Current Report Filing (8-k)

May 07 2020 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 4, 2020

Western Asset Mortgage Capital Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

DELAWARE

(STATE OF INCORPORATION)

|

|

|

|

|

|

|

|

|

|

|

001-35543

|

|

27-0298092

|

|

(COMMISSION FILE NUMBER)

|

|

(IRS EMPLOYER ID. NUMBER)

|

|

|

|

|

|

|

|

|

|

|

|

385 East Colorado Boulevard

|

|

91101

|

|

Pasadena, California

|

|

(ZIP CODE)

|

|

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES)

|

|

|

(626) 844-9400

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company [ ]

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common Stock, $0.01 par value

|

|

WMC

|

|

New York Stock Exchange

|

Item 2.02. Results of Operations and Financial Condition

On May 6, 2020, Western Asset Mortgage Capital Corporation (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended March 31, 2020. The text of the press release is furnished as exhibit 99.1 to this Form 8-K.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On May 4, 2020, the Company supplemented one of its existing securities repurchase facilities to confirm terms pursuant to which it will consolidate most of its CMBS and RMBS assets, which are currently financed by multiple counterparties, into a single term facility with limited mark to market margin requirements, as described below. Pursuant to this confirmation, a margin deficit will not occur until such time as the loan to value ratio surpasses a certain threshold (the “LTV Trigger”), on a weighted average basis per asset type, calculated on a portfolio level. If this threshold is reached, the Company may elect to provide cash margin or sell certain assets to the extent necessary to lower the ratio. The term of this facility is 12 months, subject to extensions at the counterparty’s option. All interest income generated by the assets during the term of the facility will be paid to the Company no less often than monthly, with a price differential based on three-month LIBOR plus a spread payable to the counterparty quarterly in arrears. Half of all income generated by principal repayments on the underlying assets will be applied to repay the obligations owed to the counterparty, with the remainder paid to the Company, unless the LTV Trigger has occurred, in which case all principal payments will be applied to repay the obligations.

The counterparty has a right of first refusal upon any repurchase by the Company of any asset subject to this confirmation, provided the Company may request the counterparty to solicit third party dealer bids with respect to such sale. All asset sale proceeds less 50% of any excess proceeds over the counterparty’s amortized basis will be applied to repay the obligations owed to the counterparty, with the remainder paid to the Company, unless the LTV Trigger has occurred, in which case all asset sale proceeds will be applied to repay the obligations. Customary bank financing breakage fees are also payable upon the sale of the underlying assets. The confirmation also provides for a certain minimum level of shareholders’ equity and cash, respectively.

The aggregate financing provided by the counterparty with respect to the assets covered under this confirmation is approximately $108.8 million and the market value of such assets is approximately $182.7 million.

Item 7.01. Regulation FD Disclosure

On May 7, 2020, the Company will be holding its quarterly conference call in which it will discuss its financial results. The presentation for such call is furnished herewith as Exhibit 99.2 to this Form 8-K.

Pursuant to the rules and regulations of the Securities and Exchange Commission, Exhibits 99.1 and 99.2 and the information set forth therein and herein are being furnished and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall they be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

Exhibit No.

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WESTERN ASSET MORTGAGE CAPITAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Adam C. E. Wright

|

|

|

|

|

|

Name:

|

Adam C. E. Wright

|

|

|

|

|

Title:

|

Assistant Secretary

|

|

Date: May 7, 2020

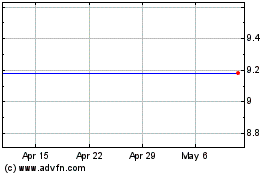

Western Asset Mortgage C... (NYSE:WMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

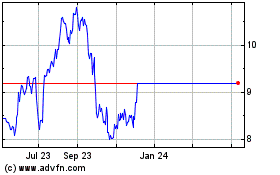

Western Asset Mortgage C... (NYSE:WMC)

Historical Stock Chart

From Apr 2023 to Apr 2024