Carmila: Result of the Option to Receive the 2020 Dividend Payment in Shares

June 11 2021 - 2:25AM

Business Wire

Regulatory News:

The Annual General Meeting of the shareholders of Carmila

(Paris:CARM) held on May 18, 2021 decided to offer shareholders an

option to receive the 2020 dividend in shares.

The issue price of the new shares has been set at €12.55 per

share, representing 95% of the average closing prices quoted on

Euronext Paris during the 20 trading days preceding the date of the

Annual General Meeting, less the net amount of the dividend of €1

per share and rounded upward to the nearest euro cent.

The option period was opened from May 26 to June 9, 2021.

For the purposes of the dividend payment in shares, 3,826,562

new shares will be issued, representing 2.68% of the share capital

and 2.69% of the voting rights of Carmila on the basis of the share

capital and the voting rights as of May 31, 2021. The settlement

and delivery of the shares as well as their admission to trading on

Euronext Paris will occur on June 15, 2021. The shares will carry

dividend rights as from January 1st, 2021 and will be fully

fungible with existing shares already listed.

The total cash dividend to be paid to the shareholders which did

not opt for the payment in shares amounts to around €94 million and

will be paid on June 15, 2021.

INVESTOR AGENDA

28 July 2021 (after trading): 2021 Interim Results 29

July 2021 (2:30 p.m. Paris time): Investor and Analyst

Meeting

ABOUT CARMILA

Carmila was founded by Carrefour and large institutional

investors in order to develop the value of shopping centres

anchored by Carrefour stores in France, Spain and Italy. As at 31

December 2020, its portfolio was valued at €6.15 billion,

comprising 215 shopping centres in France, Spain and Italy, all

leaders in their catchment areas. Inspired by a genuine retail

culture, Carmila's teams include all of the expertise dedicated to

retail attractiveness: leasing, digital marketing, specialty

leasing, shopping centre management and portfolio management.

Carmila is listed on Euronext-Paris Compartment A under the

symbol CARM. It benefits from the tax regime for French real estate

investment trusts (“SIIC”). Carmila became part of the FTSE

EPRA/NAREIT Global Real Estate (EMEA Region) indices on 18

September 2017.

Carmila became part of the Euronext CAC Small, CAC Mid &

Small and CAC Alltradable indices on 24 September 2018.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210610005975/en/

INVESTORS AND ANALYSTS Pierre-Yves Thirion – Chief

Financial Officer pierre_yves_thirion@carmila.com +33 6 47 21 60 49

PRESS Morgan Lavielle - Corporate Communications Director

morgan_lavielle@carmila.com +33 6 87 77 48 80

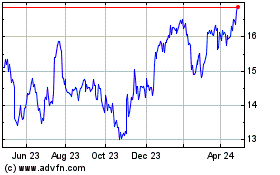

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

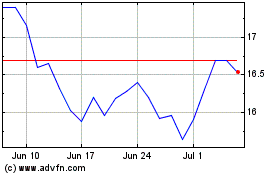

Carrefour Property Devel... (EU:CARM)

Historical Stock Chart

From Apr 2023 to Apr 2024