Investment Industry to Gather in Philadelphia at 21st Annual Groundhog Investment Forum

January 30 2014 - 2:00PM

Business Wire

The Emerald Groundhog Day Investment Forum

marks its 21st annual event on February 6th in Philadelphia, PA

with over 25 companies scheduled to present.

Emerald Asset Management, Inc. will welcome hundreds of

investment industry professionals to the 21st annual Emerald

Groundhog Day Investment Forum, scheduled to be held on Thursday,

February 6th at the Radisson Warwick Hotel in Philadelphia, PA. “We

say that the 2014 investment year begins in earnest with our annual

Forum,” said Emerald CEO and Founder Joseph E. Besecker. “Public

company senior managers, investment portfolio managers and research

analysts come together to review 2013 and provide their initial

outlook to 2014 and beyond.” This year’s Forum will include

sessions focusing on cyber security, the robotics revolution, local

and regional banks, fixed income securities and alternatives and

ongoing innovations by corporate America generating potential

investment opportunities.

The first Emerald Groundhog Day Investment Forum was held in

1994 and has grown to become the largest and most successful annual

investment event in Philadelphia. This year senior executives from

over twenty-five public and private companies are scheduled to

present. “The U.S. equity markets reached record highs in 2013 but

are off to a roller-coaster start in 2014,” said Emerald Director

of Research Joseph W. Garner. “The Forum provides a great chance to

hear how these companies are positioned moving forward and what

they are seeing in terms of growth and opportunities,” he said.

Presenting companies are scheduled to include: Rex Energy Corp

(REXX), Spirit Airlines (SAVE), FARO Technologies (FARO), Trex

Company (TREX), EPAM Systems (EPAM), GSV Capital (GSVC), Bryn Mawr

Bank Corp. (BMTC), First Business Financial (FBIZ), Northeast

Bancorp (NBN), Customers Bancorp (CUBI), Meta Financial Group

(CASH), California Republic Bancorp (CRPB), Sinclair Broadcast

Group (SBGI), Matthews International (MATW), Burnham Holdings

(BURCA), Ametek (AME), Quaker Chemical (KWR), Entercom

Communications (ETM), Neonode (NEON), Tetralogic Pharmaceuticals

(TLOG), Safeguard Scientifics (SFE), Alnylam Phamaceuticals (ALNY),

8x8 (EGHT), Aqua America (WTR), Intrexon Corp. (XON) and ICG Group

(ICGE). A full list of presenting companies, seminars by Emerald’s

investment professionals and registration details are available on

Emerald’s website at www.TeamEmerald.com/groundhog.

Presented by Emerald Asset Management, Forum sponsors include

Pepper Hamilton LLP, Janney Capital Markets, Boenning &

Scattergood, Greentree, Trout, Ebersole & Groff LLP, Sturdivant

& Co., Patriot Financial Partners L.P., and Horizons ETFs

Management (USA) LLC.

Founded in 1991, Emerald Asset Management, Inc. is a diversified

investment management company that operates thru its subsidiaries

Emerald Advisers, Inc., Emerald Mutual Fund Advisers Trust, Emerald

Separate Account Management, LLC, Emerald Fixed Income Advisers,

LLC, Emerald Direct Lending Advisers, LLC and Emerald Direct

Lending Partners, LLC. Assets managed by these companies totaled

over $2.8 billion as of December 31, 2013. “Driven by Research,”

Emerald employs an intense fundamental, research-focused investment

philosophy and focuses primarily on growth-oriented equity

investing and high-quality disciplined fixed-income investing.

Emerald Asset Management, Inc.Emerald Advisers, Inc.Emerald

Fixed Income Advisers LLCEmerald Mutual Fund Advisers TrustEmerald

Separate Account Management LLCEmerald Direct Lending Advisers

LLCEmerald Direct Lending Partners LLC3175 Oregon PikeLeola, PA

17540717.556.8900800.722.4123King of Prussia, PAPittsburgh,

PAOceanside, CAwww.TeamEmerald.com

Emerald Advisers, Inc.Joseph W. Garner, 717-556-8900

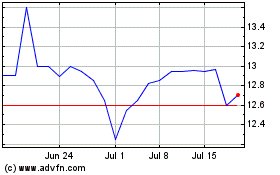

Burnham (PK) (USOTC:BURCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Burnham (PK) (USOTC:BURCA)

Historical Stock Chart

From Apr 2023 to Apr 2024