Target to Offer Free Shipping on All Online Orders

October 29 2015 - 6:29PM

Dow Jones News

By Paul Ziobro

Target Corp. is bringing back free shipping on all online orders

for the holiday season, the second straight year Chief Executive

Brian Cornell has turned to the strategy to boost digital

sales.

The shipping strategy is a key point of difference during the

holiday season between Target and rival Wal-Mart Stores Inc., which

said on Thursday that it will continue to charge a shipping fee for

all orders of less than $50. Best Buy Co. last week said it would

drop shipping fees on all orders through early January.

Mr. Cornell is leading his second holiday season at Target,

though this year's holiday shopping event will the first that bears

his full imprint. His tenure atop the retailer started in 2014,

with most of the company's holiday plans already having been

set.

One of the main changes for which he pushed last year was

dropping shipping charges during the holidays, part of Target's

goal to boost its digital business and better compete with online

rivals like Amazon.com Inc. Free shipping helped Target boost

digital sales 36% during last year's fourth quarter.

Mr. Cornell is hoping to grow Target.com's sales at a 40% annual

clip over the next five years. The retailer, though, has fallen

short of that mark in the two quarters since announcing the goal,

meaning it has to make up ground the rest of this year. Digital

sales were less than 3% of Target's business through the first half

of the year.

Target's broader holiday plans include improving the quality of

home décor and apparel, as well as sprucing up displays in key

areas of the stores. Target is also launching an online site to

sell its products to over 200 countries and adding new ways of

selling products, with curbside pickup available at 121 stores next

week.

Mr. Cornell acknowledged on Thursday that the holiday season is

unfolding at a time when shoppers remain cautious and the battle

for shoppers remains fierce. "We're going to have to fight for

every dollar, " Mr. Cornell said in an interview at Target's New

York office.

Though Target is now incorporating real marble into cutting

boards and selling hand-crafted serving trays, improvement in

quality hasn't boosted prices. "The core assortment throughout the

store is better quality, not higher prices," said Jeff Jones,

Target's chief marketing officer.

Thus far, changes in other departments have paid off. Putting

apparel on new mannequins, for instance, has boosted sales of those

items by 30%, while dinnerware and furniture featured in Target's

restaged home area sell three to four times faster than the rest of

the category, the company says.

Though the plan has been communicated from the top, Target's

stores will have to carry it out, including making sure that items

are in-stock, a major problem the retailer is beginning to tackle.

"Now it's execution time," Mr. Cornell said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 29, 2015 18:14 ET (22:14 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

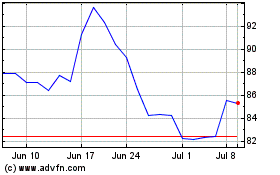

Best Buy (NYSE:BBY)

Historical Stock Chart

From Aug 2024 to Sep 2024

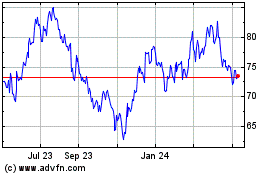

Best Buy (NYSE:BBY)

Historical Stock Chart

From Sep 2023 to Sep 2024