Ministers Try to Show Unity Before Brexit Negotiations

December 05 2016 - 11:40AM

Dow Jones News

The two U.K. government ministers who will represent Britain's

banking sector in upcoming Brexit negotiations held their first

joint meeting with financiers Monday in an effort to show a united

front after months of infighting.

The U.K. Treasury and the newly created Department for Exiting

the European Union, or Dexeu, butted heads soon after the June vote

amid a power grab for influence in the negotiations to quit the

European Union, government advisers and bankers have said.

On Monday Chancellor of the Exchequer Philip Hammond and

Secretary of State David Davis co-chaired their first round-table

discussion on Brexit with executives from the U.K.'s banking,

insurance, asset management and market infrastructure sectors. The

meeting was attended by the chairs of Barclays PLC, Santander U.K.

and top executives from Goldman Sachs Group Inc. and BlackRock

Inc., among others.

The effort to mend relations follows complaints by bankers of

having to hold multiple meetings with the two departments to

discuss the same issues. The U.K. Treasury has said it would

represent the finance sector in the negotiations, but Dexeu is in

charge of leading the overall talks.

After the vote to leave the EU, tensions initially flared when

some bankers said that it was difficult to get Dexeu to understand

their position, that the industry needed Brexit to be phased in

over several years to give them a chance to reshape their

businesses. The U.K. Treasury has been more understanding on this

point, they say.

Mr. Davis's position seems to have softened of late. Last week

he said the U.K. would consider making payments to the European

Union's budget to secure the best-possible trade access to the

bloc. That marked a turnabout from earlier when Prime Minister

Theresa May suggested the U.K. would prioritize taking control of

immigration during negotiations. Meanwhile coordination between the

two departments has improved, officials say.

Monday's meeting was held on neutral ground in a skyscraper in

central London. Bankers voiced their views on concerns and

opportunities for the sector after Brexit, according to a person

familiar with the matter. Mr. Davis and Mr. Hammond put out a joint

statement saying they recognized the importance of the U.K.'s

financial center. "We will work together to ensure it continues as

the hub for both Europe and the rest of the world," said the

statement.

Keeping the financial sector both happy and in the U.K. has

potentially huge ramifications for the country's public finances.

The sector accounts for 12% of exports and £ 60 billion of tax

revenue each year, the government said.

Banks are already scoping out foreign hubs in the EU to house

parts of their business if the U.K. does leave the single market as

expected.

Write to Max Colchester at max.colchester@wsj.com

(END) Dow Jones Newswires

December 05, 2016 11:25 ET (16:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

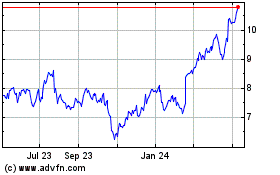

Barclays (NYSE:BCS)

Historical Stock Chart

From Aug 2024 to Sep 2024

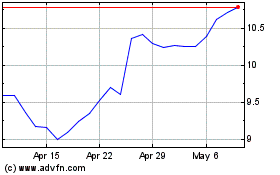

Barclays (NYSE:BCS)

Historical Stock Chart

From Sep 2023 to Sep 2024