Treasury Says Financial Rescues Will Turn Profit

March 30 2011 - 5:29PM

Dow Jones News

The U.S. government's emergency programs that helped steady the

financial system starting in 2008 are expected to turn an overall

profit of nearly $24 billion, the Treasury Department said in a new

analysis Wednesday.

Treasury officials also said they have now generated a profit

from the Troubled Asset Relief Program's loans to banks after three

financial institutions repaid a total of $7.4 billion in TARP funds

Wednesday.

The banks were SunTrust Banks Inc. (STI), of Atlanta; KeyCorp

(KEY), of Cleveland; and Financial Institutions Inc. (FISI), of

Warsaw, N.Y.

Treasury said TARP bank programs are now "in the black" by $6

billion. The federal government initially spent $245 billion to

assist troubled banks in the U.S., and now has $251 billion in

total repayments, dividends, interest and other income.

"While our overriding objective with TARP was to break the back

of the financial crisis and save American jobs, the fact that our

investment in banks has also delivered a significant profit for

taxpayers is a welcome development," Treasury Secretary Tim

Geithner said.

Treasury expects to eventually turn a $20 billion profit on the

nation's troubled banks from the TARP program alone.

Still, the Congressional Budget Office Tuesday trimmed its

estimate on the cost of the overall Troubled Asset Relief Program

to $19 billion. That's well down from an initial estimate of $356

billion, but continues to reflect losses on the bailout of American

International Group Inc. (AIG), aid to the automotive industry, and

grant programs aimed at avoiding foreclosures.

And results remain uneven across the banking sector. Larger

institutions are repaying government funds, but scores of smaller

banks have missed various payments.

Meanwhile, Treasury's overall $23.6 billion profit estimate for

all emergency lending programs was announced in a blog post by

Timothy Massad, acting assistant secretary for financial stability.

It does not include the roughly $800 billion in stimulus funds

authorized in 2009.

The largest profits stemmed from the Federal Reserve's emergency

lending programs, which generated $110.0 billion, Treasury said.

Those offset a projected $73 billion loss in money spent to

stabilize mortgage giants Fannie Mae (FNMA) and Freddie Mac (FMCC).

Rescuing the two companies has cost taxpayers $134 billion to date,

but that spending is expected to be offset by dividend payments

over the next decade.

The new Treasury analysis came on the same day Massad sparred

with a departing federal bailout watchdog over the legacy of TARP

at a congressional hearing.

On his final day on the job, Neil Barofsky, the special

inspector general for TARP, warned that the same "too big to fail"

firms that nearly brought down the financial system in 2008 have

become bigger and more interconnected and continue to maintain an

unfair advantage over small competitors.

"TARP's most significant legacy may be the exacerbation of the

problems posed by 'too big to fail,' particularly given the manner

in which Treasury executed the bailout," Barofsky said. He noted

that the bailout largely spared "executives, shareholders,

creditors and counterparties, reinforcing that not only would the

government bail out the largest institutions, but would do so in a

manner that would do little harm to the responsible

stakeholders."

But Massad, who testified later at the same hearing, rejected

the idea that TARP's main legacy was to perpetuate the "too big to

fail" problem.

"TARP was necessary to respond to the worst financial crisis we

faced in decades," he said in his remarks. "Its most significant

legacy is that it, combined with a variety of other government

actions, helped save our economy from a catastrophic collapse and

may have helped prevent a second Great Depression."

-By Andrew Ackerman and Jeffrey Sparshott; Dow Jones Newswires;

202-569-8390; andrew.ackerman@dowjones.com

--Alan Zibel contributed to this report.

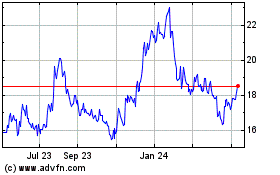

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Aug 2024 to Sep 2024

Financial Institutions (NASDAQ:FISI)

Historical Stock Chart

From Sep 2023 to Sep 2024