Yen Advances On Rising Risk Aversion; BoJ Growth, Inflation Forecasts Downgrade

April 25 2019 - 12:00AM

RTTF2

The Japanese yen was higher against its major counterparts in

the Asian session on Thursday, as worries about global economic

growth lifted the appeal of safe-haven assets. The currency was

also supported by the Bank of Japan's decision to maintain interest

rates very low at least through Spring 2020 and the downgrade of

the inflation and GDP forecasts.

Investor sentiment dampened as a drop in German business

confidence in April and contraction in the South Korean economy in

the first quarter renewed fears over slowing global growth.

The Bank of Japan kept its monetary policy unchanged, leaving

the interest rate at -0.1 percent and the yield of 10-year JGBs at

around zero percent.

The BoJ said that it will keep its current extremely low

interest rates for an extended period of time, at least through

spring 2020, reflecting uncertainties about economy and prices as

well as the impact of the scheduled consumption tax hike.

The bank would continue buying government bonds so that its

holdings increase at an annual pace of around 80 trillion yen.

U.S. earnings remains in focus after Facebook, Microsoft, Tesla,

and Visa released a set of mixed earnings after the market close

Wednesday.

The yen advanced to 111.74 against the greenback, from a low of

112.24 hit at 8:30 pm ET. Next key resistance for the yen is likely

seen around the 110.00 level.

The yen spiked up to 124.71 against the euro, a level unseen

since April 3. The yen is poised to find resistance around the

122.00 level.

The yen that closed yesterday's deals at 144.73 against the

pound strengthened to near a 4-week high of 144.31. The yen is

likely to challenge resistance around the 142.5 level, if it rises

further.

The Japanese currency appreciated to 109.56 against the franc,

following a 2-day decline to 110.02 at 7:00 pm ET. The yen is seen

finding resistance around the 107.00 level.

The yen edged up to 82.82 against the loonie and a session's

high of 73.66 against the kiwi, from its early lows of 83.17 and

74.00, respectively. On the upside, 80.5 and 72.00 are likely seen

as the next resistance levels for the yen against the loonie and

the kiwi, respectively.

Reversing from a low of 78.71 touched at 8:45 pm ET, the yen

appreciated to near a 4-week high of 78.37 against the aussie. The

next possible resistance for the yen is seen around the 77.00

area.

Looking ahead, U.S. weekly jobless claims for the week ended

April 20 and durable goods orders for March are scheduled for

release in the New York session.

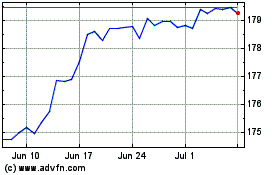

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Mar 2024 to Apr 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Apr 2023 to Apr 2024