U.S. Dollar Moves Notably Higher Amid Interest Rate Concerns

February 24 2023 - 11:23AM

RTTF2

After turning in a relatively lackluster performance over the

two previous days, the value of the U.S. dollar has moved notably

higher during trading on Friday.

The U.S. dollar index is climbing 0.64 points or 0.6 percent to

105.24, reaching its best levels in over two months.

Currently, the greenback is trading at 136.43 yen versus the

134.70 yen it fetched at the close of New York trading on Thursday.

Against the euro, the dollar is valued at $1.0547 compared to

yesterday's $1.0596.

The dollar has benefited from its appeal as a safe haven amid

ongoing concerns about the outlook for interest rates.

Adding to recent interest rate worries, the Commerce Department

released a report showing an unexpected acceleration in the annual

rate of growth by core consumer prices in the month of January.

The report said annual growth by core consumer prices, which

exclude food and energy prices, accelerated to 4.7 percent in

January from an upwardly revised 4.6 percent in December.

Economists had expected the annual rate of growth by core

consumer prices to slow to 4.3 percent from the 4.4 percent

originally reported for the previous month.

Including food and energy prices, consumer price growth also

accelerated to 5.4 percent in January from 5.3 percent in December.

The rate of growth was expected to slow to 4.9 percent.

Paul Ashworth, Chief North America Economist at Capital

Economics, called the data "another sign that the Fed might have to

leave its policy rate higher for longer."

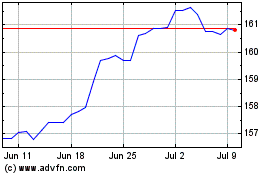

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Mar 2024 to Apr 2024

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Apr 2023 to Apr 2024