TIDMCGEO

RNS Number : 0532F

Georgia Capital PLC

12 November 2020

FINANCIAL PERFORMANCE HIGHLIGHTS (IFRS)[1]

GEL '000, unless otherwise Sep-20 Jun-20 Change Dec-19 Change

noted

Georgia Capital NAV overview

NAV per share, GEL 37.84 31.67 19.5% 46.84 -19.2%

Net Asset Value (NAV) 1,732,166 1,197,503 44.6% 1,753,868 -1.2%

Total portfolio value 2,411,271 1,826,458 32.0% 2,253,083 7.0%

Liquid assets and loans

issued 267,106 280,071 -4.6% 363,773 -26.6%

Net debt (677,865) (632,550) 7.2% (493,565) 37.3%

Georgia Capital Performance 3Q20 3Q19 Change 9M20 9M19 Change

Total portfolio value creation 452,097 (137,281) NMF (30,641) 209,302 NMF

of which, listed businesses (135,237) (174,290) -22.4% (432,982) 71,527 NMF

of which, private businesses 587,334 37,009 NMF 402,341 137,775 NMF

large portfolio companies 597,992 32,333 NMF 532,376 99,907 NMF

investment stage portfolio

companies 16,256 - NMF 78,250 - NMF

other portfolio companies (26,914) 4,676 NMF (208,285) 37,868 NMF

Investments 138,296[2] 113,413 21.9% 194,287 176,646 10.0%

Dividend income 9,972 30,609 -67.4% 14,899 86,276 -82.7%

Net income 398,032 (164,040) NMF (166,810) 141,583 NMF

Portfolio companies' performance[3] 3Q20 3Q19 Change 9M20 9M19 Change

Large portfolio companies

Revenue 303,652 299,646 1.3% 880,562 889,611 -1.0%

EBITDA 61,872 67,103 -7.8% 158,642 185,668 -14.6%

Net operating cash flow 68,573 34,194 100.5% 195,264 147,942 32.0%

Investment stage portfolio

companies

Revenue 19,164 12,559 52.6% 52,005 14,954 NMF

EBITDA 12,454 9,838 26.6% 31,721 11,322 NMF

Net operating cash flow 14,573 3,078 NMF 37,184 2,491 NMF

Total portfolio[4]

Revenue 413,715 395,106 4.7% 1,160,784 1,085,755 6.9%

EBITDA 87,062 83,310 4.5% 209,372 198,770 5.3%

Net operating cash flow 112,776 50,093 125.1% 290,728 141,015 106.2%

KEY POINTS

Ø NAV per share up 19.5% in 3Q20

o The first time valuation of GHG as a wholly owned private

company, performed by an independent valuation company, contributed

growth of 36% in NAV per share

o NAV per share was negatively impacted by valuation of our

listed asset and FX loss on GCAP net debt

Ø Solid 3Q20 results across our portfolio, with aggregated

revenues growing 4.7% y-o-y in 3Q20 (up 6.9% y-o-y in 9M20)

Ø Outstanding growth in aggregated net operating cash flow

generation, up 125.1% in 3Q20 and up 106.2% in 9M20

Ø GEL 10m dividends collected from private businesses in 3Q20

(Water Utility - GEL 5m; P&C Insurance - GEL 5m)

Ø Aggregated cash balances of portfolio companies almost doubled

in 9M20 to GEL 361m at 30-Sep-20 (GEL 282m at 30-Jun-20 and GEL

183m at 31-Dec-19)

Ø GCAP liquidity remained high at GEL 267m, down only 4.6% in

3Q20 notwithstanding US$ 9m coupon payment

VIRTUAL INVESTOR DAY 2020 WEBINAR DETAILS

An investor/analyst webinar, organised by the Group, will be

held on 12 November 2020, at 11:00 UK / 12:00 CET / 6:00 U.S

Eastern Time. 3Q20 and 9M20 results will be discussed during the

event. Please register for the webinar at Registration link .

CHAIRMAN AND CEO'S STATEMENT

Against the challenging economic backdrop created by COVID-19,

Georgia Capital's performance during the third quarter of 2020 has

been robust. This performance reflects the high level of resilience

of our private portfolio companies and continued delivery on our

strategic priorities:

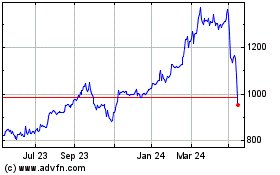

NAV per share (GEL) was up 19.5% in 3Q20 to GEL 37.84. The first

time valuation of GHG as a wholly owned private company, performed

by an independent valuation company, contributed 36% of growth to

NAV per share. This was partially offset by decreased valuation of

a listed asset and an FX loss on GCAP net debt. Overall, NAV per

share (GEL) was down 19.2% in 9M20, primarily reflecting decreased

valuations of our portfolio businesses. We believe that the GHG

valuation reflected in the 3Q20 NAV Statement reflects that the

public markets, most likely due to the relatively small size of GHG

and lack of liquidity in the trading market for its shares, were

significantly undervaluing GHG .

Our portfolio has been further strengthened. At 30-Sep-20,

following the buy-out of minority shareholders in GHG[5], 79% of

our portfolio - with a GEL 2.4 billion valuation -- is concentrated

across Bank of Georgia ("listed portfolio companies") and our

portfolio of growing, market leading, cyclically resistant private

businesses. These are Healthcare Services, Retail (pharmacy),

Insurance (P&C and Medical) and the Water Utility ("large

portfolio companies"). Renewable Energy and Education ("investment

stage portfolio companies") form a further 12% of our portfolio and

are businesses which we plan to scale up and expect will drive

value creation going forward. The remaining 9% is spread across the

five other companies in our private portfolio, which we currently

believe offer less scalable growth potential ("other portfolio

companies") as more fully described below.

Underlying operating performances across our private portfolio

remained solid. Despite COVID-19, the aggregated revenue across our

large portfolio companies increased 1.3% y-o-y in 3Q20 to GEL 303.7

million and was down by only 1% y-o-y in 9M20 to GEL 880.6 million.

Acquisitions in the investment stage portfolio companies led to

52.6% y-o-y growth in 3Q20 revenues of GEL 19.2 million (up 3.5

times y-o-y in 9M20 to GEL 52.0 million). On like-for-like

basis[6], the aggregated revenues of all businesses grew by 3% in

3Q20 and 4% in 9M20, y-o-y. The aggregated EBITDA also increased

4.5% y-o-y in 3Q20 to GEL 87.1 million (up 5.3% y-o-y to GEL 209.4

million in 9M20).

125% y-o-y growth in total net operating cash flow generation of

our portfolio in 3Q20 to GEL 113 million, reflecting strong

business growth as well as our cash preservation and accumulation

strategy (up 106% y-o-y in 9M20 to GEL 291 million). As a result,

the aggregated cash balances of our portfolio companies almost

doubled in 9M20 to GEL 361 million at 30-Sep-20 (GEL 282 million at

30-Jun-20 and GEL 183 million at 31-Dec-19).

GCAP's liquidity remained high. During 3Q20 we collected GEL 10

million dividends from our private portfolio companies and our

liquidity reduced only 4.6%, to GEL 267 million, notwithstanding

US$ 9 million coupon payment. During 3Q20, our only material

investment was the buy-out of minority shareholders in GHG, in

exchange for newly issued CGEO shares valued at GEL 138

million.

From a macro-economic perspective, Georgia's response to the

virus outbreak was rapid, with swift containment measures proving

critical in ensuring that Georgia emerged as one of the least

affected countries in Europe. While COVID-19 cases have accelerated

since September, Georgia maintains a relatively low number of

confirmed cases and deaths per capita. Georgia is expected to be

less significantly impacted compared to other tourism dependent

countries, with 5% GDP contraction forecasted by the IMF, followed

by a 5% rebound in 2021. Since the gradual lifting of a full

lockdown which lasted Mar-July, the economy has demonstrated an

ongoing gradual recovery, with real GDP growth improving every

month since the April's low of negative 16.6% y-o-y, to negative

0.7% in September (negative 5.0% y-o-y in 9M20). The recovery has

been aided by sound economic policies and international support, as

well as by diversified foreign currency inflows with record levels

of remittances (up 6.2% y-o-y in 9M20 and 23.6% y-o-y in the last

four months of Jun-Sep). The recovery was also supported by an

adjustment in external trade, with merchandise exports returning to

positive growth of 8.6% in September, and the trade deficit

reducing by $750 million, y-o-y. The Georgian Lari performed

relatively well compared to other regional currencies, aided by

more than US$ 700 million FX interventions, significant trade

adjustments and solid official reserve assets reaching US$ 3.8

billion in September (up by 4.5% y-o-y).

Despite the recent increase in COVID-19 cases, the economy

remains open and, with the exception of the hospitality and

education businesses, most of our portfolio businesses remain

largely unaffected. I am impressed by the management teams in our

portfolio companies and the way in which they have handled this

challenging year. However, the recent increases in COVID-19 cases

have created renewed uncertainty, which could affect the pace of

the expected economic recovery. While the range of possible

outcomes remains, given our strong balance sheet and, in

particular, our resilient portfolio, we are well placed to deliver

continued NAV per share growth in the upcoming quarters.

Irakli Gilauri, Chairman and CEO

DISCUSSION OF GROUP RESULTS

The discussion below analyses the Group's net asset value at

30-Sep-20 and its income for the third quarter and nine month

period then ended on an IFRS basis (see "Basis of Presentation" on

page 21 below).

Net Asset Value (NAV) Statement (IFRS)

NAV statement summarises the Group's IFRS equity value (which we

refer to as Net Asset Value or NAV in the NAV Statement below) at

the opening and closing dates (30-Jun-20 and 30-Sep-20). The NAV

Statement below, as included in the notes to the IFRS financial

statements, breaks down NAV into its components and provides a roll

forward of the related changes between the reporting periods. For

the NAV Statement for the nine months of 2020, see page 19.

Revised NAV format overview

The valuation methodology of the investments together with the

methodology underlying the preparation of the NAV Statement is

unchanged from 31 December 2019 as included in 2019 Annual Report,

except that valuation assessment of GHG businesses was performed by

an independent valuation company. With the completion of a

recommended share exchange offer for GHG shareholders in 3Q20 and

its de-listing in August, Georgia Capital acquired the 29.4%

remaining equity stake in previously separately listed GHG (the

"GHG Buy-out"), adding three private businesses to its private

portfolio (healthcare services, retail (pharmacy) and medical

insurance).

Following the GHG Buy-out, as discussed in CEO & Chairman

Statement above, we have adapted the structure of our management

and internal reporting for our private portfolio businesses, and

going forward for reporting purposes we are dividing those

businesses into three categories: large, investment stage and other

portfolio companies. Previously, the private portfolio was

presented across the late stage (Water Utility, Housing

Development, P&C Insurance), early stage (Renewable Energy,

Hospitality and Commercial Real Estate, Education, Beverages) and

pipeline (Auto Service, Digital Services) businesses. The NAV

statement below reflects the revised portfolio breakdown, in which

the Housing Development, Hospitality and Commercial Real Estate,

Beverages, Auto Service and Digital Services businesses are now

included in the "other" category.

NAV STATEMENT 3Q20

GEL '000, Jun-20 1. Value 2a. 2b. 2c. 2d. 3.Operating 4. Sep-20 Change

unless creation Investment Buyback Dividend GHG expenses Liquidity/ %

otherwise ([7]) de-listing[8] FX/Other

noted

----------- ---------- ----------- -------- --------- -------------- ------------ ----------- --------

Listed

Portfolio

Companies

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Georgia

Healthcare

Group (GHG) 335,667 (100,935) 138,265 - - (372,997) - - - -100.0%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Bank of

Georgia

(BoG) 394,402 (34,302) - - - - - - 360,100 -8.7%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Total Listed

Portfolio

Value 730,069 (135,237) 138,265 - - (372,997) - - 360,100 -50.7%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Listed

Portfolio

value change

% -18.5% 18.9% 0.0% 0.0% -51.1% 0.0% 0.0% -50.7%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Private

Portfolio

Companies

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Large

Companies 584,360 597,992 - - (9,972) 372,997 - 441 1,545,818 NMF

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Healthcare

Services - 295,641 - - - 177,859 - - 473,500 100.0%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Retail

(Pharmacy) - 296,577 - - - 178,423 - - 475,000 100.0%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Water Utility 438,989 (22,117) - - (5,000) - - 441 412,313 -6.1%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Insurance (P&C

and

Medical) 145,371 27,891 - - (4,972) 16,715 - - 185,005 27.3%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Of which,

P&C

Insurance 145,371 106 - - (4,972) - - - 140,505 -3.3%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Of which,

Medical

Insurance - 27,785 - - - 16,715 - - 44,500 100.0%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Investment

Stage

Companies 265,446 16,256 31 - - - - 442 282,175 6.3%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Renewable

Energy 184,717 16,338 - - - - - 442 201,497 9.1%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

-0

Education 80,729 (82) 31 - - - - - 80,678 . 1%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Other

Companies 246,583 (26,914) - - - - - 3,509 223,178 -9.5%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Total Private

Portfolio

Value 1,096,389 587,334 31 - (9,972) 372,997 - 4,392 2,051,171 87.1%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Private

Portfolio

value change

% 53.6% 0.0% 0.0% -0.9% 34.0% 0.0% 0.4% 87.1%

=============== ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Total

Portfolio 32.0

Value (1) 1,826,458 452,097 138,296 - (9,972) - - 4,392 2,411,271 %

=============== ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Total

Portfolio

value change

% 24.8% 7.6% 0.0% -0.5% 0.0% 0.0% 0.2% 32.0%

=============== ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

7.2

Net Debt (2) (632,550) - (631) (287) 9,972 - (5,241) (49,128) (677,865) %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

of which,

Cash

and liquid 11.6

funds 146,730 - (631) (287) 9,972 - (5,241) 13,190 163,733 %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

of which,

Loans -22.5

issued 133,341 - - - - - - (29,968) 103,373 %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

of which,

Gross 3.5

Debt (912,621) - - - - - - (32,350) (944,971) %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Net other

assets/

(liabilities)

(3) 3,595 - 600 287 - - (3,207) (2,515) (1,240) NMF

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

of which,

share-based

comp. - - - - - - (3,207) 3,207 - NMF

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Net Asset

Value 4 4.6

(1)+(2)+(3) 1,197,503 452,097 138,265 - - - (8,448) (47,251) 1,732,166 %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

NAV change % 37.8% 11.5% 0.0% 0.0% 0.0% -0.7% -3.9% 44.6%

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Shares 21.1

outstanding 37,811,929 - 7,734,010 - - - - 226,608 45,772,547 %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

Net Asset

Value

per share, 19.5

GEL 31.67 11.96 (2.34) - - - (0.22) (3.23) 37.84 %

=============== =========== ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

NAV per share,

GEL

change % 37.8% -7.4% 0.0% 0.0% 0.0% -0.7% -10.2% 19.5%

--------------- ----------- ---------- ----------- -------- --------- -------------- ------------ ----------- ----------- --------

NAV per share (GEL) was up by 19.5% in 3Q20, mainly reflecting

the minority Buy-out and subsequent revaluation of GHG. As such,

and following the GHG becoming a private company, it is now valued

together with the rest of our private portfolio:

Ø The valuation and Buy-out of GHG had an aggregate 36.0% impact

on the NAV per share in 3Q20, which was partially offset by the

negative impact of COVID-19 on the valuations of our

businesses.

Ø Reduced valuation of BoG had a -2.9% impact on the NAV per

share, while valuations also declined across our private businesses

(-2.7% impact on the NAV per share).

Ø The NAV per share was further impacted by GEL depreciation

against USD by 4.9%, resulting in a foreign exchange loss of GEL 35

million on GCAP net debt (-2.9% impact).

Portfolio overview

Our portfolio value increased by 32.0% to GEL 2.4 billion in

3Q20, reflecting a 50.7% decline and 87.1% growth in the value of

listed and private businesses, respectively. The value of our

investment in the listed assets decreased by GEL 370 million during

3Q20 mainly reflecting the de-listing and transfer of GHG to the

private portfolio. The market value of our 100% holding in GHG was

GEL 373 million on the de-listing date of 5-Aug-20 ("cost of GHG

investment" or "cost"). The value of our private portfolio

companies increased by GEL 955 million in 3Q20 reflecting the

transfer of GHG at GEL 373 million cost, addition of GEL 587

million due to value creation and decrease of GEL 10 million due to

dividends received from portfolio companies.

1) GHG minority Buy-out and de-listing

Following the completion of the GHG Buy-out in 3Q20, GCAP's

holding increased in GHG from 70.6% to 100% in exchange for 7.7

million CGEO share issuance. Our 70.6% equity stake in GHG had a

market value of GEL 336 million at 30-Jun-20 based on the LSE

closing price, increasing to GEL 474 million following the exchange

of newly issued CGEO shares into GHG shares valued at GEL 138

million. Cancellation of listing and trading of GHG shares took

effect on 5-Aug-20, when GHG's share price was down by 26.1% to GBP

0.708 from 30-Jun-20. As a result, the market value of our 100%

holding in GHG decreased by GEL 101 million to GEL 373 million as

of the date of de-listing. Following de-listing, GHG was

transferred to the private portfolio as three separate businesses:

Healthcare Services (hospitals, clinics, diagnostics), Retail

(pharmacy) and Medical Insurance. All three businesses were valued

in line with our methodology for valuation of private businesses.

In order to provide additional transparency to our valuations, we

hired an independent valuation company, to perform a valuation

assessment of each of GHG's businesses as further described on page

5.

2) Value creation

The negative value creation on listed assets was GEL 135

million, of which GEL 101 million was driven by negative value

creation on our 100% holding in GHG before de-listing and GEL 34

million by a 16.5% decrease in BoG share price in 3Q20 to GBP 8.93.

The value creation of GEL 587 million on the private portfolio

reflects: a) the first time valuation of GHG following Buy-out (GEL

620.0 million value creation); b) the 28.3 million operating

performance-related decrease in the value of our private assets

excluding GHG, primarily reflecting the negative impact of COVID-19

on LTM earnings; and c) GEL 4.3 million impact from negative

movements in valuation multiples and foreign currency exchange

rates, the later leading to net debt widening.

The table below summarises value creation drivers in our

businesses in 3Q20:

Portfolio Businesses Operating Performance Greenfields / buy-outs Multiple Change Value Creation

([9]) ([10]) and FX ([11])

--------------------------- -------------------------- -------------------------- ---------------- ---------------

GEL '000 (1) (2) (3) (1)+(2)+(3)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Listed (135,237)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

GHG (100,935)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

BoG (34,302)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Private ( 28,336 ) 620 , 003 ( 4,333 ) 587 , 334

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Large Portfolio Companies (12,3 08 ) 620 , 003 (9, 703 ) 597 , 992

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Healthcare Services - 295 , 641 - 295 , 641

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Retail (pharmacy) - 296 , 577 - 296 , 577

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Water Utility (6,963) - (15,154) (22,117)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Insurance (P&C and

Medical) (5,3 45 ) 27 , 785 5 , 451 27 , 891

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Of which, P&C Insurance (5,3 45 ) - 5 , 451 106

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Of which, Medical

Insurance - 27 , 785 - 27 , 785

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Investment Stage Portfolio

Companies 11 , 586 - 4 , 670 16 , 256

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Renewable Energy 11 , 668 - 4 , 670 16 , 338

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Education (82) - - (82)

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Other ( 27,614 ) - 700 ( 26,914 )

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Total portfolio (28,336) 620,003 (4,333) 452,097

--------------------------- -------------------------- -------------------------- ---------------- ---------------

Listed businesses (14.9% of total portfolio value)

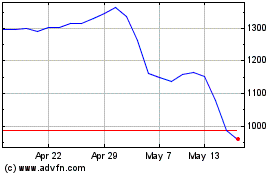

BOG ( 14.9% of total portfolio value) - Despite the COVID-19

outbreak, BoG managed to deliver an annualised ROAE of 21.8% in

2Q20. BOG's share price, along with other banks, decreased in 3Q20

by 16.5% to GBP 8.93 at 30-Sep-20 and, as a result, the market

value of our equity stake in BOG decreased by GEL 34 million. BoG

is expected to host a virtual investor day and provide an update on

strategy and performance on 17 November 2020. BoG's public

announcement on 3Q20 and 9M20 results will also be available on the

same date at https://bankofgeorgiagroup.com/results/earnings .

Private large portfolio companies (64.1% of total portfolio

value)

Healthcare Services (19.6% of total portfolio value) -

Healthcare Services business, managed by GHG, comprises three

segments: hospitals, clinics and diagnostics. The independent

valuation company estimated the fair value range of the business by

applying an income approach (DCF) and a market approach (listed

peer multiples and precedent transactions).The estimated fair value

range was similar under each valuation approach. The valuation was

performed as of 30-Jun-20 and is expected to be updated on a

semi-annual basis by the external valuation company going forward.

The implied LTM EV/EBITDA valuation multiple as of 30-Jun-20 was

12.2x including the impact of IFRS 16. Fair value was assessed at

GEL 474 million as of 30-Jun-20, as compared to the value of GEL

178 million allocated to Healthcare Services following the

de-listing.[12] As a result, a GEL 296 million value uplift was

recorded from the first-time valuation of the business following

the GHG Buy-out.

Retail (pharmacy) (19.7% of total portfolio value) - The

business consists of a retail pharmacy chain and a wholesale

business, selling pharmaceuticals and medical supplies. GCAP owns

67% of the business through GHG and the balance is owned by two

individual managing partners. The independent valuation company

applied a similar valuation approach as for Healthcare Services.

The implied LTM EV/EBITDA valuation multiple as of 30-Jun-20 was

8.7x including the impact of IFRS 16. The fair value of GCAP's

holding was assessed at GEL 475 million as of 30-Jun-20 from what

were again broadly similar ranges that resulted from each applied

valuation approach. Allocated value for the business following the

GHG Buy-out was GEL 178 million,(12) resulting in GEL 297 million

value creation.

Water Utility (17.1% of total portfolio value) - Water Utility's

3Q20 performance reflects the decreased consumption of water during

lower economic activity during the COVID-19 pandemic and a decrease

in energy revenues due to lower water inflows at Zhinvali

reservoir. Decreased consumption of water by legal entities led to

a 6.8% y-o-y decline in 3Q20 water supply revenues to GEL 35.7

million. However, according to the tariff setting methodology,

volume risk does not stay with the company and unearned revenues in

the current regulatory period (2018-2020) will be reimbursed

through tariff revision in the upcoming regulatory period,

effective from 1-Jan-21. As such, Water Utility's multiple-based

valuation, also validated against internally run DCF valuation,

implies a 10.0x multiple based on LTM EBITDA of GEL 84.6 million at

30-Jun-20. Negative value creation was GEL 22 million in 3Q20,

predominantly reflecting the foreign exchange losses on Water

Utility's borrowings.

Insurance (P&C and Medical) (7.7% of total portfolio value)

-The insurance business combines: a) P&C Insurance valued at

GEL 140.5 million and b) the newly added medical insurance business

acquired as part of the GHG transaction, valued at GEL 44.5

million.

P&C Insurance saw a 7% decrease in LTM net income in 3Q20

which led to a GEL 10.3 million decrease in equity value, but was

fully offset by the GEL 5.4 million impact of multiple growth (up

from 8.0x to 8.3x) and a GEL 5 million dividend payment. The result

was GEL 0.1 million value creation. The negative impact of COVID-19

on the business was relatively well-contained, and mainly affected

the compulsory border third-party insurance line.

Medical Insurance was valued externally, similar to healthcare

services and retail (pharmacy) businesses. The implied LTM P/E

valuation multiple as of 30-Jun-20 was 8.0x. Fair value was

assessed at GEL 44.5 million as of 30-Jun-20, as compared to the

allocated value of GEL 16.7 million following de-listing,(12)

resulting in GEL 27.8 million value creation.

Private investment stage businesses (11.7% of total portfolio

value)

Renewable Energy (8.4% of total portfolio value) - The strong

performance of Qartli Wind farm in 3Q20 led to an increase in the

related run-rate EBITDA earnings used for valuation as of

30-Jun-20. 9M20 EBITDA for Qartli wind farm was already GEL 11.2

million, and therefore the run-rate EBITDA was revised from GEL 12

million at 30-Jun-20 to GEL 14 million as of 30-Sep-20. As a

result, operating performance-related growth in the value of the

business was GEL 12 million. The valuation was also favorably

impacted by FX movements, since Renewable Energy's revenues are

fully denominated in US$ dollars. Accordingly, GEL 16 million value

was created in 3Q20, which led to the fair value increasing to GEL

201 million. Investments in our pipeline renewable energy projects

and Mestiachala HPPs continued to be measured at equity investment

cost of GEL 109 million in aggregate. At 30-Sep-20, total

enterprise value (EV) and net debt was GEL 478 million and GEL 277

million in the renewable energy business, respectively. The

distribution of EV and net debt by projects was as follows: GEL 444

million and GEL 282 million in all operating assets, of which, GEL

187 million and GEL 117 million in Mestiachala HPPs.

Education (3.3% of total portfolio value) - The third quarter is

characterized as being the slowest quarter for the education

business, given that the schools are not operational in Jul-Aug due

to holidays. The valuations multiple, LTM EBITDA earnings and

assigned equity value remained all largely unchanged in 3Q20. In

September 2020, all of our schools resumed operations, providing

on-campus teaching for learners below 7(th) grade and distance

teaching for the remaining grades due to COVID-19.

Other businesses (9.3% of total portfolio value)

Value creation in the other portfolio was negative GEL 27

million in our other private businesses in 3Q20, with the decrease

in the value primarily reflecting the negative impact of COVID-19

on LTM earnings.

The f ive businesses in our "other" private portfolio are

Housing Development, Hospitality and Commercial Real Estate,

Beverages, Auto Service and Digital Services. They had a combined

value of GEL 223.2 million at 30-Sep-20, which represented only

9.3% of our total portfolio. We currently believe these businesses

offer less scalable growth potential than our large and investment

stage companies. Going forward we will comment on key developments

in this portfolio that affect the aggregate value creation, and

absent a development material to the aggregate portfolio value, a

divestment or a change in our view of the growth potential of one

of the companies in this portfolio, will not comment on individual

businesses or their performance.

3) Investments

During the pandemic we implemented a cash accumulation and

preservation strategy and put our capital allocations on hold and

expect to make only limited investments until the end of 2020.

During 3Q20, our only material investment was related to the

Buy-out of the minority shareholders in GHG. This was paid for by

the exchange of newly issued CGEO shares into GHG shares valued at

GEL 138 million.

4) Dividends

In 3Q20, Georgia Capital collected GEL 10 million dividends in

aggregate from Water Utility and P&C Insurance, each providing

GEL 5 million (GEL 15 million dividend income in 9M20 includes GEL

5 million received from Renewable Energy in 1Q20). We expect

further dividend inflows of GEL 15 million in 4Q20, resulting in

aggregate GEL 30 million dividend income in 2020 from our private

portfolio companies.

Valuations of our holdings in portfolio companies reflecting

value creation and capital allocation activities discussed above

are summarized in the following table:

Amounts in GEL Valuation method 30-Sep-20 30-Jun-20 Change Change % share

'000 % in total

portfolio

----------- ---------- ---------- ------- -----------

Listed portfolio 360 730

(1) , 100 , 069 (369,969) -50.7% 14.9%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

335

GHG Public markets - , 667 (335,667) -100% -

---------------------- ----------------------------- ----------- ---------- ---------- ------- -----------

360 394

BoG Public markets , 100 , 402 (34,302) -8.7% 14.9%

---------------------- ----------------------------- ----------- ---------- ---------- ------- -----------

1 ,

Private portfolio 2 , 096

(2)=(a)+(b)+(c) 051,171 , 389 954,782 87.1% 85.1%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

1 ,

Large portfolio 545 584

companies (a) , 818 , 360 961,458 NMF 64.1%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

473

Healthcare Services Valued externally , 500 - 473,500 100.0% 19.6%

475

Retail (pharmacy) Valued externally , 000 - 475,000 100.0% 19.7%

412 438

Water Utility EV/EBITDA (LTM) , 313[13] , 989 (26,676) -6.1% 17.1%

Insurance (P&C 185 145

and Medical) , 005 , 371 39,634 27.3% 7.7%

Of which, P&C

Insurance P/E (LTM) 140,505 145,371 (4,866) -3.3% 5.8%

Of which, Medical

Insurance Valued externally 44,500 - 44,500 100% 1.8%

---------------------- ----------------------------- ----------- ---------- ---------- ------- -----------

Investment stage

portfolio companies 282 265

(b) , 175 , 446 16,729 6.3% 11.7%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

Sum of the parts

(EV/EBITDA and acquisition 201 184

Renewable Energy price) , 497 , 717 16,780 9.1% 8.4%

80 , 80 ,

Education EV/EBITDA (LTM) 678 729 (51) -0.1% 3.3%

---------------------- ----------------------------- ----------- ---------- ---------- ------- -----------

223 246

Other (c) , 178 , 583 (23,405) -9.5% 9.3%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

2 , 1 ,

Total portfolio 411 826

value (3)=(1)+(2) , 271 , 458 584,813 32.0% 100%

----------------------------------------------------- ----------- ---------- ---------- ------- -----------

Net debt overview

Net debt increased by GEL 45 million to GEL 678 million in 3Q20,

with the increase being driven primarily by a foreign exchange loss

of GEL 35 million. GCAP cash operating expenses of GEL 5 million,

net interest expense and fair value gains on liquid funds of GEL 10

million also contributed to the widening of net debt, partially

offset by GEL 10 million dividends received from portfolio

companies. Below we describe the components of net debt as at 30

September 2020 and at 30 June 2020:

30-Sep-20 30-Jun-20 Change

Cash at banks 138,941 85,667 62.2%

Internationally listed debt securities 24,138 43,812 -44.9%

Locally listed debt securities 654 17,251 -96.2%

Loans issued 103,373 133,341 -22.5%

Total Cash and liquid funds (a) 267,106 280,071 -4.6%

Gross Debt (b) (944,971) (912,621) 3.5%

Net debt (a)+(b) (677,865) (632,550) 7.2%

Cash and liquid funds . At 30 September 2020, cash and liquid

funds were allocated mostly in cash, internationally listed debt

securities and loans issued. Internationally listed debt securities

include Eurobonds issued by Georgian corporates. The issued loan

balance primarily refers to loans issued to portfolio companies,

which are on-lent at market terms. During 3Q20, we collected GEL 40

million (US$ 13 million) net cash from the repayment of a loan

issued to Renewable Energy, refinanced by the proceeds raised from

the Green Bond issuance in Jul-20. As a result, the issued loan

balance decreased by 22.5% in 3Q20.

In 3Q20, GCAP increased its cash balance by 62.2% to GEL 139

million (US$ 43 million) on the back of loan repayments and

dividend inflows from private portfolio companies. GCAP's

liquidity, inclusive of issued loans, remained high at GEL 267

million (US$ 83 million).

Gross debt At 30-Sep-20 the outstanding balance of US$ 300

million six-year Eurobonds due in March 2024 was GEL 945 million,

reflecting foreign exchange loss of GEL 44 million from GEL

depreciation against USD during 3Q20 ([14]) . Gross debt balance

further increased by a GEL 16 million coupon accrual(14) , which

was offset by a GEL 28 million coupon payment(14) in 3Q20.

INCOME STATEMENT (ADJUSTED IFRS)

Net income under IFRS was GEL 404.9 million in 3Q20 (net loss of

GEL 149.6 million in 9M20). The IFRS income statement is prepared

on the Georgia Capital PLC level and the results of all operations

of the Georgian holding company JSC Georgia Capital are presented

as one line item. As we conduct most of our operations through JSC

Georgia Capital, through which we hold our portfolio companies, the

IFRS results provide little transparency on the underlying

trends.

Accordingly, to enable a more granular analysis of those trends,

the following adjusted income statement presents the Group's

results of operations for the period ending September 30 as an

aggregation of (i) the results of GCAP (the two holding companies

Georgia Capital PLC and JSC Georgia Capital, taken together) and

(ii) the fair value change in the value of portfolio companies

during the reporting period. For details on the methodology

underlying the preparation of the adjusted income statement, please

refer to page 90 in Georgia Capital PLC 2019 Annual report. A full

reconciliation of the adjusted income statement to the IFRS income

statement is provided on page 18.

INCOME STATEMENT (Adjusted IFRS)

GEL '000, unless otherwise noted 3Q20 3Q19 Change 9M20 9M19 Change

---------- ---------- ------- ---------- --------- -------

Dividend income 9,972 30,609 -67.4% 14,899 86,276 -82.7%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Interest income 4,834 9,529 -49.3% 16,650 31,397 -47.0%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Realised / unrealised (loss)/ gain on liquid funds 475 654 -27.4% (4,103) 5,951 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Interest expense (15,762) (14,569) 8.2% (45,941) (40,461) 13.5%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Gross operating (loss)/income (481) 26,223 NMF (18,495) 83,163 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Operating expenses (8,448) (8,751) -3.5% (23,027) (25,359) -9.2%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

GCAP net operating (loss)/income (8,929) 17,472 NMF (41,522) 57,804 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Fair value changes of portfolio companies

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Listed portfolio companies (135,237) (174,290) -22.4% (432,982) 42,595 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Georgia Healthcare Group PLC (100,935) (115,767) -12.8% (195,347) 25,314 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Bank of Georgia Group PLC (34,302) (58,523) -41.4% (237,635) 17,281 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Private portfolio companies 577,362 6,400 NMF 387,442 80,431 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Large Portfolio Companies 588,020 32,333 NMF 522,404 91,907 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Healthcare Services 295,641 - NMF 295,641 - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Retail (pharmacy) 296,577 - NMF 296,577 - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Water Utility (27,117) 33,913 NMF (73,181) 62,602 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Insurance (P&C and Medical) 22,919 (1,580) NMF 3,367 29,305 -88.5%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Investment Stage Portfolio Companies 16,256 - NMF 73,323 - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Renewable energy 16,338 - NMF 49,058 - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Of which, Education (82) - NMF 24,265 - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Other businesses (26,914) (25,933) 3.8% (208,285) (11,476) NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Total investment return 442,125 (167,890) NMF (45,540) 123,026 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

(Loss)/Income before foreign exchange movements and

non-recurring expenses 433,196 (150,418) NMF (87,062) 180,830 NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Net foreign currency loss (35,164) (13,622) NMF (76,526) (39,247) 95.0%

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Non-recurring expenses - - NMF (3,222) - NMF

----------------------------------------------------- ---------- ---------- ------- ---------- --------- -------

Net (loss)/Income (adjusted IFRS) 3 98,032 (164,040) NMF (166,810) 141,583 NMF

===================================================== ========== ========== ======= ========== ========= =======

3Q20 and 9M20 Gross operating loss of GEL 8.9 million and GEL

41.5 million mainly reflect decreased dividend inflows due to

COVID-19 related uncertainties. Further the decrease in the average

balance of liquid funds led to decreased interest income in both

periods, down 49.3% to GEL 4.8 million in 3Q20 and down 47.0% in

9M20 to GEL 16.7 million. GCAP earned an average yield of 7.1% on

the average balance of liquid assets and issued loans of GEL 301.5

million in 9M20 (8.0% on GEL 547.7 million in 9M19). The coupon on

the 6-year US$ 300 million bond, issued in Mar-18, is 6.125%. As a

result, net interest expense was GEL 10.9 million and GEL 29.3

million in 3Q20 and 9M20 at GCAP level, respectively (GEL 5.0

million in 3Q19 and GEL 9.1 million in 9M20).

GCAP management fee expenses have a self-targeted cap of 2% of

Georgia Capital's market capitalisation. The LTM management fee

expense ratio was 2.3% at 30-Sep-20 (up from 1.7% as of 30-Sep-19).

The total LTM operating expense ratio (which includes fund type

expenses) was 3.2% at 30-Sep-20 (up from 2.2% as of 30-Sep-19). The

expense ratio reflects the negative impact of COVID-19 on Georgia

Capital PLC's share price. The components of GCAP's operating

expenses are presented in the table below:

GEL '000, unless otherwise noted 3Q20 3Q19 Change 9M20 9M19 Change

Administrative expenses ([15]) (2,634) (2,678) -1.6% (7,543) (8,154) -7.5%

Management expenses - cash-based ([16]) (2,607) (2,160) 20.7% (6,009) (6,251) -3.9%

Management expenses - share-based ([17]) (3,207) (3,913) -18.0% (9,475) (10,954) -13.5%

Total operating expenses (8,448) (8,751) -3.5% (23,027) (25,359) -9.2%

Of which, fund type expense ([18]) (2,594) (2,209) 17.4% (7,117) (6,273) 13.5%

Of which, management fee ([19]) (5,854) (6,542) -10.5% (15,910) (19,086) -16.6%

Total investment return represents the increase (decrease) in

the fair value of our portfolio. Total investment return was GEL

442.1 million in 3Q20, reflecting the first time valuation of GHG

businesses following the Offer, as described earlier in this

report. Total investment return was negative GEL 45.5 million in

9M20, mainly reflecting the negative impact of COVID-19 on our

listed asset prices and other private assets, primarily on the

hospitality and commercial Real Estate business. We discuss

valuation drivers for our businesses on pages 4-5. The performance

of each of our private large and investment stage portfolio

companies is discussed on pages 8-17. Total investment return of

GEL 442.1 million and dividend income of GEL 10.0 million together

led to GEL 452.1 million value creation in 3Q20 as presented in the

NAV statement on page 3.

The Group's net income (adjusted IFRS) is then driven by net

foreign currency loss, reflecting the impact of GEL devaluation

against the US dollar on GCAP's net foreign currency liability

balance amounting to c. US$ 218 million (GEL 699 million) at

30-Sep-20. Net foreign currency loss was GEL 35.2 million and GEL

76.5 million, respectively, in 3Q20 and 9M20. As a result of the

movements described above, GCAP's adjusted IFRS net income was GEL

398.0 million in 3Q20 and net loss was GEL 166.8 million in 9M20.

See page 18 for a reconciliation to the IFRS figures presented

above.

DISCUSSION OF PORTFOLIO COMPANIES' RESULTS (STAND-ALONE

IFRS)

The following sections present the IFRS results and business

development derived from the individual portfolio company's IFRS

accounts for large and investment stage entities. We present key

IFRS financial highlights, operating metrics and ratios along with

the commentary explaining the developments behind the numbers. For

the majority of our portfolio companies the fair value of our

equity investment is determined by the application of a listed peer

group earnings multiples to the trailing twelve months (LTM)

stand-alone IFRS earnings of the relevant business. As such, the

stand-alone IFRS results and developments driving the IFRS earnings

of our portfolio companies are key drivers of their valuations

within GCAP's financial statements. See "Basis of Presentation" for

more background on page 21.

LARGE PORTFOLIO COMPANIES

Discussion of Healthcare Services Business Results

Healthcare Services business, owned through GHG, is the largest

healthcare market participant in Georgia, accounting for 20% of the

country's total hospital bed capacity as of 30-Sep-20. Healthcare

services business comprises three segments: 1) Hospitals (17

referral hospitals with a total of 2,596 beds) providing secondary

and tertiary level healthcare services; 2) Clinics: 19 community

clinics with 353 beds (providing outpatient and basic inpatient

healthcare services) and 15 polyclinics (providing outpatient

diagnostic and treatment services); 3) Diagnostics, operating the

largest laboratory in the entire Caucasus region - "Mega Lab". As

of 30-Sep-20, the healthcare services business is 100% owned by

Georgia Capital (30-Jun-20: 70.6%).

3Q20 & 9M20 performance, Healthcare Services[20](,[21])

INCOME STATEMENT HIGHLIGHTS 3Q20 3Q19 Change 9M20 9M19 Change

Revenue, net [22] 70,876 68,585 3.3% 198,950 216,162 -8.0%

Gross Profit 31,583 29,550 6.9% 80,674 93,493 -13.7%

Gross profit margin 44.3% 42.5% +1.8ppts 40.2% 42.9% -2.7ppts

Operating expenses (ex.

IFRS 16) (12,794) (13,062) -2.0% (39,528) (39,808) -0.7%

EBITDA (ex. IFRS 16) 18,789 16,488 14.0% 41,146 53,685 -23.4%

EBITDA margin (ex. IFRS

16) 26.3% 23.7% +2.6ppts 20.5% 24.6% -4.1ppts

Adjusted [23] net profit/(loss)

ex. IFRS 16 5,200 2,156 141.2% (2,993) 11,500 NMF

Net (loss)/profit ex. IFRS

16 (28,628) 2,291 NMF (40,469) 11,731 NMF

CASH FLOW HIGHLIGHTS

Cash flow from operating

activities (ex. IFRS 16) 21,287 8,410 153.1% 73,022 28,753 154.0%

EBITDA to cash conversion

(ex. IFRS 16) 113.3% 51.0% +62.3ppts 177.5% 53.6% +123.9ppts

Cash flow from/used in

investing activities 36,917 (3,896) NMF 17,727 (13,443) NMF

Free cash flow (ex. IFRS

16) [24] 49,848 1,123 NMF 83,557 (696) NMF

Cash flow from financing

activities (ex. IFRS 16) (2,376) (4,487) -47.0% (3,026) (28,464) -89.4%

BALANCE SHEET HIGHLIGHTS 30-Sep-20 30-Jun-20 change 31-Dec-19 change

Total assets 885,943 960,076 -7.7% 953,874 -7.1%

Of which, cash balance

and bank deposits 98,905 41,958 NMF 7,648 NMF

Of which, securities and

loans issued 4,573 3,618 26.4% - NMF

Total liabilities 491,708 495,606 -0.8% 472,675 4.0%

Of which, borrowings 313,853 304,060 3.2% 291,239 7.8%

Total equity 394,235 464,470 -15.1% 481,199 -18.1%

KEY POINTS

Ø Revenue and EBITDA demonstrating growth trajectory once again

in 3Q20 y-o-y; Revenue up 3.3% and EBITDA up 14.0%

Ø Cash flow from operating activities (ex. IFRS 16) up 153.1% in

3Q20 and up 154.0% in 9M20, y-o-y

Ø Free cash flow (ex. IFRS 16) at GEL 83.6 million in 9M20, up

from negative GEL 0.7 million y-o-y

Ø Net debt [25] down 26.9% y-o-y to GEL 210.4 million as of

30-Sep-20 (down 18.6% q-o-q)

INCOME STATEMENT HIGHLIGHTS

Following the lifting of COVID-19 related lockdown restrictions

in June, which affected hospitals and clinics segments, the

healthcare business revenue started to rebound. The trend continued

into the 3(rd) quarter, which saw the number of admissions increase

by 17% at clinics, translating into 3Q20 net revenue of GEL 11.6

million, up 11.0% y-o-y. Hospitals also demonstrated a similar

trend as the number of admissions was up 3% in 3Q20 y-o-y, while

revenue for the period was GEL 57.9 million, largely flat to 2019

level (GEL 58.1 million). The diagnostics segment, which apart from

regular diagnostics services is also engaged in COVID-19 testing,

almost tripled its quarterly revenue in 3Q20 y-o-y, reaching GEL

3.3 million. All this translated into 3.3% y-o-y growth in 3Q20 net

revenue from healthcare services. 9M20 healthcare services net

revenue was down 8.0% y-o-y, reflecting a reduction in patient

footfall at healthcare facilities mainly during COVID-19 lockdown

in 2Q20.

The cost of our services in the business are captured in the

materials and direct salary rates. The materials rate increased

slightly y-o-y in 2020 (up 0.9 ppts and 2.4 ppts at hospitals and

up 0.7 ppts and 0.3 ppts at clinics, respectively, in 3Q20 and

9M20), reflecting increased consumption of medical disposables and

personal protective equipment at healthcare facilities. The 3Q20

direct salary rate remained well-controlled at hospitals (down 2.2

ppts y-o-y) and clinics (down 5.3 ppts y-o-y), leading to a 1.8

ppts y-o-y increase in the healthcare services gross margin. In

9M20, gross margin was down 2.7 ppts y-o-y to 40.2%. Due to the

cost optimization measures, the business posted positive operating

leverage in 3Q20, translating into a 14.0% y-o-y growth in

respective EBITDA earnings excluding IFRS 16. In 3Q20, EBITDA

margin (ex. IFRS 16) was 26.4% at hospitals (up 1.4 ppts y-o-y) and

23.3% at clinics (up 6.4% y-o-y). Overall, in 9M20, the business

posted GEL 41.1 million EBITDA (ex. IFRS 16), down 23.4% y-o-y.

Strong liquidity management measures resulted in a 26.9% y-o-y

decline in net debt position to GEL 210.4 million as of 30-Sep-20,

respectively decreasing 3Q20 interest expense, excluding IFRS 16

impact, by 17.2% to GEL 6.2 million. The depreciation of GEL during

2020 led to a foreign currency loss in 9M20 (GEL 3.1 million

(excluding IFRS 16)) on the relatively small portion of the

business's borrowings denominated in foreign currency. The business

had non-recurring expenses of GEL 8.8 million in 9M20, mainly

related to one-off costs associated with de-listing of GHG from

London Stock Exchange, of which, GEL 4.6 million relates to

acceleration of share-based expenses for employees. In 3Q20, a loss

from discontinued operations of GEL 25.4 million was recorded,

resulting from the disposal of a 40% equity stake in HTMC. The

business posted net losses from continuing operations excluding

IFRS 16 in both 3Q20 and 9M20, which adjusted for FX loss and

non-recurring expenses resulted in GEL 5.2 million net profit for

3Q20, (up 141.2% y-o-y) and net loss for 9M20 of GEL 3.0 million

(down from GEL 11.5 million in 9M19).

CASH FLOW HIGHLIGHTS

Cash collection from the Government and strong liquidity

management practices led to an increase in cash flow generation,

with 113.3% and 177.5% EBITDA to cash conversion ratios excluding

IFRS 16, respectively, for 3Q20 and 9M20. Strong operating cash

flow ex. IFRS 16, (up 153.1% y-o-y in 3Q20 and up 154.0% in 9M20),

reduced capex investments (down 29.9% y-o-y from GEL 23.3 million

in 9M19 to GEL 16.4 million in 9M20) and proceeds received from

selling of HTMC hospital, resulted in GEL 98.9 million ending cash

and cash equivalent balance as of 30 September 2020. Free cash flow

excluding IFRS 16 increased significantly to GEL 49.8 million in

3Q20 (up from GEL 1.1 million y-o-y), reflecting GEL 32.8 million

net proceeds from HTMC disposal. Free cash flow excluding IFRS 16

was GEL 83.6 million in 9M20 (up from negative GEL 0.7 million

y-o-y).

RECENT DEVELOPMENTS

Ø In September 2020, due to the increased spread of the COVID-19

virus, the business has mobilised c. 800 beds across the country;

At the moment, six hospitals are engaged in receiving COVID-19

patients, of which, three are located in regions and three are

located in Tbilisi.

Ø On 19 August 2020, GHG signed a Sales and Purchase Agreement

to sell a 40% equity interest in High Technology Medical Centre

University Clinic ("HTMC") to Tbilisi State Medical University,

which intends to use it as a teaching platform (the "Sale"). Total

cash consideration for the Sale was US$ 12 million (GEL 36.8

million). The sale is in line with GHG's strategy to divest

low-return generating assets. HTMC was one of the lowest return

generating assets across GHG's hospital portfolio with a FY19 ROIC

of 3.4%. The divestment, therefore, materially improves the

Healthcare business ROIC - on a pro-forma basis, increasing FY19

healthcare business ROIC by approximately 90bps.

Discussion of Retail (pharmacy) Business Results

Retail (pharmacy) business, owned through GHG, is the largest

pharmaceuticals retailer and wholesaler in Georgia, with a c.33%

market share by revenue. The business consists of a retail pharmacy

chain and a wholesale business that sells pharmaceuticals and

medical supplies to hospitals and other pharmacies. The pharmacy

chain has a total of 309 pharmacies, of which, 305 are in Georgia

and 4 are in Armenia. GCAP owns 67% in the retail (pharmacy)

business as of 30-Sep-20 (30-Jun-20: 47.3%).

3Q20 & 9M20 performance, Retail (pharmacy)[26]

INCOME STATEMENT HIGHLIGHTS 3Q20 3Q19 Change 9M20 9M19 Change

Revenue, net 159,593 146,800 8.7% 478,433 441,993 8.2%

Gross Profit 39,853 37,685 5.8% 123,571 111,934 10.4%

Gross profit margin 25.0% 25.7% -0.7ppts 25.8% 25.3% +0.5ppts

Operating expenses (ex. IFRS

16) (23,421) (22,475) 4.2% (73,511) (65,816) 11.7%

EBITDA (ex. IFRS 16) 16,432 15,210 8.0% 50,060 46,118 8.5%

EBITDA margin, (ex. IFRS 16) 10.3% 10.4% -0.1ppts 10.5% 10.4% +0.1ppts

Net (loss)/profit (ex. IFRS

16) (70) 10,034 NMF 20,449 30,405 -32.7%

Adjusted[27] net profit, (ex.

IFRS 16) 12,128 10,909 11.2% 37,285 34,430 8.3%

CASH FLOW HIGHLIGHTS

Cash flow from operating activities

(ex. IFRS 16) 15,063 (11,175) NMF 48,439 19,717 145.7%

EBITDA to cash conversion 91.7% -73.5% +165.1ppts 96.8% 42.8% +54.0ppts

Cash flow used in investing

activities (608) (672) -9.6% (1,026) (912) 12.4%

Free cash flow, (ex. IFRS 16)[28] 13,618 (13,568) NMF 44,610 17,883 149.5%

Cash flow from financing activities

(ex. IFRS 16) (36,295) 8,077 NMF (21,522) (30,327) -29.0%

BALANCE SHEET HIGHLIGHTS 30-Sep-20 30-Jun-20 change 31-Dec-19 Change

Total assets 435,178 454,006 -4.1% 396,078 9.9%

Of which, cash and bank deposits 35,918 56,797 -36.8% 7,774 NMF

Of which, securities and loans

issued 12,398 12,327 0.6% 12,167 1.9%

Total liabilities 346,204 355,204 -2.5% 303,240 14.2%

Of which, borrowings 94,612 120,751 -21.6% 84,712 11.7%

Of which, finance lease liabilities 89,065 77,418 15.0% 77,700 14.6%

IFRS 16 impact 89,065 77,418 15.0% 77,700 14.6%

Total equity 88,974 98,802 -9.9% 92,838 -4.2%

KEY POINTS

Ø Continued y-o-y growth in 3Q20 and 9M20 revenues and EBITDA

despite COVID-19 outbreak

Ø 10.3% EBITDA margin in 3Q20 and 10.5% in 9M20, substantially

exceeding the targeted 9% margin

Ø Cash collection remained strong and EBITDA to cash conversion

ratio at 91.7% in 3Q20 and at 96.8% in 9M20

Ø Outstanding free cash flow generation at GEL 44.6 million in

9M20, up 2.5 times y-o-y

Ø Net debt[29] down 28.5% from 31-Dec-19 to GEL 46.3 million as

of 30-Sep-20 (down 10.3% q-o-q from 30-Jun-20)

Ø Addition of 9 pharmacies over the last 9 months, expanding

from 296 to 305 stores countrywide

INCOME STATEMENT HIGHLIGHTS

The pharmacy business continued to deliver growing revenues in

2020, reflecting both expansion and organic sales growth, with 3.6%

and 5.1% same-store revenue growth rates in 3Q20 and 9M20,

respectively. From April sales started to slow down after strong

1Q20 results, reflecting pandemic related behavioural change, as

customers started to stock up on pharmaceuticals in March ahead of

the lockdown. However, revenue rebounded in June and the trend

continued in the third quarter. As a result, the business posted an

8.7% increase in net revenues in 3Q20 and overall, an 8.2% increase

in 9M20, y-o-y. The business issued 7.0 million bills in 3Q20 and

20.4 million in 9M20, with average customer interactions of 2.3

million per month and the average bill size of GEL 15.6 in 3Q20 (up

9.9% y-o-y) and GEL 16.2 in 9M20 (up 15.6% y-o-y).

In 3Q20, the retail revenue share in total revenue was 73.0%

(71.6% in 3Q19) and revenue from para-pharmacy as a percentage of

retail revenue from pharma was up 4.0 ppts y-o-y (from 32.1% in

3Q19 to 36.1% in 3Q20). Revenues from sales in high-margin

non-medication categories (personal care, beauty and other

parapharmacy products) were up 20.8% y-o-y to GEL 43. 9 million in

3Q20. The increase mainly related to increased sale of personal

protective items such as disinfectants, masks etc. and summer

promotions on parapharmacy products that slightly subdued the

margins, down 1.8 ppts y-o-y to 31.2%, translating into a 0.7 ppts

decrease in business gross margin to 25.0% in 3Q20. Overall, in

9M20, the retail revenue share in total revenue was 73.7% (71.2% in

9M19) and revenue from para-pharmacy as a percentage of retail

revenue from pharma was 34.7% (30.9% in 9M19). Revenues from sales

in non-medication categories, parapharmacy products, were up 21.0%

y-o-y to GEL 125. 6 million in 9M20, with a 29.8% gross profit

margin. In 9M20 the business gross margin improved by 0.5 ppts

y-o-y, reaching 25.8%.

In 3Q20, the operating leverage was positive 1.6% excluding IFRS

16 impact, reflecting a well-managed cost base and translating into

8.0% y-o-y EBITDA growth with a 10.3% EBITDA margin. In 9M20,

negative operating leverage 1.3% reflects: a) the 97.1% y-o-y

decrease in other operating income due to gain from the sale of

land in the prior year and b) increased rent expense of pharmacies

due to GEL devaluation throughout the year (about 85% of rental

contracts are denominated in US$ dollars), translating into 12.4%

y-o-y increase in 9M20 general and administrative expense excluding

IFRS 16 impact to GEL 34.1 million. The result was an 8.5% y-o-y

growth in 9M20 EBITDA excluding IFRS 16, with a 10.5% EBITDA

margin.

Interest expense, excluding IFRS 16, was down 15.2% in 3Q20

y-o-y to GEL 2.6 million, translating into an 8.0% y-o-y reduction

in 9M20 to GEL 8.2 million. As the inventory purchases are

denominated in foreign currency (c.40% in EUR and c.30% in USD),

depreciation of the local currency in 3Q20 and 9M20 resulted in FX

loss of GEL 5.1 and GEL 9.7 million, respectively, excluding IFRS

16. The business posted GEL 7.2 million net non-recurring expense

in 9M20, primarily related to one-off cost associated with GHG

de-listing, of which GEL 4.9 million relates to acceleration of

share-based expenses for employees.

As a result, the business posted a GEL 0.1 million loss in 3Q20,

excluding IFRS 16, which adjusted for FX loss and non-recurring

expenses resulted in an 11.2% y-o-y increase in net profit to GEL

12.1 million for the quarter. In 9M20, the business posted GEL 20.4

million net profit excluding IFRS 16, which, if adjusted for FX

loss and non-recurring expenses, resulted in an 8.3% y-o-y increase

in net profit to GEL 37.3 million.

CASH FLOW AND BALANCE SHEET HIGHLIGHTS

The business' strong operating cash flow with EBITDA to cash

conversion ratio of 91.7% in 3Q20 and 96.8% in 9M20, coupled with

decreased capex investments, resulted in an ending balance of cash

and cash equivalents of GEL 35.9 million as of 30-Sep-20 (up from

GEL 7.8 million at 31-Dec-19). Free cash flow profile significantly

improved in 3Q20 to GEL 13.6 million from negative GEL 13.6 million

in 3Q19, while 9M20 free cash flow was up almost three times y-o-y

to GEL 44.6 million. Strong liquidity management was reflected in

an improved leverage profile, with net debt being down 46.0% y-o-y

as of 30-Sep-20.

Discussion of Water Utility Business Results

Our Water Utility is a regulated monopoly in Tbilisi and the

surrounding area, where it provides water and wastewater services

to 1.4 million residents representing more than one-third of

Georgia's population and c. 36,000 legal entities. Water Utility

also operates hydro power plants with a total installed capacity of

149 MW. GCAP owns 100% in Water Utility as of 30-Sep-20.

3Q20 & 9M20 performance, Water Utility[30]

INCOME STATEMENT HIGHLIGHTS 3Q20 3Q19 Change 9M20 9M19 Change

Revenue 37,985 44,649 -14.9% 98,754 119,189 -17.1%

Water supply 35,651 38,267 -6.8% 94,066 104,567 -10.0%

Energy 2,334 6,382 -63.4% 4,688 14,622 -67.9%

Operating expenses (15,331) (15,616) -1.8% (43,644) (45,282) -3.6%

EBITDA 20,802 27,454 -24.2% 50,409 67,820 -25.7%

EBITDA margin 54.8% 61.5% -6.7ppts 51.0% 56.9% -5.9ppts

Net (loss)/profit (31,197) 18,164 NMF (45,298) 18,916 NMF

CASH FLOW HIGHLIGHTS

Cash flow from operating

activities 16,780 22,484 -25.4% 34,058 56,115 -39.3%

Cash flow used in

investing activities (9,395) (20,940) -55.1% (35,065) (44,767) -21.7%

Free cash flow 7,385 976 NMF (1,007) 10,452 NMF

Cash flow from financing

activities 9,052 6,167 46.8% 33,848 13,265 NMF

BALANCE SHEET HIGHLIGHTS 30-Sep-20 30-Jun-20 Change 31-Dec-19 Change

Total assets 653,180 627,853 4.0% 591,036 10.5%

Of which, cash balance 61,795 41,897 47.5% 26,581 NMF

Total liabilities 549,170 485,769 13.1% 432,741 26.9%

Of which, borrowings 490,476 397,898 23.3% 353,021 38.9%

Total equity 104,010 142,084 -26.8% 158,295 -34.3%

KEY POINTS

Ø COVID-19 related decrease in water consumption by corporates

led to 24.2% y-o-y decrease in 3Q20 EBITDA

o Emergence of corporate sector from government lockdowns led to

46.2% q-o-q increase in water supply revenues to legal entities to

GEL 23.7 million in 3Q20

Ø Energy revenues continued to have negative impact from lower

water inflows at Zhinvali Reservoir (63.4% y-o-y decline in 3Q20

energy revenues)

Ø 3Q20 free cash flow at GEL 7.4 million (up y-o-y by GEL 6.4

million)

Ø GEL 5 million dividend paid in 3Q20

Ø US$ 250 million green bond issuance in Jul-20, refinancing

existing debt and shifting principal payments to 2025

INCOME STATEMENT HIGHLIGHTS

The 14.9 % y-o-y decrease in 3Q20 revenues (down 17.1% y-o-y in

9M20) was primarily driven by a 63.4 % decrease in energy revenues

(down 67.9% y-o-y in 9M20) and a 6.8% decrease in water sales

revenues (down 10.0% y-o-y in 9M20). Extraordinarily low

precipitation related water inflows to Zhinvali HPP led to a 34.4%

y-o-y decrease in electricity generation in 3Q20 (down 32.4% in

9M20), while self-produced electricity consumption remained largely

flat. As a result, 3Q20 electricity sales in kWh decreased by 70.6%

y-o-y (down 66.2% y-o-y in 9M20). Revenue from water supply to

legal entities was down 9.3 % y-o-y to GEL 23.7 million in 3Q20

reflecting the effects of COVID-19, however, growing by 46.2% q-o-q

following the gradual recovery from COVID-19 lockdown during

Mar-May. Overall, 9M20 revenue from water supply to legal entities

was down 14.7 % y-o-y to GEL 59.2 million in 9M20. Revenues from

water supply to individuals remained broadly stable at GEL 9.9

million in 3Q20 (down 4.6% y-o-y) and at GEL 29.2 million in 9M20

(down 2.2% y-o-y). According to the tariff setting methodology,

volume risk does not stay with the company and unearned revenues in

the current regulatory period (2018-2020) will be reimbursed

through tariff setting in the upcoming regulatory period, effective

from 1-Jan-21. Continued Opex optimisation initiatives were

reflected in decreased operating expenses y-o-y in 3Q20 (down 1.8%)

and 9M20 (down 3.6%). As a result, EBITDA amounted to GEL 20.8

million in 3Q20 and GEL 50.4 million in 9M20, down y-o-y by 24.2%

in 3Q20 and by 25.7% in 9M20.

Net interest expense was up 78.6% y-o-y to GEL 8.6 million in

3Q20 and up 56.4% y-o-y to GEL 24.4 million in 9M20. The increase

partially reflects local currency depreciation. Further, in 2020,

Water Utility increased its leverage on the back of funds attracted

from IFIs and local banks to finance capital expenditures, fully

refinanced by the proceeds from US$ 250 million green bond issuance

in Jul-20. The 7.75% 5-year green notes were issued by Georgia

Global Utilities JSC, the holding company of GCAP's water utility

business and operational renewable assets and were listed on the

Irish Stock Exchange. The refinancing activities resulted in GEL

10.0 million non-recurring expenses in 3Q20 and 9M20, comprising

primarily prepayment fees. Foreign exchange losses amounted to GEL

24.4 million in 3Q20 and GEL 34.4 million in 9M20, as GEL

depreciated against USD and EUR by 11.3% and 19.0%, respectively,

over the last 12-month period. As a result, net loss was GEL 31.2

million in 3Q20 (GEL 18.2 million net profit in 3Q19) and GEL 45.3

million in 9M20 (GEL 18.9 million net profit in 9M19).

CASH FLOW HIGHLIGHTS

3Q20 operating cash flow was down by 25.4% y-o-y to GEL 16.8

million in line with the decreased revenue (operating cash flow was

down 39.3% y-o-y to GEL 34.1 million in 9M20). However, cash

collection rates for both legal entities and households remained

strong at c. 95% during 9M20. Cash flows from investing activities

increased in 3Q20 and 9M20, mainly driven by decreased development

Capex. Development capex was down by 53.5% to GEL 11.1 million in

3Q20 and by 24.5% y-o-y to GEL 39.1 million in 9M20. Free cash flow

was up by GEL 6.4 million y-o-y in 3Q20 to GEL 7.4 million. In

September 2020, the water utility business distributed a GEL 5

million dividend to Georgia Capital. The green bond issuance led to

an increase in cash flow from financing activities, contributing to

growth in Water Utility's cash balance by 47.5% in 3Q20 to GEL 61.8

million.

Discussion of Insurance (P&C and Medical) Business

Results

Insurance business comprises a) Property and Casualty (P&C)

insurance business, owned through Aldagi and b) medical insurance

business, owned through GHG. P&C insurance business is a

leading player in the local insurance market with a 28% market

share in property and casualty insurance based on gross premiums as

of 30-Jun-20. P&C also offers a variety of non-property and

casualty products such as life insurance. GHG is the country's

largest private medical insurer, with a 26.0% market share based on

2Q20 net insurance premiums. GHG offers a variety of medical

insurance products primarily to Georgian corporate and state

entities and also to retail clients. The medical insurance business

plays a significant feeder role for GHG's polyclinics, pharmacies

and hospitals. GCAP owns 100% in the insurance business as of

30-Sep-20.

3Q20 & 9M20 performance, Insurance (P&C and

Medical)[31]

INCOME STATEMENT

HIGHLIGHTS 3Q20 3Q19 Change 9M20 9M19 Change

Earned premiums, net 35,198 39,855 -11.7% 104,425 112,509 -7.2%

Of which, P&C Insurance 18,292 20,420 -10.4% 52,960 56,708 -6.6%

Of which, Medical

Insurance 16,906 19,435 -13.0% 51,465 55,801 -7.8%

Net underwriting profit 10,857 13,298 -18.4% 33,852 33,189 2.0%

Of which, P&C Insurance 7,255 8,831 -17.8% 22,262 24,272 -8.3%

Of which, Medical

Insurance 3,602 4,467 -19.4% 11,590 8,917 30.0%

Net profit 5,372 7,525 -28.6% 16,148 17,268 -6.5%

Of which, P&C Insurance 3,880 5,172 -25.0% 12,034 13,481 -10.7%

Of which, Medical

Insurance 1,492 2,353 -36.6% 4,114 3,787 8.6%

CASH FLOW HIGHLIGHTS

Net cash flows from

operating

activities 10,649 9,469 12.5% 25,056 28,274 -11.4%

Of which, P&C Insurance 7,040 7,995 -11.9% 16,945 22,662 -25.2%

Of which, Medical

Insurance 3,609 1,474 144.9% 8,111 5,612 44.5%

Free cash flow 13,146 9,239 42.3% 26,306 26,539 -0.9%

Of which, P&C Insurance 6,560 7,772 -15.6% 15,390 20,963 -26.6%

Of which, Medical

Insurance 6,586 1,467 348.9% 10,916 5,576 95.8%

BALANCE SHEET HIGHLIGHTS 30-Sep-20 30-Jun-20 Change 31-Dec-19 Change

Total assets 302,885 319,261 -5.1% 279,848 8.2%

Of which, P&C Insurance 215,283 227,268 -5.3% 200,273 7.5%

Of which, Medical

Insurance 87,602 91,993 -4.8% 79,575 10.1%

Total equity 100,143 100,732 -0.6% 89,491 11.9%

Of which, P&C Insurance 69,413 70,479 -1.5% 62,611 10.9%

Of which, Medical

Insurance 30,730 30,253 1.6% 26,880 14.3%

TOTAL INSURANCE BUSINESS HIGHLIGHTS

P&C and medical insurance have a broadly equal share in

total earned revenues, while P&C had a 72% share in total net

profit in 3Q20 (75% in 9M20). Overall, the combined ratio remained

stable at 86.7% in 9M20 and was up 2.7ppts y-o-y to 87.3% in 3Q20.

Net profit decreased by 28.6% y-o-y to GEL 5.4 million in 3Q20 and

by 6.5% to GEL 16.1 million in 9M20, y-o-y. As a result, ROAE was

20.9% in 3Q20 (35.3% in 3Q19) and 22.2% in 9M20 (27.4% in

9M19).

Discussion of results, P&C Insurance

KEY POINTS

Ø GEL 5.0 million dividend paid in 3Q20 on the back of strong

cash flow generation

Ø 10.4% y-o-y decline in revenues in 3Q20 (down 6.6% y-o-y in

9M20)

Ø Rebounding trend in net premiums written from a portfolio

through direct sales channels, up 3% y-o-y in 3Q20 (down 16% y-o-y

in 2Q20);

INCOME STATEMENT HIGHLIGHTS

3Q20 revenues decreased by 10.4% y-o-y to GEL 18.3 million (down

6.6% y-o-y to GEL 53.0 million in 9M20), mainly reflecting COVID-19

impact on compulsory border third-party liability insurance line

(MTPL). Due to restrictions imposed on traveling, net premiums

earned from MTPL was down significantly by GEL 1.7 million y-o-y in

the seasonally highest third quarter . Overall, financial pressure

and changes in customer spending habits were reflected on the net

premiums written across a portfolio through direct sales channels,

down by 16% y-o-y in 2Q20. The trend has reversed in 3Q20,

rebounding to 3% y-o-y growth, however, still below its historical

growth rate. Similarly, net premiums written from partnership

agreements with local financial institutions were down 19% y-o-y in

2Q20 and 4% in 3Q20. At 30-Sep-20, the distribution mix in gross

premiums written is as follows: direct sales channels have majority

share of 51%, followed by partnership agreements with financial

institutions and other channels of 27% and the rest is sold mainly

through brokers.

P&C Insurance's key performance ratios for 9M20 and 3Q20 are

as noted below:

Key Ratios 3Q20 3Q19 Change 9M20 9M19 Change

Combined ratio 85.6% 80.4% 5.2 ppts 82.1% 80.3% 1.8 ppts

Expense ratio 38.8% 42.5% -3.7 ppts 37.2% 40.0% -2.8 ppts

Loss ratio 46.8% 37.8% 9.0 ppts 44.9% 40.3% 4.6 ppts

ROAE 21.6% 35.0% -13.4 ppts 23.8% 30.4% -6.6 ppts