89bio, Inc. (Nasdaq: ETNB), a clinical-stage biopharmaceutical

company focused on the development and commercialization of

innovative therapies for the treatment of liver and

cardio-metabolic diseases, today reported its financial results for

the quarter ended June 30, 2020.

“We are pleased with the progress we have made

with our Phase 1b/2a trial for nonalcoholic steatohepatitis (NASH)

and look forward to reporting topline results in late third quarter

to early fourth quarter of this year,” said Rohan Palekar,

Chief Executive Officer of 89bio. “With our strengthened capital

position, we look forward to continuing to advance BIO89-100 and

remain on track to initiate the Phase 2 trial in severe

hypertriglyceridemia (SHTG) patients during this

quarter.”

Recent Highlights and Upcoming

Milestones

Topline results from the Phase 1b/2a

trial of BIO89-100 in NASH are expected in Late Q3 to Early

Q4. In April 2020, 89bio closed enrollment in its Phase

1b/2a trial of BIO89-100 in NASH. Topline results are expected in

late Q3 to early Q4.

Phase 2 trial of BIO89-100 in SHTG on

track for initiation in Q3. On May 8, 2020, the Division

of Diabetes, Lipid Disorders, and Obesity at the U.S. Food and Drug

Administration (FDA) cleared the Investigational New Drug (IND)

application for BIO89-100 in patients with

SHTG.

Completed underwritten offering of

common stock. In July 2020, 89bio received approximately

$78.3 million in net proceeds from an underwritten offering of

common stock.

Second Quarter 2020 Financial

Results

Cash Position. As of June 30,

2020, 89bio had cash, cash equivalents, and short-term investments

of $73.9 million.

Research and Development (R&D)

Expenses. R&D expenses were $8.4 million for

the three months ended June 30, 2020, compared to $3.2 million

for the three months ended June 30, 2019. The increase in R&D

expenses was primarily driven by increases in clinical development,

contract manufacturing, pre-clinical development and personnel

expenses.

General and Administrative (G&A)

Expenses. G&A expenses were $3.2 million for the

three months ended June 30, 2020, compared to $0.8 million for

the three months ended June 30, 2019. The increase in G&A

expenses was primarily due to an increase in costs related to

professional services and personnel expenses.

Net Loss. 89bio reported a net

loss of $11.8 million for the three months ended June 30, 2020,

compared to a net loss of $15.0 million for the three months

ended June 30, 2019. The decrease in net loss is primarily

attributable to increased R&D expenses for our programs and

increased G&A expenses associated with our becoming a public

company offset by a non-recurring charge in 2019 for accounting of

preferred stock liability.

About BIO89-100BIO89-100 is a

glycoPEGylated analog of FGF21 being developed for the treatment of

NASH and the treatment of severe hypertriglyceridemia (SHTG). 89bio

has specifically engineered BIO89-100 using a proprietary

glycoPEGylation technology designed to prolong the biological

activity of native FGF21. In preclinical studies, BIO89-100

demonstrated consistent beneficial effects across a range of

endpoints, including hepatic steatosis, injury, and fibrosis. In

89bio’s Phase 1a clinical trial in healthy volunteers, BIO89-100

demonstrated a favorable tolerability profile and dose-proportional

pharmacokinetics. BIO89-100 also demonstrated statistically

significant improvements in key lipid parameters for two weeks

after a single dose, which combined with results from the company’s

animal studies supports the potential for weekly or once every two

weeks dosing. A proof of concept Phase 1a/2b clinical trial

evaluating BIO89-100 in patients with NASH or NAFLD and a high risk

of NASH is currently underway and a Phase 2 trial in patients with

SHTG is expected to initiate shortly. About

89bio89bio is a clinical-stage biopharmaceutical company

focused on the development and commercialization of innovative

therapies for the treatment of liver and cardio-metabolic diseases.

The company’s lead product candidate, BIO89-100, is being developed

for the treatment of NASH and for the treatment of SHTG. BIO89-100

is a specifically engineered glycoPEGylated analog of FGF21 that is

currently in a proof of concept Phase 1b/2a clinical trial in

patients with NASH or NAFLD and a high risk of NASH and a Phase 2

trial in patients with SHTG is expected to initiate shortly. 89bio

is headquartered in San Francisco with operations in Herzliya,

Israel. Visit 89bio.com for more information.

Forward-Looking

StatementsCertain statements in this press release may

constitute “forward-looking statements” within the meaning of the

federal securities laws, including, but not limited to, 89bio’s

expectations regarding plans for its clinical programs and clinical

studies. Words such as “may,” “might,” “will,” “objective,”

“intend,” “should,” “could,” “can,” “would,” “expect,” “believe,”

“design,” “estimate,” “predict,” “potential,” “develop,” “plan” or

the negative of these terms, and similar expressions, or statements

regarding intent, belief, or current expectations, are forward

looking statements. While 89bio believes these forward-looking

statements are reasonable, undue reliance should not be placed on

any such forward-looking statements, which are based on information

available to us on the date of this release. These forward-looking

statements are based upon current estimates and assumptions and are

subject to various risks and uncertainties (including, without

limitation, those set forth in 89bio’s filings with the U.S.

Securities and Exchange Commission (SEC)), many of which are beyond

89bio’s control and subject to change. Actual results could be

materially different. Risks and uncertainties include: expectations

regarding the timing, completion and outcome of 89bio’s Phase

1b/2a proof of concept clinical trial evaluating BIO89-100 in

patients with NASH or patients with NAFLD and a high risk of NASH;

expectations regarding the timing, completion and outcome of

89bio’s proof of concept Phase 2 clinical trial evaluating

BIO89-100 in patients with SHTG; the unpredictable relationship

between preclinical study results and clinical study results; the

effect of the COVID-19 pandemic on 89bio’s clinical trials and

business operations; liquidity and capital resources; and other

risks and uncertainties identified in 89bio’s Annual Report on

Form 10-Q for the quarter ended March 31, 2020, filed May 13, 2020

with the SEC and other subsequent disclosure documents filed with

the SEC. 89bio claims the protection of the Safe Harbor contained

in the Private Securities Litigation Reform Act of 1995 for

forward-looking statements. 89bio expressly disclaims any

obligation to update or alter any statements whether as a result of

new information, future events or otherwise, except as required by

law.

|

|

|

|

|

89bio, Inc. Condensed Consolidated Statement of Operations

Data (Unaudited) (In thousands, except share and per share

amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2020 |

|

|

|

2019 |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

8,443 |

|

|

$ |

3,165 |

|

|

$ |

16,221 |

|

|

$ |

7,474 |

|

|

General and administrative |

|

|

3,230 |

|

|

|

834 |

|

|

|

6,154 |

|

|

|

1,357 |

|

|

Total operating expenses |

|

|

11,673 |

|

|

|

3,999 |

|

|

|

22,375 |

|

|

|

8,831 |

|

|

Loss from operations |

|

|

11,673 |

|

|

|

3,999 |

|

|

|

22,375 |

|

|

|

8,831 |

|

|

Other expenses (income), net |

|

|

98 |

|

|

|

10,968 |

|

|

|

(59 |

) |

|

|

10,552 |

|

|

Net loss before tax |

|

|

11,771 |

|

|

|

14,967 |

|

|

|

22,316 |

|

|

|

19,383 |

|

|

Income tax expense (benefit) |

|

|

— |

|

|

|

6 |

|

|

|

(1 |

) |

|

|

29 |

|

|

Net loss and comprehensive loss |

|

$ |

11,771 |

|

|

$ |

14,973 |

|

|

$ |

22,315 |

|

|

$ |

19,412 |

|

|

Net loss per share, basic and diluted |

|

$ |

0.85 |

|

|

$ |

24.50 |

|

|

$ |

1.62 |

|

|

$ |

31.76 |

|

|

Weighted-average shares used to compute net loss per share, basic

and diluted |

|

|

13,797,356 |

|

|

|

611,226 |

|

|

|

13,793,544 |

|

|

|

611,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

89bio, Inc. Condensed Consolidated Balance Sheet Data

(Unaudited) (In thousands) |

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

2020 |

|

|

|

2019 |

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments |

$ |

73,896 |

|

|

$ |

93,335 |

|

|

Total Assets |

|

76,562 |

|

|

|

95,553 |

|

|

Total current liabilities |

|

6,791 |

|

|

|

5,609 |

|

|

Total stockholders’ equity |

|

69,771 |

|

|

|

89,944 |

|

| |

|

|

|

| |

|

|

|

Investor Contact: Ryan Martins Chief Financial Officer

investors@89bio.com

Media Contact: Lori Rosen LDR Communications 917-553-6808

lori@ldrcommunications.com

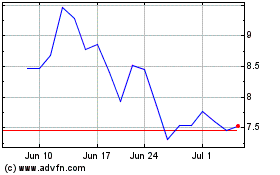

89bio (NASDAQ:ETNB)

Historical Stock Chart

From Mar 2024 to Apr 2024

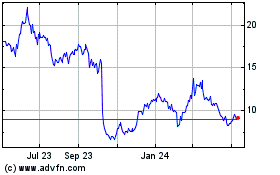

89bio (NASDAQ:ETNB)

Historical Stock Chart

From Apr 2023 to Apr 2024