The shaking of BP’s share price (LSE:BP.) was almost seismic as it fell from 486.15 at 3:13 pm to 461.83 just nine minutes later, before closing at 455.00, a decline of 5.94% on the day. You could almost tell how long it took to read the 153-page judgment handed down by U.S. District Court Judge Carl Barbier concerning the roles of BP and its partners in the 2010 Deepwater Horizon oil spill in the Gulf of Mexico. It was the worst drop in BP’s share price since 2010.

In reality, it was only the amount of time it took to read the Summary on page 152 of the judgment, which says that BP “is subject to enhanced civil penalties under the Clean Water Act . . . as the discharge of oil was the result of BPXP’s gross negligence and BPXP’s willful misconduct.”

The document went on to say that, “Fault is apportioned as follows: BP: 67%, Transocean: – 30%, Haliburton: – 3%.” Accordingly shares in Transocean (NYSE:RIG) and Haliburton (NYSE:HAL) also declined but much less so, at 0.76% and 1.52%, respectively.

BP had acquiesced to the notion of general negligence, which is how the court rule regarding the other two partners. The expectation was that a general negligence ruling would cost the company up to a maximum of $4.5 billion in fines. Hoping for a more lenient outcome, BP has reserved $3.5 billion. Experts agree that the “gross negligence and willful misconduct” ruling may result in fines more in the neighborhood of $18 billion.

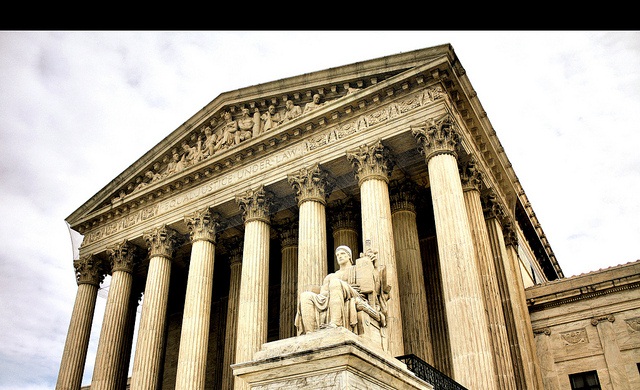

BP fired off a strong rebuttal of the decision and announced an immediate appeal to the U.S. Court of Appeals for the Fifth Circuit (which includes Louisiana). BP claims that the standard for gross negligence was not met in the case and that there was no evidence of either gross negligence or willful misconduct presented during the proceedings. At no point in the statement did BP claim no responsibility, but rather, that it “will seek to show that its misconduct merits a penalty that is less than the applicable maximum after application of the statutory factors.”

Judicial expert, Joel Mintz, of Nova Southeastern University’s Shepard Broad Law School, noted that, “This decision is a clear victory for the government. It gives the Justice Department substantial leverage to work out a settlement that will be quite costly to BP.”

The president of the National Audubon Society, David Yarnold, waved his proverbial evergreen, saying that, “This means that BP will finally be forced to pay what it owes to fix what it broke. It is a long-awaited step toward healing and recovery for the Gulf Coast, its birds and its people.” He also claimed that “BP said it was above the law,” which is patently untrue.

So, where are we. We all agree, except apparently, David Yarnold, that no actual fine has been assessed or is yet forthcoming. The appeal puts that on hold. BP appears to be confident that it will fare better in the Appeals Court, and they are probably right. For now, all parties should remain calm. There is no need to head for the exits.

The Deepwater Horizon incident was unfortunate, but it was an accident. It is not the time for tree-hugging bureaucrats to use the insidious Clean Water Act to drain billions of dollars from one of the highly successful companies that they love to hate. The case is far from over and BP is far from being done in. Patience should prevail.

Hot Features

Hot Features