UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 18, 2016

OLIN CORPORATION

(Exact name of registrant as specified in its charter)

|

| | |

Virginia | 1-1070 | 13-1872319 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

190 Carondelet Plaza, Suite 1530 Clayton, MO (Address of principal executive offices) | 63105 (Zip Code) |

|

|

(314) 480-1400 (Registrant's telephone number, including area code) |

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.05. Costs Associated with Exit or Disposal Activities.

On March 18, 2016, Olin Corporation (Olin) approved a plan to permanently close Olin’s Henderson, Nevada chlor alkali facility and to reconfigure that site to manufacture bleach and distribute caustic soda and hydrochloric acid.

As the result of this production change, Olin will incur approximately $95 million of additional pretax restructuring charges in first quarter 2016. Olin currently estimates that these restructuring charges will consist of:

|

| | | | |

Description | | Amount |

Restructuring Costs Related to Henderson | | (in millions) |

Write-off of equipment and facilities | | $ | 75 |

|

Employee-related costs | | 6 |

|

Facility exit costs | | 2 |

|

Lease and other contract termination costs | | 12 |

|

Total | | $ | 95 |

|

Item 2.06. Material Impairments.

As noted in Item 2.05 above, Olin intends to close its Henderson, Nevada chlor alkali manufacturing facility. On March 18, 2016, Olin concluded that it expects to recognize an impairment loss of approximately $75 million, related to this closure. Although Olin expects that property, plant and equipment will be impaired, it believes that all of the impairment charges will be non-cash charges.

Item 7.01. Regulation FD Disclosure.

Attached as Exhibit 99.1 and incorporated herein by reference is a copy of Olin’s press release dated March 21, 2016 announcing that its first quarter 2016 results will contain approximately $95 million of pretax restructuring charges. These charges are associated with plans to reduce our chlor alkali manufacturing capacity by 153,000 tons. Approximately 80 percent of these restructuring charges represent non-cash asset impairment charges. The cash component of these charges includes employee related costs and contract terminations associated with the Henderson, Nevada facility.

Item 9.01. Financial Statements and Exhibits.

(d) The following documents are filed with this Report:

|

| |

Exhibit No. | Description of Exhibit |

99.1 | Press Release dated March 21, 2016. |

Safe Harbor Statement

This report contains forward-looking statements, including those regarding the effect of the closing of the chlor alkali plant in Henderson, Nevada, the reconfiguration of that facility, and the reduction in capacity at the Niagara Falls, New York and Freeport, Texas facilities, and the expected amount of cash and non-cash costs and/or charges. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof and include the assumptions that underlie such statements. These statements are subject to known and unknown risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements, including but not limited to, our ability to shut down the operations discussed in this filing in a timely and effective manner and to implement the reconfiguration; changes in our business requirements; and other risks described in our SEC filings.

Olin undertakes no obligation to revise or update any forward-looking statements.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| OLIN CORPORATION

|

| By: | /s/ George H. Pain |

| | Name: | George H. Pain |

| | Title: | Senior Vice President, General Counsel and Secretary |

Date: March 21, 2016

EXHIBIT INDEX

|

| |

Exhibit No. | Exhibit |

99.1 | Press release dated March 21, 2016. |

Exhibit 99.1

Investor Contact: Larry P. Kromidas

(314) 480-1452

lpkromidas@olin.com

News

News

Olin Corporation, 190 Carondelet Plaza, Suite 1530, Clayton, MO 63105

FOR IMMEDIATE RELEASE

OLIN ANNOUNCES CHLOR ALKALI CAPACITY REDUCTIONS

Clayton, MO, March 21, 2016 - Olin Corporation (NYSE: OLN) (“Olin”) announced today that its first quarter 2016 results will contain approximately $95 million of pretax restructuring charges. These charges are associated with its plans to close a combined total of 433,000 tons of chlor alkali capacity across three separate Olin locations. Approximately 80 percent of these restructuring charges represent non-cash asset impairment charges. The cash component of these charges includes employee related costs and contract terminations associated with the Henderson, Nevada facility.

Olin will close its chlor alkali plant in Henderson, Nevada and reconfigure the facility to manufacture bleach and distribute caustic soda and hydrochloric acid. This action will reduce its chlor alkali manufacturing capacity by 153,000 tons. The Henderson workforce will be reduced by approximately 100 positions. The manufacturing of chlor alkali at the location will cease on March 31, 2016. Olin remains committed to maintaining and growing its position as the leading North American supplier of industrial bleach.

The capacity of the Niagara Falls, New York chlor alkali plant was reduced from 300,000 tons to 240,000 tons earlier this year. This plant continues to produce industrial bleach and on-purpose hydrochloric acid, in addition to chlor alkali.

The chlor alkali capacity at the Freeport, Texas facility will be reduced by 220,000 tons. The Freeport site operates both diaphragm and membrane cell technologies. The 220,000-ton reduction will be entirely from diaphragm cell capacity. Following the capacity reduction in Freeport, the site will have 1,450,000 tons of membrane cell capacity and 1,580,000 tons of diaphragm cell capacity. The capacity reduction will be effective March 31, 2016.

COMPANY DESCRIPTION

Olin Corporation is a leading vertically-integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine and caustic soda, vinyls, epoxies, chlorinated organics, bleach and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, and industrial cartridges.

Visit www.olin.com for more information on Olin.

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management's beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. These statements may include statements regarding the recent acquisition of the Acquired Business from TDCC, the expected benefits and synergies of the transaction, and future opportunities for the combined company following the transaction. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “project,” “estimate,” “forecast,” “optimistic,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. Relative to the dividend, the payment of cash dividends is subject to the discretion of our board of directors and will be determined in light of then-current conditions, including our earnings, our operations, our financial conditions, our capital requirements and other factors deemed relevant by our board of directors. In the future, our board of directors may change our dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

The risks, uncertainties and assumptions involved in our forward-looking statements, many of which are discussed in more detail in our filings with the SEC, including without limitation the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2015, include, but are not limited to, the following:

| |

• | sensitivity to economic, business and market conditions in the United States and overseas, including economic instability or a downturn in the sectors served by us, such as ammunition, vinyls, urethanes, and pulp and paper, and the migration by United States customers to low-cost foreign locations; |

| |

• | the cyclical nature of our operating results, particularly declines in average selling prices in the chlor alkali industry and the supply/demand balance for our products, including the impact of excess industry capacity or an imbalance in demand for our chlor alkali products; |

| |

• | our substantial amount of indebtedness and significant debt service obligations; |

| |

• | weak industry conditions could affect our ability to comply with the financial maintenance covenants in our senior credit facilities; |

| |

• | the integration of the Acquired Business being more difficult, time-consuming or costly than expected; |

| |

• | higher-than-expected raw material and energy, transportation, and/or logistics costs; |

| |

• | our reliance on a limited number of suppliers for specified feedstock and services and our reliance on third-party transportation; |

| |

• | economic and industry downturns that result in diminished product demand and excess manufacturing capacity in any of our segments and that, in many cases, result in lower selling prices and profits; |

| |

• | new regulations or public policy changes regarding the transportation of hazardous chemicals and the security of chemical manufacturing facilities; |

| |

• | changes in legislation or government regulations or policies; |

| |

• | failure to control costs or to achieve targeted cost reductions; |

| |

• | adverse conditions in the credit and capital markets, limiting or preventing our ability to borrow or raise capital; |

| |

• | costs and other expenditures in excess of those projected for environmental investigation and remediation or other legal proceedings; |

| |

• | unexpected litigation outcomes; |

| |

• | complications resulting from our multiple enterprise resource planning (ERP) systems; |

| |

• | the failure or an interruption of our information technology systems; |

| |

• | the occurrence of unexpected manufacturing interruptions and outages, including those occurring as a result of labor disruptions and production hazards; |

| |

• | the effects of any declines in global equity markets on asset values and any declines in interest rates used to value the liabilities in our pension plan; |

| |

• | future funding obligations to our qualified defined benefit pension plan attributable to assumed pension liabilities; |

| |

• | fluctuations in foreign currency exchange rates; |

| |

• | failure to attract, retain and motivate key employees; |

| |

• | our ability to provide the same types and levels of benefits, services and resources to the Acquired Business that historically have been provided by TDCC at the same cost; |

| |

• | differences between the historical financial information of Olin and the Acquired Business and our future operating performance; |

| |

• | the effect of any changes resulting from the transaction with TDCC in customer, supplier and other business relationships; and |

| |

• | the effects of restrictions imposed on our business following the transaction with TDCC in order to avoid significant tax-related liabilities. |

All of our forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of our forward-looking statements.

2016-06

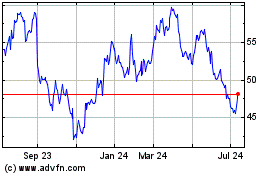

Olin (NYSE:OLN)

Historical Stock Chart

From Aug 2024 to Sep 2024

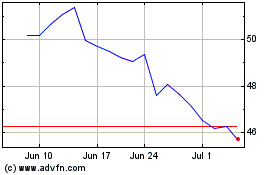

Olin (NYSE:OLN)

Historical Stock Chart

From Sep 2023 to Sep 2024