XRP To Blast Off? Analyst Predicts ‘Realistic’ 5x Surge To $3

April 13 2024 - 1:09AM

NEWSBTC

XRP, the native token of Ripple, has caught the attention of market

analyst Mikybull who is calling for a potential 5x surge in the

mid-term. This bullish prediction comes amidst recent struggles for

XRP, which is currently grappling to maintain support above the

$0.60 level. Related Reading: Bitcoin Below $70,000: Is $80K Still

Possible, Or Is The Rally Over? Mikybull bases his optimism on two

key technical indicators: the two-year moving average (MA) and a

symmetrical triangle formation on the two-month chart. XRP recently

crossed above the two-year MA, a historical signifier of

significant price increases according to the analyst. This pattern

held true in late 2017 when XRP skyrocketed to its all-time high of

$3.31 after a similar crossover. XRP Technical Chart Hints At

Breakout The symmetrical triangle on the two-month chart further

bolsters Mikybull’s prediction. This pattern often precedes a

breakout, and in XRP’s case, a breakout above the triangle’s upper

trendline could propel the price towards $3.10, aligning with

Mikybull’s 5x surge target. The 2017 price surge also coincided

with a breakout from a similar triangle formation, lending

historical credence to the analyst’s view. $XRP It has climbed

above 2-yr MA in this cycle, indicating that an upward explosive

move should bring about 5x at least. It happened in 2017 and 2021

so buckle up. pic.twitter.com/KTIKys2zMy — Mikybull 🐂Crypto

(@MikybullCrypto) April 11, 2024 A Cautious Approach Still

Warranted However, cryptocurrency enthusiasts should approach this

prediction with a dose of healthy skepticism. While technical

analysis can be a valuable tool, past performance doesn’t guarantee

future results. The broader market environment can significantly

impact individual cryptocurrency prices. Furthermore, XRP is

currently facing resistance at the $0.60 level, highlighting a

potential hurdle before any significant upward climb. Total crypto

market cap is currently at $2.39 trillion. Chart: TradingView

Regulatory Landscape And Adoption Remain Key Beyond technical

indicators, the future of XRP hinges on two crucial factors: the

ongoing legal battle with the SEC and its adoption within the

financial sector. The SEC lawsuit, which accuses Ripple of selling

unregistered securities, has cast a shadow over XRP, creating

uncertainty for investors. A positive resolution in Ripple’s favor

could significantly boost investor confidence and potentially

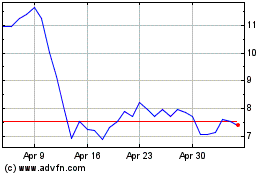

trigger a price increase. XRP price action in the last week.

Source: Coingecko On the adoption front, Ripple’s core utility lies

in facilitating faster and cheaper cross-border payments for

financial institutions. Increased adoption of Ripple’s technology

by banks and other financial players would translate to a higher

demand for XRP, potentially driving its price upwards. Related

Reading: Uniswap Bloodbath: UNI Price Crashes 16% On SEC Lawsuit

Fears A Calculated Optimism For XRP The coming months will be

crucial for XRP as the legal battle with the SEC unfolds and its

adoption within the financial sector becomes clearer. With a mix of

technical optimism and lingering uncertainties, XRP’s journey

towards the $3 target promises to be an exciting, yet potentially

volatile, ride. Featured image from Pixabay, chart from TradingView

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Jun 2024 to Jul 2024

Uniswap (COIN:UNIUSD)

Historical Stock Chart

From Jul 2023 to Jul 2024