Cumulus Media Inc. (NASDAQ: CMLS) (the “Company,” "CUMULUS MEDIA,"

“we,” “us,” or “our”) today announced operating results for the

three months and year ended December 31, 2019. For

the year ended December 31, 2019, the Company reported

net revenue of $1,113.4 million, a decrease of 2.4% from

the year ended December 31, 2018, net income

of $61.3 million and Adjusted EBITDA of $213.0

million, a decrease of 9.1% from the year

ended December 31, 2018. For the three months

ended December 31, 2019, the Company reported net revenue

of $285.5 million, a decrease of 7.7% from the three

months ended December 31, 2018, net income of $1.6

million and Adjusted EBITDA of $50.7 million, a decrease

of 22.8% from the three months ended December 31, 2018.

For the year ended December 31, 2019, the Company reported same

station net revenue, excluding the impact of political, of $1,103.2

million, an increase of 1.4% from the year ended December 31, 2018,

and same station Adjusted EBITDA, excluding the impact of

political, of $206.8 million, an increase of 0.5% from the year

ended December 31, 2018. For the three months ended December 31,

2019, the Company reported same station net revenue, excluding the

impact of political, of $282.4 million, a decrease of 1.7% from the

three months ended December 31, 2018, and same station Adjusted

EBITDA, excluding the impact of political, of $47.9 million, a

decrease of 8.0% from the three months ended December 31, 2018.

2019 Highlights

- Same Station Revenue Growth for Second Consecutive Year, Driven

by Industry-Leading Digital Growth of Nearly 60%

- Same Station Adjusted EBITDA Growth for Third Consecutive Year,

Excluding Political

- Completion of Significantly Accretive M&A and Swap

Transactions that Generated $146.5 Million in Gross Proceeds and

Created Market-Leading Clusters

- $220 Million of Debt Paydown, Reducing Net Leverage to

4.7x

- Over $275 Million of Debt Paydown Since Emergence from Chapter

11 Equating to Approximately $13.75 per Share

- Full Recapitalization of Balance Sheet that Lowered Interest

Costs and Extended Maturities

Mary G. Berner, President and Chief Executive Officer of CUMULUS

MEDIA, said, “I am very proud of the Company’s 2019 results. On a

same station basis, our team has now delivered the second year in a

row of revenue growth and, excluding the impact of political, the

third year in a row of Adjusted EBITDA growth. This performance was

driven in large part by the industry-leading growth of our digital

businesses and active cost management across our platforms.

Additionally, we made strong progress against our financial goals

during the year, paying down $220 million of debt with cash from

operations and highly accretive divestitures, reducing net leverage

to 4.7x. This year’s results reflect the success of our consistent

focus on key strategies to create value for our investors.”

Berner continued, “Despite a choppy environment and an expected

political headwind, fourth quarter revenue finished in-line with

the pacing we shared during our last earnings call, and, with some

slight favorability on expenses, we delivered Adjusted EBITDA that

was somewhat better than we had indicated. As we move into the new

year, we are further expanding our delivery of compelling audio

experiences and digital offerings that connect and support our

advertisers and listeners. And, we are optimistic about 2020 and

our continuing ability to drive strong operating and financial

performance while aggressively reducing net leverage to below

4.0x.”

Year Ended 2019 Same Station Financial

Highlights

- As compared to the year ended 2018(1) on a Same Station(2)

basis, excluding the impact of political revenue:— Net revenue

increased 1.4%— Adjusted EBITDA(3) increased 0.5%

- As compared to the year ended 2018(1) on a Same Station(2)

basis, including the impact of political revenue:— Net revenue

increased 0.1%— Adjusted EBITDA(3) decreased 5.0%

Fourth Quarter 2019 Same Station Financial

Highlights

- As compared to the fourth quarter of 2018 on a Same Station(2)

basis, excluding the impact of political revenue:— Net revenue

decreased 1.7%— Adjusted EBITDA(3) decreased 8.0%

- As compared to the fourth quarter of 2018 on a Same Station(2)

basis, including the impact of political revenue:— Net revenue

decreased 4.4%— Adjusted EBITDA(3) decreased 18.6%

As previously disclosed, on November 29, 2017, the Company and

certain of its subsidiaries filed voluntary petitions for relief

under Chapter 11 of Title 11 of the United States Code (“Chapter

11”) in the United States Bankruptcy Court for the Southern

District of New York (the “Court”). On May 10, 2018, the Court

entered an order confirming the Company’s Plan of Reorganization

(the “Plan”). On June 4, 2018, the Plan became effective in

accordance with its terms and the Company emerged from Chapter 11.

The Company's 2018 operating results and key operating performance

measures on a consolidated basis, were not materially impacted by

the reorganization.

During the third quarter of 2019, the Company reassessed its

reportable segments and concluded it has one reportable segment.

Prior to this change, the Company had two reportable segments:

Cumulus Radio Station Group and Westwood One.

References to "Successor Company" relate to the Company on and

subsequent to June 4, 2018. References to "Predecessor Company"

refer to the Company prior to June 4, 2018. For the purposes of

analyzing the results presented herein, the Company is presenting

the combined results of operations for the period June 4, 2018 to

December 31, 2018 of the Successor Company with the period January

1, 2018 to June 3, 2018 of the Predecessor Company. Although this

presentation is not in accordance with accounting principles

generally accepted in the United States, the Company believes

presenting such combined results allows for a more meaningful

comparison of results for the twelve-month period ended December

31, 2019 to the twelve-month period ended December 31, 2018. For

more information regarding the Predecessor and Successor Company

results, please see the Company’s Form 10-K for the year ended

December 31, 2018 filed with the Securities and Exchange Commission

(the “SEC”).

Operating Summary (in thousands, except percentages and

per share data):

| |

SuccessorCompany |

|

Non-GAAPCombinedPredecessorand

SuccessorCompany |

|

|

|

As Reported |

Year EndedDecember 31,2019 |

|

Year EndedDecember 31,2018 |

|

% Change |

|

Net revenue |

$ |

1,113,445 |

|

|

$ |

1,140,360 |

|

|

(2.4 |

)% |

| Net income |

$ |

61,257 |

|

|

$ |

757,581 |

|

|

N/A |

|

| Adjusted EBITDA (3) |

$ |

212,988 |

|

|

$ |

234,347 |

|

|

(9.1 |

)% |

| Basic income per share |

$ |

3.04 |

|

|

|

N/A |

|

|

N/A |

|

| Diluted income per share |

$ |

3.02 |

|

|

|

N/A |

|

|

N/A |

|

|

Same Station (2) |

SuccessorCompany |

|

Non-GAAPCombinedPredecessorand

SuccessorCompany |

|

|

| |

Year EndedDecember 31,2019 |

|

Year EndedDecember 31,2018 |

|

% Change |

|

Net revenue |

$ |

1,109,713 |

|

|

$ |

1,108,409 |

|

|

0.1 |

% |

| Adjusted EBITDA (3) |

$ |

212,623 |

|

|

$ |

223,821 |

|

|

(5.0 |

)% |

|

As Reported |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedDecember 31,2018 |

|

% Change |

|

|

Net revenue |

$ |

285,468 |

|

|

$ |

309,178 |

|

|

(7.7 |

)% |

| Net income |

$ |

1,621 |

|

|

$ |

43,732 |

|

|

N/A |

|

| Adjusted EBITDA (3) |

$ |

50,662 |

|

|

$ |

65,615 |

|

|

(22.8 |

)% |

| Basic income per share |

$ |

0.08 |

|

|

$ |

2.19 |

|

|

N/A |

|

| Diluted income per share |

$ |

0.08 |

|

|

$ |

2.18 |

|

|

N/A |

|

|

Same Station (2) |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedDecember 31,2018 |

|

% Change |

|

Net revenue |

$ |

285,468 |

|

|

$ |

298,572 |

|

|

(4.4 |

)% |

| Adjusted EBITDA (3) |

$ |

50,662 |

|

|

$ |

62,252 |

|

|

(18.6 |

)% |

Revenue Detail Summary (in thousands):

| |

SuccessorCompany |

|

Non-GAAPCombinedPredecessorand

SuccessorCompany |

|

|

|

As Reported |

Year EndedDecember 31,2019 |

|

Year EndedDecember 31,2018 |

|

% Change |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

Spot |

$ |

622,695 |

|

|

$ |

668,445 |

|

|

(6.8 |

)% |

|

Network |

316,329 |

|

|

316,050 |

|

|

0.1 |

% |

| Total Broadcast Radio

Revenue |

939,024 |

|

|

984,495 |

|

|

(4.6 |

)% |

| Digital |

78,602 |

|

|

50,265 |

|

|

56.4 |

% |

| Other |

95,819 |

|

|

105,600 |

|

|

(9.3 |

)% |

| Net Revenue |

$ |

1,113,445 |

|

|

$ |

1,140,360 |

|

|

(2.4 |

)% |

| |

SuccessorCompany |

|

Non-GAAPCombinedPredecessorand

SuccessorCompany |

|

|

|

Same Station (2) |

Year EndedDecember 31,2019 |

|

Year EndedDecember 31,2018 |

|

% Change |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

Spot |

$ |

620,095 |

|

|

$ |

647,911 |

|

|

(4.3 |

)% |

|

Network |

315,873 |

|

|

310,377 |

|

|

1.8 |

% |

| Total Broadcast Radio

Revenue |

935,968 |

|

|

958,288 |

|

|

(2.3 |

)% |

| Digital |

78,514 |

|

|

49,537 |

|

|

58.5 |

% |

| Other |

95,231 |

|

|

100,584 |

|

|

(5.3 |

)% |

| Net Revenue |

$ |

1,109,713 |

|

|

$ |

1,108,409 |

|

|

0.1 |

% |

|

As Reported |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedDecember 31,2018 |

|

% Change |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

Spot |

$ |

158,795 |

|

|

$ |

180,168 |

|

|

(11.9 |

)% |

|

Network |

79,884 |

|

|

85,101 |

|

|

(6.1 |

)% |

| Total Broadcast Radio

Revenue |

238,679 |

|

|

265,269 |

|

|

(10.0 |

)% |

| Digital |

21,618 |

|

|

15,638 |

|

|

38.2 |

% |

| Other |

25,171 |

|

|

28,271 |

|

|

(11.0 |

)% |

| Net Revenue |

$ |

285,468 |

|

|

$ |

309,178 |

|

|

(7.7 |

)% |

|

Same Station (2) |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedDecember 31,2018 |

|

% Change |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

Spot |

$ |

158,795 |

|

|

$ |

173,854 |

|

|

(8.7 |

)% |

|

Network |

79,884 |

|

|

82,493 |

|

|

(3.2 |

)% |

| Total Broadcast Radio

Revenue |

238,679 |

|

|

256,347 |

|

|

(6.9 |

)% |

| Digital |

21,618 |

|

|

15,407 |

|

|

40.3 |

% |

| Other |

25,171 |

|

|

26,818 |

|

|

(6.1 |

)% |

| Net Revenue |

$ |

285,468 |

|

|

$ |

298,572 |

|

|

(4.4 |

)% |

Balance Sheet Summary (in thousands):

| |

|

December 31,2019 |

|

December 31,2018 |

|

Cash and cash equivalents |

|

$ |

15,142 |

|

|

$ |

27,584 |

|

| Term loan due 2022 |

|

$ |

— |

|

|

$ |

1,243,299 |

|

| Term loan due 2026 (4) |

|

$ |

523,688 |

|

|

$ |

— |

|

| 6.75% Senior notes (4) |

|

$ |

500,000 |

|

|

$ |

— |

|

| |

SuccessorCompany |

|

Non-GAAPCombinedPredecessor

andSuccessorCompany |

|

|

| |

Year EndedDecember 31,2019 |

|

Year EndedDecember 31,2018 |

|

% Change |

|

Capital expenditures |

$ |

29,469 |

|

|

$ |

29,703 |

|

|

(0.8 |

)% |

| |

Three Months EndedDecember 31, 2019 |

|

Three Months EndedDecember 31, 2018 |

|

% Change |

|

Capital expenditures |

$ |

12,070 |

|

|

$ |

7,818 |

|

|

54.4 |

% |

|

|

|

|

(1) |

As

discussed within, results for the full-year 2018 period reflect the

combined results of the Successor and Predecessor Company periods

in connection with the Company's emergence from Chapter 11. |

| (2) |

Adjusted for certain station

dispositions and swaps as if these dispositions and swaps had

occurred as of April 1, 2019 and April 1, 2018 (or in the case of

KLOS-FM, as of the commencement of the LMA on April 16, 2019 and as

of April 16, 2018). |

| (3) |

Adjusted EBITDA is not a

financial measure calculated or presented in accordance with

accounting principles generally accepted in the United States of

America (“GAAP”). For additional information, see “Non-GAAP

Financial Measure.” |

| (4) |

Excludes unamortized debt

issuance costs. |

| |

|

Earnings Conference Call DetailsThe Company

will host a conference call today at 8:30 AM EST to discuss its

fourth quarter and full year 2019 operating results. A link to the

webcast of the conference call will be available on the investor

section of the Company’s website (www.cumulusmedia.com/investors/).

The conference call dial-in number for domestic callers is

877-830-7699 for call access. If prompted, the conference ID number

is 9191317. Please call five to ten minutes in advance to ensure

that you are connected prior to the call.

Following completion of the call, a recording of the call can be

accessed via a link at www.cumulusmedia.com/investors.

Forward-Looking StatementsCertain statements in

this release may constitute “forward-looking” statements within the

meaning of the Private Securities Litigation Reform Act of 1995 and

other federal securities laws. Such statements are statements other

than historical fact and relate to our intent, belief or current

expectations primarily with respect to our future operating,

financial, and strategic performance. Any such forward-looking

statements are not guarantees of future performance and involve

risks and uncertainties. Actual results may differ from those

contained in or implied by the forward-looking statements as a

result of various factors including, but not limited to, risks and

uncertainties related to our recent financial restructuring, the

implementation of our strategic operating plans, and other risk

factors described from time to time in our filings with the

Securities and Exchange Commission. Many of these risks and

uncertainties are beyond our control, and the unexpected occurrence

or failure to occur of any such events or matters could

significantly alter our actual results of operations or financial

condition. CUMULUS MEDIA assumes no responsibility to update any

forward-looking statement, which are based upon expectations as of

the date hereof, as a result of new information, future events or

otherwise.

About CUMULUS MEDIACUMULUS MEDIA (NASDAQ:

CMLS) is a leading audio-first media and entertainment company

delivering premium content to over a quarter billion people every

month – wherever and whenever they want it. CUMULUS MEDIA

engages listeners with high-quality local programming through 428

owned-and-operated stations across 87 markets; delivers

nationally-syndicated sports, news, talk, and

entertainment programming from iconic brands including the

NFL, the NCAA, the Masters, the Olympics, the Academy of Country

Music Awards, and many other world-class partners across nearly

8,000 affiliated stations through Westwood One, the largest audio

network in America; and inspires listeners through its rapidly

growing network of original podcasts that are smart,

entertaining and thought-provoking. CUMULUS MEDIA provides

advertisers with personal connections, local impact and national

reach through on-air and on-demand digital, mobile, social,

and voice-activated platforms, as well integrated digital marketing

services, powerful influencers, full-service audio solutions,

industry-leading research and insights, and live

event experiences. CUMULUS MEDIA is the only audio media

company to provide marketers with local and national advertising

performance guarantees. For more information

visit www.cumulusmedia.com.

Non-GAAP Financial Measures

From time to time, we utilize certain financial measures that

are not prepared or calculated in accordance with GAAP to assess

our financial performance and profitability. Consolidated adjusted

earnings before interest, taxes, depreciation, and amortization

("Adjusted EBITDA") is the financial metric by which management and

the chief operating decision maker allocate resources of the

Company and analyze the performance of the Company as a whole.

Management also uses this measure to determine the contribution of

our core operations to the funding of our corporate resources

utilized to manage our operations and the funding of our

non-operating expenses including debt service and acquisitions.

In determining Adjusted EBITDA, the Company excludes from net

income items not related to core operations and those that are

non-cash including: interest, taxes, depreciation, amortization,

stock-based compensation expense, gain or loss on the exchange,

sale or disposal of any assets or stations, early extinguishment of

debt, local marketing agreement fees, expenses relating to

acquisitions, divestitures, restructuring costs, reorganization

items and non-cash impairments of assets, if any.

Because of the significant effect that the Company’s

material station acquisitions and dispositions have had on our

results of operations, the Company also presents certain

financial information herein on a “Same Station” basis, both with

and excluding the effect of political advertising in order to

address the cyclical nature of the two-year election cycle. Same

Station metrics are adjusted for material station acquisitions and

dispositions as if these acquisitions and dispositions had occurred

as of the beginning of the comparable period in the prior year, as

indicated. Same station financial measures excluding the impact of

political advertising are further adjusted to exclude the impact of

political advertising in the comparable periods.

Management believes that Adjusted EBITDA and Same Station

financial measures, with and excluding the impact of political

advertising, although not measures that are calculated in

accordance with GAAP, are commonly employed by the investment

community as measures for determining the market value of a media

company and comparing the operational and financial performance

among media companies. Management has also observed that Adjusted

EBITDA and Same Station financial measures, with and excluding the

impact of political advertising, are routinely utilized to evaluate

and negotiate the potential purchase price for media companies.

Given the relevance to our overall value, management believes that

investors consider the metrics to be extremely useful.

Adjusted EBITDA and Same Station financial measures, with and

excluding the impact of political advertising, should not be

considered in isolation or as a substitute for net income, net

revenue, operating income, cash flows from operating activities or

any other measure for determining the Company’s operating

performance or liquidity that is calculated in accordance with

GAAP. In addition, Adjusted EBITDA and Same Station financial

measures, both with and excluding the impact of political

advertising, may be defined or calculated differently by other

companies and, therefore, comparability may be limited.

For further information, please

contact:Cumulus Media Inc.Investor

Relations DepartmentIR@cumulus.com404-260-6600

Supplemental Financial Data and

Reconciliations

CUMULUS MEDIA

INC.Unaudited Condensed Consolidated Statements of

Operations(Dollars in thousands)

| |

|

Successor Company |

|

SuccessorCompany |

|

Non-GAAPCombinedPredecessorandSuccessorCompany |

| |

|

|

|

|

|

|

| |

|

Three Months EndedDecember 31, |

|

Year Ended December 31, |

| |

|

2019 |

|

2018 |

|

2019 |

|

2018 |

|

Net revenue |

|

$ |

285,468 |

|

|

$ |

309,178 |

|

|

$ |

1,113,445 |

|

|

$ |

1,140,360 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Content costs |

|

109,722 |

|

|

111,424 |

|

|

405,653 |

|

|

402,773 |

|

|

Selling, general & administrative expenses |

|

116,610 |

|

|

124,772 |

|

|

461,218 |

|

|

471,829 |

|

|

Depreciation and amortization |

|

12,535 |

|

|

15,539 |

|

|

52,554 |

|

|

56,106 |

|

|

Local marketing agreement fees |

|

1,117 |

|

|

1,106 |

|

|

3,500 |

|

|

4,280 |

|

|

Corporate expenses |

|

8,646 |

|

|

7,571 |

|

|

34,372 |

|

|

31,599 |

|

|

Stock-based compensation expense |

|

1,494 |

|

|

1,620 |

|

|

5,301 |

|

|

3,635 |

|

|

Restructuring costs |

|

750 |

|

|

1,514 |

|

|

18,315 |

|

|

13,649 |

|

|

Loss (gain) on sale of assets or stations |

|

509 |

|

|

69 |

|

|

(55,403 |

) |

|

261 |

|

|

Impairment of assets held for sale |

|

1,165 |

|

|

— |

|

|

6,165 |

|

|

— |

|

|

Impairment of intangible assets |

|

15,563 |

|

|

— |

|

|

15,563 |

|

|

— |

|

|

Total operating expenses |

|

268,111 |

|

|

263,615 |

|

|

947,238 |

|

|

984,132 |

|

|

Operating income |

|

17,357 |

|

|

45,563 |

|

|

166,207 |

|

|

156,228 |

|

| Non-operating (expense)

income: |

|

|

|

|

|

|

|

|

|

Reorganization items, net |

|

— |

|

|

— |

|

|

— |

|

|

466,201 |

|

|

Interest expense |

|

(16,816 |

) |

|

(22,138 |

) |

|

(82,916 |

) |

|

(50,978 |

) |

|

Interest income |

|

5 |

|

|

16 |

|

|

25 |

|

|

86 |

|

|

Gain on early extinguishment of debt |

|

— |

|

|

201 |

|

|

381 |

|

|

201 |

|

|

Other (expense) income, net |

|

(133 |

) |

|

53 |

|

|

(177 |

) |

|

(3,369 |

) |

|

Total non-operating (expense) income, net |

|

(16,944 |

) |

|

(21,868 |

) |

|

(82,687 |

) |

|

412,141 |

|

|

Income before income taxes |

|

413 |

|

|

23,695 |

|

|

83,520 |

|

|

568,369 |

|

| Income tax benefit

(expense) |

|

1,208 |

|

|

20,037 |

|

|

(22,263 |

) |

|

189,212 |

|

|

Net Income |

|

$ |

1,621 |

|

|

$ |

43,732 |

|

|

$ |

61,257 |

|

|

$ |

757,581 |

|

| |

SuccessorCompany |

|

|

PredecessorCompany |

| |

Period fromJune 4, 2018throughDecember

31,2018 |

|

|

Period fromJanuary 1,2018 throughJune 3, 2018 |

|

Net revenue |

$ |

686,436 |

|

|

|

$ |

453,924 |

|

| Operating expenses: |

|

|

|

|

|

Content costs |

238,888 |

|

|

|

163,885 |

|

|

Selling, general and administrative expenses |

276,551 |

|

|

|

195,278 |

|

|

Depreciation and amortization |

34,060 |

|

|

|

22,046 |

|

|

Local marketing agreement fees |

2,471 |

|

|

|

1,809 |

|

|

Corporate expenses |

17,116 |

|

|

|

14,483 |

|

|

Stock-based compensation expense |

3,404 |

|

|

|

231 |

|

|

Restructuring costs |

11,194 |

|

|

|

2,455 |

|

|

Loss on sale of assets or stations |

103 |

|

|

|

158 |

|

|

Total operating expenses |

583,787 |

|

|

|

400,345 |

|

|

Operating income |

102,649 |

|

|

|

53,579 |

|

| Non-operating (expense)

income: |

|

|

|

|

|

Reorganization items, net |

— |

|

|

|

466,201 |

|

|

Interest expense |

(50,718 |

) |

|

|

(260 |

) |

|

Interest income |

36 |

|

|

|

50 |

|

|

Gain on early extinguishment of debt |

201 |

|

|

|

— |

|

|

Other expense, net |

(3,096 |

) |

|

|

(273 |

) |

|

Total non-operating (expense) income, net |

(53,577 |

) |

|

|

465,718 |

|

|

Income before income tax benefit |

49,072 |

|

|

|

519,297 |

|

| Income tax benefit |

12,353 |

|

|

|

176,859 |

|

|

Net income |

$ |

61,425 |

|

|

|

$ |

696,156 |

|

The following tables reconcile net income, the most

directly comparable financial measure calculated and presented in

accordance with GAAP, to Adjusted EBITDA for the periods presented

herein (dollars in thousands):

| |

|

SuccessorCompany |

|

Non-GAAPCombinedPredecessor andSuccessor

Company |

|

As Reported |

|

Year EndedDecember 31, 2019 |

|

Year EndedDecember 31, 2018 |

|

GAAP net income |

|

$ |

61,257 |

|

|

$ |

757,581 |

|

|

Income tax expense (benefit) |

|

22,263 |

|

|

(189,212 |

) |

|

Non-operating expense, including net interest expense |

|

83,068 |

|

|

54,260 |

|

|

Local marketing agreement fees |

|

3,500 |

|

|

4,280 |

|

|

Depreciation and amortization |

|

52,554 |

|

|

56,106 |

|

|

Stock-based compensation expense |

|

5,301 |

|

|

3,635 |

|

|

Impairment of assets held for sale |

|

6,165 |

|

|

— |

|

|

Impairment of intangible assets |

|

15,563 |

|

|

— |

|

|

(Gain) loss on sale of assets or stations |

|

(55,403 |

) |

|

261 |

|

|

Reorganization items, net |

|

— |

|

|

(466,201 |

) |

|

Restructuring costs |

|

18,315 |

|

|

13,649 |

|

|

Franchise taxes |

|

786 |

|

|

189 |

|

|

Gain on early extinguishment of debt |

|

(381 |

) |

|

(201 |

) |

| Adjusted EBITDA |

|

$ |

212,988 |

|

|

$ |

234,347 |

|

| |

|

SuccessorCompany |

|

PredecessorCompany |

|

As Reported |

|

Period from June 4,2018 throughDecember 31,

2018 |

|

Period from January 1,2018 through June

3,2018 |

|

GAAP net income |

|

$ |

61,425 |

|

|

$ |

696,156 |

|

|

Income tax benefit |

|

(12,353 |

) |

|

(176,859 |

) |

|

Non-operating expense, including net interest expense |

|

53,777 |

|

|

483 |

|

|

Local marketing agreement fees |

|

2,471 |

|

|

1,809 |

|

|

Depreciation and amortization |

|

34,060 |

|

|

22,046 |

|

|

Stock-based compensation expense |

|

3,404 |

|

|

231 |

|

|

Loss on sale of assets or stations |

|

103 |

|

|

158 |

|

|

Reorganization items, net |

|

— |

|

|

(466,201 |

) |

|

Restructuring costs |

|

11,194 |

|

|

2,455 |

|

|

Franchise taxes |

|

(45 |

) |

|

234 |

|

|

Gain on early extinguishment of debt |

|

(201 |

) |

|

— |

|

| Adjusted EBITDA |

|

$ |

153,835 |

|

|

$ |

80,512 |

|

| |

|

SuccessorCompany |

|

Non-GAAP CombinedPredecessor andSuccessor

Company |

|

Same Station (2) |

|

Year EndedDecember 31, 2019 |

|

Year EndedDecember 31, 2018 |

|

Net income |

|

$ |

60,892 |

|

|

$ |

747,055 |

|

|

Income tax expense (benefit) |

|

22,263 |

|

|

(189,212 |

) |

|

Non-operating expense, including net interest expense |

|

83,068 |

|

|

54,260 |

|

|

Local marketing agreement fees |

|

3,500 |

|

|

4,280 |

|

|

Depreciation and amortization |

|

52,554 |

|

|

56,106 |

|

|

Stock-based compensation expense |

|

5,301 |

|

|

3,635 |

|

|

Impairment of assets held for sale |

|

6,165 |

|

|

— |

|

|

Impairment of intangible assets |

|

15,563 |

|

|

— |

|

|

(Gain) loss on sale of assets or stations |

|

(55,403 |

) |

|

261 |

|

|

Reorganization items, net |

|

— |

|

|

(466,201 |

) |

|

Restructuring costs |

|

18,315 |

|

|

13,649 |

|

|

Franchise taxes |

|

786 |

|

|

189 |

|

| Gain on early extinguishment

of debt |

|

(381 |

) |

|

(201 |

) |

| Adjusted EBITDA |

|

$ |

212,623 |

|

|

$ |

223,821 |

|

|

As Reported |

|

Three Months EndedDecember 31, 2019 |

|

Three Months EndedDecember 31, 2018 |

|

GAAP net income |

|

$ |

1,621 |

|

|

$ |

43,732 |

|

|

Income tax benefit |

|

(1,208 |

) |

|

(20,037 |

) |

|

Non-operating expense, including net interest expense |

|

16,944 |

|

|

22,069 |

|

|

Local marketing agreement fees |

|

1,117 |

|

|

1,106 |

|

|

Depreciation and amortization |

|

12,535 |

|

|

15,539 |

|

|

Stock-based compensation expense |

|

1,494 |

|

|

1,620 |

|

|

Impairment of assets held for sale |

|

1,165 |

|

|

— |

|

|

Impairment of intangible assets |

|

15,563 |

|

|

— |

|

|

Loss on sale of assets or stations |

|

509 |

|

|

69 |

|

|

Restructuring costs |

|

750 |

|

|

1,514 |

|

|

Franchise taxes |

|

172 |

|

|

204 |

|

|

Gain on early extinguishment of debt |

|

— |

|

|

(201 |

) |

| Adjusted EBITDA |

|

$ |

50,662 |

|

|

$ |

65,615 |

|

|

Same Station (2) |

|

Three Months EndedDecember 31, 2019 |

|

Three Months EndedDecember 31, 2018 |

|

Net income |

|

$ |

1,621 |

|

|

$ |

40,369 |

|

|

Income tax benefit |

|

(1,208 |

) |

|

(20,037 |

) |

|

Non-operating expense, including net interest expense |

|

16,944 |

|

|

22,069 |

|

|

Local marketing agreement fees |

|

1,117 |

|

|

1,106 |

|

|

Depreciation and amortization |

|

12,535 |

|

|

15,539 |

|

|

Stock-based compensation expense |

|

1,494 |

|

|

1,620 |

|

|

Impairment of assets held for sale |

|

1,165 |

|

|

— |

|

|

Impairment of intangible assets |

|

15,563 |

|

|

— |

|

|

Loss on sale of assets or stations |

|

509 |

|

|

69 |

|

|

Restructuring costs |

|

750 |

|

|

1,514 |

|

|

Franchise taxes |

|

172 |

|

|

204 |

|

|

Gain on early extinguishment of debt |

|

— |

|

|

(201 |

) |

| Adjusted EBITDA |

|

$ |

50,662 |

|

|

$ |

62,252 |

|

The following tables reconcile as reported net

revenue and as reported Adjusted EBITDA to same station net revenue

and same station Adjusted EBITDA, both including and excluding the

impact of political, for the periods presented herein (dollars in

thousands):

| |

|

Year EndedDecember 31, 2019(SuccessorCompany) |

|

Year Ended December31, 2018 (Non-GAAP CombinedPredecessor

andSuccessor Company) |

|

As reported net revenue |

|

$ |

1,113,445 |

|

|

$ |

1,140,360 |

|

|

Station dispositions and swaps |

|

(3,732 |

) |

|

(31,951 |

) |

| Same station net revenue |

|

$ |

1,109,713 |

|

|

$ |

1,108,409 |

|

|

Political revenue |

|

(6,500 |

) |

|

(20,010 |

) |

| Same station net revenue,

excluding impact of political revenue |

|

$ |

1,103,213 |

|

|

$ |

1,088,399 |

|

| |

|

Three Months EndedDecember 31, 2019 |

|

Three Months EndedDecember 31, 2018 |

|

As reported net revenue |

|

$ |

285,468 |

|

|

$ |

309,178 |

|

|

Station dispositions and swaps |

|

— |

|

|

(10,606 |

) |

| Same station net revenue |

|

$ |

285,468 |

|

|

$ |

298,572 |

|

|

Political revenue |

|

(3,053 |

) |

|

(11,312 |

) |

| Same station net revenue,

excluding impact of political revenue |

|

$ |

282,415 |

|

|

$ |

287,260 |

|

| |

|

Year EndedDecember 31, 2019(SuccessorCompany) |

|

Year Ended December31, 2018 (Non-GAAP CombinedPredecessor

andSuccessor Company) |

|

As reported Adjusted EBITDA |

|

$ |

212,988 |

|

|

$ |

234,347 |

|

|

Station dispositions and swaps |

|

(365 |

) |

|

(10,526 |

) |

| Same station Adjusted

EBITDA |

|

$ |

212,623 |

|

|

$ |

223,821 |

|

|

Political EBITDA |

|

(5,850 |

) |

|

(18,009 |

) |

| Same station Adjusted EBITDA,

excluding impact of political EBITDA |

|

$ |

206,773 |

|

|

$ |

205,812 |

|

| |

|

Three Months EndedDecember 31, 2019 |

|

Three Months EndedDecember 31, 2018 |

|

As reported Adjusted EBITDA |

|

$ |

50,662 |

|

|

$ |

65,615 |

|

|

Station dispositions and swaps |

|

— |

|

|

(3,363 |

) |

| Same station Adjusted

EBITDA |

|

$ |

50,662 |

|

|

$ |

62,252 |

|

|

Political EBITDA |

|

(2,748 |

) |

|

(10,181 |

) |

| Same station Adjusted EBITDA,

excluding impact of political EBITDA |

|

$ |

47,914 |

|

|

$ |

52,071 |

|

The following tables provide disaggregated revenue

detail by quarter for 2019 and 2018 as reported and same station

(dollars in thousands):

|

As Reported |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedSeptember 30,2019 |

|

Three MonthsEnded June 30,2019 |

|

Three MonthsEnded March 31,2019 |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

|

|

Spot |

$ |

158,795 |

|

|

$ |

161,211 |

|

|

$ |

163,111 |

|

|

$ |

139,579 |

|

|

Network |

79,884 |

|

|

78,404 |

|

|

72,877 |

|

|

85,164 |

|

| Total Broadcast Radio

Revenue |

238,679 |

|

|

239,615 |

|

|

235,988 |

|

|

224,743 |

|

| Digital |

21,618 |

|

|

19,935 |

|

|

20,208 |

|

|

16,841 |

|

| Other |

25,171 |

|

|

21,258 |

|

|

23,477 |

|

|

25,912 |

|

| Net Revenue |

$ |

285,468 |

|

|

$ |

280,808 |

|

|

$ |

279,673 |

|

|

$ |

267,496 |

|

|

Same Station (2) |

Three MonthsEndedDecember 31,2019 |

|

Three MonthsEndedSeptember 30,2019 |

|

Three MonthsEnded June 30,2019 |

|

Three MonthsEnded March 31,2019 |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

|

|

Spot |

$ |

158,795 |

|

|

$ |

161,211 |

|

|

$ |

160,510 |

|

|

$ |

139,579 |

|

|

Network |

79,884 |

|

|

78,404 |

|

|

72,421 |

|

|

85,164 |

|

| Total Broadcast Radio

Revenue |

238,679 |

|

|

239,615 |

|

|

232,931 |

|

|

224,743 |

|

| Digital |

21,618 |

|

|

19,935 |

|

|

20,120 |

|

|

16,841 |

|

| Other |

25,171 |

|

|

21,258 |

|

|

22,890 |

|

|

25,912 |

|

| Net Revenue |

$ |

285,468 |

|

|

$ |

280,808 |

|

|

$ |

275,941 |

|

|

$ |

267,496 |

|

| |

Successor Company |

|

Non-GAAPCombinedPredecessor

andSuccessorCompany |

|

PredecessorCompany |

|

As Reported |

Three MonthsEndedDecember 31,2018 |

|

Three MonthsEndedSeptember 30,2018 |

|

Three MonthsEnded June 30,2018 |

|

Three MonthsEnded March 31,2018 |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

|

|

Spot |

$ |

180,168 |

|

|

$ |

168,554 |

|

|

$ |

174,502 |

|

|

$ |

145,221 |

|

|

Network |

85,101 |

|

|

75,716 |

|

|

72,389 |

|

|

82,844 |

|

| Total Broadcast Radio

Revenue |

265,269 |

|

|

244,270 |

|

|

246,891 |

|

|

228,065 |

|

| Digital |

15,638 |

|

|

13,459 |

|

|

11,929 |

|

|

9,239 |

|

| Other |

28,271 |

|

|

24,525 |

|

|

26,429 |

|

|

26,375 |

|

| Net Revenue |

$ |

309,178 |

|

|

$ |

282,254 |

|

|

$ |

285,249 |

|

|

$ |

263,679 |

|

| |

Successor Company |

|

Non-GAAPCombinedPredecessor

andSuccessorCompany |

|

PredecessorCompany |

|

Same Station(2) |

Three MonthsEndedDecember 31,2018 |

|

Three MonthsEndedSeptember 30,2018 |

|

Three MonthsEnded June 30,2018 |

|

Three MonthsEnded March 31,2018 |

| Broadcast Radio Revenue: |

|

|

|

|

|

|

|

|

Spot |

$ |

173,854 |

|

|

$ |

161,306 |

|

|

$ |

167,617 |

|

|

$ |

145,135 |

|

|

Network |

82,493 |

|

|

74,715 |

|

|

70,326 |

|

|

82,844 |

|

| Total Broadcast Radio

Revenue |

256,347 |

|

|

236,021 |

|

|

237,943 |

|

|

227,979 |

|

| Digital |

15,407 |

|

|

13,171 |

|

|

11,669 |

|

|

9,290 |

|

| Other |

26,818 |

|

|

22,997 |

|

|

24,493 |

|

|

26,274 |

|

| Net Revenue |

$ |

298,572 |

|

|

$ |

272,189 |

|

|

$ |

274,105 |

|

|

$ |

263,543 |

|

The following table discloses capital expenditures

for each of the Predecessor and Successor Company periods presented

below. When combined, these periods present the Company's non-GAAP

combined Predecessor and Successor capital expenditures for the

year ended December 31, 2018 (dollars in thousands):

| |

Successor Company |

|

|

Predecessor Company |

| |

Period from June 4,2018 throughDecember 31,

2018 |

|

|

Period from January 1,2018 through June

3,2018 |

|

Capital expenditures |

$ |

15,684 |

|

|

|

$ |

14,019 |

|

| |

|

|

|

|

|

|

|

|

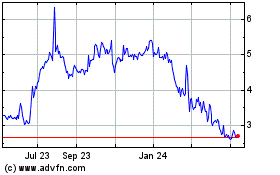

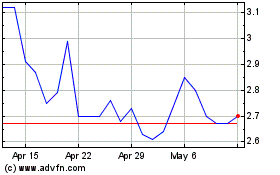

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Cumulus Media (NASDAQ:CMLS)

Historical Stock Chart

From Apr 2023 to Apr 2024