UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 11-K

(Mark One)

| | | | | | | | |

| | ý | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2021

OR

| | | | | | | | |

| | ¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-37702

AMGEN RETIREMENT AND SAVINGS PLAN

(Full title of the plan)

AMGEN INC.

(Name of issuer of the securities held)

| | | | | | | | |

| | |

| One Amgen Center Drive, | | 91320-1799 |

| Thousand Oaks, California | | (Zip Code) |

| (Address of principal executive offices) | | |

Amgen Retirement and Savings Plan

Audited Financial Statements

and Supplemental Schedules

Year Ended December 31, 2021

Contents

| | | | | |

| |

| |

| |

| Audited Financial Statements: | |

| |

| |

| |

| |

| |

| Supplemental Schedules: | |

| |

| |

| |

| |

| |

| |

| |

Report of Independent Registered Public Accounting Firm

To the Plan Participants and the Plan Administrator of Amgen Retirement and Savings Plan

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of Amgen Retirement and Savings Plan (the Plan) as of December 31, 2021 and 2020, and the related statement of changes in net assets available for benefits for the year ended December 31, 2021, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan at December 31, 2021 and 2020, and the changes in its net assets available for benefits for the year ended December 31, 2021, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on the Plan’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Schedules Required by ERISA

The accompanying supplemental schedules of assets (held at end of year) and loans or fixed income obligations in default or classified as uncollectible as of December 31, 2021, and assets (acquired and disposed of within year) and delinquent participant contributions for the year then ended, (referred to as the “supplemental schedules”), have been subjected to audit procedures performed in conjunction with the audit of the Plan’s financial statements. The information in the supplemental schedules is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedules. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ ERNST & YOUNG LLP

We have served as the Plan’s auditor since at least 1989, but we are unable to determine the specific year.

Los Angeles, California

June 23, 2022

Amgen Retirement and Savings Plan

Statements of Net Assets Available for Benefits

| | | | | | | | | | | | | | |

| | | December 31, |

| | | 2021 | | 2020 |

| Assets | | | | |

| Investments at fair value | | $ | 6,436,111,194 | | | $ | 6,028,344,525 | |

| Investments in fully benefit-responsive investment contracts at contract value | | 714,985,494 | | | 678,722,325 | |

| Notes receivable from participants | | 30,628,567 | | | 33,228,057 | |

| Other – principally due from broker | | 4,502,530 | | | 9,187,314 | |

| Total assets | | 7,186,227,785 | | | 6,749,482,221 | |

| Liabilities | | | | |

| Other – principally due to broker | | 6,957,185 | | | 8,741,768 | |

| Total liabilities | | 6,957,185 | | | 8,741,768 | |

| Net assets available for benefits | | $ | 7,179,270,600 | | | $ | 6,740,740,453 | |

See accompanying notes.

Amgen Retirement and Savings Plan

Statement of Changes in Net Assets Available for Benefits

| | | | | | | | | | |

| | | Year Ended December 31, |

| | | 2021 | | |

| Additions to (deductions from) net assets: | | | | |

| Employer contributions | | $ | 192,549,554 | | | |

| Participant contributions | | 170,659,097 | | | |

| Rollover contributions | | 37,446,206 | | | |

| Interest and dividend income | | 44,783,341 | | | |

| Net realized/unrealized gains | | 637,968,589 | | | |

| Interest income on notes receivable from participants | | 1,527,815 | | | |

| Benefits paid | | (633,334,430) | | | |

| Investment and administrative fees | | (13,070,025) | | | |

| Net increase | | 438,530,147 | | | |

| Net assets available for benefits at beginning of year | | 6,740,740,453 | | | |

| Net assets available for benefits at end of year | | $ | 7,179,270,600 | | | |

See accompanying notes.

Amgen Retirement and Savings Plan

Notes to Financial Statements

December 31, 2021

1. Description of the Plan

The following description of the Amgen Retirement and Savings Plan (the Plan) provides only general information. Participants should refer to the Plan document for a more complete description of the Plan’s provisions.

General

The Plan was established effective April 1, 1985, and was amended and restated effective January 1, 2017, and subsequently amended, with the most recent amendment adopted on October 25, 2021. The Plan is a defined contribution plan covering substantially all domestic employees of Amgen Inc. (the Company or Amgen) and participating subsidiaries. The Plan is intended to qualify under sections 401(a) and 401(k) of the Internal Revenue Code of 1986 (the Code) (see Note 4, Income Tax Status) and section 407(d)(3)(A) of the Employee Retirement Income Security Act of 1974 (ERISA).

Contributions

Subject to certain limitations (as defined in the Plan), participants may elect to contribute up to 30% of their eligible compensation in pre-tax contributions, Roth contributions (in accordance with the Code), after-tax contributions or a combination of these types of contributions (together, Individual Contributions). A participant’s combined pre-tax contributions and Roth contributions (exclusive of catch-up contributions discussed below) are subject to Internal Revenue Service (IRS) and Plan limits and could not exceed a maximum of $19,500 in 2021. Participant after-tax contributions are subject to IRS and Plan limitations and could not exceed a maximum of $9,500 in 2021. Unless an employee has voluntarily enrolled in the Plan or has declined to participate in the Plan within the first 30 days of employment, all newly eligible participants are automatically enrolled in the Plan, and contributions equal to 5% of their eligible compensation are withheld and contributed to the Plan as pre-tax contributions; such contributions are automatically increased by 1% per year until their contributions reach 10% of their eligible compensation. Participants may elect to adjust, cease or resume their Individual Contributions at any time.

Participants who are at least age 50 by the close of the Plan year may also elect to make certain additional Individual Contributions, referred to as catch-up contributions, that are subject to IRS and Plan limitations and could not exceed $6,500 in 2021. Catch-up contributions may be made as pre-tax contributions, Roth contributions or a combination of these types of contributions. Participants may also contribute pre-tax, Roth and after-tax amounts representing distributions from certain other retirement plans qualified in the United States or certain individual retirement accounts (IRAs), referred to as rollover contributions (as defined in the Plan). In addition, eligible participants that received coronavirus-related distributions from the Plan, as discussed below, or any other plan, may make contributions to the Plan during a specified period in an aggregate amount not to exceed such coronavirus-related distributions; these contributions will be treated in the same manner as rollover contributions.

Each pay period, the Company makes a non-elective contribution for all eligible participants, whether or not they have elected to make Individual Contributions to the Plan, equal to 5% of each participant’s eligible compensation (Core Contributions) up to a maximum of $14,500 in 2021. In addition, the Company makes a contribution equal to amounts contributed by the participant as pre-tax contributions or Roth contributions, including such contributions designated as catch-up contributions, of up to 5% of eligible compensation (Matching Contributions) up to a maximum of $14,500 in 2021.

Also, the Company can, at its discretion, make a special contribution (Special Contribution) on behalf of a participant who is in his or her initial year of employment with the Company and who could not make the maximum participant contribution permitted under the Plan because in the same Plan year he or she previously made pre-tax salary deferrals under a prior unrelated employer’s qualified plan.

Participants select the investments in which their Individual Contributions, including their Core Contributions, Matching Contributions and Special Contributions, if any, (collectively, Company Contributions) are to be invested, electing among various alternatives, including Amgen common stock (Amgen stock). Participants may direct a maximum of 20% of contributions to be invested in Amgen stock. In addition, participants may transfer amounts among the investment options at any time, subject to certain limitations. Notwithstanding the foregoing, if 20% or more of the value of a participant’s Plan account is invested in Amgen stock, the Plan document provides that no transfers from other investment options can be made to invest in Amgen stock.

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

The accounts of participants who had never made an investment election are allocated to investments under a qualified default investment alternative, which is intended to be compliant with ERISA regulations. At any time, participants may elect to alter the investments in their accounts made under a qualified default investment alternative.

Vesting

Participants are immediately vested with respect to their Individual Contributions, Matching Contributions and Special Contributions, if any, and earnings and losses (hereafter referred to as earnings) thereon. Participants hired prior to January 1, 2020, are also immediately vested with respect to their Core Contributions and earnings thereon. Participants hired on or after January 1, 2020, vest in full with respect to their Core Contributions and earnings thereon after three years of service, as defined by the terms of the Plan, or upon reaching age 65 while employed by Amgen, if earlier. If a participant ceases to be an employee before fully vesting in their account, the non-vested portion of the participant’s account will be treated as a forfeiture, as defined by the terms of the Plan, on the earlier of (a) the date the participant incurs a five-year break in service, as defined by the terms of the Plan or, (b) the date the participant receives a distribution of the entire vested portion of their account.

Participant Accounts

Each participant’s account is credited with: (a) the participant’s Individual Contributions; (b) an allocation of Company Contributions; and (c) earnings. The benefit to which a participant is entitled is the benefit that can be provided from the participant’s account.

Plan Investments

Plan participants can invest in seven different asset classes as well as Amgen stock or can actively manage their account under a self-directed brokerage arrangement in which a wider array of investment options are available. The value of an investment in an asset class is determined by its underlying investment vehicles, which may include one or more of the following: mutual funds, collective trust funds and portfolios which are separately managed exclusively for the benefit of Plan participants and their beneficiaries (separately managed portfolios). The separately managed portfolios invest in various types of assets, including publicly traded common and preferred stocks, collective trust funds and investment contracts. The asset classes are designed to provide participants with choices among a variety of investment objectives.

Payments of Benefits

Subject to Plan limitations, upon termination of employment, including termination due to disability (as defined in the Plan) or retirement, participants may elect to receive a full or partial distribution of their account balance in: (a) a single payment in cash; (b) a single distribution in full shares of Amgen stock (with any fractional shares paid in cash); (c) a single distribution paid in a combination of cash and full shares of Amgen stock; (d) cash installments over 10 years; or (e) a rollover distribution to an eligible retirement plan.

Participants may also elect to maintain their account balance in the Plan subsequent to termination of employment, provided that their account balance is greater than $1,000.

If a participant dies before receiving the value of his or her account balance, the participant’s beneficiary may elect to receive the distribution of remaining funds from among the alternatives described above, subject to certain Plan limitations.

Certain restrictions apply to withdrawals from the Plan while a participant continues to be employed by the Company, including coronavirus-related withdrawals, which were permitted under the Coronavirus Aid, Relief and Economic Security Act (CARES Act) enacted on March 27, 2020. In response to the CARES Act, the Plan voluntarily made a number of modifications related to withdrawals. The Plan adopted only those provisions of the CARES Act that (a) permitted participants who turned 70½ or older in 2019 to waive the requirement to take a minimum distribution in 2020 and (b) allowed qualified participants to take tax-favored distributions of up to $100,000, repayable if desired by the participant in three years, for qualifying coronavirus-related reasons through December 30, 2020.

Amgen Stock Dividends

Participants that invest in Amgen stock may elect to receive distributions of cash with respect to dividends the Company pays on Amgen stock or reinvest such dividends to acquire additional shares of Amgen stock.

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

Notes Receivable from Participants

Subject to certain restrictions, a participant can have up to two loans outstanding at any one time from his or her Plan account with a combined maximum loan amount that may not exceed the lesser of: (a) 50% of the participant’s account balance (exclusive of amounts related to Roth contributions and earnings thereon) or (b) $50,000 less certain adjustments, as applicable (as defined in the Plan). A participant’s loan is secured by his or her Plan account balance. Loans bear interest at fixed rates which, until changed by the Company, are based on the prime rate plus one percentage point as published in The Wall Street Journal, determined as of the last day of the calendar quarter preceding origination or such other rate as may be required by law. Loans are generally payable in installments over periods of up to five years, unless the loan is used to acquire a principal residence for which the term of the loan may be up to 20 years. Principal and interest payments are allocated to the participant’s account.

Plan Termination

Although it has not expressed any intent to do so, the Company has the right under the Plan to terminate the Plan subject to the provisions of ERISA. Upon termination, participants would receive distributions of their account balances.

Trustees and Custodians

Bank of America, N.A. is the Plan’s trustee and custodian with respect to the self-directed brokerage arrangement and the Amgen common stock fund. The Northern Trust Company, NA (Northern) is the Plan’s trustee and custodian with respect to the asset classes.

2. Summary of Significant Accounting Policies

Basis of Accounting

The accompanying financial statements are prepared on the accrual basis of accounting. Benefits to participants are recorded when paid.

Fair Value Measurement

The investments of the Plan are reported at fair value, except for fully benefit-responsive investment contracts, discussed below. Fair value is generally defined as the price that would be received to sell an asset or paid to transfer a liability (the exit price) in an orderly transaction between market participants at the measurement date (see Note 3, Fair Value Measurements).

Investment Income and Losses

Dividend income is recognized on the ex-dividend date, and interest income is recorded on an accrual basis. Unrealized gains and losses on investments are measured by the change in the difference between the fair value and cost of the securities held at the beginning of the year (or date purchased if acquired during the Plan year) and the end of the year. Realized gains and losses from security transactions are recorded based on the weighted-average cost of securities sold.

Fully Benefit-Responsive Investment Contracts

As of December 31, 2021 and 2020, the Plan had fully benefit-responsive investment contracts, including synthetic investment contracts and an insurance separate accounts contract (collectively, security-backed contracts). The synthetic investment contracts are comprised of wrapper contracts issued by insurance companies backed by the Plan’s ownership in collective trust funds that invest in fixed income securities. The insurance separate accounts contract is a contract issued by an insurance company backed by specified separate accounts of the issuer which are comprised of fixed income securities. Contract value is the relevant measurement attribute for security-backed contracts because this is the amount participants would receive if they were to initiate qualified transactions related to these investments. The issuers of the Plan’s security-backed contracts credit the Plan with stated rates of interest, and the issuers guarantee that all qualified participant withdrawals related to the contracts will be at contract value, except as discussed below. The crediting rates provide for realized and unrealized gains and losses on the underlying assets to be amortized over the expected duration of the underlying investments through adjustments to the future interest crediting rates rather than being reflected immediately in the net assets of the Plan. The contract values of the Plan’s security-backed contracts were as follows:

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

| | | | | | | | | | | |

| December 31, |

| 2021 | | 2020 |

| Synthetic investment contracts | $ | 533,077,342 | | | $ | 501,806,073 | |

| Insurance separate accounts contract | 181,908,152 | | | 176,916,252 | |

| Total fully benefit-responsive investment contracts | $ | 714,985,494 | | | $ | 678,722,325 | |

The security-backed contracts provide for withdrawals at other than contract value associated with certain events which are not in the ordinary course of Plan operations. These withdrawals are made at contract value, modified by a market value adjustment as defined in the contract. Circumstances which may trigger a market value adjustment are generally defined as any event that, in the reasonable determination of the issuer, has or will have a material adverse effect on the issuer’s interest under the contract. Such events may include, but are not limited to: (a) material amendments to the Plan’s structure or administration; (b) changes in or the creation of competing investment options; (c) complete or partial termination of the Plan; (d) removal of a specifically identifiable group of employees from coverage under the Plan; (e) a change in law, regulation, ruling, administrative position, or accounting standard applicable to the Plan; or (f) communication to Plan participants designed to influence a participant not to invest in the asset class that contains these contracts. The Company does not believe that the occurrence of any such event, which would limit the Plan’s ability to transact at contract value with participants, is probable.

These security-backed contracts are evergreen contracts with no maturity dates, but do contain termination provisions. The issuer is obligated to pay the excess contract value when the fair value of the underlying investments equals zero. In addition, if the Plan defaults in its obligations under the security-backed contract and such default is not corrected within the time permitted by the contract, then the contract may be terminated by the issuer and the Plan will receive the fair value of the underlying investments as of the date of termination.

Notes Receivable from Participants

Notes receivable from participants are carried at their unpaid balance plus accrued but unpaid interest, as applicable.

Due from/to Brokers

Purchases and sales of investments are recorded on a trade-date basis. Amounts due from and due to brokers arise from unsettled sale and purchase transactions, respectively.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles (GAAP) requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Risks and Uncertainties

The Plan provides for investment options representing varied combinations of equities (including Amgen stock), fixed income, and other investments. Investments, in general, particularly in securities, are exposed to various risks, such as interest rate, inflation, market and credit risks, among others. Market risk includes global events which could impact the value of investments, including securities, such as a pandemic or international conflict. Due to the level of risk associated with certain investments, including securities, it is at least reasonably possible that changes in the values of the Plan’s investments, including securities, will occur in the near term and that such changes could materially affect participant account balances and the amounts reported in the Plan’s financial statements.

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

3. Fair Value Measurements

The Plan uses various valuation approaches in determining the fair value of investments within a hierarchy that maximizes the use of observable inputs and minimizes the use of unobservable inputs by requiring that observable inputs be used when available. Observable inputs are inputs that market participants would use in pricing the investment based on market data obtained from independent sources. Unobservable inputs are inputs that reflect assumptions about the inputs that market participants would use in pricing the investment and are developed based on the best information available in the circumstances. The fair value hierarchy is divided into three levels based on the source of inputs as follows:

Level 1 – Valuations based on unadjusted quoted prices in active markets for identical investments that the Plan has the ability to access;

Level 2 – Valuations for which all significant inputs are observable, either directly or indirectly, other than Level 1 inputs;

Level 3 – Valuations based on inputs that are unobservable and significant to the overall fair value measurement.

The availability of observable inputs can vary among the various types of investments. To the extent that the valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. In certain cases, the inputs used for measuring fair value may fall into different levels of the fair value hierarchy. In such cases, for financial statement disclosure purposes, the level in the fair value hierarchy within which the fair value measurement is categorized is based on the lowest level of input used that is significant to the overall fair value measurement.

The following fair value hierarchy tables present information about each major class/category of the Plan’s investments measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair value measurements at December 31, 2021, using |

| | | Quoted prices in active markets for identical assets

(Level 1) | | Significant

other observable

inputs

(Level 2) | | Significant

unobservable

inputs

(Level 3) | | Total |

| Amgen stock | | $ | 331,811,884 | | | $ | — | | | $ | — | | | $ | 331,811,884 | |

| Cash and cash equivalents | | 49,649,048 | | | — | | | — | | | 49,649,048 | |

| Collective trust funds | | — | | | 3,643,993,561 | | | — | | | 3,643,993,561 | |

| Common and preferred stocks | | 1,546,823,788 | | | — | | | — | | | 1,546,823,788 | |

| Debt securities | | — | | | 4,828 | | | — | | | 4,828 | |

| Mutual funds | | 81,887,302 | | | — | | | — | | | 81,887,302 | |

| Self-directed brokerage accounts | | 780,896,567 | | | 1,044,216 | | | — | | | 781,940,783 | |

| | | | | | | | |

| Total investments at fair value | | $ | 2,791,068,589 | | | $ | 3,645,042,605 | | | $ | — | | | $ | 6,436,111,194 | |

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair value measurements at December 31, 2020, using |

| | | Quoted prices in active markets for identical assets

(Level 1) | | Significant

other observable

inputs

(Level 2) | | Significant

unobservable

inputs

(Level 3) | | Total |

| Amgen stock | | $ | 352,404,662 | | | $ | — | | | $ | — | | | $ | 352,404,662 | |

| Cash and cash equivalents | | 32,090,680 | | | — | | | — | | | 32,090,680 | |

| Collective trust funds | | — | | | 3,654,353,052 | | | — | | | 3,654,353,052 | |

| Common and preferred stocks | | 1,259,896,607 | | | — | | | — | | | 1,259,896,607 | |

| Debt securities | | 59 | | | 4,969 | | | — | | | 5,028 | |

| Mutual funds | | 92,035,145 | | | — | | | — | | | 92,035,145 | |

| Self-directed brokerage accounts | | 636,454,755 | | | 1,104,596 | | | — | | | 637,559,351 | |

| Total investments at fair value | | $ | 2,372,881,908 | | | $ | 3,655,462,617 | | | $ | — | | | $ | 6,028,344,525 | |

The fair values of substantially all common stocks (including Amgen stock), preferred stocks, publicly traded mutual funds and underlying investments of self-directed brokerage accounts are valued using quoted market prices in active markets with no valuation adjustment.

Collective trust funds represent interests in pooled investment vehicles designed typically for collective investment of employee benefit trusts. The fair values of these investments are determined by reference to the net asset value per unit provided by the fund managers as the basis for current transactions.

Debt securities are valued by taking into consideration valuations obtained from third-party pricing services. The pricing services use industry-standard valuation models, including both income- and market-based approaches, for which all significant inputs are observable either directly or indirectly to estimate fair value. The inputs include reported trades of and broker-dealer quotes on the same or similar securities; issuer credit spreads; benchmark securities; and other observable inputs.

4. Income Tax Status

The Plan received a determination letter from the IRS dated February 22, 2018, stating that, conditioned on the adoption of proposed Plan amendments submitted to the IRS on February 15, 2018, the Plan is qualified, in form, under Section 401(a) of the Code and, therefore, the related trust is exempt from taxation. There have been five subsequent amendments to the Plan, including amendments to satisfy the conditions in the determination letter. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualification. The Company believes the Plan is currently being operated in compliance with the applicable requirements of the Code and, therefore, believes that the Plan is qualified and the related trust is tax exempt. The Company has indicated that it currently intends to continue to take the necessary steps, if any, to maintain the Plan’s compliance with the applicable requirements of the Code.

5. Party-in-Interest Transactions

Parties-in-interest are certain entities defined under Department of Labor regulations, including Amgen, and other parties that provide services to the Plan, such as the trustees, custodians and investment managers. The Plan pays the trustees certain administrative and investment management fees, and the Company pays certain administrative fees on behalf of the Plan. The Plan invests in collective trust funds managed by Northern, certain of the Plan’s investment managers and other third parties and may invest in securities of entities that are parties-in-interest. The Plan also invests in shares of common stock of Amgen and receives dividends on those shares. Notes receivable from participants are also considered party-in-interest transactions. In addition, Northern enters into security-backed contracts with certain insurance companies on behalf of the Plan.

Amgen Retirement and Savings Plan

Notes to Financial Statements (continued)

6. Reconciliation of Financial Statements to the Form 5500

The reconciliation of net assets available for benefits per the financial statements to the Form 5500 consisted of the following:

| | | | | | | | | | | | | | |

| | | December 31, |

| | | 2021 | | 2020 |

| Net assets available for benefits per the financial statements | | $ | 7,179,270,600 | | | $ | 6,740,740,453 | |

Adjustment to fair value for fully benefit-responsive investment contracts | | 2,393,677 | | | 17,810,584 | |

| Amounts allocated to withdrawing participants | | (3,044,375) | | | (2,432,934) | |

| Deemed loans | | (384,631) | | | (337,488) | |

| Net assets per the Form 5500 | | $ | 7,178,235,271 | | | $ | 6,755,780,615 | |

The following is a reconciliation of the net investment gain per the financial statements to the Form 5500:

| | | | | | | | |

| | | Year Ended

December 31,

2021 |

| Interest and dividend income | | $ | 44,783,341 | |

| Net realized/unrealized gains | | 637,968,589 | |

| Net investment income per the financial statements | | 682,751,930 | |

| Adjustment from fair value to contract value for fully benefit-responsive investment contracts: | | |

| Less prior-year adjustment | | (17,810,584) | |

| Add current-year adjustment | | 2,393,677 | |

| Total net investment gain per the Form 5500 | | $ | 667,335,023 | |

The following is a reconciliation of expenses per the financial statements to the Form 5500:

| | | | | | | | |

| | | Year Ended

December 31,

2021 |

| Benefits paid | | $ | (633,334,430) | |

| Investment and administrative fees | | (13,070,025) | |

| Total expenses per the financial statements | | (646,404,455) | |

Amounts allocated to withdrawing participants at December 31, 2020 | | 2,432,934 | |

Amounts allocated to withdrawing participants at December 31, 2021 | | (3,044,375) | |

Deemed loans at December 31, 2020 | | 337,488 | |

Deemed loans at December 31, 2021 | | (384,631) | |

| Total expenses per the Form 5500 | | $ | (647,063,039) | |

Supplemental Schedule

Amgen Retirement and Savings Plan

EIN: 95-3540776 Plan: #001

As of December 31, 2021

Schedule H, line 4i – Schedule of Assets (Held at End of Year)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Amgen stock* | | Employer Securities 1,474,916 shares | | $ | 331,811,884 | | |

| | | | | | $ | 331,811,884 | |

| | | | | | |

| Capital Preservation Asset Class: | | | | | |

| Wells Fargo Fixed Income Fund L* | | Collective Trust Fund 21,790,625 units | | 317,243,168 | | |

| Wells Fargo Fixed Income Fund F* | | Collective Trust Fund 14,014,530 units | | 217,778,788 | | |

| Metropolitan Life Contract* | | Insurance Separate Accounts Investment Contract 1,460,908 units | | 182,357,216 | | |

| NT Collective Short Term Investment Fund* | | Collective Trust Fund 51,299,735 units | | 51,299,735 | | |

| Wells Fargo BlackRock Short Term Investment Fund S* | | Collective Trust Fund 37,867,822 units | | 37,870,238 | | |

| Wrapper Contracts | | | | — | | |

| Total Capital Preservation Asset Class | | | | | 806,549,145 | |

| | | | | | |

| Fixed Income Asset Class: | | | | | |

| MetLife Core Plus Collective Fund* | | Collective Trust Fund 16,606,811 units | | 179,851,763 | | |

| Wellington Core Bond Plus Portfolio Collective Investment Trust II* | | Collective Trust Fund 13,448,169 units | | 179,129,606 | | |

| Schroder Global Strategic Bond Trust Class W* | | Collective Trust Fund 4,557,016 units | | 46,390,419 | | |

| Putnam Absolute Return Fixed Income Fund* | | Collective Trust Fund 604,008 units | | 44,835,509 | | |

| NT Collective Aggregate Bond Index Fund / Non Lending* | | Collective Trust Fund 114,177 units | | 18,437,263 | | |

| Banc America Alternative Loan Trust Series 2004-6 Class 4A 15.0% Due 10-25-2048* | | Corporate Bond 2,439 units | | 2,605 | | |

| Interest Bearing Cash | | Cash and Cash Equivalents 2,022 units | | 2,022 | | |

| GMAC Mortgage Loan Trust 2003/J10 4.75% Due 01/25/2019 | | Corporate Bond 1,396 units | | 1,370 | | |

| Kaupthing Bank HF 02/28/2020 In Default | | Corporate Bond 310,000 units | | 775 | | |

| Total Fixed Income Asset Class | | | | | 468,651,332 | |

| | | | | | |

| Fixed Income Index Asset Class: | | | | | |

| NT Collective Aggregate Bond Index Fund / Non Lending* | | Collective Trust Fund 6,207,694 units | | 1,002,418,500 | | |

| Total Fixed Income Index Asset Class | | | | | 1,002,418,500 | |

| | | | | |

| U.S. Equity Asset Class: | | | | | |

| NT Collective Russell 3000 Index Fund / Non Lending* | | Collective Trust Fund 1,445,032 units | | 106,413,582 | | |

| Amazon Inc. | | Common and Preferred Stock 14,229 shares | | 47,444,324 | | |

| Interest Bearing Cash | | Cash and Cash Equivalents 46,095,892 units | | 46,095,892 | | |

| Visa Inc. Class A | | Common and Preferred Stock 192,841 shares | | 41,790,573 | | |

| Facebook, Inc. | | Common and Preferred Stock 100,657 shares | | 33,855,982 | | |

| Microsoft Corporation | | Common and Preferred Stock 72,522 shares | | 24,390,599 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Netflix, Inc. | | Common and Preferred Stock 40,368 shares | | 24,319,298 | | |

| Intuit | | Common and Preferred Stock 29,977 shares | | 19,281,806 | | |

| Mastercard Inc. Class A | | Common and Preferred Stock 52,567 shares | | 18,888,374 | | |

| TransDigm Group Inc. | | Common and Preferred Stock 28,227 shares | | 17,960,276 | | |

| CoStar Group Inc. | | Common and Preferred Stock 222,683 shares | | 17,598,637 | | |

| Applovin Corporation Class A | | Common and Preferred Stock 185,944 shares | | 17,527,081 | | |

| Sea Limited | | Common and Preferred Stock 70,697 shares | | 15,815,626 | | |

| Match Group Inc. | | Common and Preferred Stock 117,282 shares | | 15,510,545 | | |

| Heico Corporation Class A | | Common and Preferred Stock 117,615 shares | | 15,115,880 | | |

| ServiceNow, Inc. | | Common and Preferred Stock 23,115 shares | | 15,004,178 | | |

| Applied Materials Inc. | | Common and Preferred Stock 95,000 shares | | 14,949,200 | | |

| Wayfair Inc. Class A | | Common and Preferred Stock 71,787 shares | | 13,637,376 | | |

| NT Collective Short Term Investment Fund* | | Collective Trust Fund 13,626,293 units | | 13,626,293 | | |

| UnitedHealth Group Inc. | | Common and Preferred Stock 27,040 shares | | 13,577,866 | | |

| Lam Research Corporation | | Common and Preferred Stock 18,761 shares | | 13,491,973 | | |

| Qorvo, Inc. | | Common and Preferred Stock 81,870 shares | | 12,803,649 | | |

| KKR & Company Inc. Class A | | Common and Preferred Stock 169,936 shares | | 12,660,232 | | |

| Skyworks Solutions Inc | | Common and Preferred Stock 80,902 shares | | 12,551,136 | | |

| Salesforce.com Inc. | | Common and Preferred Stock 49,096 shares | | 12,476,766 | | |

| The Carlyle Group Inc. | | Common and Preferred Stock 223,234 shares | | 12,255,547 | | |

| Alphabet Inc. | | Common and Preferred Stock 4,132 shares | | 11,956,314 | | |

| STERIS plc | | Common and Preferred Stock 49,063 shares | | 11,942,425 | | |

| American International Group Inc. | | Common and Preferred Stock 209,643 shares | | 11,920,301 | | |

| Upstart Holdings Inc. | | Common and Preferred Stock 78,150 shares | | 11,824,095 | | |

| Square Inc Class A | | Common and Preferred Stock 71,988 shares | | 11,626,782 | | |

| Wells Fargo & Company* | | Common and Preferred Stock 239,853 shares | | 11,508,147 | | |

| Ball Corporation | | Common and Preferred Stock 116,875 shares | | 11,251,556 | | |

| General Electric | | Common and Preferred Stock 117,048 shares | | 11,057,525 | | |

| Workday Inc. Class A | | Common and Preferred Stock 39,417 shares | | 10,767,936 | | |

| Skechers USA Inc. Class A | | Common and Preferred Stock 245,480 shares | | 10,653,832 | | |

| Danaher Corporation | | Common and Preferred Stock 32,341 shares | | 10,640,512 | | |

| Entegris Inc. | | Common and Preferred Stock 75,676 shares | | 10,487,180 | | |

| NRG Energy Inc. | | Common and Preferred Stock 241,511 shares | | 10,404,294 | | |

| Lear Corporation | | Common and Preferred Stock 55,702 shares | | 10,190,681 | | |

| Splunk Inc. | | Common and Preferred Stock 87,659 shares | | 10,143,899 | | |

| Charles River Laboratories International Inc. | | Common and Preferred Stock 26,467 shares | | 9,972,236 | | |

| Clean Harbors Inc. | | Common and Preferred Stock 98,224 shares | | 9,799,808 | | |

| Alphabet Inc. Class C | | Common and Preferred Stock 3,386 shares | | 9,797,696 | | |

| Catalent Inc. | | Common and Preferred Stock 76,157 shares | | 9,750,381 | | |

| Yum! Brands Inc. | | Common and Preferred Stock 69,352 shares | | 9,630,219 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| salesforce.com, inc. | | Common and Preferred Stock 37,746 shares | | 9,592,391 | | |

| Cognizant Technology Solutions Corporation Class A | | Common and Preferred Stock 105,133 shares | | 9,327,400 | | |

| Thermo Fisher Corporation | | Common and Preferred Stock 13,781 shares | | 9,195,234 | | |

| Paypal Holdings Inc. | | Common and Preferred Stock 48,661 shares | | 9,176,491 | | |

| Wabtec Corporation | | Common and Preferred Stock 97,404 shares | | 8,971,882 | | |

| Twilio Inc. Class A | | Common and Preferred Stock 34,006 shares | | 8,955,140 | | |

| Edison International | | Common and Preferred Stock 131,133 shares | | 8,949,827 | | |

| Uber Technologies Inc. | | Common and Preferred Stock 208,325 shares | | 8,735,067 | | |

| Waste Connections Inc. | | Common and Preferred Stock 63,754 shares | | 8,687,758 | | |

| Synopsys Inc. | | Common and Preferred Stock 23,498 shares | | 8,659,013 | | |

| Abbott Lab | | Common and Preferred Stock 61,488 shares | | 8,653,821 | | |

| Equinix Inc. | | Common and Preferred Stock 10,222 shares | | 8,646,176 | | |

| Autodesk Inc. | | Common and Preferred Stock 30,639 shares | | 8,615,380 | | |

| IHS Markit Limited | | Common and Preferred Stock 63,319 shares | | 8,416,361 | | |

| Citigroup Inc. | | Common and Preferred Stock 139,168 shares | | 8,404,356 | | |

| Walt Disney Company | | Common and Preferred Stock 53,452 shares | | 8,279,180 | | |

| Atlassian Corporation PLC Class A | | Common and Preferred Stock 21,034 shares | | 8,020,054 | | |

| Regeneron Pharmaceuticals, Inc. | | Common and Preferred Stock 12,651 shares | | 7,989,360 | | |

| MSCI Inc. | | Common and Preferred Stock 12,717 shares | | 7,791,579 | | |

| Nvidia Corporation | | Common and Preferred Stock 26,280 shares | | 7,729,211 | | |

| Henry Schein Inc. | | Common and Preferred Stock 97,351 shares | | 7,547,623 | | |

| Ametek Inc. | | Common and Preferred Stock 51,281 shares | | 7,540,358 | | |

| Align Technology, Inc. | | Common and Preferred Stock 11,329 shares | | 7,445,192 | | |

| FleetCor Technologies, Inc. | | Common and Preferred Stock 33,053 shares | | 7,398,584 | | |

| Newell Brands Inc. | | Common and Preferred Stock 334,971 shares | | 7,315,767 | | |

| Shopify Inc | | Common and Preferred Stock 5,260 shares | | 7,245,071 | | |

| Equitable Holdings Inc. | | Common and Preferred Stock 220,932 shares | | 7,244,360 | | |

| Western Alliance Bancorporation | | Common and Preferred Stock 65,594 shares | | 7,061,194 | | |

| Amphenol Corporation Class A | | Common and Preferred Stock 80,122 shares | | 7,007,470 | | |

| MetLife Inc.* | | Common and Preferred Stock 111,292 shares | | 6,954,637 | | |

| FMC Corporation | | Common and Preferred Stock 62,937 shares | | 6,916,147 | | |

| Baker Hughes Company | | Common and Preferred Stock 285,320 shares | | 6,864,799 | | |

| American Express Company | | Common and Preferred Stock 41,593 shares | | 6,804,615 | | |

| Halliburton Company | | Common and Preferred Stock 292,700 shares | | 6,694,049 | | |

| Merit Medical Systems Inc. | | Common and Preferred Stock 107,250 shares | | 6,681,675 | | |

| UGI Corporation | | Common and Preferred Stock 143,440 shares | | 6,585,330 | | |

| Halozyme Therapeutics Inc. | | Common and Preferred Stock 163,603 shares | | 6,578,477 | | |

| PVH Corporation | | Common and Preferred Stock 61,570 shares | | 6,566,441 | | |

| Zoetis Inc. Class A | | Common and Preferred Stock 26,840 shares | | 6,549,765 | | |

| Sensata Technologies BV Holding | | Common and Preferred Stock 105,381 shares | | 6,500,954 | | |

| Intuitive Surgical, Inc. | | Common and Preferred Stock 17,853 shares | | 6,414,583 | | |

| DEX Inc. | | Common and Preferred Stock 11,824 shares | | 6,348,897 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Huntington Bancshares Inc. | | Common and Preferred Stock 405,224 shares | | 6,248,554 | | |

| Gildan Activewear Inc. | | Common and Preferred Stock 144,706 shares | | 6,134,087 | | |

| Dow Inc. | | Common and Preferred Stock 107,301 shares | | 6,086,113 | | |

| Matson Inc. | | Common and Preferred Stock 67,372 shares | | 6,065,501 | | |

| Charter Communications, Inc. Class A | | Common and Preferred Stock 8,952 shares | | 5,836,435 | | |

| Linde PLC | | Common and Preferred Stock 16,825 shares | | 5,828,685 | | |

| J2 Global Inc. | | Common and Preferred Stock 52,238 shares | | 5,791,105 | | |

| Amdocs Limited | | Common and Preferred Stock 75,138 shares | | 5,623,328 | | |

| LKQ Corporation | | Common and Preferred Stock 93,108 shares | | 5,589,273 | | |

| Illumina, Inc. | | Common and Preferred Stock 14,680 shares | | 5,584,859 | | |

| Hewlett Packard Enterprise Company | | Common and Preferred Stock 353,520 shares | | 5,575,010 | | |

| On Semiconductor Corporation | | Common and Preferred Stock 81,350 shares | | 5,525,292 | | |

| Voya Financial Inc. | | Common and Preferred Stock 82,772 shares | | 5,488,611 | | |

| McKesson Corporation | | Common and Preferred Stock 21,635 shares | | 5,377,812 | | |

| Snowflake Inc. Class A | | Common and Preferred Stock 15,875 shares | | 5,377,656 | | |

| Mohawk Industries Inc. | | Common and Preferred Stock 29,477 shares | | 5,370,120 | | |

| Trinet Group Inc. | | Common and Preferred Stock 56,279 shares | | 5,361,138 | | |

| Capital One Financial Corporation | | Common and Preferred Stock 36,776 shares | | 5,335,830 | | |

| Floor & Decor Holdings Inc. | | Common and Preferred Stock 40,408 shares | | 5,253,444 | | |

| RingCentral, Inc. Class A | | Common and Preferred Stock 28,035 shares | | 5,252,357 | | |

| Edwards Lifesciences Corporation | | Common and Preferred Stock 40,146 shares | | 5,200,914 | | |

| Axis Capital Holdings Limited | | Common and Preferred Stock 95,172 shares | | 5,184,019 | | |

| Fresenius Medical Care | | Common and Preferred Stock 156,997 shares | | 5,096,123 | | |

| IDEX Corporation | | Common and Preferred Stock 21,408 shares | | 5,059,139 | | |

| Sally Beauty Holdings Inc. | | Common and Preferred Stock 272,188 shares | | 5,024,590 | | |

| Brown & Brown Inc. | | Common and Preferred Stock 70,006 shares | | 4,920,022 | | |

| Warner Music Group Corporation Class A | | Common and Preferred Stock 113,275 shares | | 4,891,215 | | |

| DoorDash Inc. Class A | | Common and Preferred Stock 32,080 shares | | 4,776,712 | | |

| Sarepta Therapeutics Inc. | | Common and Preferred Stock 52,331 shares | | 4,712,407 | | |

| Ritchie Bros. Auctioneers Inc. | | Common and Preferred Stock 75,480 shares | | 4,620,131 | | |

| JP Morgan Chase & Company* | | Common and Preferred Stock 29,161 shares | | 4,617,644 | | |

| Frontdoor Inc. | | Common and Preferred Stock 122,929 shares | | 4,505,348 | | |

| Euronet Worldwide Inc. | | Common and Preferred Stock 37,558 shares | | 4,475,787 | | |

| Keysight Technologies Inc. | | Common and Preferred Stock 21,490 shares | | 4,437,900 | | |

| Ingredion Inc. | | Common and Preferred Stock 45,780 shares | | 4,424,179 | | |

| C.H. Robinson Worldwide Inc. | | Common and Preferred Stock 40,775 shares | | 4,388,613 | | |

| NOV Inc. | | Common and Preferred Stock 322,722 shares | | 4,372,883 | | |

| Exxon Mobil Corporation | | Common and Preferred Stock 71,323 shares | | 4,364,254 | | |

| BWX Technologies Inc. | | Common and Preferred Stock 90,780 shares | | 4,346,546 | | |

| Goldman Sachs Group Inc. | | Common and Preferred Stock 11,223 shares | | 4,293,359 | | |

| KAR Auction Services Inc. | | Common and Preferred Stock 265,850 shares | | 4,152,577 | | |

| Airbnb Inc. Class A | | Common and Preferred Stock 24,567 shares | | 4,090,160 | | |

| Hanesbrands Inc. | | Common and Preferred Stock 243,963 shares | | 4,079,061 | | |

| Belden Inc. | | Common and Preferred Stock 60,843 shares | | 3,999,210 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| National Retail Properties Inc. | | Common and Preferred Stock 83,009 shares | | 3,990,243 | | |

| Generac Holdings Inc. | | Common and Preferred Stock 11,272 shares | | 3,966,842 | | |

| Zendesk Inc. | | Common and Preferred Stock 37,765 shares | | 3,938,512 | | |

| Helen Trustoy Limited | | Common and Preferred Stock 15,815 shares | | 3,866,293 | | |

| Middleby Corporation | | Common and Preferred Stock 19,340 shares | | 3,805,338 | | |

| First American Financial Corporation | | Common and Preferred Stock 48,574 shares | | 3,799,944 | | |

| Woodward Inc. | | Common and Preferred Stock 33,902 shares | | 3,710,913 | | |

| Cabot Corporation | | Common and Preferred Stock 65,262 shares | | 3,667,724 | | |

| UBS Group AG | | Common and Preferred Stock 204,946 shares | | 3,662,385 | | |

| Syneos Health Inc. | | Common and Preferred Stock 35,181 shares | | 3,612,385 | | |

| Textron Inc. | | Common and Preferred Stock 46,550 shares | | 3,593,660 | | |

| Carter Inc. | | Common and Preferred Stock 34,511 shares | | 3,493,203 | | |

| New Relic Inc. | | Common and Preferred Stock 30,576 shares | | 3,362,137 | | |

| Bank of America Corporation* | | Common and Preferred Stock 75,004 shares | | 3,336,928 | | |

| ASGN Inc. | | Common and Preferred Stock 26,757 shares | | 3,301,814 | | |

| MACOM Technology Solutions Holdings Inc. | | Common and Preferred Stock 41,927 shares | | 3,282,884 | | |

| FTI Consulting Inc. | | Common and Preferred Stock 21,320 shares | | 3,270,914 | | |

| Trimble Inc. | | Common and Preferred Stock 37,506 shares | | 3,270,148 | | |

| Pfizer Inc. | | Common and Preferred Stock 55,126 shares | | 3,255,190 | | |

| Tennant Company | | Common and Preferred Stock 40,004 shares | | 3,241,924 | | |

| Rogers Corporation | | Common and Preferred Stock 11,834 shares | | 3,230,682 | | |

| Copart Inc. | | Common and Preferred Stock 21,019 shares | | 3,186,901 | | |

| GlobalFoundries Inc. | | Common and Preferred Stock 48,528 shares | | 3,152,864 | | |

| ACV Auctions Inc. Class A | | Common and Preferred Stock 163,687 shares | | 3,083,863 | | |

| Quidel Corporation | | Common and Preferred Stock 22,699 shares | | 3,064,138 | | |

| Kirby Corporation | | Common and Preferred Stock 51,105 shares | | 3,036,659 | | |

| Dycom Industries Inc. | | Common and Preferred Stock 31,731 shares | | 2,975,099 | | |

| Royal Dutch Shell PLC | | Common and Preferred Stock 67,749 shares | | 2,940,307 | | |

| Grand Canyon Education Inc. | | Common and Preferred Stock 34,288 shares | | 2,938,824 | | |

| Prosperity Bancshares Inc. | | Common and Preferred Stock 40,291 shares | | 2,913,039 | | |

| Forward Air Corporation | | Common and Preferred Stock 23,791 shares | | 2,880,852 | | |

| Graco Inc. | | Common and Preferred Stock 35,559 shares | | 2,866,767 | | |

| 8X8 Inc. | | Common and Preferred Stock 170,204 shares | | 2,852,619 | | |

| LPL Financial Holdings Inc. | | Common and Preferred Stock 17,572 shares | | 2,813,101 | | |

| HealthEquity Inc. | | Common and Preferred Stock 63,397 shares | | 2,804,683 | | |

| 2U Inc. | | Common and Preferred Stock 138,322 shares | | 2,776,123 | | |

| Carvana Company Class A | | Common and Preferred Stock 11,734 shares | | 2,719,824 | | |

| Alleghany Corporation | | Common and Preferred Stock 3,988 shares | | 2,662,349 | | |

| Hologic Inc. | | Common and Preferred Stock 34,175 shares | | 2,616,438 | | |

| Momentive Global Inc. | | Common and Preferred Stock 123,469 shares | | 2,611,369 | | |

| Cloudflare Inc. | | Common and Preferred Stock 19,762 shares | | 2,598,703 | | |

| Cardinal Health, Inc. | | Common and Preferred Stock 49,914 shares | | 2,570,072 | | |

| Gartner Inc. | | Common and Preferred Stock 7,686 shares | | 2,569,584 | | |

| Acadia Healthcare Company Inc. | | Common and Preferred Stock 42,158 shares | | 2,558,991 | | |

| Mid-American Apartment Communities Inc. | | Common and Preferred Stock 11,112 shares | | 2,549,537 | | |

| BankUnited Inc. | | Common and Preferred Stock 60,154 shares | | 2,545,116 | | |

| Bottomline Technologies Inc. | | Common and Preferred Stock 44,586 shares | | 2,517,771 | | |

| SS&C Technologies Holdings Inc. | | Common and Preferred Stock 30,611 shares | | 2,509,490 | | |

| AerCap Holdings N.V. | | Common and Preferred Stock 38,359 shares | | 2,509,446 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Cenovus Energy Inc. | | Common and Preferred Stock 203,926 shares | | 2,504,211 | | |

| 10X Genomics Inc. Class A | | Common and Preferred Stock 16,632 shares | | 2,477,503 | | |

| AMN Healthcare Services Inc. | | Common and Preferred Stock 20,132 shares | | 2,462,748 | | |

| Booking Holdings Inc. | | Common and Preferred Stock 956 shares | | 2,293,664 | | |

| National Bank Holdings Corporation Class A | | Common and Preferred Stock 52,188 shares | | 2,293,141 | | |

| Cohen & Steers Inc. | | Common and Preferred Stock 24,628 shares | | 2,278,336 | | |

| Advanced Energy Industries Inc. | | Common and Preferred Stock 24,932 shares | | 2,270,308 | | |

| Tronox Holdings PLC | | Common and Preferred Stock 93,356 shares | | 2,243,345 | | |

| Mednax Inc. | | Common and Preferred Stock 82,285 shares | | 2,238,975 | | |

| Chemed Corporation | | Common and Preferred Stock 4,223 shares | | 2,234,136 | | |

| ALLETE Inc. | | Common and Preferred Stock 33,300 shares | | 2,209,455 | | |

| Nasdaq Inc. | | Common and Preferred Stock 10,520 shares | | 2,209,305 | | |

| Itron Inc. | | Common and Preferred Stock 31,646 shares | | 2,168,384 | | |

| Signature Bank | | Common and Preferred Stock 6,564 shares | | 2,123,257 | | |

| Albany International Corporation Class A | | Common and Preferred Stock 23,777 shares | | 2,103,076 | | |

| Atmos Energy Corporation | | Common and Preferred Stock 19,662 shares | | 2,059,988 | | |

| ABM Industrials Inc. | | Common and Preferred Stock 50,404 shares | | 2,059,003 | | |

| Sotera Health Company | | Common and Preferred Stock 86,525 shares | | 2,037,664 | | |

| Harsco Corporation | | Common and Preferred Stock 119,432 shares | | 1,995,709 | | |

| ACI Worldwide Inc. | | Common and Preferred Stock 57,430 shares | | 1,992,821 | | |

| Carlisle Companies Inc. | | Common and Preferred Stock 7,991 shares | | 1,982,727 | | |

| Mimecast Limited | | Common and Preferred Stock 24,684 shares | | 1,964,106 | | |

| KBR, Inc. | | Common and Preferred Stock 41,120 shares | | 1,958,134 | | |

| Knowles Corporation | | Common and Preferred Stock 83,420 shares | | 1,947,857 | | |

| Veracyte Inc. | | Common and Preferred Stock 47,260 shares | | 1,947,112 | | |

| NCR Corporation | | Common and Preferred Stock 48,308 shares | | 1,941,982 | | |

| Bio-Techne Corporation | | Common and Preferred Stock 3,749 shares | | 1,939,508 | | |

| N-Able Technologies International Inc. | | Common and Preferred Stock 166,860 shares | | 1,852,146 | | |

| Aspen Technology Inc. | | Common and Preferred Stock 12,162 shares | | 1,851,056 | | |

| Markel Corporation Holding Company | | Common and Preferred Stock 1,490 shares | | 1,838,660 | | |

| Altra Industrial Motion Corporation | | Common and Preferred Stock 35,331 shares | | 1,822,020 | | |

| WisdomTree Investments Inc. | | Common and Preferred Stock 296,463 shares | | 1,814,354 | | |

| Fiverr International Limited | | Common and Preferred Stock 15,882 shares | | 1,805,783 | | |

| Monro Inc. | | Common and Preferred Stock 30,940 shares | | 1,802,874 | | |

| Barnes Group Inc. | | Common and Preferred Stock 37,826 shares | | 1,762,313 | | |

| AptarGroup Inc. | | Common and Preferred Stock 14,315 shares | | 1,753,301 | | |

| CarGurus Inc. Class A | | Common and Preferred Stock 51,408 shares | | 1,729,365 | | |

| Wolverine World Wide Inc. | | Common and Preferred Stock 59,278 shares | | 1,707,799 | | |

| Canada Goose Holdings Inc. | | Common and Preferred Stock 46,015 shares | | 1,705,316 | | |

| Omnicell Inc. | | Common and Preferred Stock 9,304 shares | | 1,678,814 | | |

| Hexcel Corporation | | Common and Preferred Stock 31,854 shares | | 1,650,037 | | |

| WillScot Mobile Mini Holdings Corporation | | Common and Preferred Stock 40,354 shares | | 1,648,057 | | |

| CareDx Inc. | | Common and Preferred Stock 35,578 shares | | 1,618,087 | | |

| Boston Properties Inc. | | Common and Preferred Stock 14,011 shares | | 1,613,787 | | |

| II-Vi Inc. | | Common and Preferred Stock 23,504 shares | | 1,606,028 | | |

| Herbalife Nutrition Limited | | Common and Preferred Stock 39,004 shares | | 1,596,434 | | |

| Graphic Packaging Holding Company | | Common and Preferred Stock 81,825 shares | | 1,595,588 | | |

| Smartsheet Inc. Class A | | Common and Preferred Stock 20,499 shares | | 1,587,648 | | |

| Kraton Corporation | | Common and Preferred Stock 33,505 shares | | 1,551,954 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| PacWest Bancorp | | Common and Preferred Stock 33,783 shares | | 1,525,978 | | |

| ZipRecruiter Inc. Class A | | Common and Preferred Stock 60,893 shares | | 1,518,671 | | |

| Matthews International Corporation Class A | | Common and Preferred Stock 41,315 shares | | 1,515,021 | | |

| Under Armour Inc. Class C | | Common and Preferred Stock 82,172 shares | | 1,482,383 | | |

| Huron Consulting Group Inc. | | Common and Preferred Stock 29,649 shares | | 1,479,485 | | |

| Pacific Premier Bancorp Inc. | | Common and Preferred Stock 36,368 shares | | 1,455,811 | | |

| Tenable Holdings Inc. | | Common and Preferred Stock 26,236 shares | | 1,444,817 | | |

| Cimpress plc | | Common and Preferred Stock 20,090 shares | | 1,438,645 | | |

| Privia Health Group Inc. | | Common and Preferred Stock 55,410 shares | | 1,433,457 | | |

| Supernus Pharmaceuticals Inc. | | Common and Preferred Stock 48,989 shares | | 1,428,519 | | |

| Teledyne Technologies Inc. | | Common and Preferred Stock 3,269 shares | | 1,428,193 | | |

| IAA Spinco Inc. | | Common and Preferred Stock 28,207 shares | | 1,427,838 | | |

| Kodiak Sciences Inc. | | Common and Preferred Stock 16,772 shares | | 1,421,930 | | |

| Ciena Corporation | | Common and Preferred Stock 18,365 shares | | 1,413,554 | | |

| Prestige Consumer Healthcare Inc. | | Common and Preferred Stock 22,938 shares | | 1,391,190 | | |

| Sumo Logic Inc. | | Common and Preferred Stock 102,451 shares | | 1,389,236 | | |

| Knight-Swift Transportation Holdings Inc. Class A | | Common and Preferred Stock 22,767 shares | | 1,387,421 | | |

| Box Inc. Class A | | Common and Preferred Stock 52,638 shares | | 1,378,589 | | |

| Bank Ozk | | Common and Preferred Stock 29,614 shares | | 1,377,939 | | |

| Nu Skin Enterprises Inc. Class A | | Common and Preferred Stock 27,012 shares | | 1,370,859 | | |

| JBG SMITH Properties | | Common and Preferred Stock 47,542 shares | | 1,364,931 | | |

| SLR Investment Corporation | | Common and Preferred Stock 73,775 shares | | 1,359,673 | | |

| IPG Photonics Corporation | | Common and Preferred Stock 7,893 shares | | 1,358,701 | | |

| Diamondback Energy Inc. | | Common and Preferred Stock 12,466 shares | | 1,344,458 | | |

| Sportradar Group | | Common and Preferred Stock 75,738 shares | | 1,330,717 | | |

| Encompass Health Corporation | | Common and Preferred Stock 20,220 shares | | 1,319,557 | | |

| Range Resources Corporation | | Common and Preferred Stock 72,997 shares | | 1,301,537 | | |

| Anaplan Inc. | | Common and Preferred Stock 28,078 shares | | 1,287,376 | | |

| Mandiant Inc. | | Common and Preferred Stock 72,539 shares | | 1,272,334 | | |

| BRP Group Inc. Class A | | Common and Preferred Stock 35,112 shares | | 1,267,894 | | |

| Nevro Corporation | | Common and Preferred Stock 15,219 shares | | 1,233,804 | | |

| Texas Pacific Land Corporation | | Common and Preferred Stock 978 shares | | 1,221,395 | | |

| KnowBe4 Inc. Class A | | Common and Preferred Stock 52,912 shares | | 1,213,801 | | |

| Texas Capital Bancshares Inc. | | Common and Preferred Stock 19,836 shares | | 1,195,119 | | |

| Berkshire Hills Bancorp Inc. | | Common and Preferred Stock 41,230 shares | | 1,172,169 | | |

| Arvinas Inc. | | Common and Preferred Stock 14,241 shares | | 1,169,756 | | |

| Coherus BioSciences Inc. | | Common and Preferred Stock 73,238 shares | | 1,168,878 | | |

| Abiomed Inc. | | Common and Preferred Stock 3,236 shares | | 1,162,274 | | |

| Relay Therapeutics Inc. | | Common and Preferred Stock 37,423 shares | | 1,149,260 | | |

| AZZ Inc. | | Common and Preferred Stock 20,736 shares | | 1,146,493 | | |

| Fox Factory Holding Corporation | | Common and Preferred Stock 6,632 shares | | 1,128,103 | | |

| Sterling Check Corporation | | Common and Preferred Stock 53,897 shares | | 1,105,427 | | |

| Agios Pharmaceuticals Inc. | | Common and Preferred Stock 33,477 shares | | 1,100,389 | | |

| TreeHouse Foods Inc. | | Common and Preferred Stock 26,684 shares | | 1,081,503 | | |

| John Bean Technologies Corporation | | Common and Preferred Stock 7,042 shares | | 1,081,370 | | |

| Evercore Inc. | | Common and Preferred Stock 7,954 shares | | 1,080,551 | | |

| Alamos Gold Inc. Class A | | Common and Preferred Stock 139,767 shares | | 1,074,808 | | |

| World Wrestling Entertainment | | Common and Preferred Stock 21,661 shares | | 1,068,754 | | |

| Vroom Inc. | | Common and Preferred Stock 98,021 shares | | 1,057,647 | | |

| Cooper Companies Inc. | | Common and Preferred Stock 2,482 shares | | 1,039,809 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Solarwinds Corporation | | Common and Preferred Stock 71,697 shares | | 1,017,380 | | |

| Farfetch Limited Class A | | Common and Preferred Stock 30,231 shares | | 1,010,622 | | |

| Heron Therapeutics Inc. | | Common and Preferred Stock 110,570 shares | | 1,009,504 | | |

| Consensus Cloud Solutions Inc. | | Common and Preferred Stock 17,412 shares | | 1,007,632 | | |

| Polaris Inc. | | Common and Preferred Stock 9,154 shares | | 1,006,116 | | |

| C4 Therapeutics Inc. | | Common and Preferred Stock 31,127 shares | | 1,002,289 | | |

| Shutterstock Inc. | | Common and Preferred Stock 8,977 shares | | 995,370 | | |

| 1-800-FLOWERS.COM Inc. Class A | | Common and Preferred Stock 41,874 shares | | 978,595 | | |

| Albemarle Corporation | | Common and Preferred Stock 4,184 shares | | 978,094 | | |

| SpringWorks Therapeutics Inc. | | Common and Preferred Stock 15,422 shares | | 955,856 | | |

| Axogen Inc. | | Common and Preferred Stock 101,418 shares | | 950,287 | | |

| Cal/Maine Foods Inc. | | Common and Preferred Stock 24,349 shares | | 900,670 | | |

| Cano Health Inc. Class A | | Common and Preferred Stock 100,183 shares | | 892,631 | | |

| iShares Core S&P Small-Cap ETF | | Mutual Fund 7,631 units | | 873,826 | | |

| United Community Bank Blairsville Georgia | | Common and Preferred Stock 23,216 shares | | 834,383 | | |

| Exact Sciences Corporation | | Common and Preferred Stock 10,696 shares | | 832,470 | | |

| Designer Brands Inc. Class A | | Common and Preferred Stock 58,536 shares | | 831,797 | | |

| KB Home | | Common and Preferred Stock 18,474 shares | | 826,342 | | |

| NorthWestern Corp | | Common and Preferred Stock 13,804 shares | | 789,037 | | |

| Heartland Express Inc. | | Common and Preferred Stock 45,509 shares | | 765,461 | | |

| Flowserve Corporation | | Common and Preferred Stock 24,786 shares | | 758,452 | | |

| Xperi Holding Corporation | | Common and Preferred Stock 38,238 shares | | 723,081 | | |

| Mercury Systems Inc. | | Common and Preferred Stock 13,074 shares | | 719,854 | | |

| Viking Therapeutics Inc. | | Common and Preferred Stock 156,336 shares | | 719,146 | | |

| WSFS Financial Corporation | | Common and Preferred Stock 14,312 shares | | 717,317 | | |

| Infinera Corporation | | Common and Preferred Stock 73,824 shares | | 707,972 | | |

| CalAmp Corporation | | Common and Preferred Stock 98,951 shares | | 698,594 | | |

| PetIQ Inc. Class A | | Common and Preferred Stock 30,430 shares | | 691,065 | | |

| Silgan Holdings Inc. | | Common and Preferred Stock 14,984 shares | | 641,915 | | |

| Banner Corporation | | Common and Preferred Stock 10,265 shares | | 622,778 | | |

| iShares Russell Mid-Cap ETF | | Mutual Fund 7,335 units | | 608,878 | | |

| Haemonetics Corporation | | Common and Preferred Stock 11,201 shares | | 594,101 | | |

| Oceaneering International Inc. | | Common and Preferred Stock 50,327 shares | | 569,198 | | |

| STAG Industrial Inc. | | Common and Preferred Stock 11,201 shares | | 537,200 | | |

| NexTier Oilfield Solutions Inc. | | Common and Preferred Stock 148,086 shares | | 525,705 | | |

| iShares Russell 2000 ETF | | Mutual Fund 2,104 units | | 468,035 | | |

| Alight Inc. Class A | | Common and Preferred Stock 39,442 shares | | 426,368 | | |

| eHealth Inc. | | Common and Preferred Stock 16,236 shares | | 414,018 | | |

| J & J Snack Foods Corporation | | Common and Preferred Stock 1,958 shares | | 309,286 | | |

| Talis Biomedical Corporation | | Common and Preferred Stock 53,052 shares | | 212,739 | | |

| Total U.S. Equity Asset Class | | | | | 1,714,872,738 | |

| | | | | | |

| U.S. Equity Index Asset Class: | | | | | |

| NT Collective Russell 3000 Index Fund / Non Lending* | | Collective Trust Fund 13,250,686 units | | 975,793,781 | | |

| Gaming & Leisure Properties Inc. | | Common and Preferred Stock 155 shares | | 7,542 | | |

| CTO Realty Growth Inc. | | Common and Preferred Stock 82 shares | | 5,036 | | |

| NT Collective Short Term Investment Fund* | | Collective Trust Fund 235 units | | 234 | | |

Schedule H, line 4i – Schedule of Assets (Held at End of Year) (continued)

| | | | | | | | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Current Value |

| Total U.S. Equity Index Asset Class | | | | | 975,806,593 | |

| | | | | | |

| International Equity Class: | | | | | |

| Mawer International Equity Collective Investment Trust Class B* | | Collective Trust Fund 7,906,966 units | | 142,493,012 | | |

| Polaris Capital Management Collective Investment Trust International Value Collective Fund* | | Collective Trust Fund 11,549,975 units | | 136,685,875 | | |

| Reliance Trust Institutional Retirement Trust GQG Partners International Equity Fund Series 11 Class C* | | Collective Trust Fund 7,951,753 units | | 110,131,779 | | |

| Wilmington Trust Collective Investment Trust / Jennison International Equity Opportunities CIT Class J* | | Collective Trust Fund 6,849,549 units | | 83,701,490 | | |

| Dodge & Cox International Fund | | Mutual Fund 1,690,348 units | | 79,936,563 | | |

| NT Collective MSCI All Country World Index (ACWI) ex/US Index Fund / Non Lending* | | Collective Trust Fund 204,987 units | | 44,875,034 | | |

| Interest Bearing Cash | | Cash and Cash Equivalents 8,482 units | | 8,482 | | |

| Total International Equity Asset Class | | | | | 597,832,235 | |

| | | | | | |

| International Equity Index Asset Class: | | | | | |

| NT Collective All Country World Index (ACWI) Ex/US Fund / Non Lending* | | Collective Trust Fund 2,349,363 units | | 469,637,570 | | |

| BlackRock FTSE RAFI Emerging Index Non Lendable Fund F* | | Collective Trust Fund 21,268 units | | 98,297 | | |

| Total International Equity Index Asset Class | | | | | 469,735,867 | |

| | | | | | |

| Participant Self-Directed Accounts | | Various Investments | | 781,940,783 | | |

| | | | | | 781,940,783 | |

| | | | | | |

| Notes Receivable from Participants* | | Interest Rate 4.25% - 9.25% | | 30,243,936 | | |

| | | | | | 30,243,936 | |

| | | | | | |

| Other: | | | | | |

| BIF Money Fund* | | Cash and Cash Equivalents 3,043,753 units | | 3,043,753 | | |

| Vanguard Federal Money Market | | Cash and Cash Equivalents 498,898 units | | 498,898 | | |

| NT Collective Short Term Investment Fund* | | Collective Trust Fund 303,581 units | | 303,581 | | |

| Exide Technologies | | Common and Preferred Stock 35,683 shares | | 24,978 | | |

| Exide Technologies 144A 11.0% Due 05/24/2017 | | Corporate Bond 9,077 units | | 78 | | |

| Total Other | | | | | 3,871,288 | |

| | | | | | |

| Grand Total | | | | | $ | 7,183,734,301 | |

| | | | | | | | | | | | | | |

| | | | |

| * Indicates party-in-interest | | | | |

Supplemental Schedule

Amgen Retirement and Savings Plan

EIN: 95-3540776 Plan: #001

Year Ended December 31, 2021

Schedule H, line 4i – Schedule of Assets (Acquired and Disposed of Within Year)

| | | | | | | | | | | | | | |

| Identity of Issue | | Description of Investment | | Proceeds from Dispositions |

| Participant Self-Directed Brokerage Accounts | | Various Investments | | $ | 33,444 | |

Supplemental Schedule

Amgen Retirement and Savings Plan

EIN: 95-3540776 Plan Number: #001

As of December 31, 2021

Schedule G, Part 1 – Schedule of Loans or Fixed Income Obligations

in Default or Classified as Uncollectible

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Identity of obligor | | Original

amount of

loan

(cost of

security) | | Unpaid balance

at end of year

(fair value of

security) | | Detailed description of loan including dates of making and maturity, interest rate, the type and value of collateral, any renegotiation of the loan and the terms of the renegotiation and other

material items (description of fixed income obligation) | | Amount of

principal

overdue | | Amount of

interest

overdue |

| Kaupthing Bank | | $ | 183,033 | | | $ | 775 | | | Corporate Bonds 310,000 units due 2/28/2020 | | $ | 310,000 | | | $ | — | |

Supplemental Schedule

Amgen Retirement and Savings Plan

EIN: 95-3540776 Plan Number: #001

Year Ended December 31, 2021

Schedule H, line 4a — Schedule of Delinquent Participant Contributions

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Participant Contributions Transferred Late to Plan | | Total that Constitute Nonexempt Prohibited Transactions | |

|

| Check Here if Late Participant Loan Repayments are Included: ☐ | | Contributions Not Corrected | | Contributions Corrected Outside VFCP1 | | Contributions Pending Corrections in VFCP1 | | Total Fully Corrected Under VFCP1 and PTE2 2002-51 |

| $ | 17,793 | | | $ | — | | | $ | 17,793 | | | $ | — | | | $ | — | |

Note: In 2021, the Company failed to timely remit certain participant contribution deferrals in accordance with Department of Labor regulations. The Company has calculated and remitted lost earnings with respect to such deferrals and is in the process of filing Form 5330, “Return of Excise Taxes Related to Employee Benefit Plans.”

________

1Voluntary Fiduciary Correction Program

2Prohibited Transaction Exemption

AMGEN RETIREMENT AND SAVINGS PLAN

INDEX TO EXHIBIT

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| | | | Amgen Retirement and Savings Plan (Name of Plan) |

| | | | | | |

| Date: | June 23, 2022 | | | By: | | /s/ PETER H. GRIFFITH |

| | | | | | Peter H. Griffith |

| | | | | | Executive Vice President and |

| | | | | | Chief Financial Officer |

| | | | | | Amgen Inc. |

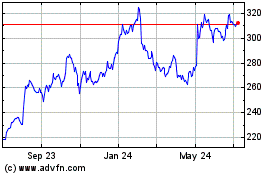

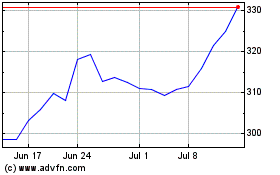

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024