Natural Gas Futures Fall Below $2/MMBtu To New 10-Year Low

April 11 2012 - 2:21PM

Dow Jones News

Natural gas futures fell below $2 a million British Thermal

Units in intraday trading Wednesday for the first time since

January 2002. The milestone was passed as weak demand and robust

production have driven prices down 55% over the last 52 weeks.

Futures were down 1.6% to $1.999/MMBtu in midday trading for the

May contract on the New York Mercantile Exchange. Prices pierced

the threshold after hovering just above it for hours.

"There's nothing that's out there right now that can push this

higher," said Scott Gettleman, an independent gas trader at the

Nymex.

Futures have been in steady decline for months now, plumbing

10-year lows on an almost weekly basis. They have tumbled below the

$2 threshold due to a host of supply and demand difficulties--few

of which show any sign of easing in the near future.

About half of all U.S. homes are heated using natural gas, and

prices typically rise in the winter. But this winter was one of the

mildest on record, squelching demand for the fuel.

At the same time, producers have shown little willingness to

reduce their record output. The decline in prices hasn't been met

with significant cuts to production. In January, Chesapeake Energy

Corp. (CHK) and ConocoPhillips (COP) both announced output

curtailments in response to falling prices, but the cuts

represented only a fraction of their production and few other

natural-gas producers followed suit.

The combination of reduced demand and abundant production has

sent prices sliding sharply. Natural gas futures are down 33% so

far this year.

Many producers, however, have shifted their drilling efforts to

focus on fields containing more profitable crude oil and natural

gas liquids. The liquids, which include ethane, propane and butane,

are crucial in the production of plastics and other products.

The number of working gas rigs in the U.S. has fallen 27% over

the last year to 647, according to oil-field services provider

Baker Hughes Inc. (BHI). At the same time, the number of oil rigs

has risen 50% to 1,329.

Still, these moves have had little impact. Gas output has

remained high because most wells produce a mix of oil and gas--no

matter whether they are classified as a natural gas well or an oil

well. High oil prices effectively are subsidizing the cost of

continued gas production in many cases. At the same time, many

producers have locked in higher gas prices on the futures market.

Others are obligated by the terms of leases on land to continue

producing gas. Such deals were struck when gas prices were much

higher.

The U.S. Energy Information Administration continues to report

record U.S. natural-gas production. Last month, the agency said

output in the lower 48 states rose to a record high of 72.85

billion cubic feet a day in January, the most recent date for which

figures are available.

The rising output is raising fears that the market could run out

of space to store gas later this year, as early as October.

Inventories now stand at 2.479 trillion cubic feet, their highest

level ever for this time of year and 60.5% above where they

typically stand at this time.

That leaves perilously little space for the typical increase in

stockpiles that takes place during the spring and summer months.

The EIA said Tuesday it expects inventories to rise to 3.923

trillion cubic feet. The agency estimates that about 4.1 trillion

cubic feet of working capacity exists across the U.S.

Additional gas demand from power generators could stall the

decline, analysts said. Barclays said power generators have been

gradually switching off coal plants and turning on gas plants,

which are growing cheaper to run. But many utilities have large

inventories of coal or long-term contracts that prevent widespread

switching.

"The power system is not prepared to respond that quickly to

this much of a drop in gas prices," said Mike Zenker, natural gas

analyst at Barclays.

However in recent weeks, speculators have been paring their bets

on lower gas prices, a sign that some of the most aggressive

selling may be over. The Commodity Futures Trading Commission

reported Friday that speculators reduced their so-called net short

position 16.6% in the most recent week.

-By Dan Strumpf, Dow Jones Newswires; 212-416-2818;

dan.strumpf@dowjones.com

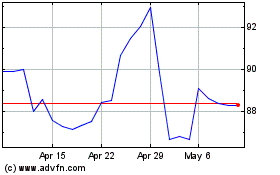

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Mar 2024 to Apr 2024

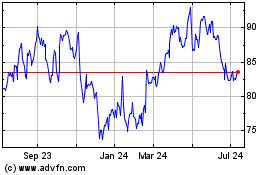

Chesapeake Energy (NASDAQ:CHK)

Historical Stock Chart

From Apr 2023 to Apr 2024