Amended Statement of Beneficial Ownership (sc 13d/a)

February 27 2020 - 12:48PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

(Amendment No. 7)*

|

|

|

|

Enzo Biochem,

Inc.

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

$0.01 par value

|

|

(Title of Class of Securities)

|

|

|

|

294100102

|

|

(CUSIP Number)

|

|

|

|

Kevin A. McGovern, Esq.

c/o Harbert Discovery Fund, LP

2100 Third Avenue North, Suite 600

Birmingham, AL 35203

(205) 987-5577

with a copy to:

Eleazer Klein, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

February

25, 2020

|

|

(Date of Event Which Requires Filing of This Statement)

|

|

|

If the filing person has previously filed a statement on Schedule

13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule

13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1

of 15 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 2 of 15 Pages

|

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 3 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Discovery Fund, LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,915,027

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,915,027

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,915,027

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.03%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 4 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Discovery Fund GP, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

1,915,027

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

1,915,027

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,915,027

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

4.03%

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 5 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Discovery Co-Investment Fund I, LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

WC

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

3,705,654

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

3,705,654

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,705,654

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.79%

|

|

14

|

TYPE OF REPORTING PERSON

PN

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 6 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Discovery Co-Investment Fund I GP, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

3,705,654

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

3,705,654

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

3,705,654

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

7.79%

|

|

14

|

TYPE OF REPORTING PERSON

OO

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 7 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Fund Advisors, Inc.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Alabama

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

5,620,681

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

5,620,681

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,620,681

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.82%

|

|

14

|

TYPE OF REPORTING PERSON

IA, CO

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 8 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Harbert Management Corporation

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Alabama

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

5,620,681

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

5,620,681

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,620,681

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.82%

|

|

14

|

TYPE OF REPORTING PERSON

CO

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 9 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Jack Bryant

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

5,620,681

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

5,620,681

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,620,681

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.82%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 10 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Kenan Lucas

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

5,620,681

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

5,620,681

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,620,681

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.82%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 11 of 15 Pages

|

|

1

|

NAME OF REPORTING PERSON

Raymond Harbert

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States of America

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

5,620,681

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

5,620,681

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

5,620,681

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

11.82%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 12 of 15 Pages

|

|

The following constitutes Amendment No. 7 to the Schedule 13D filed by the undersigned (the “Amendment No. 7”). This Amendment No. 7 amends the Schedule 13D, filed with the Securities and Exchange Commission on April 8, 2019 as specifically set forth herein.

|

|

|

|

|

As a result of the termination of the Nomination Agreement (as disclosed in Item 6 below), the Reporting Persons (as defined in Item 2 below), Fabian Blank (“Mr. Blank”), and Peter J. Clemens, IV (“Mr. Clemens”), are no longer deemed to be a "group" for purposes of Section 13(d)(3) of the Exchange Act and Rule 13d-5(b)(1) promulgated thereunder. Therefore, Mr. Blank and Mr. Clemens are no longer reporting persons and the beneficial ownership reported in this Amendment No. 7 no longer includes the beneficial ownership of Mr. Blank and Mr. Clemens.

|

|

|

|

|

Item 2.

|

IDENTITY AND BACKGROUND

|

|

|

|

|

Items 2(a) - (f) of the Schedule 13D are hereby amended and restated as follows:

|

|

|

|

|

(a), (f)

|

This Schedule 13D is being filed jointly by (i) Harbert Discovery Fund, LP, a Delaware limited partnership (the “Discovery Fund”), (ii) Harbert Discovery Fund GP, LLC, a Delaware limited liability company (the “Discovery Fund GP”), (iii) Harbert Discovery Co-Investment Fund I, LP (the “Discovery Co-Investment Fund” and together with the Discovery Fund, the “Funds”), (iv) Harbert Discovery Co-Investment Fund I GP, LLC (the “Discovery Co-Investment Fund GP” and together with the Discovery Fund GP, the “Fund GPs”), (v) Harbert Fund Advisors, Inc., an Alabama corporation (“HFA”), (vi) Harbert Management Corporation, an Alabama corporation (“HMC”), (vii) Jack Bryant, a United States citizen, (viii) Kenan Lucas, a United States citizen, and (ix) Raymond Harbert, a United States citizen (collectively “Reporting Persons”).

|

|

|

|

|

|

The filing of this statement should not be construed as an admission that any Reporting Person is, for the purposes of Section 13 of the Act or otherwise, the beneficial owner of the shares of Common Stock reported herein.

|

|

|

|

|

(b)

|

The principal business address for each of the Reporting Persons is 2100 Third Avenue North, Suite 600, Birmingham, Alabama 35203.

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 13 of 15 Pages

|

|

(c)

|

Kenan Lucas is the managing director and portfolio manager of the Discovery Fund GP and the Discovery Co-Investment Fund GP, which serves as general partner of the Discovery Fund and the Discovery Co-Investment Fund, respectively. Jack Bryant is a Senior Advisor to the Discovery Fund, and a Vice President and Senior Managing Director of HMC. Raymond Harbert is the controlling shareholder, Chairman and Chief Executive Officer of HMC, an alternative asset investment management firm that is the managing member of the Discovery Fund GP and Discovery Co-Investment Fund GP. Mr. Harbert also serves as the Chairman, Chief Executive Officer and Director of HFA, an indirect, wholly owned subsidiary of HMC, which provides the Funds with certain operational and administrative services. The principal business of each of the Funds is purchasing, holding and selling securities for investment purposes.

|

|

|

|

|

(d)

|

During the last five years, none of the Reporting Persons have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

|

|

(e)

|

During the last five years, none of the Reporting Persons have been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and were not and are not, as a result of any such proceeding, subject to a judgment, decree, or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

|

|

Item 4.

|

PURPOSE OF TRANSACTION

|

|

|

|

|

Item 4 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

|

|

On February 25, 2020, the Issuer announced that based on preliminary results of voting at the 2019 annual meeting of shareholders of the Issuer, the Issuer’s shareholders voted to elect Mr. Blank and Mr. Clemens.

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

Items 5(a) - (c) of the Schedule 13D are hereby amended and restated in their entirety as follows:

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D/A for the aggregate number of shares of Common Stock and percentages of the Common Stock beneficially owned by each Reporting Person. The percentages used in this Schedule 13D are calculated based upon 47,556,807 shares of Common Stock outstanding as of December 3, 2019, as reported in the Issuer’s Definitive Proxy Statement filed under cover of Schedule 14A, filed with the Securities and Exchange Commission on December 5, 2019.

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

|

|

|

|

|

(c)

|

Harbert has not effected any transactions in the Common Stock in the past sixty days.

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

|

Item 6 of the Schedule 13D is hereby amended and supplemented by the addition of the following:

|

|

|

|

|

|

As a result of the successful election of Mr. Blank and Mr. Clemens to the Board on February 25, 2020, each of the Nomination Agreements terminated in accordance with its terms.

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 14 of 15 Pages

|

SIGNATURES

After reasonable inquiry and to the best

of his or its knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Date: February 27, 2020

|

|

Harbert Discovery Fund, LP

|

|

|

|

|

|

|

By:

|

Harbert Discovery Fund GP, LLC,

its General Partner

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

Harbert Management Corporation,

its Managing Member

|

|

|

|

|

|

|

By:

|

/s/ John McCullough

|

|

|

|

Executive Vice President and

|

|

|

|

General Counsel

|

|

|

|

|

|

|

|

|

|

|

Harbert Discovery Fund GP, LLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

Harbert Management Corporation,

its Managing Member

|

|

|

|

|

|

|

By:

|

/s/ John McCullough

|

|

|

|

Executive Vice President and

General Counsel

|

|

|

|

|

|

|

|

|

|

|

Harbert Discovery Co-Investment Fund I, LP

|

|

|

|

|

|

|

By:

|

Harbert Discovery Co-Investment Fund I GP, LLC, its General Partner

|

|

|

|

|

|

|

|

|

|

|

By:

|

Harbert Management Corporation,

its Managing Member

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John McCullough

|

|

|

|

Executive Vice President and

General Counsel

|

|

CUSIP No. 294100102

|

SCHEDULE 13D/A

|

Page 15 of 15 Pages

|

|

|

Harbert Discovery Co-Investment Fund

I GP, LLC

|

|

|

|

|

|

|

|

|

|

|

By:

|

Harbert Management Corporation,

its Managing Member

|

|

|

|

|

|

|

By:

|

s/ John McCullough

|

|

|

|

Executive Vice President and

General Counsel

|

|

|

|

|

|

|

Harbert Fund Advisors, Inc.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John McCullough

|

|

|

|

Executive Vice President and

General Counsel

|

|

|

|

|

|

|

|

|

|

|

Harbert Management Corporation

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ John McCullough

|

|

|

|

Executive Vice President and

General Counsel

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Jack Bryant

|

|

|

|

Jack Bryant

|

|

|

|

|

|

|

By:

|

/s/ Kenan Lucas

|

|

|

|

Kenan Lucas

|

|

|

|

|

|

|

By:

|

/s/ Raymond Harbert

|

|

|

|

Raymond Harbert

|

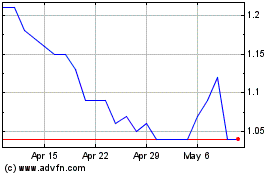

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

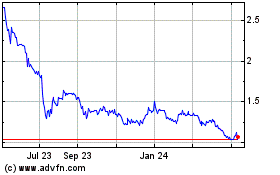

Enzo Biochem (NYSE:ENZ)

Historical Stock Chart

From Apr 2023 to Apr 2024