FT Portfolios Canada Co. Announces Estimated 2021 Annual Capital Gains Distributions for Its Exchange Traded Funds (“ETFs”)

November 23 2021 - 11:23AM

FT Portfolios Canada Co. today announced the estimated annual

capital gains distributions for its ETFs listed below for the 2021

tax year.

Please note that these are estimated amounts

only, as of October 31, 2021 and reflect forward looking

information which may cause the estimates to change before the

ETF’s December 2021 tax year-end.

These estimates are for the year-end capital

gains distributions only, which will be reinvested and the

resulting units immediately consolidated, so that the number of

units held by each investor will not change. These estimates do not

include estimates of ongoing monthly or quarterly distribution

amounts.

First Trust expects to announce the final

year-end distribution amounts, as well as the monthly and quarterly

cash distribution amounts, on or about December 22, 2021. The

record date for the 2021 annual distributions will be December 31,

2021 and payable on January 10, 2021.

|

Fund Name |

Ticker |

Estimated annual capital gain per unit

($) as at October 31, 2021 |

|

First Trust Value Line® Dividend Index ETF (CAD-Hedged) |

FUD |

4.8450 |

|

FUD.A |

5.2959 |

|

First Trust JFL Fixed Income Core Plus ETF |

FJFB |

0.1230 |

|

First Trust Dow Jones Internet ETF (formerly First Trust

AlphaDEX™ U.S. Consumer Staples Sector Index ETF) |

FDN.F |

0.3491 |

|

First Trust AlphaDEX™ U.S. Health Care Sector Index ETF |

FHH |

2.7632 |

|

FHH.F |

2.6832 |

|

First Trust AlphaDEX™ U.S. Industrials Sector Index ETF |

FHG |

2.5010 |

|

FHG.F |

3.0584 |

|

First Trust AlphaDEX™ U.S. Technology Sector Index ETF |

FHQ |

14.4674 |

|

FHQ.F |

4.5129 |

|

First Trust Morningstar Dividend Leaders ETF

(CAD‐Hedged) (formerly First Trust Dorsey Wright U.S. Sector

Rotation Index ETF (CAD‐Hedged)) |

FDL |

3.2377 |

|

First Trust Indxx Innovative Transaction and Process ETF |

BLCK |

0.0091 |

|

First Trust JFL Global Equity ETF |

FJFG |

0.0223 |

|

First Trust Cboe Vest U.S. Equity Buffer ETF – May |

MAYB.F |

0.6736 |

|

First Trust Cboe Vest U.S. Equity Buffer ETF – August |

AUGB.F |

4.0729 |

Forward-looking information This

notice contains forward-looking statements with respect to

estimated October 2021 capital gains distributions for First Trust

ETFs. By their nature, these forward-looking statements involve

risks and uncertainties that could cause the actual distributions

to differ materially from those contemplated by the forward-looking

statements. Material factors that could cause the actual

distributions to differ from the estimated distributions include,

but are not limited to, the actual amount of distributions received

by First Trust ETFs, portfolio transactions, currency hedging

transactions, and subscription and redemption activity.

For further information, please contact: FT

Portfolios Canada Co. 416-865-8065/877-622-5552

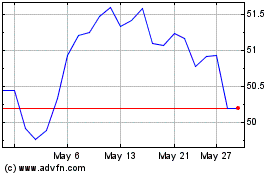

First Trust AlphaDEX US ... (TSX:FHG)

Historical Stock Chart

From Apr 2024 to May 2024

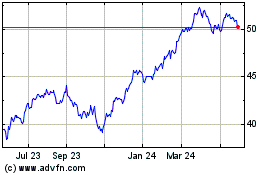

First Trust AlphaDEX US ... (TSX:FHG)

Historical Stock Chart

From May 2023 to May 2024