Mereo BioPharma Announces Interim Financial Results for the Six Months Ended June 30, 2020 and Provides Corporate Update

September 29 2020 - 7:00AM

Mereo BioPharma Group plc (NASDAQ: MREO, AIM: MPH), “Mereo” or “the

Company”, a clinical stage biopharmaceutical company focused on

oncology and rare diseases, today announces unaudited interim

financial results for the six months ended June 30, 2020 and

provides a corporate update.

Denise Scots-Knight, Chief Executive of Mereo,

said: “Following the closing of our $70 million financing in the

first half of 2020 we have focussed on executing our strategy,

advancing etigilimab (“Anti-TIGIT”) for the treatment of solid

tumors alongside developing our rare disease portfolio. We remain

on track to initiate a Phase 1b/2 study of etigilimab (Anti-TIGIT)

in combination with an anti-PD-1 in a range of solid tumor types in

Q4 2020. Our rare disease portfolio includes setrusumab for

osteogenesis imperfecta which we plan to partner prior to the

initiation of a pivotal Phase 3 study, and alvelestat which is

being investigated in an ongoing Phase 2 proof-of-concept study for

alpha-1 anti-trypsin deficiency. We were also pleased to have

recently announced the initiation of a Phase 1b/2

placebo-controlled study of alvelestat in COVID-19 infected

patients following the scientific publications demonstrating the

involvement of neutrophil elastase in COVID-19 infection pathways.

We also continue to advance other discussions with potential

partners to optimize the value of our broader product

portfolio.”

Recent Highlights and Upcoming

Milestones

Etigilimab (Anti-TIGIT) for Solid

Tumors

- On track to initiate a Phase 1b/2

study of etigilimab in combination with an anti-PD-1 in a range of

solid tumor types in Q4 2020.

Setrusumab for

Osteogenesis Imperfecta (OI)

- Receipt of FDA Rare Pediatric Disease

Designation on September 23, 2020.

- Following regulatory discussions in 1H

2020, both the FDA and EMA have agreed on the principles of a

design of a single Phase 3 pediatric pivotal study in OI.

- Intend to partner setrusumab prior to

conducting a pivotal trial of setrusumab in children with severe

OI. Partnering discussions are well underway with a range of

potential structures including options for Mereo to retain

commercial rights in certain regions.

Alvelestat for

Severe Alpha-1 Antitrypsin Deficiency

(AATD)

- Topline data from an ongoing Phase 2

proof of concept study remains on track for 2H 2021.

- Announced the initiation of a Phase

1b/2 placebo-controlled clinical trial to evaluate the safety and

efficacy of alvelestat in hospitalized, adult patients with

moderate to severe COVID-19 respiratory disease.

- Investigator-sponsored studies

underway in AATD and in the orphan disease, bronchiolitis

obliterans syndrome (BOS).

Partnering Discussions Continue for

Portfolio of Other Clinical-Stage

Programs

- Leflutrozole for hypogonadotropic

hypogonadism (HH) º Partnering discussions

continuing based on development in male infertility.

- Acumapimod for Acute Exacerbations of

Chronic Obstructive Pulmonary Disease (AECOPD)

º Discussions continuing on separate financing for the Phase

3 study agreed with the FDA and EMA.

Corporate

- Appointment of Dr. Brian Schwartz and

Dr. Jeremy Bender as Non-Executive Directors and departure of Mr

Paul Blackburn as Non-Executive Director effective October 1,

2020

- Dr. John Lewicki appointed as Chief

Scientific Officer and Dr. Ann Kapoun appointed as Head

Translational R&D in July 2020.

Financial Highlights

- Cash resources of £56.8 million as at

June 30, 2020 (June 30, 2019 £36.1 million).

- £11.8 million raised in equity and

debt in Q1 2020.

- Additional $70 million (£56 million)

raised in PIPE in Q2 2020.

- Cash runway to early 2022.

Conference Call InformationMereo

will host a live conference call and webcast today at 8:00 a.m. EDT

/ 1:00 p.m. BST to discuss the Company’s financial results and

provide a corporate update.

Dial-in numbers: (866) 688-2942 (U.S.) or +1 (561)

569-9224 (U.K./International)

Conference ID number: 9572439

A live and archived webcast may be accessed by

visiting the Investors sections of the Company’s website at

https://www.mereobiopharma.com/investors/results-reports-and-presentations/.

The archived webcast will remain available on the Company's website

following the live call.

About Mereo

BioPharmaMereo BioPharma is a

biopharmaceutical company focused on the development and

commercialization of innovative therapeutics that aim to improve

outcomes for oncology and rare diseases. Mereo's lead oncology

product candidate, etigilimab ("Anti-TIGIT"), has completed a Phase

1a dose escalation clinical trial in patients with advanced solid

tumors and has been evaluated in a Phase 1b study in combination

with nivolumab in select tumor types. Mereo's rare disease product

portfolio consists of setrusumab, which has completed a Phase 2b

dose-ranging study in adults with osteogenesis imperfecta ("OI"),

as well as alvelestat, which is being investigated in a Phase 2

proof-of-concept clinical trial in patients with alpha-1

antitrypsin deficiency ("AATD") and in a Phase 1b/2 clinical trial

in COVID-19 respiratory disease.

Additional Information The

person responsible for arranging the release of this information on

behalf of the Company is Charles Sermon, General Counsel.

Forward-Looking StatementsThis

Announcement contains "forward-looking statements." All statements

other than statements of historical fact contained in this

Announcement are forward-looking statements within the meaning of

Section 27A of the United States Securities Act of 1933, as amended

and Section 21E of the United States Securities Exchange Act of

1934, as amended. Forward-looking statements usually relate to

future events and anticipated revenues, earnings, cash flows or

other aspects of our operations or operating results.

Forward-looking statements are often identified by the words

"believe," "expect," "anticipate," "plan," "intend," "foresee,"

"should," "would," "could," "may," "estimate," "outlook" and

similar expressions, including the negative thereof. The absence of

these words, however, does not mean that the statements are not

forward-looking. These forward-looking statements are based on the

Company's current expectations, beliefs and assumptions concerning

future developments and business conditions and their potential

effect on the Company. While management believes that these

forward-looking statements are reasonable as and when made, there

can be no assurance that future developments affecting the Company

will be those that it anticipates.

All of the Company's forward-looking statements

involve known and unknown risks and uncertainties (some of which

are significant or beyond its control) and assumptions that could

cause actual results to differ materially from the Company's

historical experience and its present expectations or projections.

The foregoing factors and the other risks and uncertainties that

affect the Company's business, including those described in its

Annual Report on Form 20-F, Reports on Form 6-K and other documents

filed from time to time by the Company with the United States

Securities and Exchange Commission. The Company wishes to caution

you not to place undue reliance on any forward-looking statements,

which speak only as of the date hereof. The Company undertakes no

obligation to publicly update or revise any of our forward-looking

statements after the date they are made, whether as a result of new

information, future events or otherwise, except to the extent

required by law.

Mereo BioPharma

Contacts:

|

Mereo |

+44 (0)333 023 7300 |

|

Denise Scots-Knight, Chief Executive Officer |

|

|

|

|

|

N+1 Singer (Nominated Adviser and Broker

to Mereo) |

+44 (0)20 7496 3081 |

|

Phil Davies |

|

|

Will Goode |

|

| |

|

|

Burns McClellan (US Investor Relations Adviser

to Mereo) |

+1 212 213 0006 |

|

Lisa Burns |

|

|

Steve Klass |

|

|

|

|

|

FTI Consulting (UK Public Relations Adviser

to Mereo) |

+44 (0)20 3727 1000 |

|

Simon Conway |

|

|

Ciara Martin |

|

|

|

|

|

Investors |

investors@mereobiopharma.com |

Consolidated statement of comprehensive lossfor the

six months ended June 30, 2020

|

|

Notes |

Six months endedJune 30,

2020Unaudited£’000 |

|

Six months endedJune 30, 2019Unaudited£’000 |

|

Year endedDecember 31, 2019Audited£’000 |

|

| Research and

development expenses |

(8,479 |

) |

(11,918 |

) |

(23,608 |

) |

|

Administrative expenses |

(8,212 |

) |

(6,918 |

) |

(15,909 |

) |

|

Operating loss |

|

(16,691 |

) |

(18,836 |

) |

(39,517 |

) |

| Net income

recognised on acquisition of subsidiary |

|

— |

|

1,035 |

|

1,035 |

|

| Finance

income |

|

39 |

|

137 |

|

377 |

|

| Finance

charge |

3 |

(97,628 |

) |

(998 |

) |

(3,496 |

) |

| Loss on disposal

of intangible assets |

4 |

(11,302 |

) |

— |

|

— |

|

| Net foreign

exchange (loss)/gain |

|

(519 |

) |

(20 |

) |

483 |

|

|

Loss before tax |

|

(126,101 |

) |

(18,682 |

) |

(41,118 |

) |

|

Taxation |

|

1,482 |

|

2,459 |

|

6,274 |

|

|

Loss for the period, attributable to equity holders of the

parent |

(124,619 |

) |

(16,224 |

) |

(34,844 |

) |

|

Basic and diluted loss per share for the

period |

|

(1.05 |

) |

(0.22 |

) |

(0.39 |

) |

|

|

|

|

|

|

|

Other comprehensive income / (loss)Items that may

be subsequently reclassified to the income statement |

|

Fair value changes on investments held at fair value through

OCI |

3 |

|

88 |

|

— |

|

|

Currency translation of foreign operations |

|

1,324 |

|

711 |

|

(499 |

) |

|

|

|

|

|

|

|

Total comprehensive loss for the period, attributable to

equity holders of the parent |

|

(123,292 |

) |

(15,425 |

) |

(35,343 |

) |

|

|

|

|

|

|

| |

|

|

|

|

Consolidated balance sheetas at June 30, 2020

|

|

Notes |

June 30,

2020Unaudited£’000 |

|

June 30, 2019Unaudited£’000 |

|

December 31, 2019Audited£’000 |

|

|

Assets |

|

|

|

|

| Non-current

assets |

|

|

|

|

| Property, plant and

equipment |

|

11,225 |

|

13,100 |

|

11,558 |

|

|

Intangible assets |

4 |

31,876 |

|

45,157 |

|

44,456 |

|

|

|

|

43,101 |

|

58,257 |

|

56,014 |

|

|

Current assets |

|

|

|

|

| Prepayments |

|

1,400 |

|

3,068 |

|

2,111 |

|

| R&D tax credits |

|

6,624 |

|

7,745 |

|

10,426 |

|

| Other taxes recoverable |

|

— |

|

— |

|

979 |

|

| Other receivables |

|

1,836 |

|

1,953 |

|

572 |

|

| Short-term investments |

|

— |

|

7,828 |

|

— |

|

| Cash and short-term

deposits |

|

56,821 |

|

28,290 |

|

16,347 |

|

|

|

|

66,681 |

|

48,884 |

|

30,435 |

|

|

Total assets |

|

109,782 |

|

107,141 |

|

86,449 |

|

|

Equity and liabilities |

|

|

|

|

| Equity |

|

|

|

|

| Issued capital |

7 |

1,016 |

|

294 |

|

294 |

|

| Share premium |

7 |

161,785 |

|

121,684 |

|

121,684 |

|

| Other capital reserves |

7 |

127,727 |

|

58,004 |

|

59,147 |

|

| Employee Benefit Trust

shares |

7 |

(1,305 |

) |

(1,305 |

) |

(1,305 |

) |

| Other reserves |

7 |

4,875 |

|

7,000 |

|

7,000 |

|

| Accumulated losses |

7 |

(270,681 |

) |

(127,357 |

) |

(146,065 |

) |

|

Translation reserve |

7 |

825 |

|

711 |

|

(499 |

) |

|

Total equity |

|

24,242 |

|

59,031 |

|

40,256 |

|

|

Non-current liabilities |

|

|

|

|

| Provisions |

8 |

1,698 |

|

1,927 |

|

1,449 |

|

| Interest-bearing loans and

borrowings |

6 |

14,506 |

|

11,721 |

|

5,373 |

|

| Other liabilities |

|

44 |

|

34 |

|

44 |

|

| Warrant liability |

9 |

35,757 |

|

225 |

|

131 |

|

| Lease

liability |

|

11,167 |

|

13,139 |

|

9,318 |

|

|

|

|

63,172 |

|

27,046 |

|

16,315 |

|

|

Current liabilities |

|

|

|

|

| Trade and other payables |

|

5,489 |

|

6,758 |

|

6,352 |

|

| Accruals |

|

2,701 |

|

5,961 |

|

5,138 |

|

| Provisions |

8 |

31 |

|

334 |

|

309 |

|

| Interest-bearing loans and

borrowings |

6 |

13,254 |

|

8,011 |

|

15,139 |

|

| Contingent consideration

liability |

|

— |

|

— |

|

354 |

|

| Lease

liability |

|

893 |

|

— |

|

2,586 |

|

|

|

|

22,298 |

|

21,064 |

|

29,878 |

|

|

Total liabilities |

|

85,540 |

|

48,110 |

|

46,193 |

|

|

Total equity and liabilities |

|

109,782 |

|

107,141 |

|

86,449 |

|

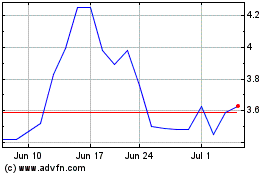

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mereo BioPharma (NASDAQ:MREO)

Historical Stock Chart

From Apr 2023 to Apr 2024