SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2023

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

ANNOUNCEMENT OF CORPORATE DEMANDS

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 3330034676-7 PUBLICLY-HELD

COMPANY

Centrais Elétricas

Brasileiras S/A (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B;

LATIBEX: XELT.O & XELT.B) in compliance with Annex I of Resolution CVM 80 of March 29, 2022, communicates to its shareholders

and to the market in general, in addition to the Announcement of Corporate Demands disclosed on June 20, 2022, the following update

in the corporate demand broken down below:

| Name of parties involved in the proceeding: |

Author: ABRADIN - BRAZILIAN ASSOCIATION OF INVESTOR

Defendants: Centrais Elétricas Brasileiras (“Eletrobras”

or “Company”) |

| Case No: |

0152617-68.2022.8.19.0001 |

| Values, assets or rights involved: |

The value of the cause was set at R$ 1,000.00 (thousand reais). |

| Demand date: |

June 09, 2022 (date of distribuition)

June 09, 2022 (date on which the company became aware) |

| Key Facts: |

This is a public civil action with a request for

urgent protection in the face of the Company assisted by ABRADIN. In summary, the author argues, among other points disclosed in the Announcement

of 06.20.2022, that:

·

Eletrobras' investors allegedly were being harmed by

the privatization and corporate restructuring carried out by the Company;

·

as the objective would be to comply with the schedule,

the Company's management would be conducting the privatization in a manner contrary to the interests of the Company, its minority shareholders

and to the detriment of the economic order;

·

• in light of the particularities related to the

legislation applicable to the companies Itaipu Binacional (“Itaipu”) and Eletrobras Termonuclear S.A. – Eletronuclear

(“Eletronuclear”), which shall remain, by virtue of a constitutional mandate and in accordance with the Itaipu Treaty, under

the direct or indirect control of the Federal Government, such companies were object of corporate restructuring, pursuant to Law No. 14,182/

21, art. 3, item I, as a condition for the privatization of the Company;

• on account of this, allegedly, the

two companies were being transferred to the Federal Government without the payment of the effective and adequate consideration to the

Company.

|

This document may contain estimates and projections that are not

statements of past events, but reflect beliefs and expectations of our administration and may constitute estimates and projections of

future events in accordance with Section 27A of the Securities Act of 1933,

As amended, and Section 21E of the Securities and Exchange Act 1934,

as amended. The words “believe”, “you will be able”, “you can”, “you will”, “you

will”, “anticipates”, “intends”, “expects” and similar aims to identify estimates that necessarily

involve risks and

uncertainties, known or not. Known risks and uncertainties include,

but are not limited to: General economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates,

inflation and Real value, changes in volumes and energy usage patterns

electricity by the consumer, competitive conditions, our level

of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs

used to operate our hydroelectric plants, our plans

Financing and investment of capital, existing and future government

regulations, and other risks described in our annual report and other documents registered with CVM and SEC. Estimates and projections

refer only to the date on which they were expressed and not

we assume no obligation to update any of these estimates or projections

due to the occurrence of new information or future events. The future results of the companies' operations and initiatives may differ

from current expectations and the investor should not

based solely on the information contained herein. This material

contains calculations that may not reflect accurate results due to rounding.

| Request or provisioning pleated: |

In summary, the author made the following requests:

·

in the context of urgent relief, that all measures intended

to implement the corporate reorganization process and privatization of Eletrobras be determined to be suspended;

·

on the merits, that the public civil action be upheld,

in order to confirm the urgent relief, and determine that the Company and its managers carry out the contracting of technical studies

to be carried out by a specialized and independent company for the purpose of evaluating Itaipu and Eletronuclear, in order to reflect

the “real market value of these assets”, as a condition for the continuation of the corporate reorganization and privatization

process of the Company;

·

summons from the Company to file a defense, if desired;

·

the subpoena of the Public Ministry, pursuant to art.

5, §1 of Law 7,347/85.

The request for urgent protection was rejected on

June 14, 2022. |

| Judicial decision |

On 05.11.2023, the Judge of the 6th Business Court

of the Judicial District of the Capital of Rio de Janeiro issued a decision that, in short, exposed that the matter under examination

is typically derived from the Corporate Law, and, therefore, it would not be appropriate to apply the Consumer Protection Code - CDC (topic

raised by the Public Ministry of the State of Rio de Janeiro in its opinion) regarding the relations between shareholders and publicly-held

corporations with shares traded on the securities market. With the application of the CDC excluded, the competence of the (state) business

court to process and judge the collective request object of the process under discussion is excluded, since the content of art. 50, I,

"c" of Statutory Law 6.956/2015 (law that provides for the organization and judicial division of the State of Rio de Janeiro

and other provisions). Additionally, the judgment also accepted the Union's manifestation to appear as a party in the process.

Thus, the business court was declared incompetent

to prosecute and judge the aforementioned action, and the case records were forwarded to the 11th Federal Court of Rio de Janeiro, for

distribution by dependency to the case records of action No. 5008304-59.2022.4.02.5101, due to possible connection (relation of similarity

between claims).

It should be noted that Eletrobras became aware of

said decision on 06.19.2023. |

Rio de Janeiro, June 28, 2023.

Elvira Cavalcanti Presta

Vice President of Finance and Investor Relations

This document may contain estimates and projections that are not

statements of past events, but reflect beliefs and expectations of our administration and may constitute estimates and projections of

future events in accordance with Section 27A of the Securities Act of 1933,

As amended, and Section 21E of the Securities and Exchange Act 1934,

as amended. The words “believe”, “you will be able”, “you can”, “you will”, “you

will”, “anticipates”, “intends”, “expects” and similar aims to identify estimates that necessarily

involve risks and

uncertainties, known or not. Known risks and uncertainties include,

but are not limited to: General economic, regulatory, political and commercial conditions in Brazil and abroad, changes in interest rates,

inflation and Real value, changes in volumes and energy usage patterns

electricity by the consumer, competitive conditions, our level

of indebtedness, the possibility of receiving payments related to our receivables, changes in rainfall and water levels in the reservoirs

used to operate our hydroelectric plants, our plans

Financing and investment of capital, existing and future government

regulations, and other risks described in our annual report and other documents registered with CVM and SEC. Estimates and projections

refer only to the date on which they were expressed and not

we assume no obligation to update any of these estimates or projections

due to the occurrence of new information or future events. The future results of the companies' operations and initiatives may differ

from current expectations and the investor should not

based solely on the information contained herein. This material

contains calculations that may not reflect accurate results due to rounding.

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: June 28, 2023

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

Vice President of Finance and Investor Relations |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

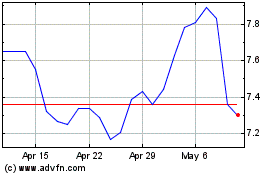

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From Apr 2024 to May 2024

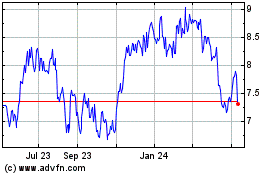

Centrais Eletricas Brasi... (NYSE:EBR)

Historical Stock Chart

From May 2023 to May 2024