Eyecity.com, Inc. Makes Major Move

July 21 2008 - 2:34PM

Marketwired

DALLAS, TX -- After evaluating the proposals brought before the

board, the recommendation was made to enter into a Letter Of Intent

with an operator located in the southern United States offering a

secondary recovery project.

As with all oil and gas plays, there is some risk. The company

feels this play substantially reduces its exposure while providing

the highest potential for success.

Primary recovery is the initial period of production when the

well is either flowing or placed on pump. This initial period is

when the well(s) will produce between 20% to 32% of the

hydrocarbons in place in the formation. When a well has limited or

no oil, gas, or water coming into the wellbore, you then move on to

what is called the secondary recovery period.

The successful to non-successful ratio of water floods, or

secondary recovery efforts, in the geographic area of this play can

be quickly categorized as having been extremely profitable. The

western portion of this field has had several secondary recovery

efforts, and has averaged almost 1 BO (Barrel of Oil) produced from

secondary recovery methods, for every 1.3 BO (Barrel of Oil)

produced from primary production. This prospect calls for the

flooding of a proven zone in the eastern portion of the field which

has produced in excess of 1.9 MMBO (Million Barrels of Oil) across

approximately 1.2 miles. This lease is situated on the highest and

thickest portion of this structure.

The Company believes that focusing on secondary recovery

properties with proven reserves is a cost and risk efficient method

to generate strong financial returns.

This Letter of Intent will be signed and a board meeting will be

held to confirm the direction of the project this coming

Thursday.

Joe Parker was quoted as saying "This play encompasses all of

the features one would look for in a secondary recovery project.

Mainly, substantial primary oil production and favorable formations

capable of accepting the water to re-pressurize the tar get

formation. I am anticipating this project providing a substantial

ROI and will assist on mitigating unnecessary risk for Eyecity.com

shareholders."

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking statements," which

are statements related to future, not past events. In this context,

the forward-looking statements often include statements regarding

our goals, plans, projections and guidance regarding our financial

position, results of operations, market position, pending and

potential future acquisitions and business strategy, and often

contain words such as "expects," "anticipates," "intends," "plans,"

"believes," "seeks" or "will." Any such forward-looking statements

are not assurances of future performance and involve risks and

uncertainties that may cause results to differ materially from

those set forth in the statements.

These risks and uncertainties include, among other things, (a)

general economic and business conditions, (b) the level of

strategic partner incentives, (c) the future regulatory

environment, (d) our cost of financing, (e) our ability to complete

acquisitions and dispositions and the risks associated therewith,

and (f) our ability to retain key personnel. These factors, as well

as additional factors, could affect our forward-looking statements.

We urge you to carefully consider this information. We undertake no

duty to update our forward-looking statements, including our

earnings outlook.

Contact: Anthony Baker 214-986-4321

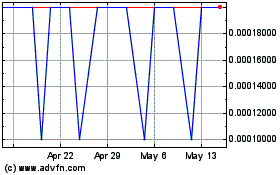

Eyecity Com (PK) (USOTC:ICTY)

Historical Stock Chart

From May 2024 to Jun 2024

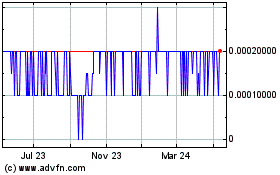

Eyecity Com (PK) (USOTC:ICTY)

Historical Stock Chart

From Jun 2023 to Jun 2024