Tyco International PLC (TYC) filed a Form 8K - Entry Into a

Definitive Agreement - with the U.S Securities and Exchange

Commission on March 16, 2016.

Term Loan Facility

On March 10, 2016, Tyco International Holding S. r.l. (the

"Borrower"), an indirect wholly owned subsidiary of Tyco

International plc ("Tyco"), entered into a Term Loan Credit

Agreement among the Borrower, each of the lenders named therein,

Citibank, N.A. ("Citibank"), as administrative agent, and Citigroup

Global Markets Inc., Merrill Lynch, Pierce, Fenner & Smith

Incorporated, Wells Fargo Securities, LLC and JPMorgan Chase Bank,

N.A., as joint lead arrangers and joint bookrunners, providing for

a senior unsecured term loan facility in the amount of

$4,000,000,000 (the "Term Loan Agreement") to finance the cash

consideration for, and fees, expenses and costs incurred in

connection with, the merger (the "Merger") of Jagara Merger Sub LLC

("Merger Sub"), a subsidiary of Tyco, with and into Johnson

Controls, Inc. ("Johnson Controls") with Johnson Controls as the

surviving corporation, pursuant to the Agreement and Plan of Merger

(the "Merger Agreement") dated as of January 24, 2016 by and among

Johnson Controls, Tyco and Merger Sub.

Any loans borrowed under the Term Loan Agreement will be made in

a single borrowing on the closing date of the facility and will

have a maturity of 3.5 years and be denominated in U.S. dollars.

The closing of the term loan facility and the funding of such

loans, if requested, shall only occur upon the satisfaction or

waiver of certain conditions that we believe to be customary for

this type of facility, including that the consummation of the

Merger in accordance with the terms of the Merger Agreement.

Neither Tyco nor any other direct or indirect parent of the

Borrower will be a borrower under, or guarantor of, the term loan

facility. The term loan facility is being provided to the Borrower

on the basis of its properties, assets and credit only, and will

not be guaranteed, or otherwise supported, directly or indirectly,

by the legacy Johnson Controls entities, properties, assets or

credit.

Borrowings under the Term Loan Agreement will bear interest at a

rate per annum equal to, at the option of the Borrower, (1) LIBOR

plus an applicable margin based on, at any time of determination,

the total leverage ratio of the Borrower, or (2) an alternate base

rate equal to the highest of (i) Citibank's prime rate, (ii) the

federal funds effective rate plus 1/2 of 1% and (iii) one-month

LIBOR plus 1%, in each case plus an applicable margin based on, at

any time of determination, the total leverage ratio of the

Borrower. The Term Loan Agreement also requires payment to the

lenders of a ticking fee accruing from the date that is thirty days

after March 10, 2016, in an amount equal to 0.15% per annum of the

aggregate commitments outstanding from time to time under the Term

Loan Agreement payable on the earlier of (i) the date the Term Loan

Agreement is terminated without funding of the loans and (ii) the

date upon which the closing occurs.

Voluntary prepayments on the loans and voluntary reductions of

unfunded commitments under the term loan facility are permissible

without penalty, subject to certain conditions pertaining to

minimum notice and minimum reduction amounts. In addition, the Term

Loan Agreement requires, prior to the termination of the

commitments in accordance with the terms thereunder, a commitment

reduction with the net cash proceeds received by or on behalf of

Tyco or any of its subsidiaries (as applicable) in respect of the

incurrence of certain indebtedness, the issuance of equity

securities, and asset sales, in each case, subject to certain

thresholds and exceptions set forth in the Term Loan Agreement.

Additionally, the Term Loan Agreement requires, after the making of

the loans at closing, a mandatory prepayment with the net cash

proceeds received by the Borrower or any of its subsidiaries from

certain types of asset sales made to affiliates, subject to

thresholds and exceptions set forth in the Term Loan Agreement.

The Term Loan Agreement contains affirmative and negative

covenants that we believe are usual and customary for senior

unsecured credit agreements, including a financial covenant

requiring the Borrower to maintain a 3.5 to 1.0 leverage ratio,

which is the ratio of the Borrower's consolidated debt to its

consolidated EBITDA, each as defined in the Term Loan

Agreement.

The negative covenants in the Term Loan Agreement include, among

other things, limitations (each of which is subject to customary

exceptions for financings of this type) on the ability of the

Borrower and its subsidiaries to:

* grant liens;

* enter into transactions resulting in fundamental changes (such

as mergers or sales of all or substantially all of the assets of

the Borrower);

* restrict subsidiary dividends or other subsidiary

distributions;

* enter into transactions with affiliates (with certain specific

limitations applicable to transactions with Tyco or subsidiaries of

Tyco other than the Borrower or any of its subsidiaries);

* permit subsidiaries to provide guarantees to other material

debt;

* and incur additional subsidiary debt.

The Term Loan Agreement also contains customary events of

default (subject to grace periods, as appropriate) including among

others: nonpayment of principal, interest or fees; breach of the

financial, affirmative or negative covenants; inaccuracy of the

representations or warranties in any material respect; payment

default on, or acceleration of, other material indebtedness;

bankruptcy or insolvency; material unsatisfied judgments; certain

ERISA violations; invalidity or unenforceability of the Term Loan

Agreement or other documents associated with the Term Loan

Agreement; and a change of control.

The representations and warranties, covenants and events of

default in the Term Loan Agreement will apply only to the Borrower

and its subsidiaries and not to Tyco, the direct or other indirect

parent companies of the Borrower or any other subsidiaries of each

of them (including Johnson Controls and its subsidiaries).

Revolving Credit Facility

On March 10, 2016, the Borrower entered into a Multi-Year Senior

Unsecured Credit Agreement among the Borrower, each of the lenders

named therein, Citibank, as administrative agent, and Citigroup

Global Markets Inc., Merrill Lynch, Pierce, Fenner & Smith

Incorporated, Barclays Bank plc, Wells Fargo Securities, LLC and

JPMorgan Chase Bank, N.A. as joint lead arrangers and joint

bookrunners, providing for revolving credit commitments in the

aggregate amount of $1,000,000,000 (the "Revolving Credit

Agreement").

The closing of the revolving credit facility, and the Borrower's

ability to borrow under the Revolving Credit Agreement remains

subject to the satisfaction or waiver of customary conditions

contained therein, including the consummation of the Merger

referred to above and the termination of the commitments of the

lenders, and payments of all amounts outstanding, under the Amended

and Restated Five-Year Senior Unsecured Credit Agreement dated as

of August 7, 2015 among Tyco International Finance S.A., as

borrower, Tyco, as guarantor, the lenders party thereto and

Citibank, as administrative agent, which provides for revolving

credit commitments in the aggregate amount of $1,500,000,000 and

which is scheduled to expire in August 2020.

Neither Tyco nor any other direct or indirect parent of the

Borrower will be a borrower under, or guarantor of, the revolving

credit facility. The revolving credit facility is being provided to

the Borrower on the basis of its properties, assets and credit

only, and will not be guaranteed, or otherwise supported, directly

or indirectly, by the legacy Johnson Controls entities, properties,

assets or credit.

The Revolving Credit Agreement has a scheduled maturity date of

August 7, 2020 and it includes an option for the Borrower to

request an increase in the aggregate principal amount of the

commitments, subject to satisfying the conditions therefor,

including obtaining increased commitments from the lenders or new

commitments from third-party financial institutions. The

commitments under the Revolving Credit Agreement may be increased

up to the amount of $1,250,000,000.

Borrowings under the Revolving Credit Agreement may be borrowed

in U.S. dollars and used for general corporate purposes.

...This item was truncated.

The full text of this SEC filing can be retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000083344416000139/a8-kxcreditagreements.htm

Any exhibits and associated documents for this SEC filing can be

retrieved at:

http://www.sec.gov/Archives/edgar/data/833444/000083344416000139/0000833444-16-000139-index.htm

Public companies must file a Form 8-K, or current report, with

the SEC generally within four days of any event that could

materially affect a company's financial position or the value of

its shares.

(END) Dow Jones Newswires

March 16, 2016 16:28 ET (20:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

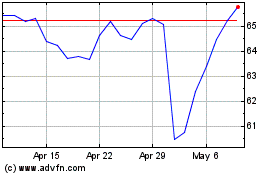

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From Apr 2024 to May 2024

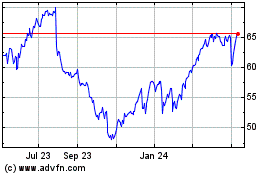

Johnson Controls (NYSE:JCI)

Historical Stock Chart

From May 2023 to May 2024