IQE PLC Acquisition Of 100% Of Csdc Private Limited ("Csdc")

October 10 2019 - 2:00AM

UK Regulatory

TIDMIQE

IQE plc

("IQE", the "Company" or the "Group")

Acquisition of 100% of CSDC Private Limited ("CSDC")

Cardiff, UK 10 October 2019: IQE plc (AIM: IQE) the leading supplier of

advanced wafer products and material solutions to the semiconductor

industry, announces the acquisition of third-party shareholdings in its

CSDC joint venture in Singapore taking its ownership to 100%.

CSDC was formed in March 2015 as a joint venture between IQE's

Singaporean subsidiary MBE Technology Pte Limited (51%), WIN

Semiconductors Corp (25%), Nanyang Technological University (18%) and

individuals of the NanYang University (6%). It was established as a

vehicle for the development and commercialisation of compound

semiconductor technologies for academic and industrial customers based

on Molecular Beam Epitaxy (MBE) technologies in Asia.

Since formation, the geo-political landscape has changed significantly.

During 2019 in particular, the localisation of Asian technology supply

chains is rapidly becoming evident and significant opportunities are

emerging for the China 5G market.

By taking the operation under 100% ownership, IQE is best placed to

1. Take the necessary steps to restructure the operation which is currently

loss-making as a result of under-utilisation of assets and property lease

obligations; and

2. Pursue Asian market sales opportunities for MBE-based products to return

the operation to profitability.

Revenue recognised by IQE and its Singaporean subsidiary will be

unaffected by the transaction. It is anticipated that post acquisition

adjusted EBITDA and adjusted Operating Profit in the consolidated group

accounts for FY19 will be adversely affected by c.GBP0.5m.

The acquisition is for a nominal fee of USD$1 to WIN Semiconductors Corp

and SGD$1 to each of the other third party shareholders, to be settled

in cash. The non-cash balance sheet impacts will be finalised as part of

the completion of acquisition accounting for the shareholdings.

For the year ended 31 December 2018, CSDC recorded net losses of

SGD$8.9m. The net liabilities attributable to CSDC as at 31 December

2018 were SGD$15.4m.

Drew Nelson will remain as a Director of CSDC and LG Yeap, General

Manager for MBE Technology Pte Limited, will become a Director of CSDC.

The acquisition constitutes a related party transaction under AIM Rule

13 by virtue of WIN Semiconductors Corp and Nanyang Technological

University being substantial shareholders in CSDC hence they are related

parties under the AIM Rules.

The directors of the Company, having consulted with Peel Hunt LLP in its

capacity as the Company's nominated adviser for the purposes of the AIM

Rules, consider the terms of the transaction to be fair and reasonable

insofar as the Company's shareholders are concerned.

Dr Drew Nelson, Chief Executive Officer of IQE, said:

"In the current geopolitical context, Singapore represents a

strategically significant site for IQE. The capabilities of the CSDC

team and skills availability in that location, coupled with proximity to

Asian chip customers and OEMs, provide a strong opportunity to

contribute to IQE's global growth opportunities. With 100% control, IQE

will be best positioned to address the current financial position and

secure the strategic direction of the operation."

CONTACTS:

IQE plc

+44 (0) 29 2083 9400

Drew Nelson

Tim Pullen

Peel Hunt LLP (Nomad and Joint Broker)

+44 (0) 20 7418 8900

Edward Knight

Nick Prowting

Christopher Golden

Citigroup Global Markets Limited (Joint Broker)

+44 (0) 20 7986 4000

Christopher Wren

Peter Catterall

Headland Consultancy (Financial PR)

+ 44 (0) 20 3805 4822

Andy Rivett-Carnac: +44 (0) 79 6899 7365

Tom James: +44 (0) 78 1859 4991

ABOUT IQE

http://iqep.com

IQE is the leading global supplier of advanced compound semiconductor

wafers that enable a diverse range of applications across:

-- handset devices

-- global telecoms infrastructure

-- connected devices

-- 3D sensing

The macro trends of 5G and connected devices are expected to drive

significant growth for compound semiconductors over the coming years.

As a scaled global epitaxy wafer manufacturer, IQE is uniquely

positioned in this market which has high barriers to entry. IQE supplies

the whole market and is agnostic to the winners and losers at chip and

OEM level. By leveraging the Group's intellectual property portfolio

including know-how and patents, it produces epitaxy wafers of superior

quality, yield and unit economics.

IQE is headquartered in Cardiff UK, and Is listed on the AIM stock

Exchange in London.

(END) Dow Jones Newswires

October 10, 2019 02:00 ET (06:00 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

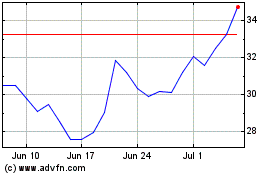

Iqe (LSE:IQE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Iqe (LSE:IQE)

Historical Stock Chart

From Apr 2023 to Apr 2024