Current Report Filing (8-k)

March 26 2019 - 6:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

March 25, 2019

Kimbell Royalty Partners, LP

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

1-38005

|

|

47-5505475

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

777 Taylor Street, Suite 810

Fort Worth, Texas

|

|

76102

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(817) 945-9700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

x

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

x

Introductory Note

On March 25, 2019, Kimbell Royalty Partners, LP, a Delaware limited partnership

(the “Partnership”), completed its previously announced acquisition (the “Acquisition”) of all of the equity interests in certain subsidiaries owned by PEP I Holdings, LLC, a Delaware limited liability company (“Phillips I Seller”), PEP II Holdings, LLC, a Delaware limited liability company (“Phillips II Seller”), and PEP III Holdings, LLC, a Delaware limited liability company (“Phillips III Seller” and, together with Phillips I Seller and Phillips II Seller, each a “Seller” and, collectively, the “Sellers”), pursuant to the Securities Purchase Agreement (the “Purchase Agreement”), dated as of February 6, 2019, by and among the Partnership, Kimbell Royalty Operating, LLC, a Delaware limited liability company (“Opco”), and the Sellers.

Item 1.01.

Entry into a Material Definitive Agreement.

Amended and Restated Registration Rights Agreement

On March 25, 2019, the Partnership entered into an Amended and Restated Registration Rights Agreement, dated as of March 25, 2019 (the “A&R RRA”), by and among the Sellers and Haymaker Minerals & Royalties, LLC, EIGF Aggregator III LLC, TE Drilling Aggregator LLC and Haymaker Management, LLC (collectively, the “Haymaker Parties”), certain affiliates of Apollo Capital Management, L.P. (the “Apollo Parties”), Rivercrest Capital Partners LP, Kimbell Art Foundation and Cupola Royalty Direct, LLC. The A&R RRA amended and consolidated (i) the Registration Rights Agreement, dated as of July 12, 2018, by and among the Partnership, the Haymaker Parties and the Apollo Parties that was entered into in connection with the acquisition of certain subsidiaries of Haymaker Minerals & Royalties, LLC and Haymaker Resources, LP (the “Haymaker Acquisition”) and (ii) the Registration Rights Agreement, dated as of December 20, 2018, by and among the Partnership and the parties (the “Dropdown Parties”) to the Partnership’s December 2018 dropdown transaction (the “Dropdown”). Pursuant to the terms of the A&R RRA, the Partnership has agreed to prepare a shelf registration statement, or an amendment to its existing shelf registration statement (the “Shelf Registration Statement”), covering the resale of the common units representing limited partner interests in the Partnership (“Common Units”) issued or issuable upon the conversion of the common units representing limited liability company interests in Opco (“Opco Common Units”) and a corresponding number of Class B units representing limited partner interests in the Partnership (“Class B Units”) issued in connection with (a) the Haymaker Acquisition, (b) the Dropdown and (c) the Acquisition (all such Common Units being the “Registrable Securities”), file the Shelf Registration Statement with the United States Securities and Exchange Commission (the “

Commission”) within 30 days of the execution of the A&R RRA and use its reasonable best efforts to cause the Shelf Registration Statement to become effective as soon as reasonably practicable following such filing but, in any event, within 120 days of the execution of the A&R RRA. If the Shelf Registration Statement is not effective prior to the 180th day after the execution of the A&R RRA, then certain applicable holders will be entitled to certain liquidated damages as set forth in the A&R RRA. The Partnership has previously satisfied its obligations regarding the filing of a Shelf Registration Statement with respect to all parties to the A&R RRA other than the Sellers.

The A&R RRA permits the Haymaker Parties, the Apollo Parties and the Sellers to request to sell any or all of their Registrable Securities in an underwritten offering that is registered pursuant to a Shelf Registration Statement, subject to certain exceptions, including, among other things, that the gross proceeds from the sale are reasonably expected to exceed $50 million in the aggregate. The A&R RRA sets forth the priority of the Haymaker Parties’, the Apollo Parties’, the Sellers’ and the Dropdown Parties’ respective rights with regard to the inclusion of Registrable Securities in any underwritten offering.

The foregoing description of the A&R RRA does not purport to be complete and is qualified in its entirety by reference to the text of the A&R RRA, a copy of which is filed as Exhibit 4.1 to this Current Report on Form 8-K and is incorporated into this Item 1.01 by reference.

2

Amendment No.1 to the Securities Purchase Agreement

On March 25, 2019, the Partnership entered into Amendment No. 1 to the Purchase Agreement (the “Amendment”), which adjusted the balance between the cash amount on the one hand, and the Opco Common Units and Class B Units on the other hand, to be held in escrow pending the outcome of ongoing litigation involving certain of the acquired subsidiaries.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the text of the Amendment, a copy of which is filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated into this Item 1.01 by reference.

Item 2.01.

Completion of Acquisition or Disposition of Assets.

On March 25, 2019, the Partnership completed the Acquisition

, pursuant to the terms of the Purchase Agreement. The terms and provisions of the Purchase Agreement are described in the Partnership’s Current Report on Form 8-K filed with the Commission on February 12, 2019 (the “Signing 8-K”).

The aggregate consideration for the Acquisition consisted of 9,400,000 Opco Common Units and an equal number of Class B Units. The Sellers paid five cents per Class B Unit issued at the closing of the Acquisition

as additional consideration with respect to the Class B Units, which is consistent with the amount paid per Class B Unit by all current holders of Class B Units.

Item 3.02.

Unregistered Sales of Equity Securities.

As reported in the Signing 8-K and pursuant to the Purchase Agreement, on February 6, 2019, the Partnership and Opco agreed to issue Class B Units and Opco Common Units, respectively, in a private placement exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities Act”), in reliance on the exemptions set forth in Section 4(a)(2) of the Securities Act. Pursuant to the terms of the Purchase Agreement, the Partnership and Opco issued 9,400,000 Class B Units and an equal number of Opco Common Units, respectively, to the Sellers on March 25, 2019. The Opco Common Units, together with the Class B Units, are exchangeable for an equal number of Common Units.

Any future issuance of Common Units pursuant to an exchange election by the holders of such Opco Common Units and such Class B Units will also be undertaken in reliance upon an exemption from the registration requirements of the Securities Act, pursuant to Section 4(a)(2) thereof.

Item 7.01.

Regulation FD Disclosure.

On March 25, 2019, the Partnership issued a news release announcing that it has completed the Acquisition. A copy of the news release is attached hereto, furnished as Exhibit 99.1 to this Current Report on Form 8-K and incorporated into this Item 7.01 by reference.

The information set forth in this Item 7.01 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 8.01.

Other Events.

The Partnership estimates that the assets included in the Acquisition derive roughly 77% of revenues from oil and natural gas liquids and over 64% of production on the assets is from the Eagle Ford Shale, Permian Basin, Haynesville Shale and Powder River Basin (on an oil-equivalent basis using a conversion factor of six Mcf of natural gas per barrel of “oil equivalent,” which is based on approximate energy equivalency and does not reflect the price or value relationship between oil and natural gas). The Acquisition is also expected to increase the Partnership’s production by approximately 1,600 barrels a day (on an oil-equivalent basis, as described above). As

3

of the Closing, there are seventeen rigs that are actively drilling on the acquired acreage, increasing the total number of rigs actively drilling on the Partnership’s acreage to 90 rigs. In addition, the Acquisition adds approximately 12,200 net royalty acres, increasing the Partnership’s total net royalty acre position by 9% to 144,100 net royalty acres across the continental U.S. Finally, the Partnership estimates that the average five-year decline rate for its proved developed producing reserves after giving effect to the Acquisition will remain near the current level of approximately 12%.

Reserve engineering is a complex and subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way, and the accuracy of any reserve estimate is a function of the quality of available data and of engineering and geological interpretation and judgment. As a result, estimates prepared by one engineer may vary from those prepared by another. Estimates relating to the Partnership’s combined oil and gas properties as of December 31, 2019 will be prepared by Ryder Scott Company, L.P. using the information available at that time. Upon completion of their review, the estimates relating to the Acquisition as of December 31, 2019 will be different from management’s current estimates of such reserves. In connection with the foregoing, please read the

cautionary statements provided under the heading “Forward-Looking Statements” below, which is incorporated into this Item 8.01 by reference.

Forward-Looking Statements

Certain information contained in this Current Report on Form 8-K and in the exhibits hereto includes forward-looking statements, in particular statements relating to the Partnership’s future operating and production results, and the tax treatment of the Partnership’s distributions. These and other forward-looking statements involve risks and uncertainties, including risks and uncertainties relating to the Partnership’s business, prospects for growth and acquisitions and the securities markets generally. Except as required by law, the Partnership undertakes no obligation and does not intend to update these forward-looking statements to reflect events or circumstances occurring after the date hereof. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the Partnership’s filings with the Commission. These include risks that the anticipated benefits of the Acquisition are not realized, as well as risks inherent in oil and natural gas drilling and production activities, including risks with respect to low or declining prices for oil and natural gas that could result in downward revisions to the value of proved reserves or otherwise cause operators to delay or suspend planned drilling and completion operations or reduce production levels; risks relating to the availability of capital to fund drilling operations that can be adversely affected by adverse drilling results, production declines and declines in oil and natural gas prices; risks of fire, explosion, blowouts, pipe failure, casing collapse, unusual or unexpected formation pressures, environmental hazards, and other operating and production risks, which may temporarily or permanently reduce production or cause initial production or test results to not be indicative of future well performance or delay the timing of sales or completion of drilling operations; risks relating to delays in receipt of drilling permits; risks relating to unexpected adverse developments in the status of properties; risks relating to the absence or delay in receipt of government approvals or third-party consents; risks relating to acquisitions, dispositions and drop downs of assets; risks relating to the Partnership’s ability to realize the anticipated benefits from and to integrate acquired assets, including the assets acquired in the Acquisition; risks relating to tax matters; and other risks described in the Partnership’s Annual Report on Form 10-K and other filings with the Commission, available at the Commission’s website at www.sec.gov. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof.

4

Item 9.01.

Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired.

Financial statements of Phillips Energy Partners, LLC, Phillips Energy Partners II, LLC and Phillips Energy Partners III, LLC are not included in this Current Report on Form 8-K. Such financial statements will be filed within 71 calendar days after the date by which this Current Report on Form 8-K is required to be filed.

(b) Pro Forma Financial Information.

Pro forma financial information giving effect to the Acquisition is not included in this Current Report on Form 8-K. Such pro forma financial information will be filed within 71 calendar days after the date by which this Current Report on Form 8-K is required to be filed.

(d) Exhibits.

|

Number

|

|

Description

|

|

2.1

|

|

Amendment No. 1 to Securities Purchase Agreement, dated as of March 25, 2019, by and among PEP I Holdings, LLC, PEP II Holdings, LLC, PEP III Holdings, LLC, Kimbell Royalty Partners, LP and Kimbell Royalty Operating, LLC

|

|

|

|

|

|

4.1

|

|

Amended and Restated Registration Rights Agreement, dated as of March 25, 2019, by and among Kimbell Royalty Partners, LP, EIGF Aggregator III LLC, TE Drilling Aggregator LLC, Haymaker Management, LLC, Haymaker Minerals & Royalties, LLC, AP KRP Holdings, L.P., ATCF SPV, L.P., Zeus Investments, L.P., Apollo Kings Alley Credit SPV, L.P., Apollo Thunder Partners, L.P., AIE III Investments, L.P., Apollo Union Street SPV, L.P., Apollo Lincoln Private Credit Fund, L.P., Apollo SPN Investments I (Credit), LLC, AA Direct, L.P., PEP I Holdings, LLC, PEP II Holdings, LLC, PEP III Holdings, LLC, Cupola Royalty Direct, LLC, Kimbell Art Foundation and Rivercrest Capital Partners LP

|

|

|

|

|

|

99.1

|

|

News Release issued by Kimbell Royalty Partners, LP dated March 25, 2019

|

5

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

KIMBELL ROYALTY PARTNERS, LP

|

|

|

|

|

|

By:

|

Kimbell Royalty GP, LLC,

|

|

|

|

its general partner

|

|

|

|

|

|

|

By:

|

/s/ R. Davis Ravnaas

|

|

|

|

R. Davis Ravnaas

|

|

|

|

President and Chief Financial Officer

|

|

|

|

|

|

Date: March 25,

2019

|

|

|

6

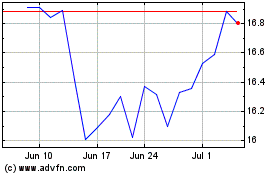

Kimbell Royalty Partners (NYSE:KRP)

Historical Stock Chart

From Mar 2024 to Apr 2024

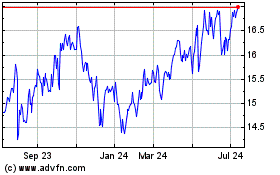

Kimbell Royalty Partners (NYSE:KRP)

Historical Stock Chart

From Apr 2023 to Apr 2024