Kazera Global PLC Investee Company Operational and Strategic Update (3373O)

May 17 2018 - 2:00AM

UK Regulatory

TIDMKZG

RNS Number : 3373O

Kazera Global PLC

17 May 2018

17 May 2018

Kazera Global

Investee Company Operational and Strategic Update

Kazera Global plc ("Kazera Global" or "the Company) the AIM

quoted investment company who, through its stake in African

Tantalum (Pty) Limited ("Aftan"), has an interest in the Namibia

Tantalite Investment Mine ("NTI" or the "Mine") in Namibia,

provides the following strategic and operational update.

Plant refurbishments and upgrades made over the last 16 months

have delivered important operational efficiencies allowing for the

consistent extraction of high purity tantalum from the Homestead

ore body. In tandem with this, MSA Group, a leading provider of

exploration, mineral resources and reserve estimation, has been

analysing the mining licence and drilling for total mineralisation

at the Homestead and Lepidolite target zones.

What is now very clear to Aftan and Kazera is that beyond the

Homestead and Lepidolite zones, the total licence area has

mineralisation that could unlock significant value. This, along

with interest from further potential offtakers, warrants a

strategic focus on defining the mineralisation over the entire

property to understand the true scale and opportunity at the NTI

Mine.

With the processing capability to produce world class quality as

well as high purity tantalum now proven and the capacity to scale

the plant with the mining operation, in addition to a water licence

to acquire water from the Orange River, Aftan will be redirecting

near-term resource and efforts on mineralisation definition.

Strategic focus

Aftan and the Company believe significant near-term value can be

unlocked through a targeted exploration programme over the next

several months across the whole property which covers 452 Ha.

Historical sample data exists, however the drilling programme will

provide increased confidence and consist of approximately 3000

metres of drilling across the mine with primary targets including

the Signalberg mountain, White City and Snake deposits. This

drilling will supplement ongoing drilling taking place at Homestead

and Lepidolite areas where over 200 samples have so far been taken.

The new drilling programme will test total mineralisation across

the licence but predominantly focus on tantalum and lithium.

A comprehensive understanding of the mineralisation will allow

Aftan, the Company and interested global offtake parties to truly

assess the fundamental and future value of the operation, and for

the development of a long-life mine plan through extensive

satellite deposits to feed the plant. Importantly, the refurbished

and upgraded plant has been designed so it can be scaled in line

with an increased mining operation.

Operational optimisation

In line with the strategic focus on mineralisation definition

and to ensure the most effective operation of the mine, Aftan will

be significantly reducing staffing numbers at the Mine. This will

reduce mining costs and optimise the operation using a multi

skilled employee base. Aftan will continue to produce and sell its

tantalum and supply the customer who has been informed of the

strategic directional change and is keen to understand the

potential of the operation. Samples from the plant's ongoing

production will also be provided to other potential offtake

partners.

Following the newly approved water licence to acquire water from

the Orange River, delivering considerably more consistent water at

higher volumes, Aftan has initiated a tender process for laying the

pipework, with the intention of utilising solar power to drive the

system. This is a highly important licence for the operation and is

aligned with the strategic focus to define wider mineralisation

across the licence.

Larry Johnson, CEO, said:

"I am very excited about the opportunity that lies across the

entire licence and am pleased with the strategic direction we are

taking to fully understand the full potential of the deposit Kazera

owns. This will provide shareholders with full details to assess

their investment and allow the Company to realise maximum value

whilst providing highly important strategic choices."

**ENDS**

Kazera Global plc (c/o Camarco) Tel: +44 (0)203

757 4980

Larry Johnson (CEO)

finnCap (Nominated Adviser and Tel: +44 (0)207

Joint broker) 220 0500

Christopher Raggett / Scott

Mathieson / Anthony Adams (corporate

finance)

Shore Capital (Joint broker) Tel: +44 (0)207

Mark Percy / Toby Gibbs (corporate 408 4090

finance)

Jerry Keen (corporate broking)

Camarco (PR) Tel: +44 (0)203

Gordon Poole / James Crothers 757 4980

/ Monique Perks

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDBLGDUCGBBGIL

(END) Dow Jones Newswires

May 17, 2018 02:00 ET (06:00 GMT)

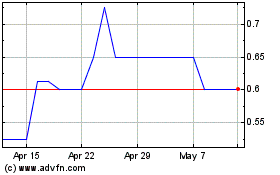

Kazera Global (LSE:KZG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kazera Global (LSE:KZG)

Historical Stock Chart

From Apr 2023 to Apr 2024