Summer “trips” lead to accident claims

June 19 2017 - 10:08AM

Business Wire

Sprains and dislocations top the list of

Colonial Life accident insurance claims

Baseball games, the beach and the backyard: June’s warm weather

brings more opportunities for outdoor activities. But it’s also a

prime season for accidental injuries.

Whether it’s an ill-timed slide into second base or lost footing

on a rocky path, sprains and dislocations are common occurrences —

and not just in the summer. In fact, they’re the most common reason

for accident insurance claims received by Colonial Life &

Accident Insurance Company all year, according to 2016 company

records.

The company’s top causes for accident claims include:

- Sprains/dislocations: 20 percent

- Arthropathies and related disorders

(arthritis): 15 percent

- Back injuries: 13 percent

- Fractures: 10 percent

Those injuries can also hurt your wallet. Not counting health

insurance, emergency room treatment for a sprained or broken ankle

can cost $500 for a mild to moderate sprain — $2,500 or more for a

fracture requiring a cast, according to costhelperhealth.com. At

the same time, a new Employee Benefit Research Institute survey

shows one in four U.S. workers and their spouses have less than

$1,000 in savings — a potentially painful financial gap.

“Most people have some health insurance that will help pay

medical expenses related to an accident, but today’s

higher-deductible plans leave many people with sizeable

out-of-pocket expenses,” says Steve Hesler, assistant vice

president for product development at Colonial Life. “Accidents can

also involve nonmedical expenses not covered by major medical

insurance, such as lost income from not being able to work, travel

for treatment or caregiver expenses.”

A voluntary accident insurance plan purchased at the workplace

can help employees protect themselves and their families from this

financial exposure. Voluntary accident insurance typically offers a

wide range of coverage, including hospital admissions, emergency

room treatment, doctor’s office and urgent care visits, surgery,

medical imaging studies and X-rays.

Learn more about accident insurance on Colonial Life’s website

or on Colonial Life’s benefits learning center.

About Colonial Life

Colonial Life & Accident Insurance Company is a market

leader in providing financial protection benefits through the

workplace, including disability, life, accident, dental, cancer,

critical illness and hospital confinement indemnity insurance. The

company’s benefit services and education, innovative enrollment

technology and personal service support more than 86,000 businesses

and organizations, representing 3.7 million of America’s workers

and their families. For more information visit www.coloniallife.com

or connect with the company at

www.facebook.com/coloniallifebenefits, www.twitter.com/coloniallife

and www.linkedin.com/company/colonial-life. Colonial Life is a

registered trademark and marketing brand of Colonial Life &

Accident Insurance Company.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170619005757/en/

Colonial LifeJeanne Reynolds,

803-678-6274jdreynolds@coloniallife.com

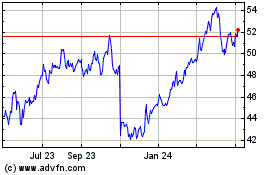

Unum (NYSE:UNM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unum (NYSE:UNM)

Historical Stock Chart

From Apr 2023 to Apr 2024