Current Report Filing (8-k)

May 26 2023 - 4:38PM

Edgar (US Regulatory)

0001350073false00013500732023-05-112023-05-11iso4217:USDxbrli:sharesiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 11, 2023

Iconic Brands, Inc. |

(Exact name of registrant as specified in its charter) |

Nevada | | 333-227420 | | 13-4362274 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

44 Seabro Avenue

Amityville, New York 11701

(Address of Principal Executive Offices)

(631) 464-4050

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Act:

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

N/A | | N/A | | N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 11, 2023, Iconic Brands, Inc. (the “Company”) entered into a 10% Original Issue Discount (OID) Convertible Promissory Note in the aggregate principal amount of $660,000 (the “Note”), with Arena Investors, LP (“Arena”). The Company received total proceeds of $600,000, net of the 10% original issue discount, before deducting expenses.

The Note matures on August 11, 2023 (the “Maturity Date”). The Note bears interest at 12% per annum beginning on the 90th day following execution, if not repaid. The Company may prepay the Note at any time, with no penalty.

In addition, if at any time after the Maturity Date any portion of the Note remains outstanding, Arena may elect to convert all or any portion of the amount outstanding into common stock, $0.001 par value per share, of the Company (“Common Stock”). The price at which the Note will convert into Common Stock will be equal to the lesser of (i) $0.0001 per share of Common Stock, or (ii) for each share of Common Stock, 50% of the lowest closing price of the Common Stock in the 30 trading days prior to the conversion notice. If, at any time the Note is outstanding, the Company issues Common Stock for a price per share less than the then applicable conversion price under the Note, then the conversion price of the Note shall be reduced to such lower price. The conversion price of the Note is lower than the par value of the Company’s Common Stock ($0.001 per share), which may cause the issuance of the Note to violate applicable Nevada law.

The Note contains customary events of default, including, but not limited to, failure to observe covenants under the Note and suspension or delisting from the over-the-counter market. Upon the occurrence of an event of default, all obligations under the Note shall become immediately due and payable within five days.

The foregoing is only a summary of the Note, and is qualified in its entirety by reference to the full text of the Note, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated by reference herein.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

To the extent required by Item 2.03 of Form 8-K, the information contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 2.04 Triggering Events That Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

On May 24, 2023, the Company received a notice of default from Arena listing the specified defaults that Arena believed have occurred, including, among other things, the Company’s failure to authorize and reserve a sufficient number of shares of its Common Stock for conversion, to effect the conversion of the Note into Common Stock as provided in the Note, and failure to instruct its transfer agent to reserve all authorized but unissued shares of its Common Stock for issuance to Arena in connection with conversion of this Note. As result of such defaults, Arena has given notice to the Company that all obligations under the Note are immediately due and payable, and Arena has reserved any and all remedies available to it as a result of such defaults.

At this time the Company is unable to pay off the entire loan balance due to Arena or meet its reserve share obligations required in the Note. Prior to the notice of default from Arena, the Company was attempting to reach a negotiated settlement with Arena, and the Company remains in discussion with Arena to remedy these events of default.

Item 3.02 Unregistered Sales of Equity Securities.

To the extent required by Item 3.02 of Form 8-K, the information set forth in Item 1.01 of this Current Report on Form 8-K above is incorporated by reference.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 16, 2023, David Allen notified the Company of his decision to resign from his position as Chief Financial Officer of the Company for personal reasons, effective as of May 19, 2023. The resignation is not the result of any disagreement with the Company with respect to any matter relating to the Company’s operations, policies or practices, including any matters related to Company’s accounting practices or financial reporting. Richard DeCicco, the Company’s Chief Executive Officer, will assume the responsibilities of Chief Financial Officer effective upon Mr. Allen’s departure and will serve as the Company’s principal financial officer and principal accounting officer for purposes of the rules and regulations of the U.S. Securities and Exchange Commission in the interim period until a replacement can be found.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Iconic Brands, Inc. | |

| | | |

Dated: May 26, 2023 | By: | /s/ Richard DeCicco | |

| Name: | Richard DeCicco | |

| Title: | Chief Executive Officer | |

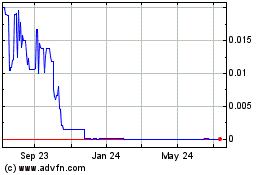

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From Apr 2024 to May 2024

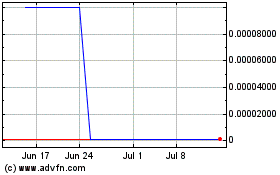

Iconic Brands (CE) (USOTC:ICNB)

Historical Stock Chart

From May 2023 to May 2024