Trxade Group, Inc. (NASDAQ: MEDS), a health services IT

company focused on digitalizing the retail pharmacy experience by

optimizing drug procurement, the prescription journey and patient

engagement in the U.S., today announced its financial results for

the fourth quarter (Q4) and year ended (FY) December 31, 2020.

Selected Financial Highlights

|

$ in Millions |

Q4 |

% Increase (Decrease) |

FY |

% Increase (Decrease) |

|

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

Revenues |

$2.0 |

|

$1.7 |

|

17.1 |

% |

$17.1 |

|

$7.4 |

|

130.3 |

% |

|

Gross Profit |

$0.1 |

|

$1.3 |

|

(90.0 |

%) |

$5.7 |

|

$4.9 |

|

17.2 |

% |

|

Gross Margin Percentage |

6.5 |

% |

76.5 |

% |

(91.5 |

%) |

33.3 |

% |

65.5 |

% |

(49.1 |

%) |

|

Net Loss |

($2.3 |

) |

($0.5 |

) |

(362.0 |

%) |

($2.5 |

) |

($0.3 |

) |

(791.6 |

%) |

|

Adjusted EBITDA* |

($1.4 |

) |

$0.2 |

|

(929.4 |

%) |

$0.1 |

|

$0.9 |

|

(89.7 |

%) |

*Adjusted EBITDA is a non-GAAP financial measure

and is described in relation to its most directly comparable GAAP

measure under “Use of Non-GAAP Financial Information” below.

Fourth Quarter 2020 and Subsequent Operational

Highlights

- Trxade continued to expand the Trxade drug procurement

marketplace nationwide, adding 328 new registered members in Q4

2020, bringing the total registered members to approximately

11,800+.

- Appointed technology entrepreneur and industry thought leader

James Ram, to lead the company's newly launched MedCheks

subsidiary, in its efforts to bring a Digital Health Passport to

market, allowing the holder to display vaccination and COVID-19

testing status.

- Trxade’s telehealth subsidiary Bonum Health signed a strategic

partnership to provide affordable telemedicine services to the

patients of approximately 100 Kinney Drug retail pharmacies in New

York and Vermont, and, the more than two million Rx discount card

members of Kinney's sister company, ProAct, Inc., a fully

integrated pharmacy benefits manager.

- Launched Trxade Prime, a revolutionary service offered by the

Company’s wholesale division, allowing the registered members on

the Trxade platform to process, consolidate and ship orders that

are placed directly with Trxade Suppliers.

- Announced partnership with SingleCare, a free prescription

savings service, to supplement Bonum Health’s enterprise telehealth

solutions with prescription discounts offered to national, regional

and local pharmacies to promote the benefit to uninsured patients

and underserved communities.

Management Commentary

“2020 was a milestone year for our company as we

continued to innovate, grow and expand. Despite the

challenges of a global pandemic, we increased revenues by 130% for

the year, a testament to our team’s continued innovation and

development of our breakthrough digital healthcare services IT

platform. As we continue to scale exciting new affiliated services,

such as our telehealth platform or our recently announced digital

health passport initiative, we anticipate continued top line growth

in the coming year.

“I am particularly pleased to announce the

launch of our new subsidiary, MedCheks, which is developing a

digital health passport to help facilitate the safe reopening of

the global economy. To head this new initiative, we brought on

James Ram. Under his lead, the Digital Health Passport is planned

to leverage both state-of-the-art encryption and blockchain

technology to conceal all private health data, allowing for the

secure exchange of data between passport holder and verifier. We

are evaluating initial roll-out locations for the pay-per-use

model.

“Bonum Health, our telehealth subsidiary, made

significant strides in the fourth quarter to more rapidly propel

adoption nationwide. We signed an exciting partnership with KPH

Healthcare services, bringing affordable healthcare to the patients

of approximately 100 Kinney Drug retail pharmacies on the East

Coast.

“Throughout the year, we have continued to drive

our business forward, achieving several key milestones in our

internal roadmap with a focus on innovation and development through

our various complementary growth opportunities. This is an exciting

time for Trxade, and I believe we are better positioned to create

sustainable value for our shareholders than at any prior time in

the Company's history,” concluded Mr. Ajjarapu, the Company’s

Chairman and Chief Executive Officer.

Fourth Quarter 2020 Financial Summary

- Revenues for the fourth quarter of 2020, increased 17.1% to $2

million, compared to revenue of $1.7 million in the same quarter

last year. The increase in revenue was primarily due to revenue

generated by the Trxade Platform and Trxade Prime.

- Gross profit in the fourth quarter of 2020, decreased 90.0% to

$0.1 million, or 6.5% of revenues, compared to gross profit of $1.3

million, or 76.5% of revenues, in the same quarter last year. The

decrease in gross profit was primarily attributable to higher costs

associated with Trxade Prime transactions and a write down of

inventory.

- Operating expenses in the fourth quarter of 2020 were $2.4

million, compared to $1.6 million in the same quarter last year.

This increase is primarily due to the Loss on Impairment of

Goodwill of $726,000 and an increase in employees with our

expansion into Business to Consumer (B2C) sales.

- Net loss in the fourth quarter of 2020 was $2.3 million, or

$0.29 per basic and diluted share outstanding, as a result of the

Loss on Impairment of Goodwill and a $1,081,000 inventory write

down, compared to a net loss of $0.5 million, or $0.04 per basic

and diluted share outstanding, in the same quarter last year.

- Adjusted EBITDA, a non-GAAP financial measure, decreased to

($1.4) million for the fourth quarter of 2020, compared to $0.2

million in the same quarter last year.

Fiscal Year Ended December 31, 2020 Summary

- Revenues for the year ended December 31, 2020, increased 130.3%

to $17.1 million, compared to revenue of $7.4 million in the

previous year. The increase in revenue was due to revenue generated

by Trxade Platform, Trxade Prime and Integra Pharma Solutions, our

wholly-owned subsidiary, which revenue increase mainly related to

Personal Protective Equipment (PPE) sales relating to the COVID-19

pandemic.

- Gross profit for 2020 increased 17.2% to $5.7 million, or 33.3%

of revenues, compared to gross profit of $4.8 million, or 65.5% of

revenues, in the same period last year. The increase in gross

profit was attributable to higher costs associated with Trxade

Prime and Integra Pharma transactions.

- Operating expenses for the full year 2020 were $8.2 million,

compared to $4.7 million in the last year. This increase is due to

the Loss on Impairment of Goodwill, an increase in employees with

our expansion into Business to Consumer (B2C) sales, IT

initiatives, and non-cash compensation.

- Net loss for the year ended December 31, 2020, was ($2.5)

million, or ($0.33) per basic and diluted share outstanding,

compared to net loss of ($0.3) million, or ($0.05) per basic and

diluted share outstanding, in the last year.

- Adjusted EBITDA, a non-GAAP financial measure, was $0.1

million, compared to $0.85 million for the year ended 2020 and

2019, respectively.

- Cash and cash equivalents were $5.9 million as of December 31,

2020, compared with $2.9 million as of December 31, 2019.

Conference Call and Webcast

Management will host a conference call on

Monday, March 29, 2021 at 5:00 p.m. Eastern time to discuss Trxade

Group’s fourth quarter and fiscal year 2020 financial results. The

call will conclude with Q&A from participants. To participate,

please use the following information:

Q4 and Fiscal Year 2020 Conference Call and

Webcast Date: Monday, March 29,

2021 Time: 5:00 p.m. Eastern time U.S. Dial-in: 1-877-425-9470

International Dial-in: 1-201-389-0878 Conference ID: 13716956

Webcast: http://public.viavid.com/index.php?id=143721

Please dial in at least 10 minutes before the

start of the call to ensure timely participation.

A playback of the call will be available through

April 29, 2021. To listen, call 1-844-512-2921 within the United

States or 1-412-317-6671 when calling internationally and enter

replay pin number 13716956. A webcast will also be available for 30

days on the IR section of the Trxade Group website or by clicking

the webcast link above.

About Trxade Group,

Inc.

Trxade Group (NASDAQ: MEDS) is a health services

IT company focused on digitalizing the retail pharmacy experience

by optimizing drug procurement, the prescription journey and

patient engagement in the U.S. The Company operates the TRxADE drug

procurement marketplace serving a total of 11,800+ members

nationwide, fostering price transparency and under the Bonum Health

brand, offering patient centric telehealth services. For more

information on Trxade Group, please visit the Company’s IR website

at investors.trxadegroup.com.

Use of Non-GAAP Financial

Information

This earnings release discusses EBITDA and

Adjusted EBITDA. These measurements are not recognized in

accordance with generally accepted accounting principles (GAAP) and

should not be viewed as an alternative to GAAP measures of

performance. EBITDA represents net income before interest, taxes,

depreciation and amortization. Adjusted EBITDA is defined as EBITDA

before stock-based compensation expense and gain (loss) in equity

investment. EBITDA and Adjusted EBITDA are presented because we

believe they provide additional useful information to investors due

to the various noncash items during the period. EBITDA and Adjusted

EBITDA have limitations as analytical tools, and you should not

consider them in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are: EBITDA and Adjusted EBITDA do not reflect cash expenditures,

future requirements for capital expenditures, or contractual

commitments; EBITDA and Adjusted EBITDA do not reflect changes in,

or cash requirements for, working capital needs; and EBITDA and

Adjusted EBITDA do not reflect the significant interest expense, or

the cash requirements necessary to service interest or principal

payments, on debt or cash income tax payments. Although

depreciation and amortization are noncash charges, the assets being

depreciated and amortized will often have to be replaced in the

future, and EBITDA and Adjusted EBITDA do not reflect any cash

requirements for such replacements. Additionally, other companies

in our industry may calculate EBITDA and Adjusted EBITDA

differently than Trxade Group, Inc. does, limiting its usefulness

as a comparative measure. See also “Reconciliation of Net Income

attributable to Trxade Group, Inc., to Earnings before Interest,

Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA”,

below.

Forward-Looking StatementsThis

press release may contain forward-looking statements, including

information about management’s view of Trxade’s future

expectations, plans and prospects, within the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995 (the “Act”). In particular, when used in the preceding

discussion, the words “may,” “could,” “expect,” “intend,” “plan,”

“seek,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “likely,” “will,” “would” and variations

of these terms and similar expressions, or the negative of these

terms or similar expressions are intended to identify

forward-looking statements within the meaning of the Act, and are

subject to the safe harbor created by the Act. Any statements made

in this news release other than those of historical fact, about an

action, event or development, are forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

factors, which may cause the results of Trxade, its divisions and

concepts to be materially different than those expressed or implied

in such statements. These risks include risks of our operations not

being profitable; claims relating to alleged violations of

intellectual property rights of others; technical problems with our

websites; risks relating to implementing our acquisition

strategies; our ability to manage our growth; negative effects on

our operations associated with the opioid pain medication health

crisis; regulatory and licensing requirement risks; risks related

to changes in the U.S. healthcare environment; the status of our

information systems, facilities and distribution networks; risks

associated with the operations of our more established competitors;

regulatory changes; healthcare fraud; COVID-19, governmental

responses thereto, economic downturns and possible recessions

caused thereby; changes in laws or regulations relating to our

operations; privacy laws; system errors; dependence on current

management; our growth strategy; and others that are included from

time to time in filings made by Trxade with the Securities and

Exchange Commission, including, but not limited to, in the “Risk

Factors” sections in its Form 10-Ks and Form 10-Qs and in its Form

8-Ks, which it has filed, and files from time to time, with the

U.S. Securities and Exchange Commission. These reports are

available at www.sec.gov. Other unknown or unpredictable factors

also could have material adverse effects on Trxade’s future results

and/or could cause our actual results and financial condition to

differ materially from those indicated in the forward-looking

statements. The forward-looking statements included in this press

release are made only as of the date hereof. Trxade cannot

guarantee future results, levels of activity, performance or

achievements. Accordingly, you should not place undue reliance on

these forward-looking statements. We undertake no obligation to

update publicly any of these forward-looking statements to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws. If we

update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those

or other forward-looking statements.

Investor Relations: Lucas Zimmerman Senior Vice

President MZ Group - MZ North America (949) 259-4987

MEDS@mzgroup.us www.mzgroup.us

Trxade Group,

Inc.Consolidated Balance

SheetsDecember 31, 2020 and 2019

| |

|

December 31, 2020 |

|

|

December 31, 2019 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

5,919,578 |

|

|

$ |

2,871,694 |

|

|

Accounts Receivable, net |

|

|

805,043 |

|

|

|

792,050 |

|

|

Inventory |

|

|

1,257,754 |

|

|

|

56,761 |

|

|

Prepaid Assets |

|

|

151,248 |

|

|

|

82,452 |

|

|

Other Receivables |

|

|

1,087,675 |

|

|

|

- |

|

|

Total Current Assets |

|

|

9,221,298 |

|

|

|

3,802,957 |

|

| |

|

|

|

|

|

|

|

|

| Property Plant and

Equipment, Net |

|

|

162,397 |

|

|

|

174,987 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

21,636 |

|

|

|

21,636 |

|

|

Deferred offering costs |

|

|

- |

|

|

|

88,231 |

|

|

Right of use leased assets |

|

|

387,371 |

|

|

|

757,710 |

|

|

Goodwill |

|

|

- |

|

|

|

725,973 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

9,792,702 |

|

|

$ |

5,571,494 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts Payable |

|

$ |

256,829 |

|

|

$ |

334,614 |

|

|

Accrued Liabilities |

|

|

219,256 |

|

|

|

98,852 |

|

|

Current Portion – Operating Lease Liabilities |

|

|

131,153 |

|

|

|

87,350 |

|

|

Customer Deposits |

|

|

10,000 |

|

|

|

- |

|

|

Notes Payable – Related Party |

|

|

225,000 |

|

|

|

- |

|

|

Total Current Liabilities |

|

|

842,238 |

|

|

|

520,816 |

|

| |

|

|

|

|

|

|

|

|

| Long Term

Liabilities |

|

|

|

|

|

|

|

|

|

Notes Payable – Related Party |

|

|

- |

|

|

|

225,000 |

|

|

Operating Lease Liabilities, net of current portion |

|

|

271,306 |

|

|

|

685,461 |

|

| Total

Liabilities |

|

|

1,113,544 |

|

|

|

1,431,277 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

|

Series A Preferred Stock, $0.00001 par value; 10,000,000 shares

authorized; none issued and outstanding as of December 31, 2020 and

December 31, 2019, respectively |

|

|

- |

|

|

|

- |

|

|

Common Stock, $0.00001 par value; 100,000,000 shares authorized;

8,093,199 and 6,539,415 shares issued and outstanding as of

December 31, 2020 and 2019, respectively |

|

|

81 |

|

|

|

65 |

|

|

Additional Paid-in Capital |

|

|

19,610,631 |

|

|

|

12,535,655 |

|

|

Retained Deficit |

|

|

(10,931,554 |

) |

|

|

(8,395,503 |

) |

|

Total Stockholders’ Equity |

|

|

8,679,158 |

|

|

|

4,140,217 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

9,792,702 |

|

|

$ |

5,571,494 |

|

Trxade Group,

Inc.Consolidated Statements of

OperationsYears Ended December 31, 2020 and

2019

| |

|

2020 |

|

|

2019 |

|

|

Revenues, net |

|

$ |

17,122,520 |

|

|

$ |

7,436,264 |

|

|

Cost of Sales |

|

|

11,415,198 |

|

|

|

2,565,500 |

|

|

Gross Profit |

|

|

5,707,322 |

|

|

|

4,870,764 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

Loss on write-off of software asset |

|

|

- |

|

|

|

368,520 |

|

|

Loss on Impairment of Goodwill |

|

|

725,973 |

|

|

|

- |

|

|

General and Administrative |

|

|

7,488,011 |

|

|

|

4,377,020 |

|

| Total Operating Expenses |

|

|

8,213,984 |

|

|

|

4,745,540 |

|

| |

|

|

|

|

|

|

|

|

|

Operating Income (Loss) |

|

|

(2,506,662 |

) |

|

|

125,224 |

|

|

|

|

|

|

|

|

|

|

|

|

Other Income |

|

|

- |

|

|

|

72,075 |

|

|

Investment Loss |

|

|

- |

|

|

|

(250,000 |

) |

|

Loss on Extinguishment of Debt |

|

|

- |

|

|

|

(178,500 |

) |

|

Interest Expense |

|

|

(29,389 |

) |

|

|

(53,227 |

) |

|

Net Loss |

|

$ |

(2,536,051 |

) |

|

$ |

(284,428 |

) |

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Common Share – Basic and Diluted |

|

$ |

(0.33 |

) |

|

$ |

(0.05 |

) |

| |

|

|

|

|

|

|

|

|

|

Weighted average Common Shares Outstanding Basic and Diluted |

|

|

7,705,620 |

|

|

|

5,929,092 |

|

Trxade Group,

Inc.Consolidated Statements of Cash

FlowsYears ended December 31, 2020 and

2019

| |

|

2020 |

|

|

2019 |

|

| Operating

Activities: |

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(2,536,051 |

) |

|

$ |

(284,428 |

) |

| |

|

|

|

|

|

|

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation Expense |

|

|

5,500 |

|

|

|

5,000 |

|

|

Options Expense |

|

|

448,404 |

|

|

|

176,376 |

|

|

Warrant Expense |

|

|

56,885 |

|

|

|

105,452 |

|

|

Common Stock Issued for Services |

|

|

1,357,759 |

|

|

|

- |

|

|

Bad Debt Expense |

|

|

10,539 |

|

|

|

11,500 |

|

|

Loss on extinguishment of debt |

|

|

- |

|

|

|

178,500 |

|

|

Investment Loss |

|

|

- |

|

|

|

250,000 |

|

|

Loss on write off of software asset |

|

|

- |

|

|

|

277,500 |

|

|

Loss on Impairment of Goodwill |

|

|

725,973 |

|

|

|

- |

|

|

Loss on write-down of Inventory |

|

|

1,218,020 |

|

|

|

- |

|

|

Amortization of Right-of-Use Asset |

|

|

97,020 |

|

|

|

89,731 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts Receivable |

|

|

(23,532 |

) |

|

|

(369,923 |

) |

|

Prepaid Assets and Other Current Assets |

|

|

(68,796 |

) |

|

|

475 |

|

|

Other Assets |

|

|

- |

|

|

|

(89,336 |

) |

|

Inventory |

|

|

(2,419,013 |

) |

|

|

23,205 |

|

|

Other Receivables |

|

|

(1,087,675 |

) |

|

|

- |

|

|

Lease Liability |

|

|

(97,033 |

) |

|

|

(74,630 |

) |

|

Accounts Payable |

|

|

(33,190 |

) |

|

|

(148,659 |

) |

|

Accrued Liabilities and Other Liabilities |

|

|

120,404 |

|

|

|

(8,988 |

) |

|

Customer Deposits |

|

|

10,000 |

|

|

|

- |

|

|

Net Cash provided by (used in) operating activities |

|

|

(2,214,786 |

) |

|

|

141,775 |

|

| |

|

|

|

|

|

|

|

|

| Investing

Activities: |

|

|

|

|

|

|

|

|

|

Purchase of Fixed Assets |

|

|

(37,505 |

) |

|

|

(82,252 |

) |

|

Purchase of Equity Method Investment |

|

|

- |

|

|

|

(250,000 |

) |

| Net Cash Used in Investing

Activities |

|

|

(37,505 |

) |

|

|

(332,252 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

Activities: |

|

|

|

|

|

|

|

|

|

Repayments of Short-Term Convertible Debt – Related Parties |

|

|

- |

|

|

|

(262,552 |

) |

|

Payment of Stock Issuance Costs |

|

|

(732,356 |

) |

|

|

- |

|

|

Proceeds from Exercise of Warrants |

|

|

37,606 |

|

|

|

166 |

|

|

Proceeds from Exercise of Stock Options |

|

|

501 |

|

|

|

- |

|

|

Proceeds from Issuance of Common Stock |

|

|

5,994,424 |

|

|

|

2,455,000 |

|

|

Net Cash provided by financing activities |

|

|

5,300,175 |

|

|

|

2,192,614 |

|

| |

|

|

|

|

|

|

|

|

| Net increase in Cash |

|

|

3,047,884 |

|

|

|

2,002,137 |

|

| Cash at Beginning of the

Year |

|

|

2,871,694 |

|

|

|

869,557 |

|

| Cash at End of the Year |

|

$ |

5,919,578 |

|

|

$ |

2,871,694 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental Cash Flow

Information |

|

|

|

|

|

|

|

|

| Cash Paid for Interest |

|

$ |

29,442 |

|

|

$ |

98,461 |

|

| Cash Paid for Income

Taxes |

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

| Non-Cash

Transactions |

|

|

|

|

|

|

|

|

| Recognition of ROU assets and

operating lease obligations |

|

$ |

- |

|

|

$ |

847,441 |

|

| Purchase of Fixed Assets

recorded in Accounts Payable |

|

$ |

- |

|

|

$ |

82,729 |

|

| Common Stock Issued for

Conversion of Note and Accrued Interest |

|

$ |

- |

|

|

$ |

386,983 |

|

| Remeasurement of ROU Assets

and Lease Liability for Nonrenewal of Lease |

|

$ |

273,319 |

|

|

$ |

- |

|

|

Reconciliation of Net Income (Loss) attributable to Trxade

Group, Inc., to Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA) and Adjusted EBITDA* |

| |

|

|

|

|

|

|

| |

|

For the three months ended December 31, |

|

|

Fiscal Year ended December 31, |

|

| |

|

|

2020 |

|

|

|

|

2019 |

|

|

|

|

2020 |

|

|

|

|

2019 |

|

|

| Net Income (Loss) attributable to Trxade Group, Inc. |

|

$ |

(2,312,162 |

) |

|

|

$ |

(495,203 |

) |

|

|

$ |

(2,536,051 |

) |

|

|

$ |

(284,428 |

) |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest, net |

|

|

6,725 |

|

|

|

|

6,410 |

|

|

|

|

29,389 |

|

|

|

|

53,227 |

|

|

| Depreciation and amortization |

|

|

1,750 |

|

|

|

|

1,250 |

|

|

|

|

5,500 |

|

|

|

|

5,000 |

|

|

| EBITDA |

|

|

(2,303,687 |

) |

|

|

|

(487,543 |

) |

|

|

|

(2,501,162 |

) |

|

|

|

(226,201 |

) |

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Share in Equity losses on Investment |

|

|

- |

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

250,000 |

|

|

| Loss on write-off of software asset |

|

|

- |

|

|

|

|

368,520 |

|

|

|

|

- |

|

|

|

|

368,520 |

|

|

| Loss on extinguishment of debt |

|

|

- |

|

|

|

|

178,500 |

|

|

|

|

- |

|

|

|

|

178,500 |

|

|

| Loss on impairment of Goodwill |

|

|

725,973 |

|

|

|

|

- |

|

|

|

|

725,973 |

|

|

|

|

- |

|

|

| Stock-based compensation |

|

|

162,877 |

|

|

|

|

113,871 |

|

|

|

|

1,863,048 |

|

|

|

|

281,828 |

|

|

| Adjusted EBITDA * |

|

$ |

(1,414,837 |

) |

|

|

$ |

178,348 |

|

|

|

$ |

87,859 |

|

|

|

$ |

852,647 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * EBITDA and Adjusted EBITDA are non-GAAP

financial measures. These measurements are not recognized in

accordance with GAAP and should not be viewed as an alternative to

GAAP measures of performance. |

|

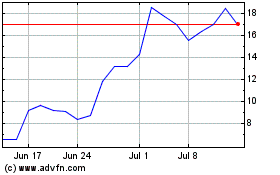

TRxADE HEALTH (NASDAQ:MEDS)

Historical Stock Chart

From Mar 2024 to Apr 2024

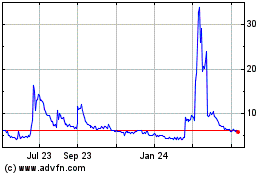

TRxADE HEALTH (NASDAQ:MEDS)

Historical Stock Chart

From Apr 2023 to Apr 2024