By Saabira Chaudhuri

Several years ago, Patty Anagostis gave away all her Burberry

handbags.

The 55-year-old Summit, N.J., resident, whose collection of 100

handbags includes numerous Louis Vuitton and Chanel satchels, said

she used to like Burberry but now finds the brand "dated."

"They need to revamp their image," she said of Burberry. "Chanel

is so classic, it never goes out of style."

Burberry Group PLC agrees that it needs to move its brand higher

up the luxury scale, chasing rivals such as Chanel SA, LVMH Moët

Hennessy Louis Vuitton SE and Hermès International SCA in the

crucial U.S. market.

Burberry Chief Executive Christopher Bailey is under pressure to

find growth in the U.S., among other markets, as he tries to offset

a sharp drop in sales in Hong Kong where Burberry has more stores

than many of its rivals.

But the company faces a sticky problem in the U.S.: controlling

its brand. Burberry is more reliant on wholesale agreements with

large department stores to sell its products in the U.S. than

anywhere else in the world, leaving it vulnerable to markdowns and

product positioning that doesn't always fit with its goal of

pushing the brand upmarket. In fiscal 2015, the company reported

35% of its Americas revenue came from wholesalers, compared with

26% globally.

"The stronger your brand, the more you can say to the department

store, 'Buddy, I manage things directly or forget it,'" said

Bernstein luxury analyst Mario Ortelli. Burberry's wholesale

relationships in the U.S. are "indicative of the relative weakness

of Burberry compared with other brands."

In a bid to wield more control, Burberry has been walking away

from some U.S. department-store agreements and reining in

distribution.

The company terminated three menswear deals with Nordstrom Inc.,

in fiscal 2015, which ended March 31 last year, according to a

person familiar with the moves. Burberry also has ended agreements

on certain product lines at Saks Fifth Avenue, a unit of Hudson's

Bay Co., and Bloomingdale's, owned by Macy's Inc., the person said.

It continues to sell clothing and accessories at all three.

Nordstrom, Saks and Bloomingdale's declined to comment.

"Burberry has a very good relationship with all of its wholesale

partners in the U.S. and has been working closely with them to

elevate the brand in this key market," said a Burberry

spokesman.

On a conference call last year, Chief Financial Officer Carol

Fairweather said Burberry's selective termination of

department-store placements is "very much part of our strategy" to

elevate the brand and move away from deals "that aren't so

brand-appropriate."

In April, the London-based company's shares plunged after it

said fiscal 2017 wholesale revenue would be 10% lower than the

prior year's levels. The forecast decline is largely due to slower

demand from U.S. department stores, which have seen tourist

spending squeezed by a stronger dollar while domestic shoppers

spend more money on home improvements and dining out and less on

clothes, according to research firm IHS Global Insight.

Despite the slump, Burberry said it plans to push fewer products

on department stores as part of its overarching effort to burnish

the brand. Burberry formerly urged U.S. department stores to boost

wholesale orders, but now "we would just much rather they bought

what they think they can sell at full price rather than having to

put it into markdown," said Fay Dodds, vice president of Burberry's

investor relations, in April.

The company runs concessions -- leased areas that it fully

controls -- at department stores such as Harrods and Selfridges in

the U.K., but it has just one concession in the U.S., at Macy's in

Manhattan.

"Moving to a concession agreement isn't easy if you don't have

strong bargaining power, since clearly the wholesale customers

would prefer to have you on a wholesale basis," said Exane BNP

Paribas analyst Luca Solca.

Burberry has been trying to strike more so-called shop-in-shop

deals -- ones that fall short of concession agreements but through

which Burberry has more control than in a simple wholesale

deal.

Ms. Dodds in July said Burberry is seeing "great growth where

we're getting dedicated shop-in-shops." The company didn't reveal

how many such agreements are in place.

Other luxury brands also have moved to slim down their wholesale

presence in the U.S.

"Our principal aim was to reduce the difference of our

presentation in the U.S. between us and the wholesaler," said Prada

SpA Chief Financial Officer Donatello Galli in December.

Gucci parent Kering SA also is taking a similar stance.

Its Chief Executive François-Henri Pinault said in February that

the fashion brand is "undertaking a major and continuous effort to

ensure true consistency between our stores and those of our

partners."

Burberry also has been shuffling its U.S. real estate of roughly

60 stores -- opening stores in more desirable locations in a bid to

attract more customers -- although the store count has stayed

roughly flat since 2011. The company is hiring in cities including

Miami, Dallas, San Diego and Boston to beef up its private-clients

team, which aims to turn big spenders into regular Burberry

shoppers by cultivating personal relationships and offering styling

services. Despite the mounting pressure on Mr. Bailey to deliver

strong sales growth, executives insist Burberry won't jeopardize

its prospects in the U.S. for a short-term boost to sales.

"We've been on this journey for the last few years but there is

still more to do," Ms. Fairweather said. "We are prepared to take

that lower growth to protect the brand long-term."

--Suzanne Kapner contributed to this article.

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com

(END) Dow Jones Newswires

May 02, 2016 19:22 ET (23:22 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

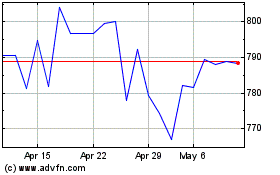

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From Apr 2024 to May 2024

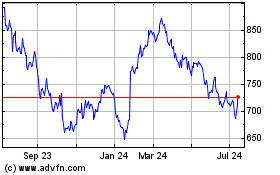

Lvmh Moet Hennessy Louis... (EU:MC)

Historical Stock Chart

From May 2023 to May 2024