UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2021

Commission File Number 001-35463

Taro Pharmaceutical Industries Ltd.

(Translation of registrant’s name into English)

14 Hakitor Street, Haifa Bay 2624761, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): _____

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): _____

CONTENTS

Notice, Proxy Statement and Proxy Card for Annual Shareholder Meeting

Taro Pharmaceutical Industries Ltd. (“Taro” or the “Company”) hereby publishes notice of its 2021 annual general meeting of shareholders (the “Meeting”), which is scheduled to take place at 10:00 a.m. (Israeli time) on Wednesday, December 15, 2021, at the Meitar Law Offices, located at 16 Abba Hillel Road, 10th Floor, Ramat Gan, Israel, 5250608.

Shareholders of record at the close of business on Monday, November 8, 2021 are entitled to vote at the Meeting.

Attached as Exhibit 99.1 to this Report of Foreign Private Issuer on Form 6-K (this “Form 6-K”) are the following documents related to the Meeting:

|

|

(i)

|

Notice of 2021 Annual General Meeting of Shareholders, which contains information concerning the agenda for the Meeting, the required majority for approval of the proposals at the Meeting, the voting procedure and additional general matters related to the Meeting.

|

|

|

(ii)

|

Proxy Statement for the Meeting, which describes in greater detail each of the proposals to be presented at the Meeting, including background information related to the proposals, additional logistical information concerning the required vote and means of voting on the proposals, and general information concerning Taro’s Board of Directors, corporate governance, executive compensation and significant shareholders.

|

Attached as Exhibit 99.2 to this Form 6-K is the form of proxy card being distributed by Taro to its shareholders of record as of the record date for the Meeting, which serves as the primary means for those shareholders to cast their votes on the proposals to be presented at the Meeting.

Exhibit Index

Exhibit 99.1

TARO PHARMACEUTICAL INDUSTRIES LTD.

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

November 5, 2021

Notice is hereby given that the 2021 annual general meeting of shareholders (the “Annual General Meeting” or the “Meeting”) of Taro Pharmaceutical Industries Ltd. (the “Company”) will be held on Wednesday, December 15, 2021, at 10:00 a.m. (Israeli time), at the Meitar Law Offices, located at 16 Abba Hillel Road, 10th Floor, Ramat Gan, Israel, 5250608 for the following purposes:

|

|

1.

|

Re-election to the Company’s Board of Directors (the “Board of Directors” or “Board”) of each of Dilip Shanghvi, Abhay Gandhi, Sudhir Valia, Uday Baldota, James Kedrowski and Dov Pekelman as an ordinary/non-External Director, as defined in the Israeli Companies Law, 5759-1999 (the “Companies Law”), to serve for a one-year term, until the close of the next annual general meeting of shareholders.

|

|

|

2.

|

Approval and ratification of an annual base salary pay range that is consistent with the Company’s Compensation Policy for Office Holders, as well as the addition of annual long-term cash incentive pay, for the Company’s chief executive officer, Uday Baldota (the “CEO”).

|

|

|

3.

|

Re-appointment of Ziv Haft Certified Public Accountants (Israel), a BDO member firm, as the Company’s independent auditors for the fiscal year ending March 31, 2022, and the additional period until the close of the next annual general meeting of shareholders of the Company, and to authorize their remuneration to be fixed, in accordance with the volume and nature of their services, by the Board of Directors or the Audit Committee thereof.

|

In addition to the foregoing proposals, members of our management will be available to review and discuss our auditor’s report and consolidated financial statements for our fiscal year ended March 31, 2021.

Shareholders of record (including shares held through a bank, broker or other nominee that is a shareholder of record) at the close of business on November 8, 2021, are entitled to vote at the Meeting. All shareholders are cordially invited to attend the Annual General Meeting in person.

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions and broker non-votes) is necessary for the approval of each of the above three numbered proposals.

In addition, the approval of the base salary pay range and the annual long-term cash incentive pay for the CEO pursuant to Proposal 2 requires that one of the following two voting requirements also be met:

•the majority voted in favor of the proposal includes a majority of the votes of shareholders who are neither controlling shareholders nor possess a conflict of interest (referred to under the Companies Law as a “personal interest”) in the approval of that proposal that is voted at the Meeting, excluding abstentions;

•the total number of votes of non-controlling, non-conflicted shareholders (as described in the previous bullet-point) who voted against the proposal does not exceed 2% of the aggregate voting power in the Company.

For purposes of the above special voting requirements for Proposal 2, Sun Pharmaceutical Industries Ltd. (“Sun Pharma”), and certain affiliates will be deemed collectively to constitute a controlling shareholder of the Company, and their votes will therefore be excluded in determining whether either of the above-described special majority conditions has been achieved.

You can vote your shares in advance of the Meeting via any of the following alternative means: (i) completing and signing a proxy card or voting instruction form (for record shareholders and shareholders holding their shares in “street name,” respectively); or (ii) recording your vote over the Internet (at the website www.voteproxy.com) by following the instructions at that website. If you are a record shareholder voting by mail, the proxy must be received by our transfer agent not later than 11:59 p.m. EST on December 14, 2021, or at our registered office not later than 4:00 a.m. Israeli time on December 15, 2021, to be validly included in the tally of ordinary shares voted at the Meeting. An earlier deadline may apply to voting via the Internet. If you hold your ordinary shares in “street name,” an earlier deadline may apply for receipt of your voting instruction form. Shareholders who subsequently revoke their proxies may vote their shares in person. An electronic copy of the proxy materials will also be available for viewing in the “Investor Relations” portion of our website at http://www.taro.com. The full text of the proposed resolutions, together with the form of proxy card for the Meeting, may also be viewed beginning on Sunday, November 7, 2021, at the registered office of the Company, 14 Hakitor Street, PO Box 10347, Haifa Bay, 2624761, Israel, from Sunday to Thursday (excluding Israeli holidays), 10:00 a.m. to 5:00 p.m. (Israeli time). Our telephone number at our registered office is +972-4-847-5700.

Israeli legal regulations presently limit public gatherings as a result of the COVID-19 pandemic. The Company furthermore desires to reduce the risk of further spreading of the virus and to safeguard the well-being of shareholders, Board and Company representatives at the Meeting. Consequently, the Company strongly encourages shareholders to vote online or mail in their proxy cards or voting instruction forms in lieu of attending the Meeting in person. If a shareholder who holds ordinary shares as of the record date for the Meeting (November 8, 2021) nevertheless desires to attend the Meeting, he, she or it must bring to the Meeting proof of ownership of ordinary shares (a copy of your share certificate or a statement showing book-entry shares). If you hold your shares in “street name” (through a bank or broker), please attach to your email the required proof of ownership to be described in the proxy statement for the Meeting, namely: a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Meeting, along with an account statement or other proof that shows that you owned your shares as of the record date for the Meeting.

In accordance with the Companies Law and regulations promulgated thereunder, any shareholder of the Company holding at least 1% of the outstanding voting rights of the Company for the Meeting may submit to the Company a proposed additional agenda item for the Meeting, to the Company’s Israeli offices, 14 Hakitor Street, PO Box 10347, Haifa Bay, 2624761, Israel, Attention: Mr. Ohad Rosner, Senior Counsel - Israeli Operations, Director, email: ohad.rosner@taro.com, no later than November 12, 2021. To the extent that there are any additional agenda items that the Board determines to add as a result of any such submission, the Company will publish an updated notice and proxy card with respect to the Meeting, no later than November 19, 2021, to be furnished to the Securities and Exchange Commission under cover of a Report of Foreign Private Issuer on Form 6-K.

BY ORDER OF THE BOARD OF DIRECTORS,

/s/ Dilip Shanghvi

Dilip Shanghvi

Chairman of the Board of Directors

2

TARO PHARMACEUTICAL INDUSTRIES LTD.

_____________________

PROXY STATEMENT

_____________________

This Proxy Statement is furnished to the holders of ordinary shares, nominal (par) value New Israeli Shekel (“NIS”) 0.0001 each (“ordinary shares”) and founders’ shares, nominal (par) value NIS 0.00001 (“founders' shares”), of Taro Pharmaceutical Industries Ltd. (the “Company” or “Taro”) in connection with the solicitation by the Board of Directors of the Company (the “Board of Directors” or “Board”) of proxies for use at the annual general meeting of shareholders (the “Annual General Meeting” or the “Meeting”), or any postponement or adjournment thereof, pursuant to the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held on December 15, 2021, at 10:00 a.m. (Israeli time) at Meitar Law Offices, our Israeli legal counsel, located at 16 Abba Hillel Road, 10th Floor, Ramat Gan, Israel.

At the Meeting, the following matters will be considered:

|

|

1.

|

Re-election to the Board of each of Dilip Shanghvi, Abhay Gandhi, Sudhir Valia, Uday Baldota, James Kedrowski and Dov Pekelman as an ordinary/non-External Director, as defined in the Israeli Companies Law, 5759-1999 (the “Companies Law”), to serve for a one-year term, until the close of the next annual general meeting of shareholders.

|

|

|

2.

|

Approval and ratification of an annual base salary pay range that is consistent with the Company’s Compensation Policy for Office Holders, as well as the addition of annual long-term cash incentive pay, for the Company’s chief executive officer, Uday Baldota (the “CEO”).

|

|

|

3.

|

Re-appointment of Ziv Haft Certified Public Accountants (Israel), a BDO member firm, as the Company’s independent auditors for the fiscal year ending March 31, 2022, and the additional period until the close of the next annual general meeting of shareholders of the Company, and to authorize their remuneration to be fixed, in accordance with the volume and nature of their services, by the Board of Directors or the Audit Committee thereof.

|

In addition to the foregoing proposals, members of our management will be available to review and discuss our auditor’s report and consolidated financial statements for our fiscal year ended March 31, 2021.

We are not aware of any other matters that will come before the Meeting. If any other matters are presented properly at the Meeting, the persons designated as proxies intend to vote upon such matters in accordance with their best judgment and the recommendation of the Board.

Board Recommendation

Our Board unanimously recommends that you vote “FOR” each of the above proposals.

Who Can Vote

You are entitled to vote at the Meeting if you are a shareholder of record at the close of business on November 8, 2021. You are also entitled to vote at the Meeting if you held ordinary shares through a bank, broker or other nominee that is one of our shareholders of record at the close of business on November 8, 2021, or which appear in the participant listing of a securities depository on that date. In that case, these proxy materials are being forwarded to you by your bank, broker, or other nominee.

If your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC of Brooklyn, New York, you are considered, with respect to those shares, the shareholder of record. In such case, these proxy materials are being sent directly to you.

Quorum

As of October 15, 2021, we had 37,584,631 ordinary shares and 2,600 founders’ shares issued and outstanding. Each ordinary share outstanding as of the close of business on the record date (November 8, 2021) is entitled to one vote upon each of the proposals to be presented at the Meeting. The founders’ shares, all of which are held by Alkaloida Chemical Company Exclusive Group Ltd., a subsidiary of our controlling shareholder, Sun Pharmaceutical Industries Ltd. (“Sun Pharma”), are entitled, in the aggregate, to one-third (1/3) of the total voting power of all of our voting shares. Under our Articles of Association, the Meeting will be properly convened if at least three shareholders attend the Meeting in person or sign and return proxies, provided that they hold shares representing at least one-third (1/3) of our voting power. If a quorum is not present within half an hour from the time scheduled for the Meeting, the Meeting will be adjourned for one week (to the same day, time and place), or to a day, time and place determined by the Chairman of the Meeting. At such adjourned meeting the presence of any two shareholders in person or by proxy (regardless of the voting power represented by their shares) will constitute a quorum.

Abstentions and “broker non-votes” are counted as present and entitled to vote for purposes of determining a quorum. A “broker non-vote” occurs when a bank, broker or other holder of record holding shares for a beneficial owner attends the Meeting but does not vote on a particular proposal because that holder does not have discretionary voting power for that particular proposal and has not received instructions from the beneficial owner. It is important for a shareholder that holds ordinary shares through a bank or broker to instruct its bank or broker how to vote its shares if the shareholder wants its shares to count towards the vote on a particular proposal.

Majority Required for Approval of Each of the Proposals

The affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon is necessary for the approval of each of the proposals. Apart from the purpose of determining a quorum, broker non-votes will not be counted as present and are not entitled to vote. Abstentions are not treated as a vote “FOR” or a vote “AGAINST” a proposal and therefore have no impact as to whether a given proposal is approved or not.

In addition to the simple majority required for the approval of all proposals, the approval of the base salary pay range and the annual long-term cash incentive pay for the CEO pursuant to Proposal 2 also requires that either of the following conditions be met:

|

|

•

|

the majority voted in favor of that proposal includes at least a majority of the votes of non-controlling shareholders who also lack a conflict of interest (referred to as a “personal interest” under the Companies Law) in the approval of that proposal that are voted thereon (not including abstentions); or

|

|

|

•

|

the total number of votes of such non-controlling, non-conflicted shareholders voted against the proposal does not exceed two percent (2%) of the aggregate voting rights in the Company.

|

A “controlling shareholder” is any shareholder that has the ability to direct a company’s activities (other than by means of being a director or office holder of the company). A shareholder is presumed to be a controlling shareholder if the shareholder “holds” (within the meaning of the Companies Law) 50% or more of the voting rights in a company or has the right to appoint the majority of the directors of the company or its general manager (that is, its chief executive officer).

Sun Pharma and certain of its affiliates have indicated to the Company that they believe that they collectively constitute a controlling shareholder. Consequently, for the purposes of Proposal 2, the shares owned or controlled by them (or by entities under their control) will not be counted among the votes of the non-controlling, non-conflicted shareholders.

A “personal interest” of a shareholder under the Companies Law (a) includes an interest of any members of the shareholder’s immediate family (or spouses thereof) or an interest of a company with respect to which the shareholder (or such a family member thereof) serves as a director or the chief executive officer, owns at least 5% of the shares or has the right to appoint a director or the chief executive officer; and (b) excludes an interest arising solely from the ownership of ordinary shares of the Company. In determining whether a vote cast by proxy is disinterested, the “personal interest” of the proxy holder is also considered and will cause that vote to be excluded from the disinterested vote, even if the shareholder granting the proxy does not have a personal interest in the matter being voted upon.

Controlling shareholders and shareholders that have a conflict of interest are qualified to participate in the vote on Proposal 2; however, the vote of such shareholders will not be counted towards or against the special majority described in the first bullet point above and, if voted against Proposal 2, will not count towards the 2% threshold described in the second bullet point above.

2

A shareholder must inform our Company before the vote (or if voting by proxy or voting instruction form, indicate on the proxy card or voting instruction form) whether or not such shareholder has a conflict of interest in the approval of the CEO’s base salary pay range and annual long-term cash incentive pay pursuant to Proposal 2. Failure to so inform us disqualifies that shareholder from participating in the vote on that approval. In order to confirm that you lack a conflict of interest in that approval and in order to therefore be counted towards or against the special majority required for that approval, you must check the box “FOR” Item 2A on the accompanying proxy card or voting instruction form when you record your vote or voting instruction on Proposal 2.

If you believe that you, or a related party of yours, is a controlling shareholder or has such a conflict of interest and you wish to participate in the vote for or against the approval of the CEO’s base salary pay range and annual long-term cash incentive pay under Proposal 2, you should check the box “AGAINST” Item 2A on the enclosed proxy card or voting instruction form. In that case, your vote will be counted towards or against the ordinary majority required for the approval of Proposal 2, but will not be counted towards or against the special majority required for approval of that proposal. If you do not check the box either “FOR” or “AGAINST” Item 2A on your proxy card or voting instruction form (whether physical or electronic), your vote on Proposal 2 will not be counted at all.

How You Can Vote

Shareholders of Record

If you are a shareholder of record, that is, your shares are registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC, these proxy materials are being sent directly to you by our transfer agent. You can vote your shares by any of the following alternative means: completing and signing a proxy card; recording your vote over the Internet (at the website www.voteproxy.com) by following the instructions at that website; or attending the Meeting. If you vote via the proxy card that has been mailed to you, please be certain to complete, sign and return it in the envelope that was enclosed with it. We will not be able to count a proxy card unless we receive it at our registered Israeli offices at 14 Hakitor Street, PO Box 10347, Haifa Bay, 2624761, Israel, by 4:00 a.m., Israeli time, on December 15, 2021, or our registrar and transfer agent receives it in the enclosed envelope, not later than 11:59 p.m. EST on December 14, 2021. An earlier deadline may apply to Internet voting.

Shareholders Holding in “Street Name”

If your ordinary shares are held in a brokerage account or by a trustee or nominee, you are considered to be the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction form by the broker, trustee or nominee or an agent hired by the broker, trustee or nominee. Please follow the enclosed instructions to direct your broker, trustee or nominee how to vote your shares, including providing voting instructions through the Internet (at the website www.voteproxy.com). All voting instructions should be submitted by 11:59 p.m. EST on December 14, 2021, (or such earlier deadline as may be indicated in the information that you receive) in order to be counted towards the tally of ordinary shares voted at the Meeting. Alternatively, if you wish to attend the Meeting and vote in person, you must obtain a “legal proxy” from the broker, trustee or nominee that holds your shares, giving you the right to vote the shares at the Meeting, along with an account statement showing that you owned your ordinary shares at or about the record date.

Various Voting Scenarios

If you are a shareholder of record and provide specific instructions (by marking a box) with regard to the proposals, your shares will be voted as you instruct. If you sign and return your proxy card without giving specific instructions with respect to a particular proposal, your shares will be voted in favor of the proposal, in accordance with the recommendation of the Board (assuming, in the case of Proposal 2, that you have indicated “FOR” or “AGAINST” in Item 2A, thereby confirming whether you have a conflict of interest concerning that proposal or are a controlling shareholder). However, if you are a beneficial owner of shares and do not specify how you want to vote on your voting instruction form, your broker will not be permitted to instruct the record shareholder of your shares to cast a vote with respect to the subject proposal (commonly referred to as a “broker non-vote”). Brokers that hold shares in “street name” for clients typically have authority to vote on “routine” proposals even when they have not received instructions from beneficial owners. The only proposal on the Meeting agenda that may be considered routine is Proposal 3 relating to the reappointment of the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2022; however, we cannot be certain whether this will be treated as a routine matter since our Proxy Statement is prepared in compliance with the Companies Law, rather than the rules applicable to domestic U.S. reporting companies. Absent specific instructions from the beneficial owner of the shares, brokers are not allowed to exercise their voting discretion, among other things, with respect to the election of directors. In that circumstance, the shares held by you will be included in determining the presence of a quorum at the Meeting, but are not considered “present” for the purpose of voting on any proposal. Such shares have no impact on the outcome of the voting on such proposal. If your shares of record are

3

held by a bank, broker, or other nominee, we urge you to give instructions to your bank, broker, or other nominee as to how your shares should be voted so that you thereby participate in the voting on these important matters. If you sign and return your proxy card or voting instruction form, the persons named as proxies will vote in their discretion on any other matters that properly come before the Meeting.

Revocation or Change of a Proxy or Voting Instructions

Shares Held by Record Shareholders

If you are a record shareholder, any proxy that you give pursuant to this solicitation may be revoked or changed by you at any time before it is voted. Proxies may be revoked or changed in one of several ways:

|

|

•

|

you can send a written notice stating that you would like to revoke your proxy, which notice must be received in our Israeli offices at least six hours prior to the time set for beginning the Meeting (i.e., by 4:00 a.m., Israeli time, on December 15, 2021);

|

|

|

•

|

you can complete and submit a new proxy card dated later than the first proxy card, which must be received no later than the deadline applicable to a notice of revocation, as described above;

|

|

|

•

|

if you voted by Internet, you can submit your revised vote via the Internet; or

|

|

|

•

|

you can attend the Meeting, and file a written notice of revocation or make an oral notice of revocation of your proxy with the chairman of the Meeting and then vote in person. Your attendance at the Meeting will not revoke your proxy in and of itself.

|

Any written notice of revocation or subsequent proxy submitted to us in advance of the Meeting as described above should be delivered to our Israeli offices, located at 14 Hakitor Street, PO Box 10347, Haifa Bay, 2624761, Israel, Attention: Mr. Ohad Rosner, Senior Counsel - Israeli Operations, Director, or hand-delivered to the chairman of the Meeting at or before the taking of the vote at the Meeting.

Shares Held in Street Name

If your shares are held on the New York Stock Exchange via a stock brokerage account or by a bank or other nominee, in order to change your voting instructions, you should follow the directions from your broker, bank or other nominee to change those instructions, or contact your broker, bank or other nominee.

Solicitation of Proxies

Proxies are being distributed to shareholders on or about November 12, 2021. Certain officers, directors and employees, of the Company, none of whom will receive additional compensation therefor, may solicit proxies by email or other personal contact. We will bear the cost for the solicitation of the proxies, including postage, printing, and handling, and will reimburse the reasonable expenses of brokerage firms and others for forwarding material to beneficial owners of shares.

We have retained MacKenzie Partners, Inc., a proxy solicitation firm, to perform various solicitation services in connection with the Meeting. We will pay MacKenzie Partners a customary fee, plus phone and other related expenses, in connection with its solicitation services. MacKenzie Partners has engaged certain of its employees to assist us in connection with the solicitation of proxies.

Voting Results

We will tally the final voting results based on the information provided by our transfer agent, and will publish the overall results of the Meeting following the Meeting in a Report of Foreign Private Issuer on Form 6-K that we will furnish to the U.S. Securities and Exchange Commission (the “SEC”).

Availability of Proxy Materials

Copies of the proxy card, the notice of the Meeting and this Proxy Statement are available in the “Investor Relations” portion of our Company’s website, at http://www.taro.com. The contents of that website are not a part of this Proxy Statement.

4

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of our ordinary shares as of October 15, 2021, by:

|

|

■

|

each person or entity known by us to own beneficially 5% or more of our outstanding shares;

|

|

|

■

|

each of our directors and executive officers individually; and

|

|

|

■

|

all of our executive officers and directors as a group.

|

The beneficial ownership of ordinary shares is determined in accordance with the rules of the SEC and generally includes any ordinary shares over which a person exercises sole or shared voting or investment power, or the right to receive the economic benefit of ownership (whether as of October 15, 2021, or whether due to the right to have that power or benefit within 60 days thereafter). The percentage of shares beneficially owned shown below is based on 37,584,631 ordinary shares outstanding as of October 15, 2021.

Except where otherwise indicated, we believe, based on information furnished to us by such owners, that the beneficial owners of the ordinary shares listed below have sole investment and voting power with respect to such shares.

Unless otherwise noted below, each beneficial holder's address is c/o Taro Pharmaceutical Industries Ltd., 14 Hakitor Street, PO Box 10347, Haifa Bay, 2624761, Israel.

|

Name

|

|

Number of Ordinary Shares

|

|

|

Percentage of Outstanding Ordinary Shares

|

|

|

Sun Pharmaceuticals Industries Ltd. (1)

|

|

|

29,497,813

|

|

|

78.48%

|

|

|

Dilip Shanghvi (2)

|

|

|

—

|

|

|

0.00%

|

|

|

Abhay Gandhi

|

|

|

—

|

|

|

0.00%

|

|

|

Sudhir Valia (3)

|

|

|

—

|

|

|

0.00%

|

|

|

Uday Baldota

|

|

|

—

|

|

|

0.00%

|

|

|

Linda Benshoshan

|

|

|

—

|

|

|

0.00%

|

|

|

Robert Stein, M.D., Ph.D.

|

|

|

—

|

|

|

0.00%

|

|

|

Dov Pekelman

|

|

|

—

|

|

|

0.00%

|

|

|

James Kedrowski

|

|

|

—

|

|

|

0.00%

|

|

|

William Coote

|

|

|

—

|

|

|

0.00%

|

|

|

Erik Zwicker

|

|

|

—

|

|

|

0.00%

|

|

|

Avi Avramoff, Ph.D.

|

|

|

—

|

|

|

0.00%

|

|

|

Hagai Reingold

|

|

|

—

|

|

|

0.00%

|

|

|

Michele Visosky

|

|

*

|

|

|

*

|

|

|

Jayesh Shah

|

|

|

—

|

|

|

0.00%

|

|

|

Victoria Chester

|

|

|

—

|

|

|

0.00%

|

|

|

Vikash Agarwal

|

|

|

—

|

|

|

0.00%

|

|

|

Anthony Dolan

|

|

|

—

|

|

|

0.00%

|

|

|

Total for all directors and officers (17 persons) listed above, as a group

|

|

*

|

|

|

*

|

|

*Less than 0.1%

|

(1)

|

As reported on the Schedule 13D/A filed by Sun Pharma on November 27, 2013.

|

|

(2)

|

Dilip Shanghvi, as the Managing Director of Sun Pharma’s board of directors and along with entities controlled by him and members of his family, control 54.5% of Sun Pharma. As of October 15, 2021, Sun Pharma and its affiliates owned 78.5% of our outstanding ordinary shares.

|

|

(3)

|

Sudhir Valia is also a director of Sun Pharma. As of October 15, 2021, Sun Pharma and its affiliates owned 78.5% of our outstanding ordinary shares.

|

The following table sets forth certain information regarding the ownership of our founders’ shares as of October 15, 2021. The percentage of ownership is based on 2,600 founders’ shares outstanding as of October 15, 2021.

|

Name

|

|

Number of

Founders’ Shares

|

|

|

Percentage of Outstanding Founders’ Shares

|

|

|

Alkaloida Chemical Company Exclusive Group Ltd.(1)

|

|

|

2,600

|

|

|

100.00%

|

|

5

|

(1)

|

Alkaloida Chemical Company Exclusive Group Ltd. (“Alkaloida”), a subsidiary of Sun Pharma, owns all 2,600 of our outstanding founders’ shares and is entitled to exercise one-third of the total voting power in our Company regardless of the number of ordinary shares then outstanding. As a result of the control that may be deemed to be held by Alkaloida, each of Dilip Shanghvi and Sudhir Valia may be deemed to beneficially own the founders’ shares held by Alkaloida. Each of Mr. Shanghvi and Mr. Valia disclaims beneficial ownership of such shares, except to the extent of his pecuniary interest therein.

|

OFFICE HOLDER COMPENSATION IN FISCAL YEAR ENDED MARCH 31, 2021

Under the Companies Law regulations, we are required to disclose the compensation of our five most highly compensated senior office holders (as defined in the Companies Law) on an individual basis in the notice of our annual general shareholder meeting or in an accompanying document (such as this Proxy Statement).

The table below outlines the compensation earned by our five most highly compensated senior office holders during or with respect to the fiscal year ended March 31, 2021, in the disclosure format of Regulation 21 of the Israeli Securities Regulations (Periodic and Immediate Reports), 1970. We refer to the five individuals for whom disclosure is provided herein as our “Covered Executives.”

For purposes of the table and the footnotes below, and in accordance with the above mentioned securities regulations, “compensation” includes base salary, bonuses, equity-based compensation, retirement or termination payments, benefits and perquisites such as car, phone and social benefits and any undertaking to provide such compensation.

Summary Compensation Table

|

Information Regarding the Covered Executive(1)

|

|

|

(U.S. dollars)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position(2)

|

|

Base Compensation(3)

|

|

|

Benefits and Perquisites(4)

|

|

|

Variable compensation(5)

|

|

|

Equity-Based Compensation

|

|

Total

|

|

|

Dilip Shanghvi

|

|

|

921,882

|

|

|

—

|

|

|

|

608,754

|

|

|

—

|

|

|

1,530,636

|

|

|

Uday Baldota

|

|

|

854,159

|

|

|

|

179,164

|

|

|

|

520,355

|

|

|

—

|

|

|

1,553,678

|

|

|

Avi Avramoff

|

|

|

396,116

|

|

|

|

125,211

|

|

|

|

139,770

|

|

|

—

|

|

|

661,097

|

|

|

Erik Zwicker

|

|

|

193,425

|

|

|

|

16,176

|

|

|

|

367,440

|

|

|

—

|

|

|

577,040

|

|

|

Daphne Huang

|

|

|

360,577

|

|

|

|

61,117

|

|

|

|

110,263

|

|

|

—

|

|

|

531,956

|

|

_________________

|

(1)

|

All amounts reported in the table represent amounts recorded in the Company’s financial statements, which in some instances is a portion of the Covered Executive’s compensation, as more fully described in the footnotes below. Cash compensation amounts denominated in currencies other than the U.S. dollar were converted into U.S. dollars at the average conversion rate during the fiscal year ended March 31, 2021.

|

|

(2)

|

Mr. Dilip Shanghvi is a director of Taro. Mr. Uday Baldota is a full-time employee of Taro and CEO and Director. Mr. Avi Avramoff is a fulltime employee of Taro and Vice President, Head of R&D. Mr. Erik Zwicker is a shared service employee of Taro and Sun Pharma, and Vice President, General Counsel and Secretary of Taro. Ms. Daphne Huang was the former Vice President, CFO and Chief Accounting Officer of Taro.

|

|

(3)

|

As approved by our Board of Directors and Compensation Committee, Mr. Shanghvi’s base compensation consists of USD 869,648 of management fees, USD 44,151 of statutory director fees and USD 8,083 of board meeting fees.

|

|

(4)

|

Amounts reported in this column include benefits and perquisites, including those mandated by applicable law. Such benefits and perquisites may include, to the extent applicable to the Covered Executive, payments, contributions and/or allocations for savings funds, pension, severance, vacation, car or car allowance, medical insurances and benefits, risk insurances (e.g., life, disability, accident), convalescence pay, payments for social security, tax gross-up payments, rent assistance, and other benefits and perquisites consistent with Taro’s guidelines.

|

|

(5)

|

Amounts reported in this column include, among other amounts, short and long-term performance based bonuses that were earned during the fiscal year ended March 31, 2021, subject to vesting.

|

Additional Information Regarding Our Board AND Corporate Governance

Item 6.C (“Board Practices”) of our Annual Report on Form 20-F for the year ended March 31, 2021, which we filed with the SEC on June 17, 2021 (which we refer to as our 2021 Form 20-F), contains information regarding our Board, its committees and our corporate governance practices. We encourage you to review those portions of our 2021 Form 20-F (which we incorporate by reference herein) to obtain additional information.

6

PROPOSAL 1

RE-ELECTION OF DIRECTORS

Background

Under the Companies Law and our Articles of Association, the directors of the Company (other than the External Directors, who serve three-year terms pursuant to the requirements of the Companies Law) are elected at each annual general meeting of shareholders. The elected directors commence their terms from the close of the annual general meeting at which they are elected and serve in office until the close of the next annual general meeting, unless such directorship is earlier vacated in accordance with the provisions of any applicable law or regulation or under our Articles of Association.

At the Annual General Meeting, it is intended that proxies (other than those directing the proxy holders to vote against the listed nominees, or to abstain) will be voted for the re-election, as ordinary/non-external directors of the Company, of the six nominees named below who shall hold office from the close of the Annual General Meeting until the close of the next annual general meeting of shareholders, unless any such director’s office is earlier vacated in accordance with the provisions of any applicable law or under our Articles of Association. The director nominees will be entitled to the remuneration approved for them by the Compensation Committee and the Board of Directors in accordance with the Compensation Policy approved by the shareholders at the December 2020 annual general meeting.

A list of the nominees, all of whom are currently directors, is as follows:

The Companies Law requires that a person will not be elected and will not serve as a director in a public company if he or she does not have the required qualifications and the ability to dedicate an appropriate amount of time for the performance of his or her position as director of the company, taking into consideration, among other factors, the special needs and size of the company. The election of a director nominee at a general shareholders meeting of a public company may not be proposed unless the nominee has declared to the company, inter alia, that he or she complies with the above-mentioned requirements and details of his or her applicable qualifications are provided.

Each of the proposed nominees has declared to the Company that he complies with the required qualifications under the Companies Law for election as a member of the Board of Directors of the Company, detailing his applicable qualifications, and that he is capable of dedicating the appropriate amount of time for the performance of his role as a member of the Board of Directors of the Company. Copies of the declarations of the director nominees are available for inspection at the Company’s offices in Haifa Bay, Israel.

Biographical Information for Director Nominees

The following information is supplied with respect to each nominee for re-election to the Board of Directors as an ordinary/non-External Director pursuant to this Proposal 1 and is based upon the records of the Company and information provided to it by the nominee:

7

Dilip Shanghvi became the Chairman of the Taro Board in August 2013, after previously serving as Director and Chairman from September 2010 to April 2012. He is the founder and Managing Director of Sun Pharma and has extensive industrial experience in the pharmaceutical industry. A first generation entrepreneur, Mr. Shanghvi has won numerous awards and recognitions, including the 2017 Entrepreneur of the Year Award from AIMA (All India Management Association), the 2016 PADMA SHRI (Fourth Highest Civilian Award in the Republic of India) from the Government of India and the 2016 NDTV Business Leadership Award (Pharmaceutical), as well as various other awards including, the Forbes Entrepreneur of the Year award in 2014, Outstanding Business Leader of the Year from CNBC TV18 in 2014, the Economic Times’ Business Leader of the Year Award in 2014, the JRD TATA Corporate Leadership Award AIMA (All India Association) in 2014, CNN IBN’s Indian of the Year (Business) in 2011, Business India’s Businessman of the Year in 2011 and Ernst and Young’s World Entrepreneur of the Year in 2011. He has also been awarded the Entrepreneur of the Year, Ernst and Young in 2010, CNBC TV 18’s First Generation Entrepreneur of the Year in 2007 and Entrepreneur of the Year (Healthcare and Life Sciences), Ernst and Young in 2005. A prestigious non-profit management association of India, Indore Management Association (IMA), presented Mr. Shanghvi with the IMA Lifetime Outstanding Achievement Award in 2018. Tel Aviv University, Israel’s largest and most comprehensive institution of higher learning, granted Mr. Shanghvi an honorary doctorate in 2019. Chemtech Foundation presented Mr. Shanghvi with the “Lifetime Achievement” - Chemtech CEO Leadership & Excellence Award for 2019. Mr. Shanghvi is a Director of various companies, including Shantilal Shanghvi Foundation and is also the Chairman and Managing Director of Sun Pharma Advanced Research Company Ltd.

Abhay Gandhi became a Director in December 2016 and Vice Chairman of the Taro Board in February 2017. Mr. Gandhi has served as Chief Executive Officer of Sun Pharmaceutical Industries, Inc. (“Sun Pharmaceuticals”) since November 2016. Mr. Gandhi also served as Interim Chief Executive Officer of Taro from January 2017 until Mr. Uday Baldota’s assumption of these duties in August 2017. Prior to joining Sun Pharmaceuticals, Mr. Gandhi served as a Director starting in November 2014, and as the CEO – India Subcontinent, of Sun Pharmaceutical Laboratories Ltd. (“SPLL”) starting in November 2013, where he was responsible for domestic operations of the business as well as certain international markets, including sales & marketing, integration efforts, business development, portfolio management and other allied functions. Prior to that appointment, Mr. Gandhi was President – India Subcontinent of SPLL from March 2012 to November 2013, Executive Vice President – International Marketing from April 2007 to March 2012 and has served in various other positions within the Sun Pharma organization for over 20 years. Prior to joining Sun Pharma, Mr. Gandhi held positions at Boehringer Mannheim Gmbh, and Nestle India Ltd. From 2013 to 2015, he was a Member of the Executive Committee of the Indian Drug Manufacturers Association (IDMA) and a Member of the Confederation of Indian Industry (CII) National Committee on Drugs and Pharmaceuticals from 2013 to 2014. Mr. Gandhi holds a Bachelor of Science and a Masters in Marketing Management from the University of Mumbai, and a Diploma in Business Management from the Institute of Chartered Financial Analysts of India (ICFAI University).

Sudhir Valia became a member of the Taro Board in September 2010. Mr. Valia joined Sun Pharma as a director in January 1994 and was a whole-time director until May 2019. He is now a non-executive director of Sun Pharma. Mr. Valia is the recipient of the CNBC TV 18’s CFO Awards for best performing CFO in the Pharma/Healthcare sector in 2012, 2009 and 2006. He also received the “Adivasi Sevak Puraskar” award from the Government of Maharashtra in 2008-2009. Prior to joining Sun Pharma, Mr. Valia was a chartered accountant in private practice. Mr. Valia is a Director of various companies, including Shantilal Shanghvi Foundation and Sun Pharma Advanced Research Company Ltd. Mr. Valia is a qualified chartered accountant in India.

Uday Baldota became a member of the Taro Board in December 2016 and assumed the role of Chief Executive Officer in August 2017. He continues as a member of the global Core Management Team of Sun Pharma. Mr. Baldota serves on the board of directors of the Association for Accessible Medicines. Mr. Baldota was formerly Executive Vice President & Chief Financial Officer of Sun Pharma. He led their global Finance function from June 2012 and was designated as the Chief Financial Officer in August 2014. From June 2005 to May 2012, Mr. Baldota served in various leadership positions as a Vice President and later Senior Vice President reporting to the Chairman and Managing Director of Sun Pharma. Mr. Baldota’s areas of responsibility over his tenure at Sun Pharma have included accounting, M&A, business finance, tax, treasury, insurance, controllership, legal, corporate secretarial, corporate communication and internal audit. Mr. Baldota was the Vice President Purchasing of Lafarge India Limited from March 2003 to June 2005 and served as its Head of Information Technology from November 1999 to March 2003. Prior to that, Mr. Baldota served in various IT and marketing roles with Sun Pharma between May 1995 and November 1999. Mr. Baldota earned a Bachelor of Technology in Chemical Engineering from Indian Institute of Technology, Delhi, and a Masters of Business Administration from the Indian Institute of Management, Ahmedabad.

8

James Kedrowski became a member of the Taro Board in May 2011. In addition, Mr. Kedrowski served as the Company’s Interim Chief Executive Officer from October 2010 until August 2013. Mr. Kedrowski was with Chattem Chemicals, Inc., an indirect subsidiary of Sun Pharma since 1997 and served as its President. Mr. Kedrowski’s prior experience includes over 20 years with Alcoa Inc., starting in sales, then purchasing roles culminating as senior purchasing agent for all chemicals, energy, and carbon. Subsequently, Mr. Kedrowski was in progressive P&L business management positions in the United States before heading to Tokyo for four years of international experience running Alcoa’s Industrial Chemicals business in Asia. Mr. Kedrowski then returned to the United States as Operational Vice President for seven North American Industrial Chemicals plants.

Dov Pekelman became a member of the Taro Board and Audit Committee in August 2011, Chairman of the Special Committee in November 2011 (disbanded in February 2013), the Stock Option Committee in March 2012 (disbanded in January 2015) and the Compensation Committee in February 2013. Professor Pekelman is currently a major shareholder of Atera Networks Ltd. and a board member of Mapi Pharma, Ltd. He serves as Dean of the Business School at the Interdisciplinary Center (IDC), Herzliya, Israel, and is Chairman of the IDC Corporation, the center’s economic arm. Professor Pekelman served as a senior consultant to Teva Pharmaceutical Industries Ltd. (NASDAQ: TEVA) from 1985 to 2008 and also founded and ran a leading, Israeli-based management-consulting firm, P.O.C. Ltd. Professor Pekelman served on the Board of Directors of several large industrial corporations, including Enzymotec (NASDAQ:ENZY), Koor Industries Ltd. (TASE: KOR) and served for 22 years on the Board of Directors of Makhteshim Agan Industries Ltd. (TASE: MAIN). Professor Pekelman was also a member of the advisory committee of the Bank of Israel. He holds a Ph.D. from the University of Chicago and a B.S. from the Technion, Israeli Institute of Technology. Professor Pekelman is a published author writing on various aspects of business operations.

Biographical Information for External Directors Not Subject to Re-election at Meeting

The following biographical information is supplied with respect to our External Directors, each of whom is in the middle of a three-year term under the Companies Law and is therefore not subject to re-election to the Board of Directors at the Meeting. The information is based upon the records of the Company and information provided to it by those directors:

Linda Benshoshan was elected as an External Director, thereby joining the Taro Board for a three-year term, in December 2016 and was re-elected for a second three-year term in December 2019. Ms. Benshoshan serves as the Chairwoman of the Audit Committee and the Chairwoman of the Compensation Committee. She served as a member of the board of Israel Discount Bank from November 2014 until May 2017. Mrs. Benshoshan has been a partner at Forma Real Estate Funds since November 2016 and a board member of Energix Renewable Energies Ltd. (TASE: ENRG). She is an External Director at MRR Thirteen Limited, External Director at Priortech Ltd and External Director at Migdal Insurance & Financial Holdings Ltd. Over the last five years, Mrs. Benshoshan has served in various capacities within the finance and academic sphere, including, as a member of the advisory board at ALTO Real Estate Funds; and an External Director and Chairwoman of the investments committee at ‘Rom’ Study Fund. Mrs. Benshoshan holds a B.A. in Economics and Sociology and an M.B.A.in Finance and Banking, from the Hebrew University of Jerusalem.

Robert Stein, M.D., Ph.D. was elected as an External Director, thereby joining the Taro Board for a three-year term, in February 2020 and serves on the Audit Committee and Compensation Committee. Dr. Stein has medical and scientific training and has over 40 years of Research and Development leadership experience in both pharmaceutical and biotechnology companies. He currently is an Operating Partner at Samsara Biocapital, Executive Vice President of Research & Development for MiMedx, and also consults widely for pharma, biotech, and academia. Dr. Stein has led R&D across all the major therapeutic areas and has made significant contributions to over nine registered medicines and thirteen monoclonal antibodies currently in late-stage clinical development. From 1980 to 1990, he was at Merck, Sharpe, and Dohme Research Labs where he was Head of Pharmacology. From 1990 to 1996 he was the first head of R&D at Ligand Pharmaceuticals. From 1996 to 2001, he was EVP of Research and Preclinical Development at DuPont-Merck / DuPont Pharmaceuticals. He then spent five years as President of R&D at Incyte, five years as President of Roche Palo Alto (formerly Syntex), three years as CEO of Kinemed, and five years as President, R&D at Agenus. Dr. Stein holds a B.S. with Honors in Biology and Chemistry from Indiana University, where he was a National Merit Scholar. He has an M.D. and a Ph.D. in Physiology and Pharmacology from Duke University Medical and Graduate Schools. He is a member of Phi Beta Kappa, Alpha Omega Alpha, and Sigma Xi Honor Societies. Dr. Stein completed his Internship and Residency at Duke, as well, and is Board Certified in Anatomic and Clinical Pathology. He is a member of the College of American Pathology, the New York Academy of Sciences, the American Association of Cancer Research, and the American Society of Clinical Oncology. Dr. Stein also has served on the Board of Directors for Geron, DiaDexus, and Archemix. He currently is a member of the Boards of Directors for Protagenic Therapeutics, Flame Biosciences, Polypid and Immunogenesis. Dr. Stein is a member of the Scientific Advisory Board for the Drug Development Institute of the James Comprehensive Cancer Center of Ohio State University and a Scientific Advisor to Washington University in St. Louis.

9

Proposed Resolutions

The Board of Directors will present the following resolutions at the Annual General Meeting pursuant to Proposal 1:

“RESOLVED, that Dilip Shanghvi be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

“RESOLVED, that Abhay Gandhi be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

“RESOLVED, that Sudhir Valia be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

“RESOLVED, that Uday Baldota be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

“RESOLVED, that James Kedrowski be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

“RESOLVED, that Dov Pekelman be, and hereby is, re-elected to serve as director of the Company until the close of the next annual general meeting of shareholders.”

Required Majority

In order to approve each above resolution pursuant to Proposal 1, the affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions) is required.

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the re-election of each of the proposed nominees under Proposal 1.

10

PROPOSAL 2

APPROVAL OF annual base salary pay range consistent with Compensation Policy, and annual long-term cash incentive pay, for the CEO

Background

As required by the Companies Law, the initial approval of, or any amendment to, the terms of service and employment of the chief executive officer in a public company require approval by the company’s compensation committee, board of directors and shareholders.

Under the Company’s Compensation Policy for Office Holders (the “Compensation Policy”), which was last approved in updated form at our December 2020 annual general meeting of shareholders, our CEO, Mr. Uday Baldota, who is deemed a “Management Office Holder” for purposes of the policy, may be entitled to receive certain compensation elements. Those elements consist of:

|

|

(i)

|

base salary and social and other benefits;

|

|

|

(ii)

|

annual cash bonus (part of which may be a discretionary bonus determined by the Compensation Committee of the Board); and

|

|

|

(iii)

|

long-term cash incentive, based on achievement of long term performance goals of the Company.

|

The text of the Compensation Policy, which served as Annex A to the notice and proxy statement for our December 2020 annual general meeting of shareholders, may be viewed at the following link: https://www.sec.gov/Archives/edgar/data/0000906338/000156459020050361/taro-6k_20201104.htm#EX99_1

As described below, at the Meeting, pursuant to this Proposal 2, we will seek both (a) ratification and approval for base salary amounts that have been, or that will be, paid to our CEO consistent with the Compensation Policy (compensation element (i) above), and (b) approval for the addition of a long-term cash incentive element to the CEO’s compensation package (compensation element (iii) above).

We are not required to, and we will not, seek, at the Meeting, any further approval for the annual cash bonus element of our CEO’s compensation package (element (ii) above), as that was previously approved by our Compensation Committee, Board of Directors and, at our 2018 annual general meeting of shareholders held in December 2018, our shareholders. That cash bonus approval has made our CEO eligible, beginning April 1, 2018, for annual bonuses targeted in an amount of 50% of his annual salary in accordance with the Compensation Policy.

We have described the base salary and long-term cash incentive compensation elements for which we seek approval below:

Base Salary

Under the Compensation Policy, our CEO’s annual base salary is determined based on the following factors:

|

|

•

|

Our CEO’s education, qualifications, skills, professional experience and achievements.

|

|

|

•

|

Our CEO’s position and areas of responsibility, the impact associated with, and scope of, his position, and his previous salary arrangements with our Company.

|

|

|

•

|

The difference between the annual cost of the employment terms of our CEO and the average and median annual salary of Taro’s employees and outsourced service providers, by geographic location, as well as whether such disparity has an effect on employment relations at our Company.

|

|

|

•

|

The ratio between our CEO’s variable compensation components and fixed compensation components.

|

|

|

•

|

Periodic executive compensation surveys (benchmarks) of companies operating in similar industries and/or with similar financial performance, per geographic location.

|

In addition, under the Compensation Policy, our CEO’s annual base salary is furthermore subject to his annual performance review and performance-based merit increase process conducted by the Compensation Committee, which, subject to the above factors, may result in an adjustment to base salary in an amount that does not exceed 20% of the base salary prior to such adjustment.

11

At the end of our fiscal year ended March 31, 2021, our Compensation Committee and Board of Directors examined our CEO’s individual performance in accordance with the above criteria and approved a 2.11% merit increase in his annual base salary. That increase was in keeping with the standard merit increase approved for all of our eligible employees and within the 2.5% increase to our budget that had been approved by our Board. Based on that approval, and subject to approval of this Proposal 2 by our shareholders at the Meeting, effective as of April 1, 2021, our CEO’s new annual salary is $872,182, subject to applicable, statutory withholdings.

Because our CEO’s base salary is subject to annual adjustment in keeping with our Compensation Policy, we are seeking approval, under this Proposal 2, for an annual base salary range for our CEO that begins at the current base salary level and that may be increased annually based on his annual performance review and annual performance-based merit increases, subject to a maximum annual increase of 20% of the base salary prior to any such adjustment. By approving this Proposal 2, our shareholders would thereby simply be approving a base salary element for our CEO that they had in effect already approved when approving the current Compensation Policy at our December 2020 annual general meeting of shareholders.

Our CEO’s base salary was last approved by our shareholders at our December 2018 annual general meeting of shareholders on December 19, 2018, in an amount of $819,200 for our fiscal year ended March 31, 2019. The Companies Law requires that the shareholders approve any amendment to the chief executive officer’s terms of service (even when such an amendment is consistent with a company’s compensation policy). Therefore, in addition to seeking approval pursuant to this Proposal 2 for the prospective annual base salary range for our CEO, we also seek ratification for all increased base salary amounts paid to our CEO since that last December 2018, shareholder approval of his base salary, consisting of $839,881 for the year ended March 31, 2020 and $854,159 for the year ended March 31, 2021.

Long-Term Cash Incentive

As noted above, under our Compensation Policy, our CEO may be eligible for long-term cash incentive (“LTI”) payments, based on achievement of long term performance goals of the Company. Our CEO, Mr. Uday Baldota, has not been awarded any such payments since he began his tenure as CEO in August 2017.

As part of its review process for our CEO at the end of our last fiscal year (ended March 31, 2021), our Compensation Committee and Board considered, and determined, to add a target LTI award of $200,000 to our CEO’s compensation package, effective as of April 1, 2021. Subject to his continued employment in his current role, our CEO would be eligible to receive an LTI award grant following the close of each fiscal year, based on the determination of the Compensation Committee and Board. The $200,000 target LTI amount would be subject to adjustment based on personal and Company-wide performance during the relevant year, within a range of up to 20% above or below the target amount, as determined by the Compensation Committee and Board. The LTI amount, to the extent awarded at the end of a fiscal year, will be paid no earlier than following the financial close of the third fiscal year following the date of award. The annual LTI amount would furthermore be subject to applicable, statutory withholdings. No LTI amounts will actually be paid out to our CEO unless he is still employed by, and actively working for, our Company at the time at which such LTI amounts are to be paid (i.e., at least until the end of the third fiscal year following the date of grant). Therefore, if approved by our shareholders at the Meeting, Mr. Baldota’s initial LTI amount will not be awarded until the end of our fiscal year ended March 31, 2022, and will not be paid unless he is employed by and actively working for our Company as of March 31, 2025.

In approving the addition of a target $200,000 LTI element to our CEO’s compensation package, our Compensation Committee and Board considered the same five factors listed in the bullet points under the heading “Base Salary” above. Our Compensation Committee and Board furthermore affirmed that the addition of the LTI element to our CEO’s compensation package is consistent with our Compensation Policy, given the CEO’s status as a “Management Office Holder” under the policy.

Proposed Resolutions

The Board of Directors will present the following resolutions at the Annual General Meeting pursuant to Proposal 2:

“RESOLVED, that an annual base salary amount beginning, effective as of April 1, 2021, at $872,182 per fiscal year, and that future annual base salary adjustments— each of which does not constitute an increase of more than 20% above the then-current base salary immediately prior to any such adjustment— in accordance with the Company’s performance review and merit increase process set forth in the Company’s Compensation Policy for Office Holders, as amended from time to time, be, and hereby are, approved in all respects for payment to Mr. Baldota in his role as Chief Executive Officer of the Company, as described in Proposal 2 of the proxy statement for the Company’s 2021 Annual General Meeting of Shareholders;”

12

“FURTHER RESOLVED, that the $839,881 and $854,159 annual base salary amounts paid to Mr. Uday Baldota in his role as Chief Executive Officer of the Company for the fiscal years ended March 31, 2020 and March 31, 2021, respectively, consistent with the Company’s Compensation Policy for Office Holders be, and hereby are, ratified and approved in all respects;” and

“FURTHER RESOLVED, that the addition of a $200,000 target annual long-term cash incentive amount, subject to upwards or downwards adjustment by up to 20% based on actual individual and Company-wide performance in a given fiscal year, to the compensation package of Mr. Baldota in his role as Chief Executive Officer of the Company commencing with the fiscal year ending March 31, 2022, and continuing each fiscal year thereafter, to be awarded at the end of each fiscal year and payable following the passage of an additional three fiscal years following award, subject to Mr. Baldota’s continued, active employment by our Company, as described in Proposal 2 of the proxy statement with respect to the 2021 Annual General Meeting of Shareholders, and as previously approved by the Board at the recommendation of the Compensation Committee, be, and the same hereby is, approved in all respects.”

Required Vote

As described above (under “Majority Required for Approval of Each of the Proposals”), the approval of the base salary pay range and the annual long-term cash incentive pay under this Proposal 2 requires the affirmative vote of shareholders present in person or by proxy and holding ordinary shares representing a majority of the votes cast with respect to this proposal. Furthermore, under the Companies Law, the approval of this proposal requires that either: (i) the foregoing ordinary majority includes at least a majority of the voting power of non-controlling shareholders who lack a conflict of interest in approval of this proposal and who are present in person or by proxy and who vote on this proposal (excluding abstentions and broker non-votes); or (ii) the total votes cast in opposition to the proposal by the non-controlling, non-conflicted shareholders (as described in clause (i)) does not exceed 2% of all of the voting power in our Company.

Please see the description under “Majority Required for Approval of Each of the Proposals” concerning the requirement to check the box “FOR” in Item 2A of your proxy card or voting instruction form to confirm that you are not a controlling shareholder and that you lack a conflict of interest in the approval of Proposal 2 in order to enable your vote to be counted towards or against the special majority required for its approval. If you or a related party of yours is a controlling shareholder or possesses a conflict of interest, please check the box “AGAINST” in Item 2A, in which case your vote will count towards or against the ordinary majority required for approval of Proposal 2 but will not count towards or against the special majority required for its approval. If you do not complete Item 2A, your vote will not be counted at all on Proposal 2.

Sun Pharma and certain affiliates have indicated to the Company that they believe that they collectively constitute a controlling shareholder. Therefore, the shares owned or controlled by them (or by entities under their control) will not be counted among the votes of the non-controlling, non-conflicted shareholders for purposes of Proposal 2.

Board Recommendation

The Board unanimously recommends a vote FOR the foregoing resolution approving the base salary pay range and the annual long-term cash incentive pay for our CEO.

13

PROPOSAL 3

RE-APPOINTMENT OF INDEPENDENT AUDITORS

Background

Ziv Haft, Certified Public Accountants (Israel), a member firm of BDO (“Ziv Haft”), has been nominated and approved by the Board of Directors and the Audit Committee for re-appointment as the Company's independent auditors for the fiscal year ending March 31, 2022, and for the additional period until the close of the annual general meeting of the shareholders of the Company that follows the Meeting. The shareholders at the Meeting are requested to approve such auditors’ re-appointment and authorize their remuneration, to be fixed, in accordance with the volume and nature of their services, by the Audit Committee and the Board of Directors.

We paid the following fees for professional services rendered by Ziv Haft for the years ended March 31, 2021 and 2020, respectively.

|

|

|

Year ended

|

|

|

Year ended

|

|

|

|

|

March 31, 2021

|

|

|

March 31, 2020

|

|

|

|

|

(in millions)

|

|

|

Audit fees

|

|

$

|

0.74

|

|

|

$

|

0.70

|

|

|

Tax fees

|

|

|

0.03

|

|

|

|

0.03

|

|

|

Other fees

|

|

|

0.02

|

|

|

|

0.03

|

|

|

Total

|

|

$

|

0.79

|

|

|

$

|

0.76

|

|

The audit fees for the years ended March 31, 2021 and 2020, respectively, represent fees for professional services rendered for the audits of our annual consolidated financial statements, statutory or regulatory audits of us and our subsidiaries, consents and assistance with review of documents filed with the SEC. All services provided by the Company’s independent auditors, including those set forth in the table above, were approved by the Audit Committee.

Tax fees represent fees for professional services related to tax compliance, including the preparation of tax returns and claims for refund, and tax planning and tax advice, including assistance with tax audits and appeals, tax services for employee benefit plans and assistance with respect to requests for rulings from tax authorities.

Other fees represent fees for additional professional services performed for certain legal entities.

Policy on Pre-Approval of Audit and Non-Audit Services of Independent Auditors

Our Audit Committee is responsible for the oversight of our independent auditors’ work. The Audit Committee’s policy is to pre-approve all audit and non-audit services provided by our independent registered public accounting firm, Ziv Haft. These services may include audit services, audit-related services, tax services and other services, as further described below. The Audit Committee sets forth the basis for its pre-approval in detail, listing the particular services or categories of services that are pre-approved, and setting forth a specific budget for such services. Additional services may be pre-approved by the Audit Committee on an individual basis. Once services have been pre-approved, Ziv Haft and our management then report to the Audit Committee on a periodic basis regarding the extent of services actually provided in accordance with the applicable pre-approval, and regarding the fees for the services performed.

Proposed Resolution

The Board of Directors will present the following resolution at the Annual General Meeting:

“RESOLVED, that the Company’s independent auditors, Ziv Haft, Certified Public Accountants (Israel), a member firm of BDO, be, and hereby are, re-appointed as the Company’s independent auditors for the fiscal year ending March 31, 2022, and for the additional period until the close of the next annual general meeting of the shareholders of the Company, and that their remuneration is hereby authorized to be fixed, in accordance with the volume and nature of their services, by the Audit Committee and the Board of Directors.”

Required Majority

In order to approve the above resolution pursuant to Proposal 3, the affirmative vote of the holders of a majority of the voting power represented at the Meeting in person or by proxy and voting thereon (which excludes abstentions) is required.

14

Board Recommendation

The Board of Directors unanimously recommends a vote FOR the reappointment of BDO Israel as described above.

REVIEW AND DISCUSSION OF AUDITOR’S REPORT AND CONSOLIDATED FINANCIAL STATEMENTS

The Board of Directors has approved, and is presenting to the shareholders for discussion at the Meeting, the Company’s annual consolidated balance sheet as of March 31, 2021, the consolidated statements of income for the fiscal year then ended, and the auditor’s report thereon, all of which are included in our Annual Report on Form 20-F for our fiscal year ended March 31, 2021, which we filed with the SEC on June 17, 2021. That annual report can be accessed at http://www.taro.com and through the EDGAR website of the SEC at www.sec.gov. None of the auditor’s report, consolidated financial statements, the Form 20-F or the contents of our website form part of the proxy solicitation material.

ADDITIONAL INFORMATION

The Company is subject to the information reporting requirements of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), applicable to foreign private issuers. The Company fulfills these requirements by filing reports with the SEC. The Company’s filings with the SEC are available to the public on the SEC’s website at www.sec.gov. As a foreign private issuer, the Company is exempt from the rules under the Exchange Act related to the furnishing and content of proxy statements. The circulation of this Proxy Statement should not be taken as an admission that the Company is subject to those proxy rules.

BY ORDER OF THE BOARD OF DIRECTORS,

/s/ Dilip Shanghvi

Dilip Shanghvi

Chairman of the Board of Directors

Dated: November 5, 2021

15

Exhibit 99.2

TARO PHARMACEUTICAL INDUSTRIES LTD.

Proxy for 2021 Annual General Meeting of Shareholders to be held on December 15, 2021

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned shareholder of Taro Pharmaceutical Industries Ltd. (the “Company”) hereby appoints each of Ohad Rosner, Anat Edrey and Avi Avramoff with full power of substitution to each of them, the true and lawful attorney, agent and proxy of the undersigned, to vote, as designated on the reverse side, all of the Ordinary Shares of the Company held of record in the name of the undersigned at the close of business on Monday, November 8, 2021, at the 2021 Annual General Meeting of Shareholders (the “Meeting”) of the Company to be held on Wednesday, December 15, 2021, at 10:00 a.m., Israeli time, at the offices of the Company’s Israeli legal counsel, Meitar Law Offices, located at 16 Abba Hillel Road, 10th Floor, Ramat Gan, Israel, 5250608, and at any and all adjournments or postponements thereof, on the following matters (appearing on the reverse side), which are more fully described in the Notice of Annual General Meeting of Shareholders (the “Notice”) and Proxy Statement relating to the Meeting (the “Proxy Statement”).

The undersigned acknowledges receipt of the Notice and Proxy Statement.

This proxy, when properly executed, will be voted in the manner directed herein by the undersigned. If no direction is made with respect to proposalS 1 OR 3, this proxy will be voted “FOR” THOSE proposalS. If no direction is made with respect to Proposal 2, the undersigned will be deemed to have not participated in the voting on THAT proposal (UNLESS THE UNDERSIGNED COMPLETES ITEM 2A, AS DESCRIBED BELOW, IN WHICH CASE this PROXY WILL BE VOTED “FOR” PROPOSAL 2 AS WELL). this proxy will FURTHERMORE be voted in such manner as the holder of the proxy may determine with respect to any other business as may properly come before the Meeting or aNY and aLL adjournments or postponements thereof.

IMPORTANT NOTE: The vote under this proxy will not be counted towards or against the majority required for the approval of PROPOSAL 2 unless the undersigned indicates that (i) he, she or it is NOT a controlling shareholder and DOES NOT have a conflict of interest in the approval of THAT PROPOSAL by checking the box “FOR” Item 2A on the reverse side, or (ii) he, she or it is a controlling shareholder or has a conflict of interest in the approval of THAT PROPOSAL by checking the box “AGAINST” ITEM 2A on the reverse side.

Any and all proxies heretofore given by the undersigned are hereby revoked.

(Continued and to be signed on the reverse side)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 5, 2021

TARO PHARMACEUTICAL INDUSTRIES LTD.

By: /s/ Uday Baldota

Name:Uday Baldota

Title:Chief Executive Officer and Director

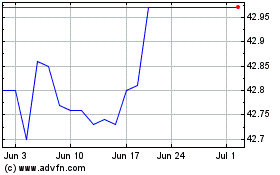

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Taro Pharmaceutical Indu... (NYSE:TARO)

Historical Stock Chart

From Apr 2023 to Apr 2024