false

0000922247

0000922247

2023-11-27

2023-11-27

0000922247

ctdh:CommonStockParValue0001PerShareCustomMember

2023-11-27

2023-11-27

0000922247

ctdh:WarrantsToPurchaseCommonStockCustomMember

2023-11-27

2023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

November 27, 2023

Date of Report (Date of earliest event reported)

CYCLO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-39780 |

|

59-3029743

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

6714 NW 16th Street, Suite B

Gainesville, Florida

|

|

32653

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(386) 418-8060

Registrant’s telephone number, including area code

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☒

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.0001 per share

|

|

CYTH

|

|

The Nasdaq Stock Market LLC

|

|

Warrants to purchase Common Stock

|

|

CYTHW

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On November 27, 2023, Cyclo Therapeutics, Inc. (the “Company”) received written notice (“Notice”) from the Nasdaq Stock Market (“Nasdaq”) stating that the Company does not comply with the minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b) for continued listing on The Nasdaq Capital Market because the Company’s stockholders’ equity, as reported in the Company’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2023, is below $2.5 million (i.e., $1,052,670). In addition, the Company does not meet the alternative compliance standards relating to the market value of listed securities or net income from continuing operations.

As stated in the Notice, unless the Company requests an appeal of Nasdaq’s determination regarding delisting, trading of the Company’s common stock and warrants will be suspended at the opening of business on December 6, 2023, and a Form 25-NSE will be filed with the Securities and Exchange Commission, which will remove the Company’s securities from listing and registration on The Nasdaq Stock Market. In accordance with the appeal procedures set forth in the Nasdaq Listing 5800 Series, the Company intends to timely submit a hearing request to a Hearings Panel (the “Panel”) on or before December 4, 2023, which will stay the suspension of the Company’s securities and the filing of the Form 25-NSE pending the Panel’s decision.

The Notice has no immediate impact on the continued listing of the Company’s common stock or warrants, which will continue to trade on The Nasdaq Capital Market under the symbols “CYTH” and “CYTHW”, respectively.

Item 8.01 Other Events

The Company expects that it will be able to meet the Nasdaq minimum stockholders’ equity requirement by year end, with cash that it receives from its merger with Applied Molecular Transport Inc. (“AMTI”). The Company entered into an Agreement and Plan of Merger (“Merger Agreement”) with AMTI on September 21, 2023. On November, 20, 2023, the Company filed a registration statement on Form S-4/A (No. 333-275371) (the “Registration Statement”) with the Securities and Exchange Commission (“SEC”) that includes (i) a proxy statement of the Company in connection with a special meeting of its stockholders to vote on certain matters in connection with the Merger, (ii) a proxy statement of AMTI in connection with its special meeting of stockholders to vote on a proposal to approve the Merger Agreement and certain other matters and (iii) an offering prospectus of the Company to be used in connection with the Company’s offer to acquire AMTI stock held by stockholders of AMTI. On November 21, 2023, the Registration Statement was declared effective by the SEC and the Company and AMTI commenced mailing the joint proxy statement/prospectus to their respective stockholders on or about November 27, 2023.

Important Information for Investors and Stockholders

This Current Report on Form 8-K is not a proxy statement or solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed business combination and shall not constitute an offer to sell or a solicitation of an offer to buy any securities nor shall there be any sale of securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended.

The Company filed with the SEC a Registration Statement on Form S-4 (No. 333-275371), which contains a joint proxy statement/prospectus, which both AMTI and the Company have mailed to their respective stockholders in connection with the transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, JOINT PROXY STATEMENT/PROSPECTUS, AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders are able to obtain free copies of the registration statement and the proxy statement/prospectus and other documents filed with the SEC by the Company and AMTI through the web site maintained by the SEC at www.sec.gov. In addition, investors and security holders are able to obtain free copies of the registration statement and the proxy statement/prospectus from the Company by contacting Info@cyclodex.com or from AMTI by contacting corporate.secretary@appliedmt.com.

Participants in the Solicitation

The Company and AMTI, and their respective directors and executive officers, may be deemed to be participants in the solicitation of proxies in respect of the transactions contemplated by the Merger Agreement. Information regarding the Company’s directors and executive officers is contained in the Company’s proxy statement, filed with the SEC on June 13, 2023. Information regarding AMTI’s directors and executive officers is contained in AMTI’s proxy statement, filed with the SEC on April 28, 2023. Additional information regarding the persons who may be deemed participants in the proxy solicitation and a description of their direct and indirect interests in the proposed business combination is contained in the Registration Statement and the joint proxy statement/prospectus.

Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements for the purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995 and other federal securities laws. These statements are often identified by the use of words such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “objective,” “ongoing,” “plan,” “potential,” “predict,” “project,” “should,” “to be,” “will,” “would,” or the negative or plural of these words, or similar expressions or variations, although not all forward-looking statements contain these words. The Company cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur and actual results could differ materially from those expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those identified herein, and those discussed in the section titled “Risk Factors” set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 and its Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, and in AMTI’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, each of which is on file with the SEC. Among other things, there can be no guarantee that the proposed business combination will be completed in the anticipated timeframe or at all, that the conditions required to complete the proposed business combination will be met, or that the combined company will realize the expected benefits of the proposed business combination, if any. These risks are not exhaustive. New risk factors emerge from time to time, and it is not possible for the Company’s management to predict all risk factors, nor can the Company assess the impact of all factors on the Company’s business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. Except as required by law, the Company undertakes no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CYCLO THERAPEUTICS, INC.

|

| |

|

|

|

Date: November 30, 2023

|

By:

|

/s/ N. Scott Fine

|

| |

|

N. Scott Fine, Chief Executive Officer

|

v3.23.3

Document And Entity Information

|

Nov. 27, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

CYCLO THERAPEUTICS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 27, 2023

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-39780

|

| Entity, Tax Identification Number |

59-3029743

|

| Entity, Address, Address Line One |

6714 NW 16th Street, Suite B

|

| Entity, Address, City or Town |

Gainesville

|

| Entity, Address, State or Province |

FL

|

| Entity, Address, Postal Zip Code |

32653

|

| City Area Code |

386

|

| Local Phone Number |

418-8060

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000922247

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $.0001 per share

|

| Trading Symbol |

CYTH

|

| Security Exchange Name |

NASDAQ

|

| WarrantsToPurchaseCommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase Common Stock

|

| Trading Symbol |

CYTHW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ctdh_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ctdh_WarrantsToPurchaseCommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

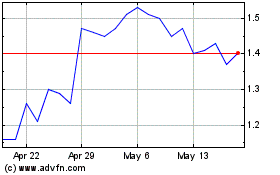

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From May 2024 to May 2024

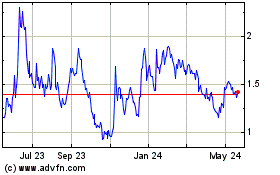

Cyclo Therapeutics (NASDAQ:CYTH)

Historical Stock Chart

From May 2023 to May 2024