Amended Statement of Beneficial Ownership (sc 13d/a)

March 13 2018 - 12:36PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

|

Under the Securities Exchange Act of 1934*

|

|

(Amendment No. 1)*

|

|

|

|

Autoliv,

Inc.

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

par value $1.00 per share

|

|

(Title of Class of Securities)

|

|

|

|

052800109

|

|

(CUSIP Number)

|

|

|

Cevian Capital II GP Limited

11-15 Seaton Place

St. Helier, Jersey JE4 0QH

Channel Islands

Attention: Denzil Boschat

+44 1534 828 513

with a copy to:

Schulte Roth & Zabel LLP

919 Third Avenue

New York, NY 10022

Attention: Eleazer N. Klein, Esq.

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

March 12,

2018

|

|

(Date of Event Which Requires Filing of This Statement)

|

If the filing person has previously filed a

statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 6 Pages)

______________________________

* The remainder of this cover page shall be

filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of

this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934

("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions

of the Act (however, see the Notes).

|

CUSIP No. 052800109

|

SCHEDULE 13D/A

|

Page

2

of 6 Pages

|

|

1

|

NAME OF REPORTING PERSON

Cevian Capital II GP Limited

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

¨

(b)

ý

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Jersey

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

6,530,530

|

|

8

|

SHARED VOTING POWER

-0-

|

|

9

|

SOLE DISPOSITIVE POWER

6,530,530

|

|

10

|

SHARED DISPOSITIVE POWER

-0-

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

6,530,530

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.5%

|

|

14

|

TYPE OF REPORTING PERSON

IA, OO

|

|

|

|

|

|

|

|

CUSIP No. 052800109

|

SCHEDULE 13D/A

|

Page

3

of 6 Pages

|

This Amendment

No. 1 ("

Amendment No. 1

") amends and supplements the statement on Schedule 13D filed with the Securities and Exchange

Commission on March 1, 2018 (the "

Original Schedule 13D

", and the Original Schedule 13D as amended, the "

Schedule

13D

"), with respect to the Common Stock, par value $1.00 per share (the "

Common Stock

")

of

Autoliv, Inc.

, a

Delaware corporation

(the

"

Issuer

")

. This Amendment No. 1 amends Items 3, 5(a)-(d) and 6 as set forth below. Capitalized terms used

herein and not otherwise defined in this Amendment No. 1 have the meanings set forth in the Schedule 13D.

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

|

|

|

|

Item 3 is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

As of the date hereof, the Reporting Person has purchased for the account of the Master Fund an aggregate of 6,530,530 shares of Common Stock for an aggregate consideration (including brokerage commission) of approximately USD 901,237,120. The Master Fund funded these purchases out of its general working capital. The shares of Common Stock were purchased using Swedish Krona. For the purposes of this Schedule 13D, a conversion rate of USD 1.00 for each SEK 8.2479 was used.

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

|

Item 5(a)-(d) is hereby amended and restated as follows:

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of shares of Common Stock and percentages of the shares of Common Stock beneficially owned by the Reporting Person. The percentage used in this Schedule 13D is calculated based upon 87,087,509 shares of Common Stock outstanding as of February 28, 2018, as reported on the Issuer's website.

|

|

|

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which the Reporting Person has the sole power to vote or direct the vote and sole power to dispose or to direct the disposition.

|

|

|

|

|

(c)

|

The transactions in the shares of Common Stock by the Reporting Person for the benefit of the Master Fund in the past sixty days, which were acquired in private transactions with a broker dealer counterparty, are set forth in

Schedule B

, and are incorporated herein by reference.

|

|

|

|

|

(d)

|

No person other than the Master Fund and the Reporting Person is known to have the right to receive, or the power to direct the receipt of dividends from, or proceeds from the sale of, such shares of Common Stock.

|

|

CUSIP No. 052800109

|

SCHEDULE 13D/A

|

Page

4

of 6 Pages

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

|

|

Item 6 is hereby amended and restated in its entirety as follows:

|

|

|

|

|

|

To the best of the Reporting Person's knowledge, there are no contracts, arrangements, understandings or relationships (legal or otherwise) among the persons named in Item 2 hereof and between such persons and any person with respect to any securities of the Issuer, including but not limited to transfer or voting of any of the securities of the Issuer, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies, including any securities pledged or otherwise subject to a contingency the occurrence of which would give another person voting power or investment power over such securities other than standard default and similar provisions contained in loan agreements.

|

|

CUSIP No. 052800109

|

SCHEDULE 13D/A

|

Page

5

of 6 Pages

|

SIGNATURES

After reasonable inquiry

and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Date: March 13, 2018

|

|

CEVIAN CAPITAL II GP LIMITED

|

|

|

|

|

|

|

|

|

By:

|

/s/ Denzil Boschat

|

|

|

Name:

|

Denzil Boschat

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

|

CUSIP No. 052800109

|

SCHEDULE 13D/A

|

Page

6

of 6 Pages

|

Schedule B

This Schedule sets

forth information with respect to each purchase and sale of shares of Common Stock which were effectuated by the Reporting

Person for the benefit of the Master Fund in the past sixty days. All transactions were effectuated through private

transactions with a broker dealer counterparty.

|

Trade Date

(Year-Month-Day)

|

Common Stock Purchased (Sold)

|

Price ($)*

|

|

3/12/2018

|

2,348,983

|

138.24

|

|

3/12/2018

|

4,181,547

|

137.65

|

* Excluding

commissions, SEC fees, etc. (rounded to nearest cent). The shares of Common Stock were purchased using Swedish Krona. For purposes

of this Schedule 13D, a conversion rate of USD 1.00 for each SEK 8.2479 was used.

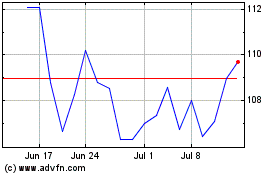

Autoliv (NYSE:ALV)

Historical Stock Chart

From Mar 2024 to Apr 2024

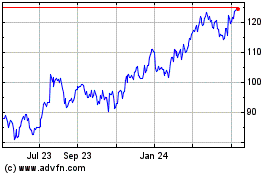

Autoliv (NYSE:ALV)

Historical Stock Chart

From Apr 2023 to Apr 2024