UPDATE: Alumina 1st Half Net Profit US$44.2 Million; Dividend 2 US Cents

August 09 2010 - 8:58PM

Dow Jones News

Alumina Ltd. (AWC.AU) said Tuesday that first half net profit

for the period ended June 30 jumped to US$44.2 million from US$4.2

million a year earlier.

On an underlying basis, it recorded a US$22.2 million profit

compared to a US$10.4 million loss in the first half of 2009. A

consensus of three analysts had forecast the figure at US$36

million, with a wide range from US$28 million to US$43 million.

The company attributed the improvement to higher sales volumes

and prices and good cost control, offset by the impact of a

stronger Australian dollar and costs associated with ramping up its

Brazilian operations.

Chief Executive John Bevan forecast that global alumina demand

would grow 12% this year.

"Profit is up and the major turnaround in cash flow and market

conditions has enabled the board to reinstate the interim

dividend," he said.

Alumina, whose sole significant asset is a 40% stake in the

Alcoa World Alumina and Chemicals joint venture with Alcoa Inc.

(AA), will pay a dividend of 2 U.S. cents per share. It didn't pay

a dividend in the previous corresponding period.

Revenue for AWAC rose 55% to US$2.65 billion, compared to

US$1.71 billion during the first half of 2009.

The company was still suffering last year from the effects of

the global financial crisis, during which market aluminum prices

averaged below US$1,400/ton compared to an average of US$2,160/ton

in the first six months of this year.

The Australian dollar has also strengthened against the U.S.

dollar since the previous year to a first half average of US$0.8930

from US$0.7130 the previous year.

However, the effect of that change no longer shows up in

Alumina's results, after the company changed its reporting currency

to U.S. dollars in February.

AWAC is the world's largest producer of alumina, an intermediate

material used in the production of aluminum from bauxite ore. It

operates bauxite mines and alumina refineries near Perth, Western

Australia, and smelters on the coast of Victoria, as well as owning

assets in the U.S., Brazil, Spain, Guinea, Suriname and

Jamaica.

During the first half of the year Alumina received US$94.9

million in dividends from AWAC--its main form of cash

income--compared to US$79.8 million in the first six months of

2009.

Bevan said the company was seeing signs that the market was

moving toward shorter term, index-based pricing of alumina, in line

with changes that have taken place over the past year in the

pricing of iron ore and coking coal.

"The industry trend toward shorter and spot contracts for

alumina has continued," he said. "We see this providing continued

momentum for index-based pricing of alumina."

Alumina has traditionally been priced around 12%-17% of the

market aluminum price, a convention that ties it to swings in the

metal markets and smoothes over the material's own supply-demand

balance.

-By David Fickling, Dow Jones Newswires; +61 2 8272 4689;

david.fickling@dowjones.com

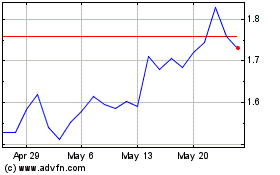

Alumina (ASX:AWC)

Historical Stock Chart

From May 2024 to Jun 2024

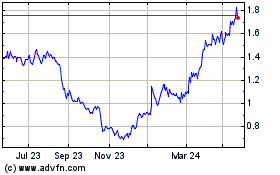

Alumina (ASX:AWC)

Historical Stock Chart

From Jun 2023 to Jun 2024