TIDMEVG

RNS Number : 1895R

Evgen Pharma PLC

13 June 2018

For immediate release 13 June 2018

Evgen Pharma plc

("Evgen", the "Company" or the "Group")

Final Results for the year ended 31 March 2018

Evgen Pharma plc (AIM: EVG), the clinical stage drug development

company focused on the treatment of cancer and neurological

conditions, announces its final results for the year ended 31 March

2018.

Highlights

-- Interim data released from ongoing STEM (SFX-01 in the

Treatment and Evaluation of Metastatic Breast Cancer) Phase IIa

clinical study

-- 11 new sites opened for STEM trial in Spain, France, Belgium

and UK and a total of 44 patients recruited to date

-- 2 new sites opened in UK in ongoing SAS (SFX-01 After

Subarachnoid Haemorrhage) Phase IIb clinical study and 65 patients

recruited to date

-- Launch of Scientific and Medical Advisory Board ("SMAB")

with, as initial members, the sulforaphane experts Professor

Giovanni Mann, Professor of Vascular Physiology, King's College,

London, and Professor Albena Dinkova-Kostova, Professor of Chemical

Biology, University of Dundee

-- Further elucidation of SFX-01 mechanism of action in breast

cancer

-- Additional patents granted over SFX-01 including first patent

grant in Europe for SFX-01, relating to manufacturing and scale-up

processes

-- Financial performance in line with expectations:

- Total comprehensive loss of GBP2.6m (2017: loss of GBP3.1m)

- Net cash outflow of GBP0.2m (2017: outflow of GBP3.3m (before

short-term investment movements))

- Cash and short-term investments and cash on deposit at 31

March 2018 of GBP3.63m (31 March 2017: GBP3.86m)

-- Fundraising in December 2017 raised GBP2.1m after

expenses

Dr Stephen Franklin, Chief Executive Officer of Evgen Pharma,

said:

"We are very encouraged by the interim data from the STEM trial

which was announced earlier this week. Patient recruitment in both

trials is on track to report around the end of the year.

"Interest in the potential of sulforaphane continues to gain

momentum. There are now approximately 1,800 peer-reviewed

scientific publications on sulforaphane and, since the beginning of

2018, the publication rate is running at an all-time high of over

five publications per week.

"With the ongoing growth of scientific data supporting the

therapeutic potential of sulforaphane, together with the positive

progress of our Phase II trials, we remain confident in the

prospects for the Company."

Analyst meeting

A meeting for analysts will be held at 10.30am this morning, 13

June 2018, at the offices of Buchanan, 107 Cheapside, London EC2V

6DN. Please contact Buchanan on 020 7466 5000 for further

information.

An updated version of the Company's investor presentation will

be available to download at www.evgen.com from 8.00am today.

Enquiries:

Evgen Pharma plc c/o +44 (0) 20

Dr Stephen Franklin, CEO 7466 5000

Richard Moulson, CFO

www.evgen.com

Buchanan +44 (0) 20 7466

Mark Court, Sophie Wills, Tilly Abraham 5000

Northland Capital Partners Limited

Matthew Johnson, Tom Price

(Corporate Finance) +44 (0) 20 3861

John Howes, Rob Rees (Corporate Broking) 6625

WG Partners LLP +44 (0) 20 3705

Nigel Barnes, Claes Spång 9330

Notes for editors:

About Evgen Pharma plc

Evgen is a clinical stage drug development company whose lead

programmes are in breast cancer and subarachnoid haemorrhage, a

type of stroke. The Company's core technology is Sulforadex(R), a

method for synthesising and stabilising the naturally occurring

compound sulforaphane and novel proprietary analogues based on

sulforaphane. The lead product, SFX-01, is a patented composition

of synthetic sulforaphane and alpha-cyclodextrin.

Evgen commenced operations in January 2008 and has its

headquarters at The Colony, Wilmslow, Cheshire, and its registered

office is at the Liverpool Science Park, Liverpool. It joined the

AIM market of the London Stock Exchange in October 2015 and trades

under the ticker symbol EVG.

For further information, please visit: www.evgen.com

For commissioned research on the Company, please visit:

http://evgen.com/investors/analyst-coverage/

CHAIRMAN'S STATEMENT

During the past year, Evgen has focused on the clinical

development of our lead product candidate, SFX-01. We are testing

SFX-01 in two indications, metastatic breast cancer and

subarachnoid haemorrhage ("SAH"), and have now enrolled over two

thirds of the total patients in each trial. In parallel, both our

own research collaborators, and academics elsewhere, have made

considerable progress in understanding the mechanisms of action of

sulforaphane in different disease models. New collaborations were

signed with a number of partners including King's College London

and Imperial College London.

STEM is a 60 patient, Phase IIa open label study in metastatic

breast cancer being conducted across Europe. Earlier this week we

reported data from the first 20 patients to have entered the trial

and we are delighted that the product is proving to be well

tolerated with encouraging signs of anti-tumour activity.

SAS is a Phase IIb randomised, double blind, placebo-controlled

study recruiting 90 patients in SAH at three centres. Being a

blinded trial, data will become available only after recruitment is

complete. Nevertheless, we can say that SFX-01 is demonstrating a

benign safety and tolerance profile, particularly when compared

with other therapies in the breast cancer and SAH areas.

Our collaborators at the University of Manchester presented data

in January showing that SFX--01 targets cancer stem cells in

metastatic breast cancers and potently suppresses a key target

believed to account for resistance to endocrine therapy. These

findings add further support to our presumed mechanism of action

for SFX-01 in breast cancer. Furthermore, and in relation to the

mechanism of action of SFX-01 in subarachnoid haemorrhage, our CEO,

Dr Stephen Franklin was invited to, and presented at, a recent

expert meeting in Madrid which was dedicated to the Nrf2 pathway

and its role in a number of neurodegenerative diseases.

Our intellectual property ("IP") platform around sulforaphane

continues to expand and we have identified, via our collaboration

with the University of Liverpool, CSIC and the University of

Seville, a number of sulforaphane analogues which could be

developed as second-generation oncology products.

During the current financial year we expect to report final data

on both ongoing trials with the opportunity for significant

increases in the Company's valuation. We are very excited at the

prospect of demonstrating the clinical benefits of our sulforaphane

technology, with the capacity to move into pivotal clinical trials

and secure the appropriate industry partners to complete

commercialisation.

CHIEF EXECUTIVE OFFICER'S REVIEW

OPERATIONAL OVERVIEW

Evgen is developing a platform, comprising expertise,

intellectual property and clinical data, around a new class of

pharmaceuticals based on a molecule called sulforaphane.

Sulforaphane has attracted huge scientific interest and has been

shown to have anti-cancer and neuroprotective qualities in a wide

range of preclinical and clinical studies, for example breast

cancer, prostate cancer, multiple sclerosis and autism. In

particular, we are seeking to exploit sulforaphane's modulation of

two separate and unrelated mechanistic targets: Nrf2 and STAT3.

Evgen has exclusive rights to the only technology

(Sulforadex(R)) proven to synthesise this very unstable molecule in

a stabilised composition that will satisfy regulatory and medicinal

needs for a pharmaceutical and that can be used as a

therapeutic.

Evgen's first product developed using the Sulforadex(R)

technology is SFX-01; a synthetic copy of sulforaphane stabilised

within a cone-shaped sugar molecule called alphacyclodextrin.

SFX-01 has been advanced through preclinical and Phase I clinical

trials and is now in Phase II in two separate indications:

metastatic breast cancer and subarachnoid haemorrhage ("SAH").

Our assets include novel analogues of sulforaphane that have

been synthesised and have undergone a first screening, with a view

to identifying the most promising of these compounds, thereby

reinforcing our leading position in the sulforaphane field.

OBJECTIVE AND STRATEGY

Evgen's ambition is to be the world leader in sulforaphane and

sulforaphane-like compounds, establishing a leading position in

this new class of pharmaceuticals. The strategy to achieve this

objective is to:

-- continue clinical development of SFX-01 in SAH and metastatic breast cancer (see below);

-- capitalise on the broad potential of SFX-01 by appraising

and, if commercially appropriate, initiating clinical studies in

additional cancer and neurological indications;

-- support investigator-initiated studies (i.e. academic units

typically with grant funding) in new areas to increase scientific

understanding and expand the clinical applications of SFX-01 in a

cost-effective manner (see below);

-- expand our intellectual property portfolio, including

specific dose regimes, product formulations and new uses, and

composition of matter based on novel sulforaphane analogues;

-- complete one or more licensing agreements when attractive terms are achievable;

-- in due course, opportunistically diversify the product

pipeline, where the Directors believe such opportunities have a

good strategic fit.

SPONSORED PROGRAMMES

Evgen is initially focusing on demonstrating the efficacy of

SFX-01 in one oncology indication and one neurology indication to

demonstrate the potential breadth of application of SFX-01 as an

anti-cancer agent and neuroprotectant respectively:

-- STEM (SFX-01 in the Treatment and Evaluation of Metastatic

Breast Cancer), a 60 patient multi-centre trial in Europe

(including the UK); and

-- SAS (SFX-01 After Subarachnoid Haemorrhage), a 90-patient trial in the UK.

Evgen also has a clinical interest in other oncology and

neurology indications, for example prostate cancer and multiple

sclerosis.

INVESTIGATOR-INITIATED STUDIES

In addition to our core in-house programmes, we will continue to

support academic research and we will facilitate

investigator-initiated studies (completely or largely funded by the

investigator or relevant charities) to broaden the range of

applications for SFX-01 and increase our mechanistic understanding

in these different disease areas.

Currently, we are working with research groups conducting

pre-clinical work to investigate the potential of SFX-01, inter

alia, in: triple negative breast cancer (University of Manchester,

UK), prostate cancer (Tulane University, US), glioblastoma

(University of L'Aquila, Italy), osteoarthritis (RVC, University of

London, UK), ischaemic stroke and autism (both at King's College

London, UK). We are hopeful that some of these projects will

progress into clinical evaluation over the next few years.

Furthermore, we have a mechanistic collaboration with Imperial

College London (UK) and are reviewing the potential to support a

clinical trial in Non-alcoholic Fatty Liver Disease led by the

University of Dundee (UK).

PIPELINE

SFX-01 in breast cancer

Breast cancer is the biggest cause of cancer deaths in women

worldwide. In around 75% of breast cancers, the hormone oestrogen

plays a key part in tumour growth. Such tumours express the

oestrogen receptor (ER+) and, if the cancer is metastatic,

endocrine therapy is the main treatment. It is thought that hormone

independent cancer stem cells are implicated in the development of

resistance to hormone therapy and the spread of the disease by

metastases. Since 2012, Evgen has worked with University of

Manchester scientists at the Cancer Research UK Manchester

Institute and together we have generated promising data showing

SFX-01 reduces the number of cancer stem cells in patient-derived

breast cancer tissue in xenograft models. The xenograft studies

used a combination of hormone therapy and SFX-01, with the role of

SFX-01 being to target the cancer stem cell population. Crucially,

the data also showed that SFX-01 is unique, compared with existing

therapies, in deactivating phosphorylated STAT3, a key agent in

cancer proliferation and resistance to current standards of

care.

STEM is a multi-centre, Phase IIa clinical trial. Led by

Principal Investigator Dr Sacha Howell of the Christie Hospital in

Manchester, the trial will recruit 60 patients from 14 sites in the

UK, France, Spain and Belgium.

All STEM patients will have ER+ metastatic breast cancer and

will have been on treatment with either tamoxifen, aromatase

inhibitors (AI) or fulvestrant. Prior to entry to the STEM trial,

patients must have previously responded to their current hormone

therapy for at least six months but then present with progressive

disease, thereby demonstrating the start of resistance to the

hormone therapy. Once entered into the trial, patients continue to

receive their failing hormone therapy in addition to SFX-01 and

have regular scans through to week 24. Patients discontinue the

trial when one of the scans shows disease progression or at week

24.

The primary endpoints are safety/tolerability and clinical

benefit rate ("CBR") as measured by RECIST (Response Evaluation

Criteria In Solid Tumours). After 24 weeks, for responding

patients, there is a compassionate use programme that provides

continued access to SFX-01 with follow-up for safety.

On 11 June 2018 we announced an interim update on the first 20

patients to have completed the trial. In particular, that at this

interim stage, in the opinion of the Principal Investigator, Dr

Sacha Howell, and of the Company's Chief Medical Advisor:

-- SFX-01 is proving to be well tolerated with no safety concerns arising

-- SFX-01 shows encouraging early signs of anti-tumour activity:

- Four patients had their disease stabilised (that is, having

come on to the trial with progressive disease, their tumours

stopped progressing) for the full duration of the study through to,

and including, a favourable final scan result at week 24. Of these

four patients, one also had a partial response, which is a

reduction in tumour size of at least 30% on one scan

- In addition to the above four patients, a further two patients

had their disease stabilised through to, and including, the week 18

scan but then showed disease progression at the final week 24 scan.

One of these two patients also demonstrated a partial response on

one scan before disease progression was recorded at the final

scan

All patients that have a favourable week 18 scan are registered

in the compassionate use programme to ensure continuity of drug

between the final week 24 scan and the scan result, which can be

some time later. Those that have a favourable week 24 scan continue

on the programme.

Putting this interim update into a clinical context, the trial's

Principal Investigator, Dr Sacha Howell of the Christie Hospital,

Manchester, UK, said:

"The design of the STEM study, adding the drug to endocrine

therapy on which a patient's cancer was progressing, sets a high

bar for SFX-01. In light of this, these interim results are highly

encouraging. Objective responses indicate activity in this setting,

and disease stabilisation for 6-12+ months represents clinically

meaningful prolongation of response. SFX-01 is generally well

tolerated and the results together, should they look similar in the

final analysis, suggest further investigation of SFX-01 in advanced

breast cancer is warranted."

Prof Francois Duhoux, of University Clinics St-Luc, Brussels,

and the Belgium national coordinator for the trial, said:

"Six of these first 20 patients came through my clinic and I can

confirm the excellent safety profile of SFX-01. These patients have

metastatic disease and have demonstrated progression on their

endocrine therapy prior to coming on the trial, and, instead of

switching to an alternative regimen, they continued their endocrine

therapy with the addition of SFX-01. While we must of course wait

for the results of the entire study before making any definitive

judgment, in this context I think that the initial results

pertaining to efficacy are highly encouraging."

STEM remains on track to report around the end of 2018 with 14

sites having already recruited 44 patients across the UK, Belgium,

Spain and France.

The trial is registered at ClinicalTrials.gov and can be viewed

at this link:

https://clinicaltrials.gov/ct2/show/NCT02970682?term=SFX-01&rank=2

SFX-01 in subarachnoid haemorrhage

Aneurysmal SAH is a form of stroke, caused by a ruptured

aneurysm which leads to a bleed in the subarachnoid space of the

brain. It is a relatively rare condition, accounting for around 5%

of all strokes. It is fatal in approximately 50% of cases with

approximately 15% dying before they reach hospital. A delayed

cerebral ischaemia (DCI), which happens 3-14 days after the initial

haemorrhage, remains the single most important cause of morbidity

and mortality in those patients that survive the initial bleed.

Over 60% of surviving patients suffer some permanent neurological

deficit.

Nimodipine, the current standard of care, is a generic and has

been used for more than 20 years, during which time there have been

no significant clinical advances in the treatment of SAH. Whilst

SAH is relatively rare, the market potential for this devastating

condition, with its high unmet clinical need, is significant. In

October 2015, Credit Suisse estimated potential peak sales of

$1.7bn by 2032 for a Phase III development product based on the

intraventricular delivery of a nimodipine-based formulation.

SFX-01 is aimed at reducing the neurological damage associated

with the DCI via the up-regulation of the Nrf2-ARE (nuclear factor

erythroid2-related factor 2-antioxidant response element)

pathway.

Sulforaphane, the active principal in SFX-01, is a well-known

activator of the Nrf2-ARE pathway which plays a protective role in

many physiological stress processes such as inflammatory damage,

oxidative stress, and the accumulation of toxic metabolites, which

are all involved in the DCI following SAH. The trial is a

double-blind, placebo-controlled study of 90 patients; 45 receiving

nimodipine and placebo and 45 receiving nimodipine and SFX-01. The

primary endpoints are Transcranial Doppler (essentially blood flow

as measured by ultrasound through the brain's blood vessels and a

measure of the DCI), safety and pharmacokinetics.

Importantly, secondary endpoints include a cognitive measurement

of clinical improvement ("the modified Rankin Scale") assessed at

7, 28, 90 and 180 days post haemorrhage. Potential follow-on

studies would almost certainly have primary clinical endpoints

based on such clinical outcomes.

The trial is registered at ClinicalTrials.gov and can be viewed

at this link:

https://clinicaltrials.gov/ct2/show/NCT02614742?term=evgen&rank=1.

To date, 44 patients have been recruited from two UK centres:

University Hospital Southampton and the Western General Hospital in

Edinburgh. The Queen Elizabeth Hospital in Birmingham remains an

initiated site but will now unlikely recruit patients due to their

staffing restraints. However, St Bartholomew's Hospital in London

has now also been initiated and is expected to recruit its first

patient imminently. These centres are projected to be sufficient to

meet recruitment targets and we continue to anticipate the read-out

of the primary endpoints of the study around the end of calendar

year.

EARLY STAGE PIPELINE

The Group acquired exclusive worldwide rights to analogues of

sulforaphane from the University of Seville in 2015 as part of our

strategy to secure a leading position in the intellectual property

around sulforaphane--based drugs. Researchers at the University of

Liverpool have evaluated 41 analogues which represent new chemical

entities based on sulforaphane's core structure. The analogues were

assessed for their cytotoxic potential against a breast cancer cell

line and for their ability to activate Nrf2, which is considered to

have a key role in sulforaphane's mechanism of action against

neurological conditions. The research work demonstrated that 21 of

the analogues are at least twice as cytotoxic against (that is,

able to eliminate) breast cancer cells as SFX--01, with the most

potent being eight--fold more cytotoxic, and that none of the

analogues are as potent as SFX--01 as an activator of Nrf2. The

results suggest that some of the analogues merit further study as

anti--cancer agents and they also provide reassurance that SFX--01,

as a synthesised and stabilised copy of naturally occurring

sulforaphane, is the optimal sulforaphane--based active for

development in subarachnoid haemorrhage and potentially other

neurological indications.

INTELLECTUAL PROPERTY UPDATE

During, and since, the last reporting period, our IP portfolio

was further strengthened with a number of key patents being

granted.

The current status of the intellectual property portfolio is as

follows:

-- The "parent" patent application entitled "Stabilised

Sulforaphane" is granted in Australia, Canada, EU and US and

pending in Japan and Hong Kong

-- The principal manufacturing patent application, entitled

"Scale-Up Process" is granted in Australia, China, Europe, Japan

and the US and pending in Brazil and Canada

-- The patent application providing protection around novel

analogues based on sulforaphane, and entitled "Sulforaphane

Derivatives" is granted in Australia, China, Europe, Japan and the

US and pending in Canada

In summary, a large part of the current patent portfolio has now

moved to grant status.

The Company still awaits its position with regard to

compositional claims in Europe and Japan. The recent patent grant

in Europe, entitled "Stabilised Sulforaphane" was expedited to

secure additional process claims but a pending divisional

application (which will likely be examined in 2018) will determine

the extent to which compositional patent protection is secured in

the EU. Likewise, the Japanese position with regard to

compositional claims is expected in 2018.

Further patent protection is reviewed on an on-going basis, and

new applications associated with product formulation and dosing

regimens will be filed at the appropriate time.

RECENT ADVANCES IN SULFORAPHANE SCIENCE

There are now approximately 1,800 peer-reviewed scientific

journals investigating sulforaphane, in terms of its mechanism of

action and its potential therapeutic utility across a range of

diseases. In calendar-year 2017, publications reached a record 187

and this will likely be surpassed again in 2018 as the publications

count has already reached 126.

A recent publication from Mao et al (2018) further supports the

idea that sulforaphane inhibits proliferation, induces apoptosis,

and decreases the "stemness" of cancer cells through a mechanism

related to STAT3 signalling ("Sulforaphane promotes apoptosis, and

inhibits proliferation and self-renewal of nasopharyngeal cancer

cells by targeting STAT signal through miRNA-124-3p").

In the field of neurology research, a publication by Yang et al

(2018) supports the view that sulforaphane treatment may alleviate

ischaemic injuries and cognitive dysfunction ("Protective effects

of sulforaphane in experimental vascular cognitive impairment:

Contribution of the Nrf2 pathway"). They report a

sulforaphane-mediated neuroprotective effect that was associated

with an enhanced activation of Nrf2 and an upregulation of heme

oxygenase 1, resulting in reduced neuronal death and maintenance of

the integrity of the blood brain barrier.

KEY PERFORMANCE INDICATORS

Key Performance Indicators include a range of financial and

non-financial measures (such as clinical trial progress). Details

about the progress of our development programs (non-financial

measures) are included elsewhere in this Strategic Report, and

below are the other indicators (financial measures) considered

pertinent to the business.

(GBPm)

Year-end cash and short-term investments

and cash on deposit held: (2017: GBP3.9m) 3.6

--------

The reduction in year-end cash reflects working capital,

pre-clinical and clinical expenditures during the year offset

substantially by the fundraising in December 2017 which raised

GBP2.1m net of expenses.

(GBPm)

Cash flows (including short-term investments)

Net cash outflow: (2017: GBP3.3m) 0.2

--------

The net cash outflow again reflects working capital,

pre-clinical and clinical expenditures during the year offset

substantially by the fundraising completed during the year.

(GBPm)

Operating loss: (2017: GBP3.7m) 3.0

--------

The operating loss reflects pre-clinical and clinical activity

in the year and related product manufacture.

FINANCIAL REVIEW

The financial performance for the year ended 31 March 2018 was

in line with expectations.

Losses

The total loss for the year was GBP2.6m (31 March 2017: GBP3.1m)

including a charge for share-based compensation of GBP0.1m (2017:

GBP0.2m). Operating expenses excluding share-based compensation

reduced to GBP2.9m (2017: GBP3.5m) principally because the costs of

the ongoing clinical trials of SFX-01 are in part front-end loaded

due to set-up costs which were incurred in 2017, and because the

SAH clinical trial was put on temporary hold for six months during

the year.

Share-based compensation

Accounting standards require a charge to be made against the

grant of share options and recognised in the Consolidated Statement

of Comprehensive Income. This amounted to GBP0.1m (2017: GBP0.2m)

and has no impact on cash flows.

Headcount

The average headcount of the Group for the year was 9 (2017:

10).

Taxation

The Group has elected to claim research and development tax

credits under the small or medium enterprise research and

development scheme of GBP0.44m (2017: GBP0.58m). The reduction

compared with the prior year reflects lower spend on the clinical

development programmes.

Share capital

In December 2017 19,166,667 ordinary shares of 0.25p each were

issued pursuant to a placing to existing and new shareholders at

12p per share. The placing raised GBP2.3m before expenses.

A total of 837,600 ordinary shares of 0.25 pence each were

issued pursuant to exercises of share options granted under

individual share option grants. These options had an exercise

prices of 5p in respect of 628,000 options and 0.875p in respect of

209,600 options.

Cash flows and financial position

The cash position (including short-term deposits) at 31 March

2018 decreased to GBP3.6m (31 March 2017: reduced to GBP3.9m).

Continued clinical expenditure on the two phase II trials of SFX-01

and recurring general and administrative costs were partially

offset by the share placing proceeds (GBP2.1m net) and receipt of

the 2016 and 2017 tax credits (GBP0.67m).

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on Risk Management and Internal Control

and Related Financial and Business Reporting". The Directors have

prepared detailed financial forecasts and cash flows looking beyond

12 months from the date of the approval of these financial

statements. In developing these forecasts, the Directors have made

assumptions based upon their view of the current and future

economic conditions that will prevail over the forecast period.

The Directors estimate that the cash held by the Group together

with known receivables will be sufficient to support the current

level of activities to the end of December 2018. The Directors are

continuing to explore sources of finance available to the Group and

have confidence that they will be able to secure sufficient cash

inflows for the Group to continue its activities for not less than

12 months from the date of approval of these financial statements;

they have therefore prepared the financial statements on a going

concern basis. Because the additional finance is not committed at

the date of approval of these financial statements, these

circumstances represent an uncertainty as to the Group's ability to

continue as a going concern. Should the Group be unable to obtain

further finance such that the going concern basis of preparation

were no longer appropriate, adjustments would be required including

to reduce balance sheet values of assets to their recoverable

amounts, to provide for further liabilities that might arise and to

reclassify fixed assets as current assets.

PEOPLE

We were delighted to welcome Sally Ross to the senior management

team as Clinical Development Officer. Sally has a strong scientific

and regulatory background from AstraZeneca and Chiltern

International and will support us as we plan for and execute late

stage clinical trials in our lead programmes.

We have also recently established a Scientific and Medical

Advisory Board ('SMAB') to provide us with additional scientific

and clinical expertise to support our development. The first two

members are Professor Giovanni Mann, Professor of Vascular

Physiology at King's College London and Professor Albena

Dinkova-Kostova, Deputy Head of Cancer Research Division /Professor

of Chemical Biology at the University of Dundee School of Medicine.

Both have extensive experience of working with sulforaphane;

Professor Mann in looking at its action and role in neurology and

cardiovascular disease and Professor Dinkova-Kostova in relation to

cancer. Further appointments, including US-based scientists and

clinicians, will be made in due course.

We thank all our academic and clinical partners, suppliers and

staff for their continued support and enthusiasm. We would also

like to thank our investors for their continued support.

OUTLOOK

The outlook for Evgen is positive. We have two Phase II trials

of SFX-01 ongoing in different disease areas, with the potential

for differentiated product formats. Furthermore, we support

investigator-led academic studies in new disease areas and these

are generating preclinical data which may ultimately support

further trials, either of SFX-01 or novel analogues. These include

further opportunities in cancer and neurology but also in the field

of regenerative medicine. All have considerable commercial

opportunity and we look forward to the future with confidence.

Barry Clare Dr Stephen Franklin

Chairman Chief Executive

Officer

12 June 2018 12 June 2018

Consolidated Statement of Comprehensive Income

for the year ended 31 March 2018

Year Year

ended ended

31 March 31 March

2018 2017

Notes GBP'000 GBP'000

Operating expenses

------ ---------- ----------

Operating expenses (2,915) (3,449)

------ ---------- ----------

Share based compensation (111) (209)

------ ---------- ----------

Total operating expenses (3,026) (3,658)

------ ---------- ----------

Operating loss (3,026) (3,658)

------ ---------- ----------

Finance income - 17

------ ---------- ----------

Finance expense - (3)

------ ---------- ----------

Loss on ordinary activities before taxation (3,026) (3,644)

------ ---------- ----------

Taxation 443 576

------ ---------- ----------

Loss and total comprehensive expense attributable

to equity holders of the parent for the year (2,583) (3,068)

------ ---------- ----------

Loss per share attributable to equity holders

of the parent (pence) 5

------ ---------- ----------

Basic loss per share (3.28) (4.19)

------ ---------- ----------

Diluted loss per share (3.28) (4.19)

------ ---------- ----------

Consolidated Statement of Financial Position

as at 31 March 2018

Group

Notes As at As at

31 March 31 March

2018 2017

GBP'000 GBP'000

------ ---------- ----------

ASSETS

------ ---------- ----------

Non-current assets

------ ---------- ----------

Property, plant and equipment 12 11

------ ---------- ----------

Intangible assets 113 128

------ ---------- ----------

Investments in subsidiary - -

undertaking

------ ---------- ----------

Total non-current assets 125 139

------ ---------- ----------

Current assets

------ ---------- ----------

Trade and other receivables 77 84

------ ---------- ----------

Current tax receivable 432 660

------ ---------- ----------

Cash and cash equivalents 3,626 3,859

------ ---------- ----------

Total current assets 4,135 4,603

------ ---------- ----------

Total assets 4,260 4,742

------ ---------- ----------

LIABILITIES AND EQUITY

------ ---------- ----------

Current liabilities

------ ---------- ----------

Trade and other payables 389 514

------ ---------- ----------

Total current liabilities 389 514

------ ---------- ----------

Equity

------ ---------- ----------

Ordinary shares 6 233 183

------ ---------- ----------

Share premium 12,560 10,495

------ ---------- ----------

Merger reserve 2,067 2,067

------ ---------- ----------

Share based compensation 1,587 1,476

------ ---------- ----------

Retained deficit (12,576) (9,993)

------ ---------- ----------

Total equity attributable

to equity holders of the

parent 3,871 4,228

------ ---------- ----------

Total liabilities and equity 4,260 4,742

------ ---------- ----------

Consolidated Statement of Changes in Equity

for the year ended 31 March 2018

Share

Ordinary Share Merger based Retained

shares premium reserve compensation deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- -------------- --------- ---------

Balance at 31 March

2016 183 10,495 2,067 1,267 (6,925) 7,087

--------- --------- --------- -------------- --------- ---------

Total comprehensive

expense for the

period - - - - (3,068) (3,068)

--------- --------- --------- -------------- --------- ---------

Transactions with

owners

--------- --------- --------- -------------- --------- ---------

Share based compensation

--------- --------- --------- -------------- --------- ---------

- share options - - - 209 - 209

--------- --------- --------- -------------- --------- ---------

Total transactions

with owners - - 209 - 209

--------- --------- --------- -------------- --------- ---------

Balance at 31 March

2017 183 10,495 2,067 1,476 (9,993) 4,228

--------- --------- --------- -------------- --------- ---------

Total comprehensive

expense for the

period - - - - (2,583) (2,583)

--------- --------- --------- -------------- --------- ---------

Transactions with

owners

--------- --------- --------- -------------- --------- ---------

Share issue - cash 48 2,034 - - - 2,082

--------- --------- --------- -------------- --------- ---------

Share issue - options

exercised 2 31 - - - 33

--------- --------- --------- -------------- --------- ---------

Share based compensation

--------- --------- --------- -------------- --------- ---------

- share options - - - 111 - 111

--------- --------- --------- -------------- --------- ---------

Total transactions

with owners 50 2,065 - 111 - 2,226

--------- --------- --------- -------------- --------- ---------

Balance at 31 March

2018 233 12,560 2,067 1,587 (12,576) 3,871

--------- --------- --------- -------------- --------- ---------

Consolidated Statements of Cash Flows

for the year ended 31 March 2018

Group

Year Year

ended ended

31 March 31 March

2018 2017

GBP'000 GBP'000

---------- ----------

Cash flows from operating activities

---------- ----------

Loss before taxation (3,026) (3,644)

---------- ----------

Finance expense - 3

---------- ----------

Depreciation and amortisation 21 17

---------- ----------

Share based compensation 111 209

---------- ----------

(2,894) (3,415)

---------- ----------

Changes in working capital

---------- ----------

(Increase)/decrease in trade and

other receivables 7 (4)

---------- ----------

Increase/(decrease) in trade and

other payables (125) 198

---------- ----------

Cash used in operations (118) 194

---------- ----------

Taxation received 671 30

---------- ----------

Net cash used in operating activities (2,341) (3,191)

---------- ----------

Cash flows from investing activities

---------- ----------

Acquisition of intangible assets - (68)

---------- ----------

Purchase of property, plant and

equipment (7) (8)

---------- ----------

Short-term investments and cash

on deposit - 2,006

---------- ----------

Net cash (used in)/generated from

investing activities (7) 1,930

---------- ----------

Cash flows from financing activities

---------- ----------

Proceeds from issue of shares 2,333 -

---------- ----------

Issue costs (218) -

---------- ----------

Net cash generated from financing

activities 2,115 -

---------- ----------

Movements in cash and cash equivalents

in the period (233) (1,261)

---------- ----------

Cash and cash equivalents at start

of period 3,859 5,120

---------- ----------

Cash and cash equivalents at end

of period 3,626 3,859

---------- ----------

1. General information

Evgen Pharma Plc ('Evgen' or 'the Company') is a public limited

company incorporated and domiciled in England & Wales and is

admitted to trading on the AIM market of the London Stock Exchange

under the symbol EVG. The address of its registered office is

Liverpool Science Park Innovation Centre 2, 146 Brownlow Hill,

Liverpool, Merseyside L3 5RF. The principal activity of the Company

is clinical stage drug development.

2. Basis of preparation and significant accounting policies

The financial information set out herein does not constitute

statutory accounts as defined in Section 434 of the Companies Act

2006. The financial information for the year ended 31 March 2018

has been extracted from the Group's audited financial statements

which were approved by the Board of Directors on 12 June 2018 and

which, if adopted by the members at the Annual General Meeting,

will be delivered to the Registrar of Companies for England and

Wales.

The financial information for the year ended 31 March 2017 has

been extracted from the Group's audited financial statements which

were approved by the Board of Directors on 12 June 2017 and which

have been delivered to the Registrar of Companies for England and

Wales. The report of the auditor on these financial statements was

unqualified, did not contain a statement under Section 498(2) or

Section 498(3) of the Companies Act 2006, but did include a matter

to which the auditors drew attention by way of emphasis without

qualifying their report.

The report of the auditor on the 31 March 2018 financial

statements was unqualified, did not contain a statement under

Section 498(2) or Section 498(3) of the Companies Act 2006 but did

include a matter to which the auditors drew attention by way of

emphasis without qualifying their report relating to the basis of

preparation which is reproduced below:

'Material uncertainty related to going concern

We draw attention to note 2 in the financial statements

concerning the group's ability to continue as a going concern. The

going concern status of the group is dependent upon the management

of the timing of settlement of its liabilities and the raising of

further funds in the short to medium term. Forecasts prepared by

management indicate that if they are unable to manage the group's

liabilities as planned or the external fund raising does not occur

in the short to medium term they would have an immediate

requirement to seek alternative sources of funding. As stated in

note 2, these events or conditions, along with other matters set

forth in note 2, indicate that a material uncertainty exists that

may cast doubt on the group's ability to continue as a going

concern. Our opinion is not modified in respect of this

matter.'

The information included in this preliminary announcement has

been prepared on a going concern basis under the historical cost

convention, and in accordance with International Financial

Reporting Standards (IFRSs) as adopted by the EU and the

International Financial Reporting Interpretations Committee (IFRIC)

interpretations issued by the International Accounting Standards

Board ("IASB") that are effective or issued and early adopted as at

the date of these financial statements and in accordance with the

provisions of the Companies Act 2006.

The information in this preliminary statement has been extracted

from the audited financial statements for the year ended 31 March

2018 and as such, does not contain all the information required to

be disclosed in the financial statements prepared in accordance

with the International Financial Reporting Standards ('IFRS').

This announcement was approved by the board of directors and

authorised for issue on 12 June 2018.

3. Going concern

As part of their going concern review the Directors have

followed the guidelines published by the Financial Reporting

Council entitled "Guidance on Risk Management and Internal Control

and Related Financial and Business Reporting". The Directors have

prepared detailed financial forecasts and cash flows looking beyond

12 months from the date of the approval of these financial

statements. In developing these forecasts, the Directors have made

assumptions based upon their view of the current and future

economic conditions that will prevail over the forecast period.

The Directors estimate that the cash held by the Group together

with known receivables will be sufficient to support the current

level of activities to the end of December 2018. The Directors are

continuing to explore sources of finance available to the Group and

have confidence that they will be able to secure sufficient cash

inflows for the Group to continue its activities for not less than

12 months from the date of approval of these financial statements;

they have therefore prepared the financial statements on a going

concern basis. Because the additional finance is not committed at

the date of approval of these financial statements, these

circumstances represent an uncertainty as to the Group's ability to

continue as a going concern. Should the Group be unable to obtain

further finance such that the going concern basis of preparation

were no longer appropriate, adjustments would be required including

to reduce balance sheet values of assets to their recoverable

amounts, to provide for further liabilities that might arise and to

reclassify fixed assets as current assets.

4. Segmental information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker is responsible for allocating

resources and assessing performance of operating segments.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors, for the

purposes of resource allocation and assessment of performance is

based wholly on the overall activities of the Group. The Group has

therefore determined that it has only one reportable segment under

IFRS 8.

5. Loss per share

Basic loss per share is calculated by dividing the loss for the

period attributable to equity holders by the weighted average

number of ordinary shares outstanding during the year.

For diluted loss per share, the loss for the year attributable

to equity holders and the weighted average number of ordinary

shares outstanding during the year is adjusted to assume conversion

of all dilutive potential ordinary shares.

As at 31 March 2018 and 31 March 2017, the Group had no dilutive

potential ordinary shares in issue.

The calculation of the Group's basic and diluted loss per share

is based on the following data:

Year Year

ended ended

31 March 31 March

2018 2017

GBP'000 GBP'000

Loss for the year attributable to equity holders for

basic loss and adjusted for the effects of dilution (2,583) (3,068)

---------- ----------

As at As at

31 March 31 March

2018 2017

Number Number

Weighted average number of ordinary shares for basic loss

per share 78,697,455 73,153,169

----------- -----------

Effects of dilution:

----------- -----------

Share options - -

----------- -----------

Weighted average number of ordinary shares adjusted for

the effects of dilution 78,697,455 73,153,169

----------- -----------

Year Year

ended ended

31 March 31 March

2018 2017

Pence Pence

Loss per share - basic and diluted (3.28) (4.19)

---------- ----------

The loss and the weighted average number of ordinary shares for

the years ended 31 March 2018 and 2017 used for calculating the

diluted loss per share are identical to those for the basic loss

per share. This is because the outstanding share options would have

the effect of reducing the loss per ordinary share and would

therefore not be dilutive under the terms of International

Accounting Standard ("IAS") No 33.

6. Share issues

Ordinary shares

Company

Share Capital

Number GBP'000

----------- --------------

At 31 March 2017 73,272,591 183

----------- --------------

Issued on exercise of options 837,600 2

----------- --------------

Issued under placing agreement 19,166,667 48

----------- --------------

At 31 March 2018 93,276,858 233

----------- --------------

On 31 August 2017 837,600 ordinary shares were issued in

connection with the exercise of share options.

On 28 December 2017 19,166,667 ordinary shares were issued at a

price of GBP0.12 raising GBP2.3 million which after share issue

expenses of GBP0.2 million gave net consideration of GBP2.1

million.

7. Related parties

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note.

Key management compensation is disclosed in note 5 of the

consolidated financial statements. Directors' emoluments are

disclosed in the Directors' Remuneration Report.

During the year ended 31 March 2018, the Group purchased

services totalling GBP187,822 (year ended 31 March 2017:

GBP179,819) from The Clinical Trial Company Limited, a company of

which Richard Moulson, a Director, is also a Director. The amount

owed to The Clinical Trial Company Limited at 31 March 2018 was

GBP2,077 (31 March 2017: GBPnil).

During the year ended 31 March 2018, the Group purchased

consultancy services totalling GBPnil (year ended 31 March 2017:

GBP3,600) from Dr Alan Barge, a Director. The amount owed to Dr

Alan Barge at 31 March 2018 was GBPnil (31 March 2017: GBPnil).

During the year ended 31 March 2018, the Group purchased

consultancy services totalling GBP17,970 (year ended 31 March 2017:

GBPnil) from FD Consult Ltd, a company controlled by Richard

Moulson. The amount owed to FD Consult Ltd at 31 March 2018 was

GBPnil (31 March 2017: GBPnil).

During the year ended 31 March 2018, the Group was charged

monitoring and Director fees totalling GBP26,500 (year ended 31

March 2017: GBP26,500) by SPARK Impact Limited, manager of North

West Fund for Biomedical, a shareholder. The amount owed to SPARK

Impact, manager of North West Fund for Biomedical at 31 March 2018

was GBPnil (31 March 2017: GBPnil).

During the year ended 31 March 2018, the Group was charged

monitoring and Director fees totalling GBPnil (year ended 31 March

2017: GBP22,500) by Enterprise Ventures Limited, manager of Rising

Stars Growth Fund II, a shareholder. The amount owed to Enterprise

Ventures Limited, manager of Rising Stars Growth Fund II at 31

March 2018 was GBPnil (31 March 2017: GBPnil).

8. Report and accounts

A copy of the Annual Report and Accounts will shortly be sent to

all shareholders with notice of the Annual General Meeting and will

also be available to download from the Group's website at

www.evgen.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SFEESEFASEFM

(END) Dow Jones Newswires

June 13, 2018 02:00 ET (06:00 GMT)

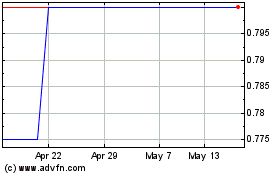

Evgen Pharma (LSE:EVG)

Historical Stock Chart

From Mar 2024 to Apr 2024

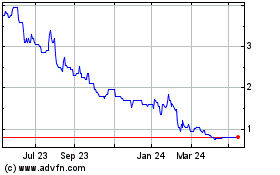

Evgen Pharma (LSE:EVG)

Historical Stock Chart

From Apr 2023 to Apr 2024