Oil Services ETFs in Focus on Schlumberger Earnings - ETF News And Commentary

January 21 2014 - 10:00AM

Zacks

The oil-field services industry has been pushed down sharply in the

Zacks Industry Rank list and presently stays in the bottom 7%

thanks to lower oil prices and the taper-backed recent strength in

the greenback.

Despite this negative backdrop, the sector kicked off this earnings

season on a decent note. A gradual pickup in the global economy

might be credited for this nice beginning to this in-focus

sector.

The sector bellwether,

Schlumberger Ltd.

(

SLB), came out with solid numbers on January 17,

signaling that some ETFs that have high exposure in this company

might be interesting plays, especially if the oil service sector is

on the verge of turning around (read: Energy ETFs Surge on Q3 Oil

Service Earnings Beats).

Schlumberger 4Q Earnings in Details

The world’s largest oilfield services provider dished out a decent

Q4 by reporting adjusted earnings of $1.35 per share (excluding

special items), which beat the Zacks Consensus Estimate of $1.33

and the year-ago number of $1.04.

Total revenue of $11.9 billion was up 7.4% from the year-earlier

level of $11.1 billion and in line with the Zacks Consensus

Estimate. The company’s strong international exposure, especially

surging demand from the Middle East and Asia, and stepped-up

activity in the U.S. Gulf of Mexico which is making up for the

reduced onshore activity, helped it to stand out in the energy

equities space.

Hopes are building up as we look into Schlumberger’s overall

outlook for 2014, especially from foreign markets. Also, a

day before the earnings release, Schlumberger announced a 28% hike

in quarterly dividend adding to investors’ optimism.

Market Impact

Quite expectedly, the company’s strong earnings had a positive

impact on the sector, as SLB shares were up 1.81% on the day with

elevated volumes of roughly two times a normal day. The increased

trading could have a huge impact on ETFs that are heavily invested

in this renowned oil-service company.

Below, we have highlighted three oil-services ETFs with the highest

allocation to SLB that could see some gains in a few upcoming

trading sessions and are in focus following Schlumberger’s earnings

(read: 3 Top Performing Energy ETFs in Focus Now):

iShares US Oil

Equipment & Services ETF

(IEZ)

This ETF – tracking the Dow Jones U.S. Select Oil Equipment &

Services Index – invests about $507.0 million in assets in 51

securities, focusing solely on the energy world. In-focus SLB takes

up the first position here with 21.49% of holdings. Generally, when

one stock accounts for as much as 21% of an ETF's weight, its

individual performance decides a lot of the fund’s price

movement.

The fact proved true in this case also as this ETF gained about

0.43% in Friday trading. The fund also surged a handsome 28% in

2013. IEZ is a cheaper fund, charging 45% of expense ratio.

Market Vectors Oil Services ETF

(OIH)

OIH tracks the Market Vectors US Listed Oil Services 25 Index. The

index invests $1.48 billion of assets in 26 holdings. OIH devotes

as much as 20.56% weight to SLB, followed by 10.76% in

HAL. OIH is cheap in the space with an expense ratio of

0.35%.

The fund was up about 0.32% on the day, and returned about 25.85%

in 2013.

PowerShares Dynamic Oil & Gas Services Fund

(PXJ)

This product offers exposure to 30 energy stocks with SLB at the

top position, allocating 5.18% of total assets. PXJ tracks the

Dynamic Oil & Gas Services Intellidex Index and has amassed

about $123.5 million thus far. The ETF charges 62 bps in

fees, so it is a bit more expensive than some of its counterparts

in the space.

The fund added about 0.40% on the day of SLB’s earnings release,

and 27.49% in 2013 (read: Is This the Top for Oil Service

ETFs?).

Bottom Line

Schlumberger’s earnings have surprised the market for the last four

quarters by decent margins and called for average surprise of

2.98%. This should serve as a cornerstone for the entire oil

services industry. This week, we are due for earnings announcements

from other sector behemoths including

Halliburton

(HAL) and

Baker Hughes (BHI).

While many are still not convinced about the prospect of

oil-field services sector at this moment, risk-tolerant investors

can buy in on the ongoing dip. And investors should note that the

basket form of approach is always better than investing in a single

company while it comes to playing a risky sector like what we are

seeing with the oil field services space right now.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-US OIL E (IEZ): ETF Research Reports

MKT VEC-OIL SVC (OIH): ETF Research Reports

PWRSH-DYN OIL&G (PXJ): ETF Research Reports

SCHLUMBERGER LT (SLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From Apr 2024 to May 2024

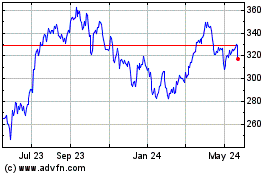

VanEck Oil Services ETF (AMEX:OIH)

Historical Stock Chart

From May 2023 to May 2024