Parkmead Group Buys 15% Stake In UK Gas Fields

November 15 2011 - 4:15AM

Dow Jones News

Parkmead Group PLC (PMG.LN) said Tuesday it has bought its first

physical oil and gas asset--a 15% interest in three blocks in the

U.K. Southern North Sea, containing the Platypus and Possum gas

prospects from Exxon Mobil Corp. (XOM) subsidiary XTO UK Ltd.

Due to a confidentiality agreement, the company said it was

unable to disclose the amount it paid for the interest. However, in

a separate release, the company said that Executive Chairman Tom

Cross has provided the company with a GBP8 million loan for the

acquisition and for the ongoing development of the assets acquired,

including drilling.

The two-year loan will have an interest rate of 2.5% above LIBOR

and it will be secured by a standard floating charge provided by

the group.

Parkmead said the acquisition marks an important step in the

first stage of its development to become a significant new

independent oil and gas company. The company's only other asset is

a 2.06% stake in Faroe Petroleum PLC (FPM.LN).

The Platypus Rotliegendes gas accumulation was discovered in

2010 by Dana Petroleum PLC which found 218 vertical feet of gas

bearing sands. Parkmead said that Platypus has the potential to

contain up to 180 billion cubic feet of gas in place.

The Possum structure is located immediately adjacent to the

Platypus gas field and has estimated resources of around 100

billion cubic feet of gas in place.

The operator, Dana Petroleum, holds a 45% stake and has secured

a rig to drill a well on the Platypus and Possum complex, scheduled

to start in the first quarter of 2012.

Shares at 0840 GMT were up 2.5 pence, or 19.6%, at 15.25 pence

in a slightly lower Alternative Investment Market--down 0.1%

-By Iain Packham, Dow Jones Newswires; 44-20-7842-9269;

iain.packham@dowjones.com

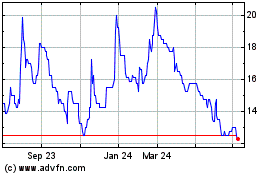

Parkmead (LSE:PMG)

Historical Stock Chart

From Aug 2024 to Sep 2024

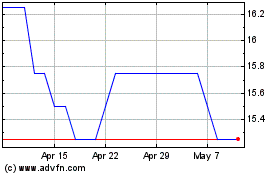

Parkmead (LSE:PMG)

Historical Stock Chart

From Sep 2023 to Sep 2024