Allstate's April CAT Loss Falls YoY - Analyst Blog

May 18 2012 - 9:15AM

Zacks

Home and auto insurer, Allstate Corp. (ALL)

announced its pre-tax catastrophe (CAT) loss estimates for April

2012 yesterday, which is expected to be about $280 million.

Besides, the company’s CAT loss includes the effect of about 10

natural disasters.

Although Allstate’s April CAT loss estimates are higher than

that recorded in the whole of first quarter of 2012, it is still

meek figure when compared with $1.4 billion worth of CAT loss

recorded in April last year. CAT losses stood at $259 million in

the first quarter of 2012, plunging 22.2% from $333 million in the

year-ago quarter.

Since last year Allstate has started disclosing its quarterly

and monthly CAT loss estimates if the amount exceeded $150 million

in any month. Allstate decided to do so in order to generate

greater transparency. On Wednesday, another peer –

Progressive Corp. (PGR) – reported a decline in

CAT losses for April 2012 to $46 million from $55 million in April

last year.

Earlier this month, Aon Benfield, through its latest Global

Catastrophe Recap report, projected CAT losses of over $1.0 billion

in April 2012 for the US insurance industry. The losses are mostly

due to the widespread tornado, hail and wind that smashed life and

property in central and southern parts of the US.

CAT Loss’ Effect on Earnings

Severe weather-related adverse events have become a growing

concern for insurers and reinsurers in recent years. The

weather-pattern changes have resulted in regular occurrence of

floods, earthquakes, hurricanes, hailstorms, tsunami etc.

Moreover, CAT losses have not only been increasing the claims

payments of the insurers, but it also has been nibbling into the

earnings of the companies, thereby distorting the operational

dynamics for quite some time post the weather-related events.

Several insurers including Allstate, Hartford Financial

Services Inc. (HIG), PartnerRe Ltd. (PRE)

and The Travelers Companies (TRV), among others,

saw most or all of their earnings being swabbed away after

incurring significant CAT losses.

Allstate itself witnessed its CAT loss jump by about 73% over

2010 to $3.82 billion in 2011, while total combined ratio weakened

to 103.4% in 2011 from 98.1% in 2010. Consequently, the company’s

operating net income plunged to $689 million or $1.32 per share

against $1.54 billion or $2.84 per share in 2010.

However, Allstate reported operating earnings per share of $1.42

in the first-quarter of 2012, which outpaced the Zacks Consensus

Estimate of $1.12 and the year-ago quarter’s earnings of 93 cents.

Operating income spiked up 43.7% to $710 million from $494 million

in the year-ago quarter.

Results for the quarter reflected lower catastrophe losses,

which further led to reduced claims expenses coupled with higher

premiums. Besides, expansion in the underlying margin for Allstate

brand homeowners and other personal lines along with higher

investment income and realized capital gains benefited results.

These were offset by higher operating expenses. However,

prudent capital management and liquidity were quite impressive

during the reported quarter.

Despite the CAT losses, the Zacks Consensus Estimate projects

Allstate’s second quarter earnings to shoot up 175% year over year

to 93 cents per share. With respect to the estimate revisions, 14

of 22 firms have revised their estimates upward in the last 30

days, while a couple of downward revisions were witnessed, thereby

justifying the underlying strength of the stock.

Neutral on the long term

Nevertheless, by and large, we believe the tough market

situation looks likely to return after years of sharp decline in

prices, as the disasters caused by severe weather-related events

this year are pushing prices higher in the insurance industry.

Overall, Allstate should be stable in the long run based on its

agency expansion plan, ratings affirmation, product restructuring

and acquisitions. However, the new share repurchase comes with

higher debt costs as Allstate funds it by issuing debt. Overall,

though continued synergies are expected from Allstate’s

industry-leading position, diversification and pricing discipline,

we believe that the current volatile economy will continue to

impact its premiums and income until the markets regain momentum.

Consequently, we maintain a Neutral stance in the long-term with a

Zacks Rank #3, which implies a short-term Hold rating.

ALLSTATE CORP (ALL): Free Stock Analysis Report

HARTFORD FIN SV (HIG): Free Stock Analysis Report

PROGRESSIVE COR (PGR): Free Stock Analysis Report

PARTNERRE LTD (PRE): Free Stock Analysis Report

TRAVELERS COS (TRV): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

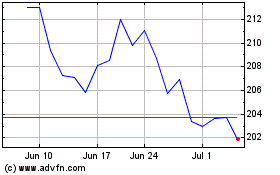

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

The Travelers Companies (NYSE:TRV)

Historical Stock Chart

From Apr 2023 to Apr 2024