of 57,029 common shares to the following individuals for services provided: Tremain McGlown (14,257);

and Jeremy Haile (42,772), at an issue price of US$11.69.

(3) On

July 15, 2022, the Company granted 11,719 RSUs to a member of the board of directors pursuant to the Company’s incentive plan.

The fair value of the RSUs will be recognized as share-based compensation expense over the vesting period, which is approximately one

year.

(4) On

August 10, 2022, the Company granted 7,346 RSUs to a member of the board of directors pursuant to the Company’s incentive plan.

The fair value of the RSUs will be recognized as share-based compensation expense over the vesting period, which is approximately one

year.

(5) On

August 31, 2022 the Company issued a total of 87,963 common shares pursuant to the vesting of RSUs to the following individuals: Tom

Rogers (37,698); Lou Schwartz (39,683); and Mike Munoz (10,582) at an issuance price of US$0.75.

(6) On

November 9, 2022 the Company issued a total of 108,269 common shares pursuant to the vesting of RSUs to the following individuals: Larry

Rutkowski (19,878); Bryan Reyhani (2,793); Bryan Reyhani (26,340); Rudolph Cline-Thomas (17,038); Edward Montserrat (9,872); John Wilk

(12,353); Jake Phillips (2,913); Jason Rogers (5,034); Albert Alemany (3,003); Adam Hynes (6,293); and Benj Smith (2,797) pursuant to

the vesting of RSUs at an exercise price of US$0.69.

(7) On

November 25, 2022 the Company issued a total of 10,164 common shares pursuant to the vesting of RSUs to the following individuals: Darrin

Patrick (1,833); John Wilk (2,777); Mike Munoz (2,777) and Benj Smith (2,777) at an exercise price of US$0.63.

(8) On

November 30, 2022, the Company issued a total of 114,057 common shares to the following individuals for services: Tremain McGlown (28,514);

and Jeremy Haile (85,543) at an issue price of US$11.69.

(9) On

March 22, 2023, the Company issued 200,000 common shares to settle outstanding debt.

(10) On

March 22, 2023, the Company issued 100,000 common shares to fully settle an outstanding litigation matter.

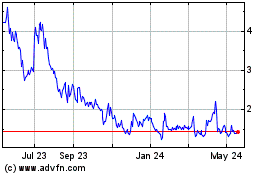

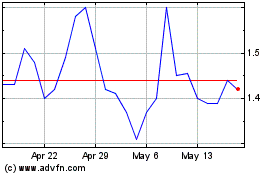

TRADING

PRICE AND VOLUME

The

Common Shares are listed and posted for trading on the TSXV and on the NASDAQ under the trading symbol “GAME”. The following

table sets forth, on a monthly basis, the reported price range (which are not necessarily the closing prices) and the aggregate volume

of trading of the Common Shares on the TSXV and the NASDAQ, respectively, for the months indicated. Immediately before the completion

of the Transaction, the Company intends to complete the Consolidation.

| | |

TSXV

(prices in Canadian dollars) | | |

NASDAQ

(prices in U.S. dollars) | |

| Date | |

Price Range (high - low) | | |

Total Volume | | |

Price Range (high - low) | | |

Total Volume | |

| | |

| | |

| | |

| | |

| |

| March 1 - 30, 2023 | |

$ | 3.25 - $1.78 | | |

| 184,526 | | |

$ | 2.39 - $1.26 | | |

| 2,394,826 | |

| February 2023 | |

$ | 2.63 - $1.75 | | |

| 246,510 | | |

$ | 1.95 - $1.19 | | |

| 7,967,100 | |

| January 2023 | |

$ | 1.94 - $1.43 | | |

| 135,779 | | |

$ | 1.46 - $0.91 | | |

| 1,861,900 | |

| December 2022 | |

$ | 2.29 - $0.68 | | |

| 571,642 | | |

$ | 1.77 - $0.51 | | |

| 10,165,749 | |

| November 2022 | |

$ | 0.95 - $0.75 | | |

| 73,931 | | |

$ | 0.72 - $0.56 | | |

| 832,080 | |

| October 2022 | |

$ | 1.14 - $0.79 | | |

| 52,073 | | |

$ | 0.90 - $0.56 | | |

| 1,040,915 | |

| September 2022 | |

$ | 0.93 - $0.70 | | |

| 83,015 | | |

$ | 0.77 - $0.51 | | |

| 820,435 | |

| August 2022 | |

$ | 1.37 - $0.93 | | |

| 86,513 | | |

$ | 1.11 - $0.70 | | |

| 763,420 | |

| July 2022 | |

$ | 1.70 - $1.10 | | |

| 70,057 | | |

$ | 1.39 - $0.80 | | |

| 1,370,642 | |

| June 2022 | |

$ | 1.25 - $0.95 | | |

| 81,442 | | |

$ | 1.05 - $0.73 | | |

| 619,413 | |

| May 2022 | |

$ | 1.71 - $1.05 | | |

| 65,649 | | |

$ | 1.39 - $0.78 | | |

| 888,629 | |

| April 2022 | |

$ | 2.80 - $1.40 | | |

| 100,869 | | |

$ | 2.26 - $1.08 | | |

| 1,342,125 | |

| March 2022 | |

$ | 3.67 - $2.13 | | |

| 283,694 | | |

$ | 2.99 - $1.52 | | |

| 1,518,524 | |

| February 2022 | |

$ | 4.25 - $3.10 | | |

| 202,742 | | |

$ | 3.36 - $2.34 | | |

| 833,715 | |

On

March 30, 2023, the closing price of the Common Shares was CDN$1.79 on the TSXV, and US$1.41 on the NASDAQ.

Details

of the Offering

The

Offering consists of up to 7,200,000 Subscription Receipts at a price of US$1.25 per Subscription Receipt. Each Subscription Receipt

represents the right to receive, without payment of additional consideration, one post-Consolidation Common Share upon closing of the

Transaction.

Set

forth below is a summary of the material attributes and characteristics of the Subscription Receipts. This summary does not purport to

be complete. The subscription receipt agreement governing the terms of the Subscription Receipts to be dated as of the Offering Closing

Date among the Company, the Agent, and the Escrow Agent (the “Subscription Receipt Agreement”) will be filed with the securities

regulatory authorities in Canada and with the SEC on or after the Offering Closing Date.

The

Subscription Receipts will be issued on the Offering Closing Date pursuant to the Subscription Receipt Agreement. The Escrowed Funds

will be delivered to and held in escrow by the Escrow Agent pending: (i) receipt of a notice (the “Escrow Release Notice”)

in prescribed form signed by the Company and the Agent confirming: (a) that the parties to the Arrangement Agreement are able to complete

the Transaction in accordance with the terms of the Arrangement Agreement; (b) the Consolidation has been completed (with (a), the “Escrow

Release Conditions”); (ii) termination of the Arrangement Agreement or the Company advising the Agent or announcing to the public

that it does not intend to proceed with the Transaction; or (iii) either (i) or (ii) having not been completed by the Outside Date, at

which time the Escrowed Funds will be released to the Company and the Agent or returned to each holder of Subscription Receipts as described

below.

The

closing of the Transaction is subject to several conditions including no order of any governmental authority remaining outstanding which

prohibits or otherwise makes illegal the completion of the Transaction. See “Recent Developments—Arrangement Agreement”.

Upon the consummation of the Transaction, the Company will send the Escrow Release Notice to the Escrow Agent. Provided that the Escrow

Release Notice is delivered to the Escrow Agent on or prior to the Outside Date, the Escrow Agent will automatically issue and deliver

the appropriate number of Common Shares to each registered holder of Subscription Receipts without any further action required by such

holder and without payment of additional consideration. Contemporaneously with the issuance and delivery of the Common Shares to the

holders of Subscription Receipts, the Company will issue a press release specifying that Common Shares have been so issued and delivered

and the Escrowed Funds will be released to the Company.

In

the event that all of the conditions to the closing of the Transaction are satisfied or waived on or prior to the Offering Closing Date,

the Company will deliver Common Shares on the Offering Closing Date instead of Subscription Receipts. In such event, the proceeds of

the Offering will be paid to the Company and will not be held in escrow by the Escrow Agent. In addition, the Over-Allotment Option will

be exercisable to purchase Common Shares rather than Subscription Receipts.

In

the event that the Transaction fails to close on or prior to the Outside Date or is otherwise terminated, the Escrow Agent and the Company

will return to each holder of Subscription Receipts, commencing on the third business day following the Outside Date or Termination Date,

as the case may be, an amount equal to (i) the aggregate issue price of such holder’s Subscription Receipts plus (ii) an amount

equal to such holder’s share of the interest earned on the Escrowed Funds, net of any applicable withholding taxes.

Under

the Subscription Receipt Agreement, original purchasers of Subscription Receipts pursuant to the Offering will have a contractual right

of rescission following the issuance of Common Shares to such purchaser upon the exchange of the Subscription Receipts to receive the

amount paid for the Subscription Receipts if the Prospectus or this Prospectus Supplement (including documents incorporated herein by

reference) or any amendment hereto contains a misrepresentation or is not delivered to such purchaser, provided such remedy for rescission

is exercised within 180 days of the Offering Closing Date.

From

time to time while the Subscription Receipts are outstanding, the Company, the Agent and the Escrow Agent, without the consent of the

holders of the Subscription Receipts, may amend or supplement the Subscription Receipt Agreement for certain purposes, including making

any change that, in the opinion of the Escrow Agent, does not prejudice the rights of the holders of the Subscription Receipts. The Subscription

Receipt Agreement provides for other modifications and alterations thereto and to the Subscription Receipts issued thereunder by way

of an extraordinary resolution. The term “extraordinary resolution” is defined in the Subscription Receipt Agreement to mean,

in effect, a resolution passed by the affirmative votes of the holders of not less than 662⁄3% of the number of outstanding Subscription

Receipts represented and voting at a meeting of Subscription Receipt holders or an instrument or instruments in writing signed by the

holders of not less than 662⁄3% of the number of outstanding Subscription Receipts.

The

Subscription Receipts and the Common Shares issuable upon the exchange of the Subscription Receipts will be delivered under the book-based

system through CDS or its nominee and deposited in electronic form, or will otherwise be delivered registered as directed by the Agent,

on the Closing Date. Except in limited circumstances, a purchaser of Subscription Receipts will receive only a customer confirmation

from the registered dealer from or through which the Subscription Receipts are purchased and who is a CDS participant. CDS will record

the CDS participants who hold Subscription Receipts on behalf of owners who have purchased Subscription Receipts in accordance with the

book-based system. No definitive certificates will be issued unless specifically requested or required.

Holders

of Subscription Receipts are not shareholders and Subscription Receipts do not carry any voting rights in the Company. Holders of Subscription

Receipts are entitled only to receive Common Shares on exchange of their Subscription Receipts or to a return of the Offering Price and

an amount equal to such holder’s share of the interest earned on the Escrowed Funds, in each case as applicable, as described above.

Plan

of Distribution

Pursuant

to the Agency Agreement, the Company has engaged the Agent to act as its agent to offer for sale to the public, on a “best efforts”

agency basis, up to 7,200,000 Subscription Receipts at the Offering Price, for aggregate gross consideration of up to US$9,000,000, payable

in cash to the Company against delivery of the Subscription Units, subject to the terms and conditions of the Agency Agreement and the

Subscription Receipt Agreement. The obligations of the Agent under the Agency Agreement are subject to certain closing conditions and

may be terminated at the Agent’s discretion on the basis of “disaster out”, “material adverse change out”,

“regulatory out”, and “breach out” provisions in the Agency Agreement and may also be terminated upon the occurrence

of certain other stated events. There is no minimum amount of funds that must be raised under the Offering. This means that the Company

could complete the Offering after raising only a small proportion of the Offering set out above.

The

Company has granted to the Agent the Over-Allotment Option exercisable at any time until the earlier of (i) 30 days following the Offering

Closing Date, and (ii) the Termination Date, to purchase up to an additional 15% of the Subscription Receipts at the Offering Price,

solely to cover over-allocations, if any, and for market stabilization purposes. If the Over-Allotment Option is exercised in full, the

total price to the public, the Agent’s Fee and the net proceeds to the Company, before expenses and interest, will be US$10,350,000,

US$724,500 (of which 50% is payable upon release of the Escrowed Funds) and US$9,625,500, respectively. The grant of the Over-Allotment

Option and the distribution of the Subscription Receipts that may be issued on the exercise of the Over-Allotment Option and the Common

Shares issuable on exchange of these Subscription Receipts are also qualified under this Prospectus Supplement. A purchaser who acquires

securities forming part of the Agent’s over allocation position acquires those securities under the Prospectus, regardless of whether

the Agent’s over-allocation position is ultimately filled through the exercise of the Over-Allotment Option or secondary market

purchases.

The

terms of the Offering were established through negotiations between the Company and the Agent.

Pursuant

to the Agency Agreement, the Company has agreed to pay to the Agent the Agent’s Fee equal to 7.0% of the gross proceeds from the

sale of Subscription Receipts (including any gross proceeds raised on exercise of the Over-Allotment Option), provided that the Agent’s’

Fee shall not be paid in respect of gross proceeds from the sale of Subscription Receipts to purchasers on the President’s List.

The Agent’s Fee is payable as to 50% on the Offering Closing Date and 50% upon release of the Escrowed Funds. In the event the

Escrowed Funds are refunded to purchasers, the Agent’s Fee will consist solely of the amount payable on the Offering Closing Date.

Subscriptions

for Subscription Receipts will be received subject to rejection or allotment in whole or in part, and the right is reserved to close

the subscription books at any time without notice.

There

is currently no market through which the Subscription Receipts may be sold and purchasers may not be able to resell Subscription Receipts

purchased under this Prospectus Supplement. The Company has applied to the TSXV to list, and notified NASDAQ of, the Common Shares

issuable upon exchange of the Subscription Receipts. Listing is subject to the Company fulfilling all the listing requirements of the

TSXV and NASDAQ.

This

Offering is being made concurrently in each of the provinces of Canada, other than Québec, and in the United States pursuant to

the MJDS. The Subscription Receipts will be offered in Canada and the United States through the Agent either directly or, if applicable,

through their respective Canadian or United States registered broker-dealer affiliates or through a selling group of appropriately registered

dealers and brokers.

The

Company has agreed that, subject to certain exceptions, including pursuant to the Transaction, it shall not issue or agree to issue any

Common Shares or other securities convertible into, or exchangeable for, Common Shares prior to 90 days after the Offering Closing Date

without the prior consent of the Agent, which consent shall not be unreasonably withheld.

In

connection with this Offering, the Agent may, subject to applicable law, over-allocate the issuance of Subscription Receipts or effect

transactions which stabilize or maintain the market price of the Common Shares at levels other than those which otherwise might prevail

on the open market. Stabilizing transactions consist of bids or purchases made for the purpose of preventing or retarding a decline in

the market price of such securities while this Offering is in progress. These transactions may also include making short sales of the

securities, which involve the sale by the Agent of a greater number of securities than they are required to purchase in this Offering.

Short sales may be “covered short sales”, which are short positions in an amount not greater than the Over-Allotment Option,

or may be “naked short sales”, which are short positions in excess of that amount. The Agent may close out any covered short

position either by exercising the Over-Allotment Option, in whole or in part, or by purchasing the securities in the open market. In

making this determination, the Agent will consider, among other things, the price of the securities available for purchase in the open

market compared with the price at which they may purchase the securities through the Over-Allotment Option. If, following the closing

of this Offering, the market price of the securities decreases, the short position created by the over-allocation position in the securities

may be filled through purchases in the market, creating upward pressure on the price of the securities. If, following the closing of

this Offering, the market price of the securities increases, the over-allocation position in the securities may be filled through the

exercise of the Over-Allotment Option in respect of the securities at the Offering Price. The Agent must close out any naked short position

by purchasing the securities in the open market. A naked short position is more likely to be created if the Agent are concerned that

there may be downward pressure on the price of the securities in the open market that could adversely affect investors who purchase in

this Offering. Any naked short sales will form part of the Agent’s over-allocation position. In addition, pursuant to policy statements

of certain securities regulators, the Agent may not, throughout the period of distribution, bid for or purchase Subscription Receipts

or Common Shares. The policy statements allow certain exceptions to the foregoing prohibitions. The Agent may only avail themselves of

such exceptions on the condition that the bid or purchase not be engaged in for the purpose of creating actual or apparent active trading

in, or raising the price of, the Common Shares. These exceptions include a bid or purchase permitted under the Universal Market Integrity

Rules for Canadian Marketplaces of Market Regulation Services Inc., relating to market stabilization and passive market making activities

and a bid or purchase made for and on behalf of a customer where the order was not solicited during the period of distribution. Pursuant

to the first mentioned exception, in connection with the Offering, the Agent may over-allot or effect transactions which stabilize or

maintain the market price of the Common Shares at levels other than those which otherwise might prevail on the open market. Such transactions,

if commenced, may be discontinued at any time.

Certain

Income Tax Considerations

In

the opinion of Fogler, Rubinoff LLP, counsel to the Company, and Norton Rose Fulbright Canada LLP, counsel to the Agent, the following

is a fair summary, as of the date hereof, of the principal Canadian federal income tax considerations generally applicable under the

Income Tax Act (Canada) (the “Tax Act”) to the acquisition, holding and disposition of the Subscription Receipts

and Common Shares that are qualified for distribution under this Prospectus. This summary applies only to a holder who is a beneficial

owner of Subscription Receipts and Common Shares and who, for the purposes of the Tax Act, and at all relevant times: (i) deals

at arm’s length with the Company and the Agent; (ii) is not affiliated with the Company or the Agent; and (iii) holds the Subscription

Receipts and will hold the Common Shares as capital property (a “Holder”).

Subscription

Receipts and Common Shares will generally be considered to be capital property of a Holder unless they are held in the course of carrying

on a business of trading or dealing in securities or were acquired in one or more transactions considered to be an adventure or concern

in the nature of trade.

This

summary is not applicable to a Holder (i) that is a “financial institution” (as defined in the Tax Act for the purposes of

the mark-to-market rules), (ii) an interest in which would be a “tax shelter investment” (as defined in the Tax Act), (iii)

that is a “specified financial institution” (as defined in the Tax Act), (iv) that has elected to report its “Canadian

tax results” (as defined in the Tax Act) in a currency other than Canadian currency, (v) that has entered or will enter into a

“derivative forward agreement” or “synthetic disposition arrangement” (each as defined in the Tax Act) with respect

to the Subscription Receipts or Common Shares, or (vi) that receives dividends on the Common Shares under or as part of a “dividend

rental arrangement” (as defined in the Tax Act). Any such Holder should consult its own tax advisor with respect to an investment

in the Subscription Receipts and Common Shares.

Additional

considerations, not discussed herein, may be applicable to a Holder that is a corporation resident in Canada, and is, or becomes, or

does not deal at arm’s length with a corporation resident in Canada that is, or becomes, as part of a transaction or event or series

of transactions or events that includes the acquisition of the Subscription Receipts and Common Shares, controlled by a non-resident

person (or a group of such persons that do not deal at arm’s length) for purposes of the “foreign affiliate dumping”

rules in section 212.3 of the Tax Act. Any such Holder should consult its own tax advisor with respect to the consequences of any of

the transactions described in this Prospectus Supplement.

This

summary is based upon: (i) the current provisions of the Tax Act and the regulations thereunder (the “Regulations”) in

force as of the date hereof; (ii) all specific proposals to amend the Tax Act and the Regulations which have been publicly announced

by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Proposed Amendments”); and (iii)

counsel’s understanding of the current published administrative policies and assessing practices of the Canada Revenue Agency (the

“CRA”). No assurance can be given that the Proposed Amendments will be enacted or otherwise implemented in their current

form, or at all. This summary does not otherwise take into account or anticipate any changes in law, administrative policy or assessing

practice, whether by legislative, regulatory, administrative, governmental or judicial decision or action, nor does it take into account

provincial, territorial or foreign tax legislation or considerations.

This

summary is of a general nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended

to be, nor should it be construed to be, legal or tax advice to any particular Holder. Accordingly, Holders should consult their own

tax advisors with respect to their particular circumstances.

Currency

Conversion

Generally,

for purposes of the Tax Act, all amounts relating to the acquisition, holding or disposition of Subscription Receipts and Common Shares

must be determined in Canadian dollars based on the rate of exchange quoted by the Bank of Canada on the date such amount arose or such

other rate of exchange as may be acceptable to the CRA.

Acquisition

of Common Shares Pursuant to the Terms of the Subscription Receipts

A

Holder of Subscription Receipts will not realize any capital gain or capital loss upon the acquisition of the Common Shares pursuant

to the terms of the Subscription Receipts. The cost to a Holder of a Common Share acquired pursuant to the terms of a Subscription Receipt

will generally be equal to the amount paid by the Resident Holder for the Subscription Receipt. The adjusted cost base to a Holder of

Common Shares acquired pursuant to the terms of the Subscription Receipts will be determined by averaging the cost of such Common Shares

(being the amount paid to acquire the Subscription Receipts) with the adjusted cost base immediately before that time of any other Common

Shares owned by the Holder as capital property immediately prior to the acquisition.

Holders

Resident in Canada

This

portion of the summary is generally applicable to a Holder who, at all relevant times, is, or is deemed to be, resident in Canada for

the purposes of the Tax Act (a “Resident Holder”). Certain Resident Holders whose Common Shares might not otherwise

qualify as capital property may be entitled to make the irrevocable election provided by subsection 39(4) of the Tax Act to have the

Common Shares and every other “Canadian security” (as defined in the Tax Act) owned by such Resident Holder in the taxation

year of the election and in all subsequent taxation years deemed to be capital property. Such election is not available in respect of

the Subscription Receipts. Resident Holders should consult their own tax advisors for advice as to whether an election under subsection

39(4) of the Tax Act is available and/or advisable in their particular circumstances.

Dispositions

of Subscription Receipts

A

disposition or deemed disposition by a Resident Holder of a Subscription Receipt (which does not include the acquisition of a Common

Share pursuant to the terms of Subscription Receipts), including on the repayment of the Offering Price of a Subscription Receipt as

a consequence of the Transaction failing to close on or prior to the Outside Deadline or Termination Date, as applicable, will generally

result in the Resident Holder realizing a capital gain (or capital loss) equal to the amount, if any, by which the proceeds of disposition

exceed (or are less than) the aggregate of the adjusted cost base to the Resident Holder thereof and any reasonable costs of disposition.

The

cost to a Resident Holder of a Subscription Receipt will generally be equal to the amount paid to acquire the Subscription Receipt. The

adjusted cost base to a Resident Holder of a Subscription Receipt will generally be determined by averaging the cost of all Subscription

Receipts held by the Resident Holder as capital property immediately before the disposition. Such capital gain (or capital loss) will

be subject to the tax treatment described below under “— Holders Resident in Canada — Taxation of Capital Gains

and Capital Losses”.

In

the event that a Resident Holder becomes entitled to the repayment of the Offering Price of a Subscription Receipt as a consequence the

Transaction failing to close on or prior to the Outside Deadline or Termination Date, as applicable, any amount that is paid to the Resident

Holder by the Company as, or on account of, interest and that is included in the Resident Holder’s income, will be excluded from

the Resident Holder’s proceeds of disposition of the Subscription Receipt.

Pro

Rata Share of Interest

In

the event that the Transaction fails to close on or prior to the Outside Deadline or Termination Date, as applicable, Resident Holders