Neither the Securities and Exchange Commission

(the “SEC”) nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the

adequacy of this pricing supplement or the accompanying product supplement, underlying supplement, prospectus supplement and prospectus.

Any representation to the contrary is a criminal offense.

Pricing supplement to product supplement no. 3-I dated

April 13, 2023, underlying supplement no. 1-I dated April 13, 2023

and the prospectus and prospectus supplement, each dated April 13, 2023

Key Terms

|

Issuer:

JPMorgan Chase Financial Company LLC, an indirect, wholly owned finance subsidiary of JPMorgan Chase & Co.

Guarantor:

JPMorgan Chase & Co.

Index: The

J.P. Morgan Tactical Blend Index (Bloomberg ticker: JPUSTACB Index). The level of the Index reflects a deduction of 0.85% per annum that

accrues daily.

Participation Rate: At

least 275% (to be provided in the pricing supplement)

Pricing Date: On

or about July 26, 2023

Original Issue Date (Settlement Date): On

or about July 31, 2023

Observation Date*: July

28, 2025

Maturity Date*: July

31, 2025

*

Subject to postponement in the event of a market disruption event and as described under “General Terms of Notes — Postponement

of a Determination Date — Notes Linked to a Single Underlying — Notes Linked to a Single Underlying (Other Than a Commodity

Index)” and “General Terms of Notes — Postponement of a Payment Date” in the accompanying product supplement |

|

Payment at Maturity: At

maturity, you will receive a cash payment, for each $1,000 principal amount note, of $1,000 plus the Additional Amount, which may

be zero.

You are entitled to repayment of principal in full at maturity,

subject to the credit risks of JPMorgan Financial and JPMorgan Chase & Co.

Additional Amount: The

Additional Amount payable at maturity per $1,000 principal amount note will equal:

$1,000

× Index Return × Participation Rate,

provided that the Additional

Amount will not be less than zero.

Index Return:

(Final

Value – Initial Value)

Initial Value

Initial Value: The

closing level of the Index on the Pricing Date

Final Value: The

closing level of the Index on the Observation Date

|

|

PS-1

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

The J.P. Morgan Tactical Blend Index

The J.P. Morgan Tactical

Blend Index (the “Index”) was developed and is maintained and calculated by J.P. Morgan Securities LLC (“JPMS”).

The description of the Index and methodology included in the accompanying underlying supplement is based on rules formulated by JPMS (the

“Rules”). The Rules, and not this description, will govern the calculation and constitution of the Index and other decisions

and actions related to its maintenance. The Rules in effect as of the date of the accompanying underlying supplement are included as Annex

A to the underlying supplement. The Index is the intellectual property of JPMS, and JPMS reserves all rights with respect to its ownership

of the Index. The Index is reported by Bloomberg L.P. under the ticker symbol “JPUSTACB Index.”

The Index attempts

to provide a dynamic rules-based allocation to the excess return performance of the J.P. Morgan U.S. Low Volatility Index (Total Return)

(the “Equity Constituent”) and one of the following two “Defensive Constituents”: (1) the J.P. Morgan Core Bond

Index (the “Bond Constituent”) and (2) the Invesco DB US Dollar Index Bullish Fund (the “Currency Constituent”),

less a daily Index adjustment of 0.85% per annum. The selected Defensive Constituent is determined based on a momentum signal; and changes

from one Defensive Constituent to the other are implemented over a period of up to 5 days, subject to changes in the signal during the

period. The Index targets a volatility level of 5.0% (the “Target Volatility”), subject to a maximum total weight of 150%

(the “Maximum Total Weight”); however, because the methodology used to calculate the realized volatility of the Index is based

on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the

Index on an annualized basis is expected to be lower than its Target Volatility of 5.0%. The Equity Constituent, the Bond Constituent

and the Currency Constituent are individually referred to herein as a “Portfolio Constituent”.

The Equity Constituent.

The Equity Constituent is an index that applies a rules-based methodology to seek to track the total return of a portfolio of stocks selected

from the components of the Solactive United States 1000 Index, with stocks with the highest realized volatility excluded, with weightings

selected to seek sector diversification and with a weighting preference for stocks with lower realized volatility. There is, however,

no assurance that the Index will exhibit lower volatility or provide higher risk-weighted returns than the Solactive United States 1000

Index or any other index or strategy. For additional information about the Equity Constituent, see “Background on the J.P. Morgan

U.S. Low Volatility Index (Total Return)” in the accompanying underlying supplement.

The Defensive Constituents.

The Index Calculation Agent (as defined below) select the Defensive Constituent for inclusion in the Index (the “Selected Defensive

Constituent”) based on the price momentum of the Bond Constituent:

The Bond Constituent

is an index that applies a rules-based methodology to evaluate recent market conditions and allocate exposure dynamically across up to

ten (10) exchange-traded funds (“ETFs”) that each track a U.S. dollar fixed income sector. For additional information about

the Bond Constituent, see “Background on the J.P. Morgan Core Bond Index” in the accompanying underlying supplement.

The Currency Constituent

is an ETF that generally seeks to track changes in the level of the Deutsche Bank Long USD Currency Portfolio Index–Excess ReturnTM

(the “DB Dollar Index”) by establishing long positions in ICE U.S. Dollar Index (“USDX®”) futures contracts

designed to replicate the performance of taking a long position in the U.S. dollar against a basket of six (6) currencies composed of

the Euro, Japanese Yen, British Pound, Canadian Dollar, Swedish Krona and Swiss Franc. The DB Dollar Index is intended to provide a general

indication of the international value of the U.S. dollar relative to this basket of currencies and is composed solely of long positions

in the USDX® futures contracts. All else being equal, the Currency Constituent increases when the U.S. dollar appreciates and decreases

in value when the trade-weighted basket of currencies strengthen against the U.S. dollar.

The Index provides

a balanced exposure to the Portfolio Constituents and rebalances from time to time based on the price momentum of the Bond Constituent

and the realized volatility of the underlying notional portfolio.

Determining the Selected

Defensive Constituent. The price momentum of the Bond Constituent on a given Index Business Day is calculated by comparing the closing

level of the Bond Constituent on such day against the closing level on the Index Business Days that is sixty (60) days prior to such day

(the “60-Day Price Momentum Signal”). If the Bond Constituent exhibits a positive 60-Day Price Momentum Signal on any given

Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Bond Constituent will be identified as

the Selected Defensive Constituent for such day. However, if the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum

Signal on any given Index Business Day and on each of the two (2) Index Business Days preceding such day, then the Currency Constituent

will be identified as the Selected Defensive Constituent for such day. In either scenario, if the 60-Day Price Momentum Signal on such

day is not repeated on both of the two (2) preceding Index Business Days, then the Selected Defensive Constituent will be whichever one

was last selected. Whenever the Selected Defensive Constituent changes from the Bond Constituent to the Currency Constituent (and vice

versa) (each, a “Defensive Constituent Switch Day”), the Index will rebalance its exposure to the Portfolio Constituents starting

on the immediately following Index Business Day and ending on the Index Business Day after the earlier of (y) the next Defensive Constituent

Switch Day and (z) the Index Business Day for which the volatility budget of each Defensive Constituent as of such day is equal to the

preliminary volatility budget of such Defensive Constituent calculated as of the Defensive Constituent Switch Day, up to a maximum of

five (5) days. In addition, the Index will rebalance its exposure to the Portfolio Constituents on any other Index Business Day where

the volatility of the notional portfolio underlying the Index is less than four point five percent (4.5%) or greater than five point five

percent (5.5%), calculated as of the immediately preceding Index Business Day.

Considerations Relating

to the Volatility of the Portfolio Constituents. Under normal market conditions, the Equity Constituent’s realized volatility has

tended to be relatively more variable than the realized volatility of the Defensive Constituents. Consequently, the Index methodology

may be more likely to allocate exposure to the Selected Defensive Constituent during periods of relatively higher market volatility and

to shift exposure from the Selected Defensive Constituent to the Equity Constituent under market conditions exhibiting relatively lower

market volatility. In addition, because the Index methodology calculates realized volatility over periods ranging from 5 days to three

years and

|

PS-2

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

allocates a greater proportion to the Selected

Defensive Constituent during periods of greater equity market volatility, the Index has tended to exhibit an annualized realized volatility

that is lower than the Target Volatility of 5.0%.

In general, equity

markets have historically been more likely to outperform fixed-income and U.S. dollar currency markets during periods of relatively lower

market volatility and to underperform fixed-income and U.S. dollar currency markets during periods of relatively higher market volatility.

However, there can be no assurance that the Index allocation strategy will achieve its intended results or that the Index will outperform

any alternative index or strategy that might reference the Portfolio Constituents. Past performance should not be considered indicative

of future performance.

The Index seeks to

allocate risk between the Equity Constituent and the Selected Defensive Constituent such that the risk associated with each of the Equity

Constituent and the Selected Defensive Constituent is approximately equal by measuring the volatility of each Portfolio Constituent and

setting the weight of such Portfolio Constituent in inverse proportion to its volatility. Therefore, all else being equal, a lower realized

volatility for a Portfolio Constituent will generally result in a higher weight for that Portfolio Constituent, while a higher realized

volatility will generally result in a lower weight. Under normal market conditions, because the Bond Constituent generally attempts to

allocate to a portfolio with a realized volatility less than or equal to 5.0%, and the historical realized volatility of the Currency

Constituent has generally ranged from 6.0% to 9.0%, the Equity Constituent’s realized volatility has tended to be significantly

higher than those of the Defensive Constituents. Furthermore, because the methodology used to calculate the realized volatility of the

Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility

of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which

has the effect of further lowering the weight of the Equity Constituent. Past performance should not be considered indicative of future

performance. Consequently, the Index may have significant exposure for an extended period of time to the Selected Defensive Constituent,

and that exposure may be greater, perhaps significantly greater, than its exposure to the Equity Constituent. However, the returns of

the Selected Defensive Constituent may be significantly lower than the returns of the Equity Constituent, and possibly even negative while

the returns of the Equity Constituent are positive, which will adversely affect the level of the Index.

Furthermore, under

circumstances where the Equity Constituent’s realized volatility is significantly higher than that of the Selected Defensive Constituent,

the performance of the Index is expected to be influenced to a greater extent by the performance of the Equity Constituent than by the

performance of the Bond Constituent, unless the weight of the Selected Defensive Constituent is significantly greater than the weight

of the Equity Constituent. Consequently, even in cases where the allocation to the Selected Defensive Constituent is greater than the

allocation to the Equity Constituent, the Index may be influenced to a greater extent by the performance of the Equity Constituent than

by the performance of the Selected Defensive Constituent because, under some conditions, the greater allocation to the Selected Defensive

Constituent will not be sufficiently large to offset the greater realized volatility of the Equity Constituent.

Calculating the level

of the Index. On any given day, the closing level of the Index (the “Index Level”) reflects the weighted excess return performance

of the Portfolio Constituents (i.e., the total return performance less the notional financing cost) less the daily deduction of 0.85%

per annum. The Index Level was set equal to 100.00 on November 24, 2006, the base date of the Index. The Index Calculation Agent began

calculating the Index on a live basis on March 30, 2023.

The Index provides

“excess return” exposure to the Portfolio Constituents because of the daily deduction of a notional financing cost, which

is calculated by reference to the Effective Federal Funds Rate, from the performance of the Portfolio Constituents. The Effective Federal

Funds Rate is a measure of the interest rate at which depository institutions lend balances at the Federal Reserve to other depository

institutions overnight, calculated as the volume-weighted median of overnight federal funds transactions reported by U.S. banks and U.S.

branches and agencies of non-U.S. banks, and is quoted on the basis of an assumed year of 360 days.

Our affiliate, JPMS,

is currently the sponsor of the Index (in such capacity, the “Index Sponsor”) and the calculation agent of the Index (in such

capacity, the “Index Calculation Agent”).

No assurance can be given that the investment

strategy used to construct the Index will achieve its intended results or that the Index will be successful or will outperform any alternative

index or strategy that might reference the Portfolio Constituents. Furthermore, no assurance can be given that the realized volatility

of the Index will approximate the Target Volatility. The actual realized volatility of the Index may be greater or less than the Target

Volatility.

If the aggregate weight of the Portfolio Constituents

in the Index is less than 100%, the Index will not be fully invested, and any uninvested portion will earn no return. The daily deduction

of 0.85% per annum is fully applied in calculating the Index Level, even when the Index is not fully invested.

The Index is described as a “notional”

or “synthetic” portfolio of assets because there is no actual portfolio of assets to which any person is entitled or in which

any person has any ownership interest. The Index merely references certain assets, the performance of which will be used as a reference

point for calculating the Index Level.

Terms used in this

pricing supplement, but not defined herein, will have the meanings ascribed to them in the accompanying underlying supplement.

See “The J.P.

Morgan Tactical Blend Index” in the accompanying underlying supplement for more information about the Index.

|

PS-3

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Hypothetical Payout Profile

The following table and graph illustrate the hypothetical

payment at maturity on the notes linked to a hypothetical Index. The hypothetical payments set forth below assume the following:

| ● | an Initial Value of 100.00; and |

| ● | a Participation Rate of 275.00%. |

The hypothetical Initial Value of

100.00 has been chosen for illustrative purposes only and may not represent a likely actual Initial Value. The actual Initial Value will

be the closing level of the Index on the Pricing Date and will be provided in the pricing supplement. For historical data regarding the

actual closing levels of the Index, please see the historical information set forth under “Hypothetical Back-Tested Data and Historical

Information” in this pricing supplement.

Each hypothetical total return or

hypothetical payment at maturity set forth below is for illustrative purposes only and may not be the actual total return or payment at

maturity applicable to a purchaser of the notes. The numbers appearing in the following table and graph have been rounded for ease of

analysis.

| Final Value |

Index Return |

Additional Amount |

Payment at Maturity |

| 165.00 |

65.00% |

$1,787.50 |

$2,787.50 |

| 150.00 |

50.00% |

$1,375.00 |

$2,375.00 |

| 140.00 |

40.00% |

$1,100.00 |

$2,100.00 |

| 130.00 |

30.00% |

$825.00 |

$1,825.00 |

| 120.00 |

20.00% |

$550.00 |

$1,550.00 |

| 110.00 |

10.00% |

$275.00 |

$1,275.00 |

| 105.00 |

5.00% |

$137.50 |

$1,137.50 |

| 101.00 |

1.00% |

$27.50 |

$1,027.50 |

| 100.00 |

0.00% |

$0.00 |

$1,000.00 |

| 95.00 |

-5.00% |

$0.00 |

$1,000.00 |

| 90.00 |

-10.00% |

$0.00 |

$1,000.00 |

| 80.00 |

-20.00% |

$0.00 |

$1,000.00 |

| 70.00 |

-30.00% |

$0.00 |

$1,000.00 |

| 60.00 |

-40.00% |

$0.00 |

$1,000.00 |

| 50.00 |

-50.00% |

$0.00 |

$1,000.00 |

| 40.00 |

-60.00% |

$0.00 |

$1,000.00 |

| 30.00 |

-70.00% |

$0.00 |

$1,000.00 |

| 20.00 |

-80.00% |

$0.00 |

$1,000.00 |

| 10.00 |

-90.00% |

$0.00 |

$1,000.00 |

| 0.00 |

-100.00% |

$0.00 |

$1,000.00 |

|

PS-4

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

The following graph demonstrates

the hypothetical payments at maturity on the notes for a sub-set of Index Returns detailed in the table above (-50% to 50%). There can

be no assurance that the performance of the Index will result in a payment at maturity in excess of $1,000.00 per $1,000 principal amount

note, subject to the credit risks of JPMorgan Financial and JPMorgan Chase & Co.

How the

Notes Work

Upside Scenario:

If the Final Value is greater than

the Initial Value, investors will receive at maturity the $1,000 principal amount plus the Additional Amount, which is equal to

$1,000 times the Index Return times the Participation Rate of at least 275.00%.

| ● | Assuming a hypothetical Participation Rate of 275.00%, if the closing level of the Index increases by

10.00%, investors will receive at maturity a return equal to 27.50%, or $1,275.00 per $1,000 principal amount note. |

Par Scenario:

If the Final Value is equal to the

Initial Value or is less than the Initial Value, the Additional Amount will be zero and investors will receive at maturity the principal

amount of their notes.

The hypothetical returns and hypothetical

payments on the notes shown above apply only if you hold the notes for their entire term. These hypotheticals do not reflect the

fees or expenses that would be associated with any sale in the secondary market. If these fees and expenses were included, the hypothetical

returns and hypothetical payments shown above would likely be lower.

|

PS-5

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Selected Risk Considerations

An investment in the notes involves

significant risks. These risks are explained in more detail in the “Risk Factors” sections of the accompanying prospectus

supplement and product supplement.

Risks Relating to the Notes

Generally

| ● | THE NOTES MAY NOT PAY MORE THAN THE PRINCIPAL AMOUNT AT MATURITY — |

If the Final Value is

less than or equal to the Initial Value, you will receive only the principal amount of your notes at maturity, and you will not be compensated

for any loss in value due to inflation and other factors relating to the value of money over time.

| ● | CREDIT RISKS OF JPMORGAN FINANCIAL AND JPMORGAN CHASE & CO. — |

Investors are dependent

on our and JPMorgan Chase & Co.’s ability to pay all amounts due on the notes. Any actual or potential change in our

or JPMorgan Chase & Co.’s creditworthiness or credit spreads, as determined by the market for taking that credit risk,

is likely to adversely affect the value of the notes. If we and JPMorgan Chase & Co. were to default on our payment obligations,

you may not receive any amounts owed to you under the notes and you could lose your entire investment.

| ● | The Index is subject

to a 0.85% per annum daily deduction and the deduction of a notional financing cost — |

One

way in which the Index may differ from a typical index is that its level will be subject to a 0.85% per annum daily deduction and the

deduction from the performance of each Portfolio Constituent of a notional financing cost calculated by reference to the Effective Federal

Funds Rate. The Index Adjustment and the notional financing cost will be deducted daily. As a result of the deduction of the Index Adjustment

and the notional financing cost, the level of the Index will trail the value of a hypothetical identically constituted notional portfolio

from which no such Index Adjustment or cost is deducted.

| ● | AS A FINANCE SUBSIDIARY, JPMORGAN FINANCIAL HAS NO INDEPENDENT OPERATIONS AND HAS LIMITED ASSETS —

|

As a finance subsidiary

of JPMorgan Chase & Co., we have no independent operations beyond the issuance and administration of our securities. Aside

from the initial capital contribution from JPMorgan Chase & Co., substantially all of our assets relate to obligations of

our affiliates to make payments under loans made by us or other intercompany agreements. As a result, we are dependent upon payments from

our affiliates to meet our obligations under the notes. If these affiliates do not make payments to us and we fail to make payments on

the notes, you may have to seek payment under the related guarantee by JPMorgan Chase & Co., and that guarantee will rank

pari passu with all other unsecured and unsubordinated obligations of JPMorgan Chase & Co.

| ● | THE NOTES DO NOT PAY INTEREST. |

| ● | YOU WILL NOT HAVE ANY RIGHTS WITH RESPECT TO THE PORTFOLIO CONSTITUENTS, THE FUTURES CONTRACTS OR THE SECURITIES INCLUDED IN THE

PORTFOLIO CONSTITUENTS. |

The notes will not be

listed on any securities exchange. Accordingly, the price at which you may be able to trade your notes is likely to depend on the price,

if any, at which JPMS is willing to buy the notes. You may not be able to sell your notes. The notes are not designed to be short-term

trading instruments. Accordingly, you should be able and willing to hold your notes to maturity.

| ● | THE FINAL TERMS AND VALUATION OF THE NOTES WILL BE PROVIDED IN THE PRICING SUPPLEMENT — |

You should consider your

potential investment in the notes based on the minimums for the estimated value of the notes and the Participation Rate.

Risks Relating to Conflicts of Interest

We and our affiliates play

a variety of roles in connection with the notes. In performing these duties, our and JPMorgan Chase & Co.’s economic

interests are potentially adverse to your interests as an investor in the notes. It is possible that hedging or trading activities of

ours or our affiliates in connection with the notes could result in substantial returns for us or our affiliates while the value of the

notes declines. Please refer to “Risk Factors — Risks Relating to Conflicts of Interest” in the accompanying product

supplement. See also “ — Risks Relating to the Index — Our Affiliate, JPMS, Is the Sponsor of the Index, the Equity

Constituent and the Bond Constituent and May Adjust the Index or such Portfolio Constituent in a Way that Affects Its Level” below.

JPMS is one of the primary

dealers through which the U.S. Federal Reserve conducts open-market purchases and sales of U.S. Treasury and federal agency securities,

including U.S. Treasury notes. These activities may affect the prices and yields on the U.S.

|

PS-6

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Treasury notes, which may

in turn affect the level of the Bond Constituent and the level of the Bond Constituent. JPMS has no obligation to take into consideration

your interests as a holder of the notes when undertaking these activities.

| ● | OUR PARENT COMPANY, JPMORGAN CHASE & CO.,

IS CURRENTLY ONE OF THE COMPANIES THAT MAKE UP THE (1) Solactive United States 1000 Index, THE REFERENCE INDEX tracked by THE EQUITY CONSTITUENT

and (2) the Vanguard Short-Term Corporate Bond ETF, the Vanguard Intermediate-Term Corporate Bond ETF and the Vanguard Long-Term Corporate

Bond ETF, ETFs potentially underlying the Bond Constituent. |

Although our parent company, JPMorgan Chase & Co.,

is currently one of the companies included in certain of the Portfolio Constituents, JPMorgan Chase & Co. will not have

any obligation to consider your interests in taking any corporate action that might affect the securities included in the reference index

underlying the Equity Constituent or the ETFs underlying the Bond Constituent.

| ● | JPMS AND ITS AFFILIATES MAY HAVE PUBLISHED RESEARCH, EXPRESSED OPINIONS OR PROVIDED RECOMMENDATIONS THAT ARE INCONSISTENT WITH

INVESTING IN OR HOLDING THE NOTES, AND MAY DO SO IN THE FUTURE — |

Any research, opinions or recommendations

could affect the market value of the notes. Investors should undertake their own independent investigation of the merits of investing

in the notes and the Portfolio Constituents and the securities composing the Portfolio Constituents.

Risks Relating to the Estimated Value and Secondary

Market Prices of the Notes

| ● | THE ESTIMATED VALUE OF THE NOTES WILL BE LOWER THAN THE ORIGINAL ISSUE PRICE (PRICE TO PUBLIC) OF THE

NOTES — |

The estimated value of

the notes is only an estimate determined by reference to several factors. The original issue price of the notes will exceed the estimated

value of the notes because costs associated with selling, structuring and hedging the notes are included in the original issue price of

the notes. These costs include the selling commissions, the projected profits, if any, that our affiliates expect to realize for assuming

risks inherent in hedging our obligations under the notes and the estimated cost of hedging our obligations under the notes. See “The

Estimated Value of the Notes” in this pricing supplement.

| ● | THE ESTIMATED VALUE OF THE NOTES DOES NOT REPRESENT FUTURE VALUES OF THE NOTES AND MAY DIFFER FROM

OTHERS’ ESTIMATES — |

See “The Estimated

Value of the Notes” in this pricing supplement.

| ● | THE ESTIMATED VALUE OF THE NOTES IS DERIVED BY REFERENCE TO AN INTERNAL FUNDING RATE — |

The internal funding

rate used in the determination of the estimated value of the notes may differ from the market-implied funding rate for vanilla fixed income

instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference may be based on, among

other things, our and our affiliates’ view of the funding value of the notes as well as the higher issuance, operational and ongoing

liability management costs of the notes in comparison to those costs for the conventional fixed income instruments of JPMorgan Chase & Co.

This internal funding rate is based on certain market inputs and assumptions, which may prove to be incorrect, and is intended to approximate

the prevailing market replacement funding rate for the notes. The use of an internal funding rate and any potential changes to that rate

may have an adverse effect on the terms of the notes and any secondary market prices of the notes. See “The Estimated Value of the

Notes” in this pricing supplement.

| ● | THE VALUE OF THE NOTES AS PUBLISHED BY JPMS (AND WHICH MAY BE REFLECTED ON CUSTOMER ACCOUNT STATEMENTS)

MAY BE HIGHER THAN THE THEN-CURRENT ESTIMATED VALUE OF THE NOTES FOR A LIMITED TIME PERIOD — |

We generally expect that

some of the costs included in the original issue price of the notes will be partially paid back to you in connection with any repurchases

of your notes by JPMS in an amount that will decline to zero over an initial predetermined period. See “Secondary Market Prices

of the Notes” in this pricing supplement for additional information relating to this initial period. Accordingly, the estimated

value of your notes during this initial period may be lower than the value of the notes as published by JPMS (and which may be shown on

your customer account statements).

| ● | SECONDARY MARKET PRICES OF THE NOTES WILL LIKELY BE LOWER THAN THE ORIGINAL ISSUE PRICE OF THE NOTES

— |

Any secondary market

prices of the notes will likely be lower than the original issue price of the notes because, among other things, secondary market prices

take into account our internal secondary market funding rates for structured debt issuances and, also, because secondary market prices

may exclude selling commissions, projected hedging profits, if any, and estimated hedging costs

|

PS-7

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

that are included in

the original issue price of the notes. As a result, the price, if any, at which JPMS will be willing to buy the notes from you in secondary

market transactions, if at all, is likely to be lower than the original issue price. Any sale by you prior to the Maturity Date could

result in a substantial loss to you.

| ● | SECONDARY MARKET PRICES OF THE NOTES WILL BE IMPACTED BY MANY ECONOMIC AND MARKET FACTORS — |

The secondary market price

of the notes during their term will be impacted by a number of economic and market factors, which may either offset or magnify each other,

aside from the selling commissions, projected hedging profits, if any, estimated hedging costs and the level of the Index. Additionally,

independent pricing vendors and/or third party broker-dealers may publish a price for the notes, which may also be reflected on customer

account statements. This price may be different (higher or lower) than the price of the notes, if any, at which JPMS may be willing to

purchase your notes in the secondary market. See “Risk Factors — Risks Relating to the Estimated Value and Secondary Market

Prices of the Notes — Secondary market prices of the notes will be impacted by many economic and market factors” in the accompanying

product supplement.

Risks Relating to the Index

| ● | Our Affiliate, JPMS,

Is the Sponsor of the Index, the Equity Constituent and the Bond Constituent and May Adjust the Index or such Portfolio Constituent in

a Way that Affects Its Level. |

JPMS, one of our affiliates,

currently acts as the sponsor of the Index, the Equity Constituent and the Bond Constituent and is responsible for, among other things,

developing the guidelines and policies governing the composition and calculation of such indices. In performing these duties, JPMS may

have interests adverse to the interests of investors in an investment or instrument referencing the Index, particularly where JPMS, as

the Index Sponsor, is entitled to exercise discretion. The rules of the Index, the Equity Constituent and the Bond Constituent may be

amended at any time by the Index Sponsor, in its sole discretion. Such rules also permit the use of discretion by the sponsor in relation

to such index in specific instances, including, but not limited to, the selection of any substitute or successor, the adjustment of the

respective index levels under certain extraordinary events and the interpretation of the respective rules. Although JPMS, acting as the

Index Sponsor and the Index Calculation Agent, will make all determinations and take all action in relation to the Index acting in good

faith and in a commercially reasonable manner, it should be noted that JPMS may have interests adverse to the interests of investors in

an investment or instrument referencing the Index and the policies and judgments for which JPMS is responsible could have an impact, positive

or negative, on the level of the Index and the value of the notes.

Although judgments, policies

and determinations concerning the Index and the Portfolio Constituents are made by JPMS, JPMorgan Chase & Co., as the ultimate

parent company of JPMorgan Chase Bank and JPMS, ultimately controls JPMorgan Chase and JPMS. JPMS has no obligation to consider your interests

in taking any actions that might affect the value of your notes. Furthermore, the inclusion of the Portfolio Constituents in the Index

is not an investment recommendation by us or JPMS of any of the Portfolio Constituents, or any of the securities, ETFs or futures contracts

composing any of the Portfolio Constituents.

| ● | The Index may not

be successful or outperform any alternative strategy that might be employed in respect of the Portfolio Constituents — |

The Index follows a notional

rules-based proprietary strategy that operates on the basis of pre-determined rules. Under this strategy, the Index seeks to maintain

an annualized realized volatility approximately equal to the Target Volatility of 5.0% by rebalancing its exposures to the Portfolio Constituents

from time to time based on the realized portfolio volatility and the price momentum of the Bond Constituent. By seeking to maintain an

annualized realized volatility approximately equal to the Target Volatility, the Index may underperform an alternative strategy that seeks

to maintain a higher annualized realized volatility or an alternative strategy that does not seek to maintain a level volatility.

No assurance can be given

that the investment strategy on which the Index is based will be successful or that the Index will outperform any alternative strategy

that might be employed in respect of the Portfolio Constituents.

| ● | The Index may not

approximate the Target Volatility — |

No

assurance can be given that the Index will maintain an annualized realized volatility that approximates

the Target Volatility. The actual realized volatility of the Index may be greater or less than the Target Volatility. The Index

seeks to maintain an annualized realized volatility approximately equal to the Target Volatility of 5.0% by rebalancing its exposures

to the Portfolio Constituents from time to time based on the realized portfolio volatility. However,

there is no guarantee that trends exhibited by the realized portfolio volatility will continue in the future. The volatility of a notional

portfolio on any day may change quickly and unexpectedly. In addition, because the methodology used to calculate the realized volatility

of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized

volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher,

which may adversely affect the level of the Index and the value of the notes.

|

PS-8

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

| ● | The Index should

not be compared to any other index or strategy sponsored by any affiliates of JPMorgan Chase & Co. (each, a “J.P.

Morgan Index”) and cannot necessarily be considered a revised, enhanced or modified version of any other J.P. Morgan Index — |

The Index follows a notional

rules-based proprietary strategy that may have objectives, features and/or constituents that are similar to those of other J.P. Morgan

Indices. No assurance can be given that these similarities will form a basis for comparison between the Index and any other J.P. Morgan

Index, and no assurance can be given that the Index would be more successful than or outperform any other J.P. Morgan Index. The Index

operates independently and does not necessarily revise, enhance, modify or seek to outperform any other J.P. Morgan Index.

| ● | The Index may be

significantly uninvested — |

The weighting methodology

of the Index may result in an aggregate weight of less than 100% on any day. If the Index tracks a notional portfolio with an aggregate

weight that is less than 100%, the Index will not be fully invested, and any uninvested portion will earn no return. The Index may be

significantly uninvested on any given day, and will realize only a portion of any gains due to appreciation of the Portfolio Constituents

on any such day. The daily deduction of the Index Adjustment is fully applied in calculating the Index Level, even when the Index is not

fully invested.

| ● | A significant portion

of the Index’s exposure may be allocated to the Selected Defensive Constituent — |

Under normal market conditions,

the Equity Constituent has tended to exhibit a realized volatility that is higher than the Target Volatility and that is higher than the

realized volatility of each of the Defensive Constituents in general over time. As a result, the Index will generally need to reduce its

exposure to the Equity Constituent in order to approximate the Target Volatility. Furthermore, because the methodology used to calculate

the realized volatility of the Index is based on the highest volatility over three separate look-back intervals (5 days, 63 days and 756

days), the actual realized volatility of the Index on an annualized basis is more likely to be lower than the Target Volatility of 5.0%

than it is likely to be higher, which has the effect of further lowering the weight of the Equity Constituent. Therefore, the Index may

have significant exposure for an extended period of time to the Selected Defensive Constituent, and that exposure may be greater, perhaps

significantly greater, than its exposure to the Equity Constituent. However, the returns of the Selected Defensive Constituent may be

significantly lower than the returns of the Equity Constituent, and possibly even negative while the returns of the Equity Constituent

are positive, which will adversely affect the level of the Index and the value of the notes.

| ● | The Index may be

more heavily influenced by the performance of the Equity Constituent than the performance of the Selected Defensive Constituent in general

over time — |

Under normal market conditions,

the Equity Constituent’s realized volatility has been relatively more variable and has tended to be significantly higher than those

of the Defensive Constituents. Under these circumstances, the Index is generally expected to be more heavily weighted towards the Selected

Defensive Constituent. Furthermore, because the methodology used to calculate the realized volatility of the Index is based on the highest

volatility over three separate look-back intervals (5 days, 63 days and 756 days), the actual realized volatility of the Index on an annualized

basis is more likely to be lower than the Target Volatility of 5.0% than it is likely to be higher, which has the effect of further lowering

the weight of the Equity Constituent. However, under circumstances where the Equity Constituent’s realized volatility is significantly

higher than that of the Selected Defensive Constituent, the performance of the Index is expected to be influenced to a greater extent

by the performance of the Equity Constituent than by the performance of the Selected Defensive Constituent, even if the weight of the

Selected Defensive Constituent is significantly greater than the weight of the Equity Constituent.

Consequently, even in cases

where the allocation to the Selected Defensive Constituent is greater than the allocation to the Equity Constituent, the Index may be

influenced to a greater extent by the performance of the Equity Constituent than by the performance of the Selected Defensive Constituent

because, under some conditions, the greater allocation to the Selected Defensive Constituent will not be sufficiently large to offset

the greater realized volatility of the Equity Constituent.

Accordingly, the level

of the Index may decline if the value of the Equity Constituent declines, even if the value of the Selected Defensive Constituent increases

at the same time. See also “— Changes in the values of the Portfolio Constituents may offset each other” below.

| ● | Correlation of performances

between the Portfolio Constituents may reduce the performance of the Index — |

Performances

of the Portfolio Constituents may become highly correlated from time to time, including, but not limited to, a period in which there is

a substantial decline in the level or the price of the Portfolio Constituents. High correlation during periods of negative returns among

Portfolio Constituents could have an adverse effect on the performance of the Index.

|

PS-9

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

| ● | Changes in the values

of the Portfolio Constituents may offset each other — |

Price

movements among the Portfolio Constituents may not correlate with each other. At a time when the value of one Portfolio Constituent increases,

the value of the other Portfolio Constituents may not increase as much or may decline. Therefore, in calculating the level of the Index,

increases in the value of one Portfolio Constituent may be moderated, or more than offset, by lesser increases or declines in the value

of the other Portfolio Constituent, which will adversely affect the level of the Index and the value of the notes.

| ● | HYPOTHETICAL BACK-TESTED DATA RELATING TO THE INDEX DO NOT REPRESENT ACTUAL HISTORICAL DATA AND ARE SUBJECT TO INHERENT LIMITATIONS

— |

The hypothetical back-tested

performance of the Index set forth under “Hypothetical Back-Tested Data and Historical Information” in this pricing supplement

is purely theoretical and does not represent the actual historical performance of the Index and has not been verified by an independent

third party. Hypothetical back-tested performance measures have inherent limitations. Hypothetical back-tested performance

is derived by means of the retroactive application of a back-tested model that has been designed with the benefit of hindsight.

Alternative modelling techniques might produce significantly different results and may prove to be more appropriate. Past performance,

and especially hypothetical back-tested performance, is not indicative of future results. This type of information has inherent

limitations and you should carefully consider these limitations before placing reliance on such information.

| ● | If the value of a Portfolio Constituent changes,

the level of the Index may not change in the same manner — |

Changes in the value

of any Portfolio Constituent may not result in a comparable change in the level of the Index or the market value of any investment or

instrument linked to the Index.

| ● | The Index comprises notional assets and liabilities

— |

The exposure of the Index

to its Portfolio Constituents is purely notional and will exist solely in the records maintained by or on behalf of the Index Calculation

Agent. There is no actual portfolio of assets to which any person is entitled or in which any person has any ownership interest. Consequently,

there will be no claim against any of the reference assets that compose the Index.

| ● | The Index has a very limited operating history

and may perform in unanticipated ways — |

The Index was established

on March 30, 2023 and therefore has a very limited operating history. Past performance should not be considered indicative of future performance.

| ● | The Index is subject to market risks — |

The performance of the

Index is dependent in part on the performance of its Portfolio Constituents. As a consequence, any investment or instrument linked to

the Index is exposed to the performance of the Portfolio Constituents. Geopolitical and other events (e.g., wars, terrorism or natural

disasters) may disrupt securities and currency markets and adversely affect global economies and markets, thereby adversely affecting

the performance of the Portfolio Constituents and the Index.

| ● | The investment strategy used to construct the

Index involves rebalancing from time to time — |

The Index is subject to

rebalancing from time to time based on the realized portfolio volatility and the price momentum of the Bond Constituent. For this purpose,

the price momentum of the Bond Constituent on a given Index Business Day is calculated based on the 60-Day Price Momentum Signal. If the

Bond Constituent exhibits a positive 60-Day Price Momentum Signal on any given Index Business Day and on each of the two (2) Index Business

Days preceding such day, then the Bond Constituent will be identified as the Selected Defensive Constituent for such day. However, if

the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal on any given Index Business Day and on each of the two

(2) Index Business Days preceding such day, then the Currency Constituent will be identified as the Selected Defensive Constituent for

such day. In either scenario, if the 60-Day Price Momentum Signal on such day is not repeated on both of the two (2) preceding Index Business

Days, then the Selected Defensive Constituent will be whichever one was last selected. Following each Defensive Constituent Switch Day,

the Index will rebalance its exposure to the Portfolio Constituents starting on the immediately following Index Business Day and ending

on the Index Business Day after the earlier of (y) the next Defensive Constituent Switch Day and (z) the Index Business Day for which

the volatility budget of each Defensive Constituent as of such day is equal to the preliminary volatility budget of such Defensive Constituent

calculated as of the Defensive Constituent Switch Day, up to a maximum of five (5) days. In addition, the Index will rebalance its exposure

to the Portfolio Constituents on any other Index Business Day where the volatility of the notional portfolio underlying the Index is less

than four point five percent (4.5%) or greater than five point five percent (5.5%), calculated as of the immediately preceding Index Business

Day. By contrast, a notional portfolio that does not rebalance from time to time in this manner could see greater compounded gains over

time through exposure to a consistently and rapidly appreciating portfolio consisting of the relevant Portfolio Constituents. Therefore,

the return on any investment or instrument linked to the Index may be less than the return on an alternative

|

PS-10

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

investment in the relevant

Portfolio Constituents that is not subject to rebalancing. No assurance can be given that the investment strategy used to construct the

Index will outperform any alternative investment in the Portfolio Constituents of the Index.

| ● | The Index determines the Selected Defensive

Constituent based on the momentum of the Bond Constituent — |

The Index determines the

Selected Defensive Constituent based on the momentum of the Bond Constituent. If the Bond Constituent exhibits a positive 60-Day Price

Momentum Signal, and this continue for the following two (2) days, then the Selected Defensive Constituent as of the last day will be

the Bond Constituent. However, if the Bond Constituent exhibits a negative or neutral 60-Day Price Momentum Signal, and this continue

for the following two (2) days, then the Selected Defensive Constituent as of the last day will be the Currency Constituent. In either

scenario, if the 60-Day Price Momentum Signal on such last day is not repeated on the preceding two (2) days, then the Selected Defensive

Constituent will be whichever one was last selected. The momentum strategy generally seeks to benefit from positive trends in the returns

of the Bond Constituent, and allocate to the Currency Constituent when the momentum signal for the Bond Constituent is not positive. As

such, the allocation to the Bond Constituent is based in part on the recent performance of the Bond Constituent ETFs. However, there is

no guarantee that recent performance trends will continue in the future. Moreover, in circumstances where the Bond Constituent exhibits

a negative or neutral 60-Day Price Momentum Signal, there is no assurance that the Currency Constituent will outperform the Bond Constituent.

In addition, due to the

momentum investment strategy to determine the Selected Defensive Constituent, the Index may fail to realize gains that could occur as

a result of obtaining exposures to financial instruments that have experienced negative returns, but which subsequently experience a recovery

or a sudden spike in positive returns. As a result, if market conditions do not represent a continuation of prior observed trends, the

level of the Index, which is rebalanced based on prior trends, may decline.

| ● | There are risks associated with the momentum

investment strategy underlying the rebalancing methodology of the Index — |

The rebalancing methodology

of the Index reflects a momentum investment strategy and seeks to provide exposure to positive price momentum of the Bond Constituent

through its rebalancing process. Momentum investing generally seeks to capitalize on positive trends in the returns of financial instruments. If

the Bond Constituent exhibits a positive 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Bond

Constituent will be included in the Index as the Selected Defensive Constituent. However, if the Bond Constituent exhibits a negative

or neutral 60-Day Price Momentum Signal, and this continue for the following two (2) days, then the Index will generally rebalance to

switch its exposure from the Bond Constituent to the Currency Constituent as the Selected Defensive Constituent. In non-trending, sideways

markets, the Index will maintain the Selected Defensive Constituent last selected and may be subject to “whipsaws.” A whipsaw

occurs when the market reverses and does the opposite of what is indicated by the trend indicator, resulting in a trading loss during

the particular period.

Furthermore, due to the

“long-only” construction of the Index, the weight of each Portfolio Constituent will not fall below zero at any time even

if the Selected Defensive Constituent has displayed a negative recent performance period. Moreover, once a selected portfolio has been

identified and implemented, the Index will track the performance of the Selected Defensive Constituent until the next re-weighting, even

when the values of that Selected Defensive Constituent is trending downwards or when the Selected Defensive Constituent is otherwise performing

significantly worse than its recent performance, or than the other Defensive Constituent.

| ● | A Portfolio Constituent may be replaced by a

substitute index or ETF upon the occurrence of certain extraordinary events — |

Following the occurrence

of certain extraordinary events with respect to a Portfolio Constituent, the affected Portfolio Constituent may be replaced by a substitute

index or ETF. These extraordinary events generally include events that could materially interfere with the ability of market participants

to transact in positions with respect to the Index (including positions with respect to any Portfolio Constituent or the reference index

of any Portfolio Constituent). See the accompanying underlying supplement for a summary of events that could trigger an extraordinary

event.

|

PS-11

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

The changing of a Portfolio

Constituent may affect the performance of the Index, and therefore, the return on any investment or instrument linked to the Index, as

the replacement Portfolio Constituent may perform significantly better or worse than the original Portfolio Constituent. For example,

the substitute or successor Portfolio Constituent may have higher fees or worse performance than the original Portfolio Constituent. Moreover,

the policies of the sponsor of the substitute index or ETF concerning the methodology and calculation of the substitute index or ETF,

including decisions regarding additions, deletions or substitutions of the assets underlying the substitute index or ETF, could affect

the level or price of the substitute index or ETF and therefore the performance of the Index and the value of the notes. The performance

of the Index and the amount payable on the notes and their market value could also be affected if the sponsor of a substitute index or

the sponsor of the reference index of a substitute ETF discontinues or suspends calculation or dissemination of the relevant index, in

which case it may become difficult to determine the market value of the notes. The sponsor of the substitute index or ETF will have no

obligation to consider any person’s interests in calculating or revising such substitute index or ETF.

| ● | The Index seeks to allocate notional exposure

between the Equity Constituent and the Selected Defensive Constituent so that the risk associated with each constituent is roughly equal.

However, the Index methodology may not be successful at achieving “risk-parity” among the Portfolio Constituents — |

The Index is subject to

rebalancing from time to time in part based on the realized portfolio volatility and seeks to weight the notional exposure to the Equity

Constituent and the Selected Defensive Constituent such that the risk associated with each of the Equity Constituent and the Selected

Defensive Constituent is approximately equal. This is accomplished by measuring the realized volatility of each of the Equity Constituent

and the Selected Defensive Constituent and setting the weight of the Equity Constituent and the Selected Defensive Constituent in inverse

proportion to its respective volatility. Therefore, all else being equal, a lower realized volatility for a Portfolio Constituent will

generally result in a higher weight for that Portfolio Constituent, while a higher realized volatility will generally result in a lower

weight. However, there can be no assurance that historical trends in volatility will continue in the future. Thus, the realized volatility

of the Portfolio Constituents in the future could differ significantly from their historical volatility. Furthermore, because the Index

adjusts its notional exposure to the Portfolio Constituents only on Rebalancing Days (as defined below), the Index will not be able to

adjust its notional exposure to the Portfolio Constituents to account for any change in volatility until a subsequent Rebalancing Day.

As a result, the Index may not successfully weight the notional exposure to the Portfolio Constituents such that the risks associated

with the Equity Constituent and the Selected Defensive Constituent are approximately equal. In this circumstance, the Index may not be

able to maintain “risk-parity” between the Equity Constituent and the Selected Defensive Constituent between Rebalancing Days,

which may adversely affect the level of the Index and the value of the notes.

| ● | The Portfolio Constituents will likely be unequally

weighted in the Index — |

In seeking to achieve

roughly equal risk allocation between the Equity Constituent and the Selected Defensive Constituent, the Equity Constituent and the Selected

Defensive Constituent will likely be unequally weighted. All else being equal, the performance of the Portfolio Constituent with the higher

weighting will influence the performance of the Index to a greater degree than the performance of the Portfolio Constituent with lower

weighting. If the Portfolio Constituent with the higher weighting perform poorly, its poor performance could negate or diminish the effect

on the performance of the Index of any positive performance by the lower-weighted Portfolio Constituent.

| o | THE INDEX WAS ESTABLISHED ON MARCH 30, 2023, AND THE Equity

Constituent and the Bond Constituent, which were recently formed, have limited operating histories and MAY PERFORM IN UNANTICIPATED

WAYS. |

| o | THE NOTES ARE NOT COMMODITY FUTURES CONTRACTS OR SWAPS AND ARE NOT REGULATED UNDER THE COMMODITY EXCHANGE

ACT OF 1936, AS AMENDED |

| o | HISTORICAL PERFORMANCE OF THE INDEX SHOULD NOT BE TAKEN AS AN INDICATION OF THE FUTURE PERFORMANCE

OF THE INDEX DURING THE TERM OF THE NOTES |

| o | THE NOTES ARE SUBJECT TO SIGNIFICANT RISKS ASSOCIATED WITH FIXED-INCOME SECURITIES, INCLUDING INTEREST

RATE-RELATED RISKS AND CREDIT RISK. |

Please refer to the “Risk Factors”

section of the accompanying underlying supplement for more details regarding the above-listed and other risks.

|

PS-12

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Hypothetical Back-Tested Data and Historical

Information

The following graph sets forth

the hypothetical back-tested performance of the Index based on the hypothetical back-tested weekly closing levels of the Index from January

5, 2018 through March 29, 2023, and the actual historical performance from March 30, 2023 through June 23, 2023. Since the Index was established

on March 30, 2023, only back-tested performance is reflected in the graph below. The closing level of the Index on June 28, 2023 was 199.16.

We obtained the closing levels above and below from the Bloomberg Professional® service, without independent verification.

The data for the hypothetical

back-tested performance of the Index set forth in the following graph are purely theoretical and do not represent the actual historical

performance of the Index. See “Selected Risk Considerations — Risks Relating to the Index — Hypothetical Back-Tested

Data Relating to the Index Do Not Represent Actual Historical Data and Are Subject to Inherent Limitations” above.

The hypothetical back-tested

and historical closing levels of the Index should not be taken as an indication of future performance, and no assurance can be given as

to the closing level of the Index on the Pricing Date or the Observation Date. There can be no assurance that the performance of the Index

will result in a payment at maturity in excess of your principal amount, subject to the credit risks of JPMorgan Financial and JPMorgan

Chase & Co.

The hypothetical back-tested closing levels of the Index

have inherent limitations and have not been verified by an independent third party. These hypothetical back-tested closing levels are

determined by means of a retroactive application of a back-tested model designed with the benefit of hindsight. Hypothetical back-tested

results are neither an indicator nor a guarantee of future returns. No representation is made that an investment in the notes will or

is likely to achieve returns similar to those shown. Alternative modeling techniques or assumptions would produce different hypothetical

back-tested closing levels of the Index that might prove to be more appropriate and that might differ significantly from the hypothetical

back-tested closing levels of the Index set forth above.

Treatment

as Contingent Payment Debt Instruments

You

should review carefully the section entitled “Material U.S. Federal Income Tax Consequences,” and in particular the subsection

thereof entitled “Tax Consequences to U.S. Holders — Notes with a Term of More than One Year — Notes Treated as Contingent

Payment Debt Instruments” in the accompanying product supplement no. 3-I. Unlike a traditional debt instrument that provides for

periodic payments of interest at a single fixed rate, with respect to which a cash-method investor generally recognizes income only upon

receipt of stated interest, our special tax counsel, Latham & Watkins LLP, is of the opinion that the notes will be treated for U.S.

federal income tax purposes as “contingent payment debt instruments.” Assuming this treatment is respected, as discussed in

that subsection, you generally will be required to accrue original issue discount (“OID”) on your notes in each taxable year

at the “comparable yield,” as determined by us, although we will not make any payment with respect to the notes until maturity.

Upon sale or exchange (including at maturity), you will recognize taxable income or loss equal to the difference between the amount received

from the sale or exchange, and your adjusted basis in the note, which generally will equal the cost thereof, increased by the amount of

OID you have accrued in respect of the note. You generally must treat any income as interest income and any loss as ordinary loss to the

extent of previous interest inclusions, and the balance as capital loss. The deductibility of capital losses is subject to limitations.

Special rules may apply if the Additional Amount is treated as becoming fixed prior to maturity. You should consult your tax adviser concerning

the application of these rules. The discussions herein and in the accompanying product supplement do not address the consequences to taxpayers

subject to special tax accounting rules under Section 451(b) of the Code. Purchasers who are not initial purchasers of notes at their

issue price should consult their tax advisers with respect to the tax consequences of an investment in notes, including the treatment

of the difference, if any, between the basis in their notes and the notes’ adjusted issue price.

|

PS-13

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Section

871(m) of the Code and Treasury regulations promulgated thereunder (“Section 871(m)”) generally impose a 30% withholding tax

(unless an income tax treaty applies) on dividend equivalents paid or deemed paid to Non-U.S. Holders with respect to certain financial

instruments linked to U.S. equities or indices that include U.S. equities. Section 871(m) provides certain exceptions to this withholding

regime, including for instruments linked to certain broad-based indices that meet requirements set forth in the applicable Treasury regulations.

Additionally, a recent IRS notice excludes from the scope of Section 871(m) instruments issued prior to January 1, 2025 that do not have

a delta of one with respect to underlying securities that could pay U.S.-source dividends for U.S. federal income tax purposes (each an

“Underlying Security”). Based on certain determinations made by us, we expect that Section 871(m) will not apply to the notes

with regard to Non-U.S. Holders. Our determination is not binding on the IRS, and the IRS may disagree with this determination. Section

871(m) is complex and its application may depend on your particular circumstances, including whether you enter into other transactions

with respect to an Underlying Security. If necessary, further information regarding the potential application of Section 871(m) will be

provided in the pricing supplement for the notes. You should consult your tax adviser regarding the potential application of Section 871(m)

to the notes.

The

discussions in the preceding paragraphs, when read in combination with the section entitled “Material U.S. Federal Income Tax Consequences”

(and in particular the subsection thereof entitled “— Tax Consequences to U.S. Holders — Notes with a Term of More than

One Year — Notes Treated as Contingent Payment Debt Instruments”) in the accompanying product supplement, constitute the full

opinion of Latham & Watkins LLP regarding the material U.S. federal income tax consequences of owning and disposing of notes.

Comparable

Yield and Projected Payment Schedule

We

will determine the comparable yield for the notes and will provide that comparable yield, and the related projected payment schedule,

in the pricing supplement for the notes, which we will file with the SEC. If the notes had been issued on June 29, 2023 and we had determined

the comparable yield on that date, it would have been an annual rate of 5.58%, compounded semiannually. The actual comparable yield that

we will determine for the notes may be higher or lower than 5.58%, and will depend upon a variety of factors, including actual market

conditions and our borrowing costs for debt instruments of comparable maturities. Neither the comparable yield nor the projected payment

schedule constitutes a representation by us regarding the actual amount of the payment that we will make on the notes.

The Estimated

Value of the Notes

The

estimated value of the notes set forth on the cover of this pricing supplement is equal to the sum of the values of the following hypothetical

components: (1) a fixed-income debt component with the same maturity as the notes, valued using the internal funding rate described below,

and (2) the derivative or derivatives underlying the economic terms of the notes. The estimated value of the notes does not represent

a minimum price at which JPMS would be willing to buy your notes in any secondary market (if any exists) at any time. The internal

funding rate used in the determination of the estimated value of the notes may differ from the market-implied funding rate for vanilla

fixed income instruments of a similar maturity issued by JPMorgan Chase & Co. or its affiliates. Any difference may

be based on, among other things, our and our affiliates’ view of the funding value of the notes as well as the higher issuance,

operational and ongoing liability management costs of the notes in comparison to those costs for the conventional fixed income instruments

of JPMorgan Chase & Co. This internal funding rate is based on certain market inputs and assumptions, which may prove

to be incorrect, and is intended to approximate the prevailing market replacement funding rate for the notes. The use of an internal

funding rate and any potential changes to that rate may have an adverse effect on the terms of the notes and any secondary market prices

of the notes. For additional information, see “Selected Risk Considerations — Risks Relating to the Estimated Value

and Secondary Market Prices of the Notes — The Estimated Value of the Notes Is Derived by Reference to an Internal Funding Rate”

in this pricing supplement.

The value of the derivative

or derivatives underlying the economic terms of the notes is derived from internal pricing models of our affiliates. These models are

dependent on inputs such as the traded market prices of comparable derivative instruments and on various other inputs, some of which are

market-observable, and which can include volatility, dividend rates, interest rates and other factors, as well as assumptions about future

market events and/or environments. Accordingly, the estimated value of the notes is determined when the terms of the notes are set based

on market conditions and other relevant factors and assumptions existing at that time.

The estimated value of the notes

does not represent future values of the notes and may differ from others’ estimates. Different pricing models and assumptions could

provide valuations for the notes that are greater than or less than the estimated value of the notes. In addition, market conditions and

other relevant factors in the future may change, and any assumptions may prove to be incorrect. On future dates, the value of the notes

could change significantly based on, among other things, changes in market conditions, our or JPMorgan Chase & Co.’s

creditworthiness, interest rate movements and other relevant factors, which may impact the price, if any, at which JPMS would be willing

to buy notes from you in secondary market transactions.

The estimated value of the notes

will be lower than the original issue price of the notes because costs associated with selling, structuring and hedging the notes are

included in the original issue price of the notes. These costs include the selling commissions paid to JPMS and other affiliated or unaffiliated

dealers, the projected profits, if any, that our affiliates expect to realize for assuming risks inherent in hedging our obligations under

the notes and the estimated cost of hedging our obligations under the notes. Because hedging our

|

PS-14

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

obligations entails risk and

may be influenced by market forces beyond our control, this hedging may result in a profit that is more or less than expected, or it may

result in a loss. A portion of the profits, if any, realized in hedging our obligations under the notes may be allowed to other affiliated

or unaffiliated dealers, and we or one or more of our affiliates will retain any remaining hedging profits. See “Selected Risk Considerations

— Risks Relating to the Estimated Value and Secondary Market Prices of the Notes — The Estimated Value of the Notes Will Be

Lower Than the Original Issue Price (Price to Public) of the Notes” in this pricing supplement.

|

PS-15

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

Secondary Market Prices of the Notes

For information about factors

that will impact any secondary market prices of the notes, see “Risk Factors — Risks Relating to the Estimated Value and Secondary

Market Prices of the Notes — Secondary market prices of the notes will be impacted by many economic and market factors” in

the accompanying product supplement. In addition, we generally expect that some of the costs included in the original issue price of the

notes will be partially paid back to you in connection with any repurchases of your notes by JPMS in an amount that will decline to zero

over an initial predetermined period. These costs can include selling commissions, projected hedging profits, if any, and, in some circumstances,

estimated hedging costs and our internal secondary market funding rates for structured debt issuances. This initial predetermined time

period is intended to be the shorter of six months and one-half of the stated term of the notes. The length of any such initial period

reflects the structure of the notes, whether our affiliates expect to earn a profit in connection with our hedging activities, the estimated

costs of hedging the notes and when these costs are incurred, as determined by our affiliates. See “Selected Risk Considerations

— Risks Relating to the Estimated Value and Secondary Market Prices of the Notes — The Value of the Notes as Published by

JPMS (and Which May Be Reflected on Customer Account Statements) May Be Higher Than the Then-Current Estimated Value of the Notes for

a Limited Time Period” in this pricing supplement.

Supplemental

Use of Proceeds

The notes are offered to meet

investor demand for products that reflect the risk-return profile and market exposure provided by the notes. See “Hypothetical Payout

Profile” and “How the Notes Work” in this pricing supplement for an illustration of the risk-return profile of the notes

and “The J.P. Morgan Tactical Blend Index” in this pricing supplement for a description

of the market exposure provided by the notes.

The original issue price of the

notes is equal to the estimated value of the notes plus the selling commissions paid to JPMS and other affiliated or unaffiliated dealers,

plus (minus) the projected profits (losses) that our affiliates expect to realize for assuming risks inherent in hedging our obligations

under the notes, plus the estimated cost of hedging our obligations under the notes.

Additional

Terms Specific to the Notes

You may revoke your offer to purchase

the notes at any time prior to the time at which we accept such offer by notifying the applicable agent. We reserve the right to change

the terms of, or reject any offer to purchase, the notes prior to their issuance. In the event of any changes to the terms of the notes,

we will notify you and you will be asked to accept such changes in connection with your purchase. You may also choose to reject such changes,

in which case we may reject your offer to purchase.

You should read this pricing supplement

together with the accompanying prospectus, as supplemented by the accompanying prospectus supplement relating to our Series A medium-term

notes of which these notes are a part, and the more detailed information contained in the accompanying product supplement and the accompanying

underlying supplement. This pricing supplement, together with the documents listed below, contains the terms of the notes and supersedes

all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing

terms, correspondence, trade ideas, structures for implementation, sample structures, fact sheets, brochures or other educational materials

of ours. You should carefully consider, among other things, the matters set forth in the “Risk Factors” sections of the accompanying

prospectus supplement, the accompanying product supplement and the accompanying underlying supplement, as the notes involve risks not

associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting and other advisers before

you invest in the notes.

|

PS-16

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

You may access these

documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date

on the SEC website):

| · | Product supplement no. 3-I dated April 13, 2023: |

https://www.sec.gov/Archives/edgar/data/19617/000121390023029706/ea153081_424b2.pdf

| · | Underlying supplement no. 19-I dated April 13, 2023: |

https://www.sec.gov/Archives/edgar/data/19617/000121390023029546/ea152984_424b2.pdf

Our Central Index Key, or CIK, on the SEC website is

1665650, and JPMorgan Chase & Co.’s CIK is 19617. As used in this pricing supplement, “we,” “us”

and “our” refer to JPMorgan Financial.

|

PS-17

| Structured Investments

Notes Linked to the J.P. Morgan Tactical Blend Index |

|

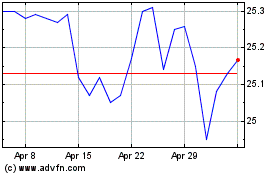

JP Morgan Chase (NYSE:JPM-C)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM-C)

Historical Stock Chart

From Apr 2023 to Apr 2024