Statement of Changes in Beneficial Ownership (4)

August 10 2021 - 7:27PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

KOTICK ROBERT A |

2. Issuer Name and Ticker or Trading Symbol

Activision Blizzard, Inc.

[

ATVI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Executive Officer |

|

(Last)

(First)

(Middle)

C/O ACTIVISION BLIZZARD, INC., 3100 OCEAN PARK BOULEVARD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/7/2021 |

|

(Street)

SANTA MONICA, CA 90405

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock, par value $0.000001 per share | 8/7/2021 | | A | | 116317 (1) | A | $0 | 4889884 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 183723 (1) | D | $0 | 4706161 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 231624 (2) | D | $0 | 4474537 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 71381 (2) | D | $0 | 4403156 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 140626 (2) | D | $0 | 4262530 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 70067 (2) | D | $0 | 4192463 | D | |

| Common Stock, par value $0.000001 per share | 8/7/2021 | | F | | 139789 (2) | D | $0 | 3908698 (3) | D | |

| Common Stock, par value $0.000001 per share | | | | | | | | 1 | I | By ASAC II LLC (4) |

| Common Stock, par value $0.000001 per share | | | | | | | | 4800 | I | By UTMAs for the benefit of minor children (5) |

| Common Stock, par value $0.000001 per share | | | | | | | | 36918 | I | By GRATs (6) |

| Common Stock, par value $0.000001 per share | | | | | | | | 2 | I | By Delmonte Investments, LLC (7) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | The performance conditions underlying this previously disclosed performance-based restricted stock unit award were achieved at the maximum level and as a result the reporting person received 116,317 shares of the Company's common stock in excess of shares previously disclosed at the target level. Pursuant to the terms of the award agreement, the Company withheld 183,723 of the shares otherwise earned in order to satisfy the resulting tax withholding obligation. |

| (2) | The performance conditions underlying these previously disclosed performance-based restricted stock unit awards were achieved at the maximum level. Pursuant to the terms of the award agreements, the Company withheld an aggregate of 653,487 shares of the shares otherwise earned in order to satisfy the resulting tax withholding obligation. |

| (3) | The performance conditions underlying the performance-based restricted stock unit award previously disclosed on August 9, 2017 were not achieved, therefore 143,976 shares did not vest and have been removed from reported holdings. |

| (4) | The reporting person and Brian G. Kelly are the managers of ASAC II LLC. The reporting person disclaims beneficial ownership of the Company's common stock held by ASAC II LLC except to the extent of his pecuniary interest therein. |

| (5) | The reporting person disclaims beneficial ownership of the Company's common stock held by these UTMAs except to the extent of his pecuniary interest therein. |

| (6) | These shares are held by grantor retained annuity trusts for the benefit of the reporting person's children, of which the reporting person is the trustee. |

| (7) | Reflects shares of the Company's common stock indirectly beneficially owned through Delmonte Investments, LLC, of which the reporting person is a member and manager. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

KOTICK ROBERT A

C/O ACTIVISION BLIZZARD, INC.

3100 OCEAN PARK BOULEVARD

SANTA MONICA, CA 90405 | X |

| Chief Executive Officer |

|

Signatures

|

| /s/ Robert A. Kotick | | 8/10/2021 |

| **Signature of Reporting Person | Date |

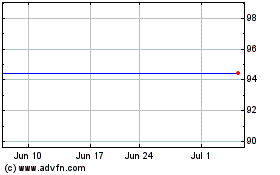

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

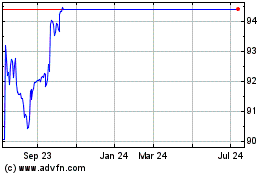

Activision Blizzard (NASDAQ:ATVI)

Historical Stock Chart

From Apr 2023 to Apr 2024