OTHER OFFERING PARTICIPANT

FREE WRITING PROSPECTUS

Dated July 19, 2018

Filed pursuant to Rule 433

(To Prospectus dated November 10, 2016)

Registration Statement No. 333-214579

Global Net Lease, Inc. (the “Company”

or "GNL") has filed a registration statement on Form S-3 (including a prospectus dated November 10, 2016) with the Securities

and Exchange Commission (the “SEC”), which became automatically effective upon filing, and a prospectus supplement,

for the offering to which this communication relates. The registration statement and the prospectus supplement have also been filed

with the Israeli Securities Authority (the “ISA”). Before you invest, you should read the prospectus supplement, the

prospectus included in the registration statement and other documents the Company has filed with the SEC and the ISA for more complete

information about the Company and the offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov,

by visiting the Company’s website, www.globalnetlease.com, or by visiting the Magna website at www.magna.isa.gov.il under

the Company’s name. Alternatively, the Company, or Value Base Underwriting and Securities Distribution Ltd. (“Value

Base”), will arrange to send you the registration statement or the prospectus supplement if you request it by calling 972-3-6223383

or toll-free at 1-866-902-0063.

Value Base, the distributor for the offering

in Israel, provided copies of the credit rating report originally published by S&P Global Ratings Maalot Ltd. to prospective

investors (the “Report”). The text of the Report (with contact information redacted) is reproduced below:

|

|

Please

note that this translation was made for convenience purposes only and under no circumstances shall obligate S&P Global

Ratings Maalot Ltd. The translation has no legal status and S&P Global Ratings Maalot Ltd. does not assume any responsibility

whatsoever as to its accuracy and is not bound by its contents. In the case of any discrepancy with the official Hebrew version,

the Hebrew version shall apply.

|

[Logo of S&P Maalot]

Global

Net Lease, Inc.

July 9, 2018

New Rating

Determination of a company rating of

‘ilAA-’ with a stable forecast; determination of a rating of ‘ilA’ for the issue of Preferred Series B

shares at a scope of up to NIS 900 million par value

Table

of contents

|

Summary Rating action

|

3

|

|

|

|

|

Main rating considerations

|

3

|

|

|

|

|

Rating forecast

|

6

|

|

|

|

|

Rating adjustments

|

6

|

|

|

|

|

Methodology and related articles

|

7

|

|

2

| July 9, 2018

|

New Rating

|

New Rating

Determination of a company rating of

‘ilAA-’ with a stable forecast; determination of a rating of ‘ilA’ for the issue of Preferred Series B

shares at a scope of up to NIS 900 million par value

Summary

|

|

·

|

Global Net Lease, Inc. (the “Company”) is an American REIT fund that is traded on the

New York Stock Exchange and which will list its ordinary shares for trading on the Tel Aviv Stock Exchange, is engaged in the lease

of office, industrial, distribution and trade center buildings in the United States and Europe, and owns over 330 assets with a

value of $3.3 billion (on a historic cost basis). The Company and its assets are managed by AR Global, which manages four REIT

funds (including GNL) with an asset scope of over $10 billion throughout the United States and Europe since 2006.

|

|

|

·

|

The Company’s business risk profile is supported mainly by the scope of the asset portfolio,

geographic distribution, diversification of assets, and high quality of most of the tenants from various sectors. On the other

hand, the business profile is limited by the low diversification of tenants, short period of activity of the fund and aggressive

investment strategy.

|

|

|

·

|

The Company’s financial risk profile is supported by a good debt coverage ratio and interest

relative to the comparison group and a leveraging level that is also adequate given the plan for the purchase of assets in an annual

scope of approximately $1 billion. It is noted that in order to calculate the financial ratios, we calculate the preferred shares

as debt and the current payments to holders thereof as interest payments.

|

|

|

·

|

We determine an issuer rating of ‘ilAA-’ for Global Net Lease, Inc. We also determine

a rating of ‘ilA’ for the issue of series B preferred shares in a total scope of up to NIS 900 million par value.

|

|

|

·

|

The rating for the preferred shares reflects a reduction of one rating notch of the global rating

for flexibility for the Company in the postponement of dividend payments without the same constituting an insolvency event of the

issuer, and the subsequent conversion to the domestic rating, and the reduction of two rating notches from the domestic rating

for the inherent subordination of the preferred shares relative to other debts of the Company.

|

|

|

·

|

The stable rating outlook reflects our assessment that in the upcoming 12 months, the Company’s

asset portfolio will include triple-net assets that will present operational stability in light of the portfolio diversification

and tenant stability. We expect that the scope of the asset portfolio will increase substantially in the upcoming years in accordance

with the Company’s investment plan. The ratios appropriate for the current rating are the adjusted debt ratio and debt to

equity ratio (on the basis of historic cost) of approximately 60% and an EBITDA to financing ratio of approximately 2.4x.

|

Rating action

On July 9, 2018, S&P Maalot determined

a rating of ‘ilAA-’ for Global Net Lease, Inc., which is engaged in the lease of office, industrial, distribution and

commercial centers in the United States and Europe. The rating forecast is stable. Additionally, S&P Maalot determined a rating

of ‘ilA’ for the preferred B series of shares in a total scope of up to NIS 900 million par value.

Main rating considerations

Global Net Lease, Inc. (the “Company”)

is an American REIT fund traded on the New York Stock Exchange and which will list its ordinary shares for trading on the Tel Aviv

Stock Exchange. The fund is largely held by institutional investors in the United States (approximately 62%). The Company and its

assets are managed by AR Global, which manages four REIT funds (including GNL) with an asset scope of over $10 billion throughout

the United States and Europe since 2006. It is our understanding that the other REIT funds managed by AR Global lease assets of

different kinds than those of the Company. The services agreement is in force until 2035.

|

3

| July 9, 2018

|

New Rating

|

As of March 2018, the total value of the

Company’s asset portfolio is approximately $3.3 billion (on a historic cost basis) and is comprised of over 330 office, industrial,

commercial distribution and commercial buildings in the United States and six countries in Europe (with a high credit rating).

The Company intends to continue to acquire new assets in a scope of approximately $1 billion per year, primarily in the United

States, such that the composition of the asset portfolio will be 60% United States and 40% Europe (compared to 50/50 currently).

The Company’s business risk profile

is supported by the size of the asset portfolio and annual EBITDA of over $200 million (based on the Company’s current asset

portfolio), which are relatively high for the comparison group; the diversification of assets – over 330 assets in 40 cities

in seven countries; high occupancy rates (approximately 99.5% on average); high quality tenants that usually have a good credit

rating; and a high duration of lease agreements (8.6 years) compared to the comparison group, while only approximately 10% of the

lease agreements are expected to end by 2022; and a relatively high lease renewal rate.

On the other hand, the business profile

is limited by a relatively low diversification of tenants, as most of the assets are leased by a single tenant; but the location

of the assets in secondary areas outside of cities; by a relatively short management / ownership history for most of the assets,

nevertheless, the management company has in our estimation accumulated experience of more than a decade in properties similar to

those of the Company; and by an aggressive investment strategy.

The Company’s financial risk profile

reflects relatively low leveraging, as expressed in a debt to debt and equity ratio (on the basis of historic cost) that is expected

to increase up to approximately 60% after the acquisition of the assets, and a good interest and debt coverage ratio relative to

the comparison group. It is noted that the leveraging ratios and the interest coverage are impacted from the fact that we are relating

to preferred shares of the Company (Series B offered and the existing Series A) as financial debt and calculate the periodic payments

thereon as interest payments. This is done in light of the instrument characteristics that do not meet the conditions for receipt

of a capital component,

inter alia

, the existence of a fine for postponing payments, and a dividend distribution obligation

in order to maintain the REIT status, which reduce the Company’s incentives to postpone the dividend payments (when necessary).

The Company’s financial risk profile is also supported by the financial policy presented to us to maintain the leveraging

level appropriate for the rating.

In determining the rating for the preferred

shares, we implement,

inter alia

, the methodology for rating hybrid capital instruments and the methodology for the determination

of ratings on the domestic scale. The starting point for the rating is the global issuer rating. The rating for the preferred shares

reflects a reduction of one rating notch in the global rating due to the Company’s flexibility in the postponement of the

dividend payments without the same constituting an insolvency event of the issuer, and subsequently indicate a conversion to the

domestic rating, through use of the conversion tables, and then reduce two rating notches from the domestic rating in order to

reflect the inherent subordination of the preferred shares compared to the other debts of the Company, and thus reach the rating

of the instrument on the domestic scale.

|

4

| July 9, 2018

|

New Rating

|

Our base scenario is based on the following

main assumptions:

|

|

·

|

Growth of GDP in the United States of 2.8% in 2018 and 2.2% in 2019.

|

|

|

·

|

Annual growth of revenue from same assets of approximately 1%.

|

|

|

·

|

Completion of the acquisition of income-generating assets in a total annual scope of approximately

$1 billion,

inter alia

, from preferred share consideration.

|

|

|

·

|

The issue of a new series of preferred shares, Series B, in a total scope of up to NIS 900 million

par value, the consideration from which will be used primarily for the acquisition of assets.

|

|

|

·

|

Ongoing investments in existing assets of approximately $10-15 million per year.

|

|

|

·

|

An expectation of a slight decline in gross profitability in accordance with the expected transaction

characteristics.

|

|

|

·

|

Dividend distribution on the basis of the Company’s policy to distribute at least 90% of

the distributable profits.

|

|

|

·

|

The issue of capital in a scope of up to $565 million in order to finance the acquisition of new

assets, while maintaining a leveraging level of up to 60%, based on the Company’s financial policy as provided to us.

|

Instead of our basic scenario, the leveraging

and debt coverage ratio are expected in the upcoming years to be:

|

|

·

|

An adjusted EBITDA to financing expenses ratio of approximately 2.4x-2.6x.

|

|

|

·

|

The adjusted debt to EBITDA ratio of 9.0x-11.0x.

|

|

|

·

|

Debt to debt and equity ratio of up to 60% (on a historic cost basis).

|

In examining the Company’s capital

structure, we examine,

inter alia

, the Company’s exposure to fluctuations in the exchange rate, in light of the fact

that the Company’s debt is denominated in foreign currencies (US dollar, pound sterling, and euro). The Company’s policy,

as provided to us, is to hedge to the currency exposure through appropriate financial instruments.

Liquidity

We estimate the level of liquidity of Global

Net Lease, Inc. as adequate. We expect that the ratio between the Company’s resources for its uses will exceed 1.2x in the

upcoming 12 months. The examination of the Company’s liquidity is based on the scope of cash and the positive current cash

flow against the expected investments. We estimate that the Company will maintain surplus of resources of assets in a scenario

of a decrease of 10% in EBITDA as well. The Company has bank loans, all of which are without a recourse right to the Company. It

is our understanding that the Company meets all of the financial covenants with sufficient margin.

The following are the sources and uses

at a high level of certainty of the Company, based on our estimate, as of April 1, 2018, and until March 31, 2019:

|

Main sources

|

Main uses

|

|

·

Cash

balance of approximately $107 million;

·

Annual

cash flow of approximately $120-125 million;

·

Issue

of preferred shares in a scope of up to approximately $248 million (including issuance expenses);

·

Use

of a signed credit limit until 2021 in a scope of approximately $60 million;

·

The

receipt of bank financing for the acquisition of new assets in a scope of up to $128 million (based on an LTV of 50%);

·

Refinancing

of a portion in a scope of approximately $204 million.

|

·

Payment

of bank debt in the amount of approximately $222 million;

·

The

purchase of new assets in a scope of approximately $255 million (signed);

·

Current

capital investments in a scope of approximately $2 million;

·

Current

dividend in the amount of approximately $135 million.

|

|

5

| July 9, 2018

|

New Rating

|

Rating forecast

The stable rating outlook reflects our

estimate that in the upcoming 12 months, the Company’s asset portfolio will include triple-net assets that present operating

stability in light of the diversification of the portfolio and stability of the tenants. We expect that the scope of the asset

portfolio will increase substantially in the upcoming years in accordance with the Company’s investment policy. The ratios

appropriate for the current rating are the adjusted debt to debt and equity ratio (on a historic cost basis) of approximately 60%

and an EBITDA to financing expenses ratio of approximately 2.4x.

Positive scenario

The increase to the rating will be possible

if the Company substantially increases its asset portfolio and its cash flow, while improving the diversification of the assets

and tenants and maintaining the financial ratios set forth above. Alternatively, increasing the rating will be possible if the

Company presents the adjusted EBITDA to financing expenses ratio of approximately 3x and the debt to debt and equity ratio (on

a historic cost basis) of approximately 50% over time.

The negative scenario

We will consider a negative rating action

if the Company does not maintain the financial ratios set forth above, or in the event of a deterioration in the Company’s

liquidity. In our estimate, these scenarios may be possible if the Company materially deviates from its investment plan, which

will detrimentally impact its financial profile or if a deterioration occurs in the activity markets for leasing in which the Company

operates.

Rating adjustments

Business distribution: neutral

Capital structure: neutral

Liquidity: neutral

Financial policy: neutral

Management, strategy, and corporate governance:

neutral

Comparison to attribution group: positive

|

6

| July 9, 2018

|

New Rating

|

Methodology and related

articles

|

|

·

|

Rating scales and definitions: use of rating forecast and on CreditWatch

,

September 14, 2009

|

|

|

·

|

Methodology: methodology of the assessment of management and corporate

governance of companies and insurers

, November 13, 2012

|

|

|

·

|

Methodology: key factors for rating real estate companies

,

November 19, 2013

|

|

|

·

|

Methodology: rating groups of companies

, November 19,

2013

|

|

|

·

|

Methodology: corporate ratings – financial ratios and adjustments

,

November 19, 2013

|

|

|

·

|

Methodology – core articles: general methodology and corporate

ratings

, November 19, 2013

|

|

|

·

|

Methodology: methodology of state risk assessment

, November

19, 2013

|

|

|

·

|

Methodology: industry risk

, November 19, 2013

|

|

|

·

|

Rating scales and definitions: credit rating in domestic scales

,

September 22, 2014

|

|

|

·

|

Methodology: criteria for rating the issuances of non-financial

companies on the domestic rating scale of S&P Maalot

, September 22, 2014

|

|

|

·

|

Methodology: methodology for the assessment of the liquidity profile

of corporations

, December 16, 2014

|

|

|

·

|

Methodology – general: methodology for connecting the long-term

rating with the short-term rating

, April 7, 2017

|

|

|

·

|

Rating scales and definitions: conversion tables of S&P between

ratings on the global scale and ratings on the domestic scales

, August 14, 2017

|

|

|

·

|

Definitions of the S&P Global Ratings rating

, June

26, 2017

|

|

|

·

|

Opinions and interpretation: the relationship between the global

rating scale and the Israeli rating scale

, January 25, 2016

|

|

General details (as of July 9, 2018)

|

|

Global Net Lease, Inc.

|

|

|

Issuer rating(s)

|

|

|

long-term

|

ilAA-Stable

|

|

|

|

|

Issue rating(s)

|

|

|

Preferred shares

|

|

|

Series B preferred shares

|

ilA

|

|

|

|

|

Issuer rating historic

|

|

|

long-term

|

|

|

July 9, 2018

|

ilAA-/Stable

|

|

|

|

|

Additional details

|

|

|

Time in which the event occurred

|

July 9, 2018 3:22 pm

|

|

Time in which the event was first apparent

|

July 9, 2018 3:22 pm

|

|

Rating initiated by

|

The rated company

|

|

7

| July 9, 2018

|

New Rating

|

Monitoring of a credit rating

We monitor, on an ongoing basis, developments

that might impact the credit rating of the issuers of a specific series of bonds that we rate. The monitoring is intended to ensure

that the rating will be updated on an ongoing basis, and to identify the parameters that can lead a change in the rating.

S&P Maalot is the commercial name

of S&P Global Ratings Maalot Ltd. For the most updated list of ratings and for additional information regarding the monitoring

policy of the credit rating, please visit the S&P Global Ratings Maalot Ltd. website at

www.maalot.co.il

.

All rights reserved. ® Do not change,

reengineer, duplicate, distribute in any manner, amend or store on a database or system for recovery of information the contents

(including the ratings, analyses, information, assessments, content and products) and any part thereof (hereinafter, together,

the “content”) without the prior written consent of S&P Global Ratings Maalot Ltd. or affiliated companies (hereinafter

jointly: “S&P”). S&P and third parties that provide it with services, including its directors, managers, shareholders,

employees and agents (hereinafter jointly: the “Affiliated Party/Parties”) do not audit the contents and do not verify

the accuracy or completion thereof, including but not limited to inaccuracies, omissions, or whether it is updated or available

at all times. The content is provided on an “as is” basis. S&P and affiliated parties do not provide an undertaking

or representation, directly or indirectly, including but not limited to regarding the degree of quality or suitability for any

given need, and that the content will not include errors and/or mistakes.

S&P and affiliated parties will not

bear any liability for direct and/or indirect damages of any type or kind, including ancillary or consequential damages (including,

without derogating from the generality of the above, damages for loss of work and business, loss of income or profits, loss of

information, harm to reputation, loss of business opportunities or reputation), caused in connection with use of the content, even

in the event in which the possibility of such damages was known in advance.

Analyses related to ratings and other analyses,

including but not limited to the ratings and other information included in the content constitutes a subjective expression by S&P

as of the date of their publication, and do not constitute a matter of fact or a recommendation to purchase, hold or sell any securities,

or to make any decisions regarding the performance of investments. S&P does not undertake any update of the content after its

publication. Do not rely on the content without making decisions regarding investments. S&P does not serve as an “expert”

or consultant regarding investments and/or securities.

In order to maintain independence and

a lack of reliance on the actions of the various units of S&P, S&P maintains a distinction between these actions. As a

result, certain units may have information that is not available to other units of S&P. S&P has formed procedures and

processes in order to maintain confidentiality of non-public information and information that is received in connection with analytical

processes that it carries out. S&P receives financial consideration for the provision of the rating services and the analytical

analyses that it performs, generally from the issuers or the underwriters of the rated securities, or the debtors, as the case

may be. S&P reserves the right to distribute its opinion and analyses. The public ratings of S&P and the analyses appear

on the S&P Maalot website, at

www.maalot.co.il

and the website of S&P, at the

address

www.standardandpoors.com

, and may also appear in other publications of S&P

and third parties.

|

8

| July 9, 2018

|

New Rating

|

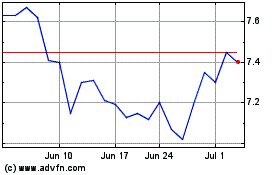

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From Mar 2024 to Apr 2024

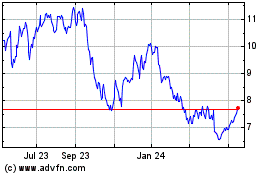

Global Net Lease (NYSE:GNL)

Historical Stock Chart

From Apr 2023 to Apr 2024